Student Loans: Next Steps

Student loan forgiveness carries multiple political benefits and risks. Ultimately, Biden will decide by August whether to enact wide-scale student loan forgiveness and extend the student loan payment pause. Borrowers hope to avoid a nightmare scenario of no student loan cancellation and a restart of student loan payments. Importantly, no matter what Biden decides, you should have a game plan for student loan repayment. For example, you may not qualify for student loan forgiveness or only a portion of your student loans could be forgiven. Similarly, an extension of the student loan payment pause likely is temporary, meaning student loan repayment would still be required. Learning all your options to pay off student loans is your best investment. Here are some top ways to pay student loans and save money:

Student Lines Of Credit

If you have a student line of credit through your financial institution, you’ll have to pay the interest on the amount of money you borrow while youre still in school.

After you graduate, many financial institutions give you a 4 to 12-month grace period. During this time, you only have to pay the interest on your line of credit. After this period, youll pay back your debt through a repayment schedule agreed upon with your financial institution.

Contact your financial institution to get information about paying back your student line of credit.

The Debt Avalanche Method

Becky had a mix of Direct Unsubsidized, Subsidized, and Parent PLUS Loans, all federal loans. The Unsubsidized and Subsidized Loans had a much lower interest rate than the Parent PLUS Loans some were as low as 3.4%.

To pay off her debt as quickly as possible, Becky used the debt avalanche method. With this strategy, she listed all of her debt from the loans with the highest interest rate to the loans with the lowest. She kept making the minimum payments on all of her loans, but put any extra money she had toward the loans with the highest interest rate. By tackling the more expensive debt first, she was able to cut down on interest charges and save more money.

Recommended Reading: What Is Mortgage Loan Originator License

How Does Paying Off Student Loans Increase Your Credit Score

At its core, credit scoring is very simple. FICO and VantageScore both reward you for having a well-established history of responsible credit use. Responsible means taking care not to overextend yourself financially and always paying your bills on time.

When you take out an installment loan and make regular payments on it, it demonstrates that youre managing your credit responsibly, which is good for your score.

Paying your student loans benefits the following factors that affect your credit score:

- Payment history: Your payment history is a record of your payments and whether you made them on time or not. Keeping your loan paid as agreed will build your payment history and improve your credit score.

- Amounts owed: Amounts owed is FICOs name for the scoring factor that looks at how much credit youre actively usingin other words, the size of your debts. The more of your loan you pay off, the less credit youll be using and the better your score in this category will be.

- Also known as the length of your credit history, this measures how old your various loans and credit accounts are. Paying your student loan wont directly benefit this factor, but the longer your student loan remains on your credit report, the more it will age, which will improve your score.

The upshot is that over the lifetime of your loan, youll contribute to all three scoring factors, benefitting your credit score.

Fixed Vs Floating Interest Rates

You can request to have a fixed interest rate. You can only make this change once. Contact the NSLSC or the Alberta Student Aid Service Centre for more information.

|

CIBC prime rate plus 2% |

Prime rate of Canadian banks plus 2% |

To compare the cost of choosing floating and fixed rates, use the Government of Canadas loan repayment estimator.

Read Also: How Many Americans Have Student Loan Debt

Student Loan Forgiveness: Biden Could Alienate Independent Voters

With student loan forgiveness, Biden risks alienating various constituencies. For example, moderate and independent voters may oppose increased government spending. In an uncertain economic environment, these voter groups may prefer Biden to forgo broad student loan forgiveness. Why? Beyond the expected cost of nearly $400 billion, some voters could view wide-scale student loan relief as wealth redistribution. Democrats could lose control of the U.S. House of Representatives in the upcoming election. So, independent voters could play an important role in helping Democrats to retain their majority.

Visualize The Future Without Student Loans

Effectiveness level: Low

While this isnt exactly a repayment strategy, it can help you find motivation to get rid of your debt, especially if its causing a lot of stress in your life.

Heres an easy way to start your visualization. Think of the one thing you hate most about having student loans. Maybe its that you cant afford to go on a vacation, or maybe you have to eat rice and beans to scrape together enough money to pay your bills. Perhaps you drive a crappy car that breaks down all the time.

Now close your eyes and imagine what your life would be like if that No. 1 most hated thing were no longer a problem because you dont have student loans. How would your life change for the better? Would you be happier? What would you do without having to worry about student loans?

Is this a life you want to have? With enough hard work, getting rid of your student debt can become reality. Now go get it!

Don’t Miss: Where To Apply For Parent Plus Loan

Burning That Student Debt: Caseys Story

When Casey finished her undergraduate study she was determined to incinerate her pile of student debt at record speed and she did. In just 22 months, at age 27, she had managed to repay the government in full, a feat that helped propel her to the top echelons of Canadas money blogosphere.

READ MORE: How Canadians go from student debt to default

Burning more than $20,000 in student loans in less than two years wasnt easy. To turbo-charge her income, Casey lined up a chemistry tutoring gig on top of a full-time job. In addition, shed work as a freelance writer in the evenings and take up odd jobs shed find on Kijiji during the weekend.

I remember one time my only job was to go scan every item in the baby section at The Bay and I got, like, $18 an hour.

I basically didnt say no to anything that paid me at least $15 dollars an hour, she added.

With money coming in from multiple sources, Casey was able to throw as much as $1,000 at her debt pile every month.

But when she signed up for an MBA in Finance from the University of Calgary she discovered her debt-slashing exploit had one big drawback.

WATCH :What to know before withdrawing from RESP savings

Casey had to resort to borrowing from a financial institution through a line of credit instead. Luckily, she landed a full-time job with a base salary of $75,000 during the second year of her MBA, which she attended at night, and was able to bring in another $30,000 from Money After Graduation.

Exercise Your Rights As A Servicemember

Your service counts towards Public Service Loan Forgiveness.After you make 120 qualifying monthly payments under the PSLF program, you can apply to have your remaining loan balance forgiven, tax free.Learn more about your next steps from the PSLF Help Tool.

Get your interest rate capped.The Servicemembers Civil Relief Act entitles you to have your interest rate reduced to 6% on all debts taken out before your service began, including both federal and private student loans. Federal student loans can be reduced to 0% when you are serving in a hostile area. Reductions in federal student loan interest should happen automatically check your statements to make sure. Contact your private student loan servicer to request a rate cap.

and the the Department of Education’s guide to federal loan benefits for servicemembers.

Also Check: Is There Still Student Loan Forgiveness

Stay With The Standard Repayment Plan

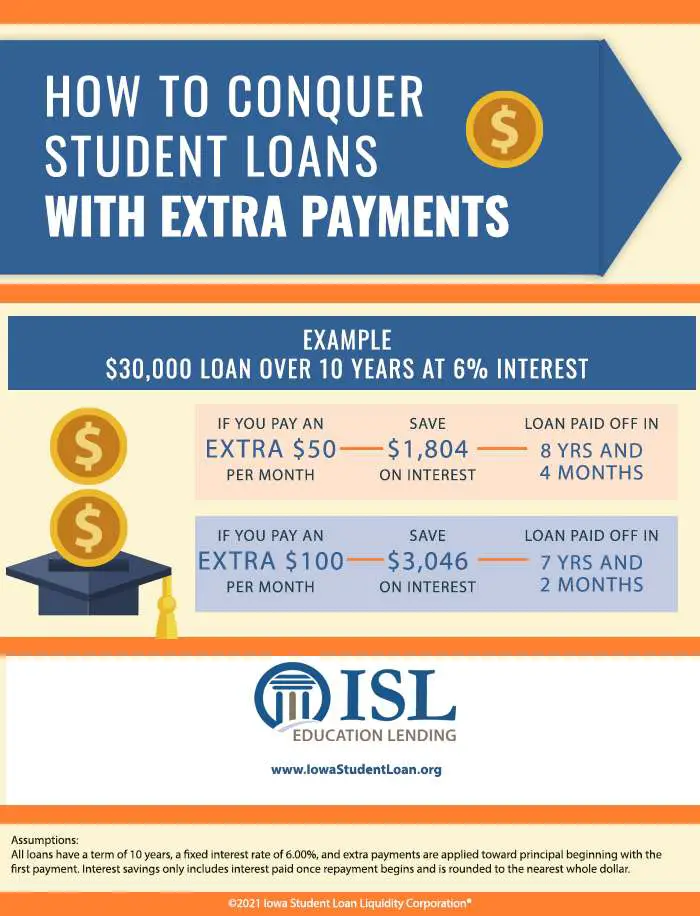

For all federal student loans, unless borrowers choose a different payment option, borrowers are placed on a 10-year Standard Repayment Plan . As noted, with the SRP, you make monthly payments at a fixed interest rate for 10 years. The interest rate is usually lower than other options, but if you have excellent credit you may be able to get a lower rate with a private lender.

If you can’t make extra payments on your loan, the fastest way to pay off your loan is to stay with the SRP.

As noted, if you have a federal student loan, you can also sign up for one of four income-driven repayment plans. The income-driven plans extend the payoff timeline to 20 years for undergraduate loans and 25 years for graduate loans.

You may also want to look into student loan consolidation under the Federal Student Loan Consolidation program. Only federal loans are eligible for consolidation. Consolidating your federal student loans combine them into one loan with one monthly payment at a fixed interest rate. The fixed interest rate is the weighted average of all the loans being consolidated. Student loan consolidation lengthens your repayment time to a maximum of 30 years, depending on how much debt you owe.

If you can afford to stick with the SRP, this is usually a faster way to pay off your loans than using income-driven repayment plans or loan consolidation.

Early Repayment Of Your Student Loan

Before making an early repayment, we recommend that, if you hold other loans , credit cards or lines of credit, you verify the interest rate of each credit product you hold and pay off the credit product with the highest interest rate.

Because student loans have very attractive interest rates and the interest paid is tax deductible, it is to your advantage to prioritize debts bearing the highest interest rates and pay off your student loan afterwards. Feel free to contact your caisse advisor to find out more.

Also Check: How Much Home Can I Afford Va Loan

How To Pay Off Student Loans Fast In Canada

Student debt has been a problem in Canada for decades, but in recent years the problem has inched toward crisis. Students across the country are graduating with higher debt levels than ever before, and taking longer to pay off their student loans than previous generations. This is causing more and more young people to put other areas of their life on hold, such as buying a home or starting a family. Fortunately, following a few key tips and strategies can speed up the process of paying off student loans.

Take A Job That Offers Forgiveness

Effectiveness level: Medium-High

Certain jobs, like public service work or teaching, may offer forgiveness for part or all of your student loans. All you have to do is meet the requirements to get your student loans forgiven. See our guides to Public Service Loan Forgiveness and teacher student loan forgiveness for more details.

There is one potential downside: You need to meet all the requirements and complete the full term of work required to get any forgiveness.

Since these forgiveness programs are typically used in conjunction with income-driven repayment plans, your payments will decrease but interest charges will accumulate. If you wind up ineligible for forgiveness for any reason, youll be stuck with greater interest charges.

In addition to these federal student loan forgiveness programs, some states also offer loan repayment assistance programs . These LRAPs also usually come with a work requirement. If you qualify, you could get money toward paying off your federal student loans.

Read Also: How To Get An Rv Loan With Bad Credit

Determine How Much You Owe

To make your student loan repayment plan, first list all your debt, including both federal and private loans.

- You can find out your debt balances by using the National Student Loans Data System to identify federal loans. Check your credit report at AnnualCreditReport.com to find your private loans.

- Contact each lender to find out the interest rate and outstanding balance, and make a list of all you owe.

Also, list all your income coming in each month, as well as your expenditures. This will give you an idea of how much extra money you can put toward your student loan debt.

Increase Your Income With A Side Hustle

If your biggest problem is income, pick up a part-time job on the nights or weekends so you can stack cash quickly. Then toss that extra cash directly at your student loan debt! There are a ton of side hustle options out thereeverything from driving an Uber and delivering food to walking dogs and house-sitting. When I was paying off my student loans, I drove for Lyft and Uber and did freelance marketing work to pay those bad boys off even faster.

And dont hit me with the I dont have time for another job excuse. If you have time to hang out with your friends, scroll Instagram, or watch Netflix, you have time to make a few extra bucks.

Remember, the extra job wont last forever. Youre just trying to get intense and kick that student loan debt out of your life so you can move on with your life.

You May Like: How To Use Land As Equity For Construction Loan

Biden Risks Alienating Voters Who Dont Have Student Loans

If Biden proceeds with wide-scale student loan forgiveness, he risks alienating voters who dont have student loans. According to the latest student loan debt statistics, there are approximately 45 million student loan borrowers. If the U.S. adult population is about 250 million, nearly 80% of adult Americans no longer have student loans or never borrowed student loans. This includes Americans who didnt attend or couldnt afford college. These constituencies are also facing economic hardship. They may question why Biden would approve substantial economic relief only for student loan borrowers while excluding others who are also struggling financially.

How Can I Pay Off My Loans Fast

Many graduates want to pay off their student loans as fast as possible. Battist said she would like to have hers completely paid off within the next six years. “I would love to pay this off within the shortest time possible to minimize the interest rates,” she said.

If you want to be aggressive with paying off your loans, Williams suggests you try to refinance your loans and get a cheaper interest rate, if possible. “That way you save yourself some money on interest, and it can bring your monthly payment down as well.” Williams also suggests that any time you get extra money, put it toward a student loan payment. “If you get a bonus, a tax refund, or you get money from family, a friend or for a holiday, take all those extra dollars and throw them at the loan.”

Another option that Williams and Sun both suggest if you really want to pay off your loans in three to five years, is to pick up a side hustle. It can be driving an Uber or Lyft, doing freelance projects or really anything that can make you some extra cash alongside the money from your full-time job, that can go toward the loan payments.

“While three years sounds like a really long time, if you’re, let’s say, 21 graduating college and at 24 you’re student loan debt-free, from three years of sacrifice, you’ve got a whole life ahead of you,” Williams said.

Read Also: Can You Pay Off Your Car Loan Early

Work For An Employer With Repayment Assistance

Employer student loan repayment assistance is growing in popularity as a workplace benefit. Employers who offer this benefit pay a certain amount of money towards employees student debt each month. Amounts vary, but typically employers offer around $100 to $300 monthly.

When you work for a company that offers this benefit, keep paying the minimums yourself and use the extra funds from your employer to pay down the balance more quickly.

What Are The Risks Of This Strategy

Before paying off your student loans with a credit card, there are a few potential risks. First, if you cannot stick to your budget and pay off your debt within the promotional period, youll be stuck with a high-interest rate on your remaining balance. Additionally, if you miss a payment or make a late payment, you may be charged an additional balance transfer fee by your credit card issuer. Finally, remember that using a credit card can help you build your credit historybut only if you use it responsibly.

Read Also: How Much Is The Average Student Loan Debt

How One Woman Paid Off $68000 In Student Loans In 2 Years

Like many high school students, Becky Blake dreamed of going to college away from home to enjoy her independence.

Despite her parents encouraging her to stay in-state to take advantage of a less expensive education, Becky decided to go to a private out-of-state university.

But by choosing a pricier school, Becky graduated with $98,400 in student loan debt. And thanks to the high interest rates on some of her loans, that number would only grow.

With that student loan balance, which I knew was only going to get larger with the minimum payments I was paying to the loan servicer, I was going to end up paying five-figures in interest over the length of the loan, she said.

Even though she had a hefty student loan balance, Becky was focused on achieving financial freedom. By coming up with an aggressive debt repayment plan, she was able to pay off a huge chunk of her student debt approximately $68,000 in under two years. Heres how she did it.