How To Use Idfc First Banks Eligibility Calculator

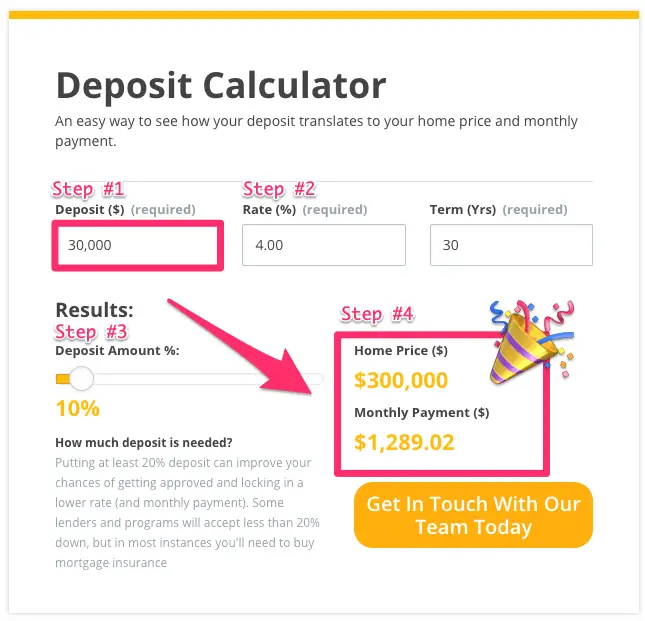

Our home eligibility calculator is designed to make it easy for you to check your housing loan eligibility. The loan eligibility calculator tells your home loan eligibility by factoring in your monthly income, tenure of the loan, home loan interest, and common deductions.

Before you apply for a home loan, use the home loan eligibility calculator online to check how much you can borrow. Enter your take-home salary, loan tenure that youre looking for, rate of interest, and current EMIs youre paying. When you enter all this data, the housing loan eligibility calculator evaluates the home loan amount youre eligible for.

You Are About To Enter A Third Party Website & Cimb Group’s Privacy Policy Will Cease To Apply

This link is provided for your convenience only and shall not be considered or construed as an endorsement or verification of such linked website or its contents by CIMB Group.

CIMB Group makes no warranties as to the status of this link or information contained in the website you are about to access.

WE USE COOKIES. By continuing to browse the website, you will be agreeing to our Privacy Policy and use of Cookies. Learn more about our Privacy Policy and Cookies Usage. Do you wish to proceed?

What Other Factors Determine How Much House I Can Afford

Beyond the price you offer to pay and the amount you have for a down payment, there are other expenses involved in home-buying, as well, including:

- , which can include recording fees or transfer taxes in your location as well as fees charged by your lender and lawyer

- , which often have to be set aside in escrow and are added to your monthly mortgage payments

- Homeowners insurance, which also can be paid through escrow

Also Check: How To Transfer A Car Loan To Someone Else

How To Increase Home Loan Eligibility

Listed below are some of the ways to increase home loan eligibility and improve the chances of availing of a housing loan at favourable terms and interest rate.

- Improve CIBIL score: Lending institutions tend to provide home loans at attractive interest rates to individuals who possess an ideal CIBIL score above 750. Timely payment of bills, EMIs, credit card dues and not applying for multiple credit products simultaneously are some ways to improve CIBIL score

- Clear existing loans: Lenders also assess loan repayment capacity by gauging an individuals debt-to-income ratio. Hence, clearing existing loans before applying for a new one can increase home loan eligibility

- Opt for a joint home loan: The home loan eligibility improves if one applies for this credit product jointly with an earning co-applicant or spouse

Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

Recommended Reading: Fha Loan Refinance Calculator

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

How To Use Credit Karmas Home Affordability Calculator

If youre planning to buy a house, youll need to get a sense of how much home you can afford.

Our home affordability calculator could help you estimate how much you can afford to pay for a home as well as your estimated monthly mortgage payment and closing costs. This calculator provides an estimate based on the information you provide. It doesnt consider other costs associated with home ownership, such as maintenance and utilities.

Keep in mind that home price isnt the only factor that affects affordability. The interest rate on your home loan, your down payment and your loan term can all affect how much you end up paying for your home.

Our home affordability calculator considers the following factors:

Recommended Reading: Usaa Auto Loan Rates And Terms

What Affects Loan Amount And Tenure

AgeGenerally, the younger you are, the longer your maximum loan tenure possible. Regulations have also capped maximum loan tenures for HDB flats and private properties at 30 and 35 years respectively.

For loan tenure longer than 25 years for HDB flats , the maximum loan amount could be reduced to 55% of property purchase price as well.

Income and Financial Commitment

- In calculating your maximum home loan amount, banks will take into account the ratio of your debt to your income. This is called the Total Debt Servicing Ratio and this ratio is capped at 60% of all borrowers’ gross monthly income.

- If you are purchasing a HDB flat, banks also have to calculate your Mortgage Servicing Ratio . MSR is capped at 30% of all borrowers’ gross monthly income. Calculation of MSR is based on loan amount and combined monthly gross income.

- Your maximum home loan amount is determined by TDSR, MSR , loan tenure and a medium-term 3.5% interest rate.Check out our calculators below to find out how much you can borrow.

Mortgage Calculator: How Much Can I Borrow

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You May Like: Does Upstart Allow Co Signers

How To Use Hdfc’s Home Loan Emi Calculator

All you need to do is input the following to arrive at your EMI:

- Loan Amount: Input the desired loan amount that you wish to avail

- Loan Tenure : Input the desired loan term for which you wish to avail the housing loan. A longer tenure helps in enhancing the eligibility

- Interest Rate : Input interest rate.

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

Also Check: Apply Capital One Auto Loan

House Affordability Based On Fixed Monthly Budgets

This is a separate calculator used to estimate house affordability based on monthly allocations of a fixed amount for housing costs.

In the U.S., conventional, FHA, and other mortgage lenders like to use two ratios, called the front-end and back-end ratios, to determine how much money they are willing to loan. They are basic debt-to-income ratios , albeit slightly different and explained below. For more information about or to do calculations involving debt-to-income ratios, please visit the Debt-to-Income Ratio Calculator.

Because they are used by lenders to assess the risk of lending to each home-buyer, home-buyers can strive to lower their DTI in order to not only be able to qualify for a mortgage, but for a favorable one. The lower the DTI, the more likely a home-buyer is to get a good deal.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Read Also: Bayview Loan Servicing Charlotte Nc

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

How Can I Qualify To Borrow More

If youre disappointed by the how much can I borrow results, remember that there are many factors at work. Small improvements in one or more can make a substantial difference:

A bigger down payment always helps. The more money you put down, the better youll look in the eyes of the lender.

Be a tactical buyer. If school districts wont play a role in your family for years, consider finding a home in a transitioning neighborhood maybe buying a starter home rather than a forever home. Youll likely get a better home value and wont need to borrow as much.

Reduce debt even a little. Paying off or down a credit card or two can help in several ways. Your debt-to-income ratio will go down and you may even get a nice bump in your credit score.

You May Like: Can I Use A Va Loan To Buy Land

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

What Are Real Estate Construction Loans

Before delving into the specifics of loan types and how they might work for you, there are some commonalities shared by all real estate construction loans, including:

- banks while mortgage companies might be most common with securing a conventional mortgage, they tend to shy away from the complexity and risk of real estate construction loans. Banks are where you need to concentrate your efforts seeking this kind of financing, most often, as well as some government programs

- land usually, the property on which you will be building is included in the real estate construction loan. It is not required though. If you own property already, you actually may be able to leverage it as collateral, and get better terms for your construction loan

- plans you will need to provide detailed plans and timetables to qualify for this type of financing. Expect much more scrutiny, supervision and direct activity with your lender

- FICO as a real estate construction loan is often lacking a home as collateral, the borrowers FICO score is much more important than it might be in other financing.

Most often, construction loans are short-term loans that turn into a longer, more conventional mortgage when building is complete. The larger part is usually 15 or 30 years.

How the loan works more specifically depends on the type on loan you secure, and who you secure it with.

Also Check: Bayview Loan Servicing Class Action Lawsuit

Why Consider Refinancing

Refinancing a mortgage is when you end your current mortgage and start a new one. You can do this with your current mortgage provider or a new one. If you’re refinancing your mortgage while you’re in the middle of an exiting mortgage term, you’re likely to be hit with a prepayment penalty – more on that below.

There are two main reasons youâd consider doing a refinance: To lower your existing mortgage rate, or to access the equity youâve built in your home as cash.

What Can I Afford

Thank you for taking the time to complete our calculator. Based on the information your entered, your results are illustrated in the table below.

For more information, visit us at www.scotiabank.com/mortgage to locate your nearest branch or Home Financing Advisor.

| You can afford a home with: |

|---|

| A maximum purchase price of: 256,192.54 |

| Based on… |

| A minimum down payment of: 250,075.56 |

| A monthly payment of:1,600.00 |

| A total mortgage amount of: 12,810.00 |

| Includes mortgage default insurance premium of $6,693.02 |

For the purposes of this tool, the default insurance premium figure is based on a premium rate of 4.0% of the mortgage amount, which is the rate applicable to a loan-to-value ratio of 90.01% 95.00%. However, the insurance rate for your scenario may be higher or lower than this, which would normally result in a higher or lower insurance premium, respectively. Current premium rates may be found at https://www.cmhc-schl.gc.ca/en/co/moloin/moloin_005.cfm.

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

Don’t Miss: Fha Loan Refinance

Using The Mortgage Qualifying Calculator

The Mortgage Qualifying Calculator is designed to be easy to use and largely self-explanatory. Just fill in the various fields with the information requested. Start by choosing if you want to base the calculation on your annual income, the purchase price of the home you’re looking at or the monthly payment you can afford. Then work down the page entering your other information and the calculator will figure out the other two values for you and display them in gray.

For example:

- Enter your annual income and the Mortgage Qualifying Calculator will determine the maximum purchase price you can afford and the associated monthly payment.

- Enter the purchase price and the calculator will tell you the income you need and the monthly payment required. Or,

- Enter the monthly payment you’re thinking of and the Mortgage Qualifying Calculator will tell you the income needed to qualify and the home purchase price that will cover.

Then go down the rest of the page entering the information requested. Your answers will be displayed in gray at the top of the page. Click “View report” for a detailed breakdown and an amortization report.

What Monthly Expenses Do You Have

! Please enter an amount less than }.

Estimate your monthly expenses such as groceries, transportation, child care, insurance, shopping, media and regular contributions to savings.

Please do not include rent or housing expenses.

If you’re buying a home with a spouse, partner, friend or family member, include their monthly expenses as well.

If this amount is higher than your monthly income before taxes, please contact us to discuss your options.

Step 6 of 6

Also Check: Does Carvana Prequalify Hurt Credit

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.