You Previously Tried To Certify Employment For Pslf But Were Denied

If the Department previously said your employer was not eligible for PSLF then you need to submit a new form through the PSLF Help Tool to see if you can receive credit toward forgiveness. You can also see which employers the Department has already deemed eligible through the PSLF Help Tool. Please note that this waiver does not affect qualifying employer rules. Your employer still needs to be a governmental organization, a 501 organization, or a not-for-profit organization that provides a designated public service to get PSLF under normal rules and the Limited PSLF Waiver.

Eligible Loans And Qualifying Payments

Note: Loan eligibility and qualifying payment rules have been suspended through October 31, 2022 under the Limited PSLF Waiver.

Not all student loans qualify for PSLF as the program specifies only William D. Ford Direct Loans are eligible. Private loans or other federal student loans may become eligible if you consolidate them into a Direct Consolidation Loan.

Loan payments only count towards the 120 qualifying payments when made under a qualifying repayment plan, for the full amount shown on the bill, no later than 15 days after your due date and while employed by a qualifying employer.

Which Loans Are Eligible For Pslf

Private student loans are not eligible for loan forgiveness. PSLF is only a program for student loans of the Federal Direct Loans type. These include:

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Direct PLUS Loans

- Direct Consolidation Loans

If the loan isnt on the list above, its not eligible for loan forgiveness.

Important Note Regarding FFEL and Perkins Loans: President Biden announced that there will be a limited waiver until October 31, 2022 for prior payments that were made under FFEL or Perkins Loans. However, to qualify, you must consolidate your loan into a new Direct student loan AND have employment certifications on file for those past payments. Learn more here.

If you’re looking to consolidate your old FFEL loans, check out this guide: Student Loan Consolidation.

Read Also: How Much Home Loan Can I Get On 70000 Salary

Are Direct Consolidation Loans Really Eligible

Direct Consolidation Loans are eligible for loan forgiveness, but with several important caveats.

First, if you and your spouse consolidated onto a Direct Consolidation Loan, and only one of you met the employment requirements, the portion of the balance attributable to the qualified employee is forgiven. The rest is not.

Additionally, joint consolidation loans from the Federal Family Education Loan Program cannot be forgiven.

Finally, any time you consolidate your federal loans, you restart the 120-payment requirement.

Borrowers With At Least One Ffel Program Loan Or Federal Perkins Loan

![[highlight] Public Service Loan Forgiveness Employment Certification ... [highlight] Public Service Loan Forgiveness Employment Certification ...](https://www.understandloans.net/wp-content/uploads/highlight-public-service-loan-forgiveness-employment-certification.png)

- Verify your loan types in your Aid Summary at studentaid.gov

- Verify eligible employment by completing Step 1 of the PSLF Help Tool.

- If any employer is eligible and you have at least one loan that is not a Direct Loan, request a Direct Consolidation Loan by October 31, 2022.

- Submit a PSLF form with the PSLF Help Tool by October 31, 2022.

Recommended Reading: How Much Can I Get Home Loan

You’ve Got Options If You Were Denied Pslf

If your application for Public Service Loan Forgiveness was denied, you may be able to receive loan forgiveness under the Temporary Expanded Public Service Loan Forgiveness opportunity.

As part of this opportunity, the Department of Education reconsiders your eligibility using an expanded list of qualifying repayment plans.

Bottom Line: Verifying Employer Eligibility For Public Service Loan Forgiveness Is Easy

Figuring out whether or not you qualify for Pubic Service Loan Forgiveness should not require a law degree.

For the vast majority of borrowers, it is as simple as submitting a form.

Student loan expert Michael Lux is a licensed attorney and the founder of The Student Loan Sherpa. He has helped borrowers navigate life with student debt since 2013.

Insight from Michael has been featured in US News & World Report, Forbes, The Wall Street Journal, and numerous other online and print publications.

Also Check: Is 10 Interest High For Auto Loan

You Currently Have Direct Loans And Have Not Yet Applied For Pslf

You will need to submit a PSLF form so we can review your loans under the simplified rules and determine whether your current or past employers qualify for PSLF. You can submit this form through the PSLF Help Tool at StudentAid.gov/PSLF. Because we expect an influx of applicants due to this announcement, you may see some delays in having your application processed, but we will work as quickly as possible to assist you. You will need to submit your application by October 31, 2022.

Identify Your Federal Loan Types To See If You Need To Consolidate

Borrowers can have several different types of federal loans, including Direct Loans, Federal Family Education Loans , and Perkins Loans. Some federal loans are even owned by private companies. To qualify for the Limited PSLF Waiver, borrowers with federal loan types that are not Direct Loans must consolidate those loans into the Direct Loan Program by October 31, 2022.

- Parent PLUS Loans are not directly eligible for the Limited PSLF Waiver. However, Parent PLUS Loans that were previously consolidated into a Direct Consolidation Loan will receive credit for repayment periods after the consolidation. Additionally, if Parent PLUS Loans are or were consolidated with student loans that the parent took out for their own education, the entire resulting Direct Consolidation Loan can receive credit under the waiver based on the parents student loans.

Heres how to see whether your loans are Direct Loans, FFELs, or Perkins Loans:

- Log in to your Federal Student Aid Account at studentaid.gov. If you havent already set up an FSA ID, please create one.

- Once logged in to studentaid.gov, you will see your account dashboard as pictured below, which shows your total federal loan balance.

- Next to “My Aid,” click “View Details.”

- Scroll down the page to the section entitled “Loan Types.” In the Loan Types section, you will see different categories of loans as shown below.

You May Like: Can I Get An Emergency Loan With Bad Credit

What Is The Pslf Program Who Can Apply

The PSLF program, first launched in 2007, was designed to help public servants pay off their loans faster.

The program works by offering loan forgiveness to eligible public servants who have made 120 qualifying student loan payments. Yet, prior to last October’s expansion of the program, it had a horrible approval rate: Almost 99% of borrowers who had applied since 2008 were denied.

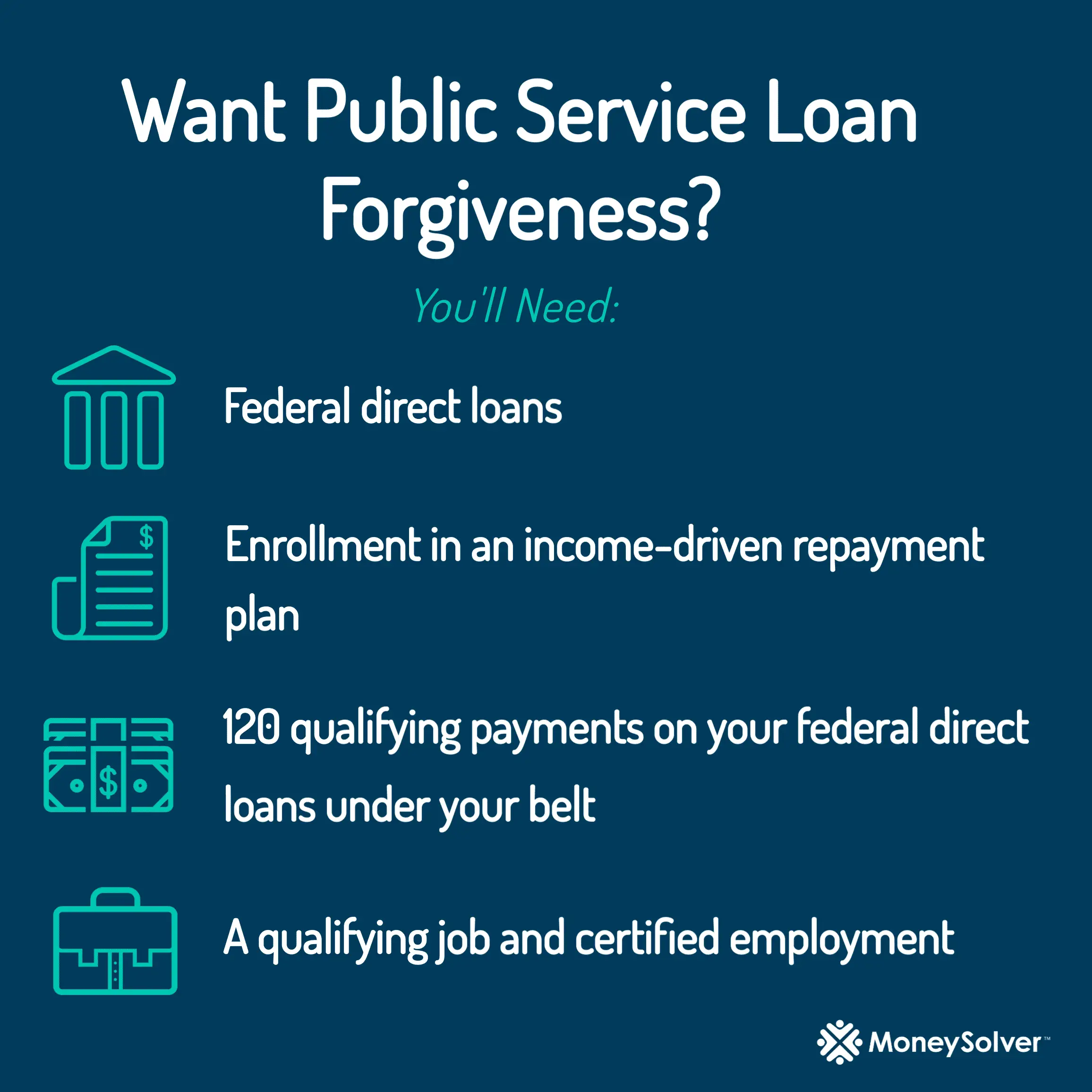

To qualify for PSLF you must be employed full-time by a US federal, state, local or tribal government agency — this includes the military — or a nonprofit organization. You must have federal Direct Loans or other types of federally backed loans that have already been consolidated into Direct Loans and you must make 120 qualifying payments or 10 years of payments. Examples of borrowers who qualify for PSLF are workers like teachers, nurses and firefighters who serve their local communities.

How Do I Apply For The Temporary Pslf Forgiveness Waiver

The Department of Education has a dedicated tool to help guide your application for the limited waiver. The deadline to apply for the waiver is 11:59 p.m. ET on Oct. 31, 2022, but the sooner you apply, the better. Some borrowers may not have to take any action to have their loans canceled — but it’s a good idea to confirm your specific details.

If you have FFEL or Perkins loans, you’ll need to consolidate them into Direct Loans before applying for the PSLF waiver. As long as you complete the consolidation application and the PSLF application before the deadline, you can qualify for the expanded waiver — even if your consolidation takes several more weeks.

You can consolidate qualifying federal student loans into a Direct Loan online at the Federal Student Aid website. You can find the application for consolidation here. By consolidating into one Direct Loan and then applying for the expanded PSLF waiver, your past payments can now count toward loan forgiveness, as long as you are in a qualifying public service job.

You May Like: How Can I Get Loan From Bank

Public Service Loan Forgiveness

You may be eligible to receive loan forgiveness of the remaining balance of your Direct Loans * under the Public Service Loan Forgiveness Program if you:

- Are employed by:

- a federal, state, or local tribal government organization this includes the U.S. military

- a nonprofit organization that is tax-exempt under Section 501 of the Internal Revenue Code or

- a nonprofit organization that is not tax-exempt under Section 501 of the Internal Revenue Code if it provides certain types of qualifying public services.

directly employed by a qualifying employer

Learn more by using the PSLF Help Tool to see whether you might qualify and to apply for PSLF electronically, or you can download the Public Service Loan Forgiveness and Temporary Expanded PSLF Certification & Application .

What Counts As A Government Employer For The Pslf Program

Any U.S. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. This includes employers such as the U.S. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts .

A government contractor isnt considered a government employer.

You can visit our Public Service Loan Forgiveness Help Tool, which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

Recommended Reading: Who Will Pay For Student Loan Forgiveness

Who’s Gotten Pslf So Far

Public Service Loan Forgiveness began in 2007, meaning the first batch of borrowers became eligible for relief in 2017. A total of $10 billion has been erased for 175,000 borrowers so far.

The approval rate is low, but improving. Among all 1,299,286 combined applications for PSLF and TEPSLF submitted from November 9, 2020 onward, only 130,728 have been deemed eligible for forgiveness, according to April 2022 data from the Department of Education. That means only 10.1% of all applications have been approved. However, this is still an improvement: From November 2020 through October 2021, only 2.4% of combined applications had been approved.

Borrowers get nearly six figure debt erased, on average. The average balance of borrowers whose loans were discharged under PSLF was $67,592.

IDR forgiveness fixes are here. Millions of borrowers are will benefit from one-time fixes that count past payments toward the 240 or 300 needed to qualify for income driven repayment forgiveness, the Department of Education announced on April 19. The fixes are also expected to cancel debt for at least 40,000 borrowers through Public Service Loan Forgiveness. So far more than 128,000 borrowers have had their debt discharged by the waiver and collectively had $8 billion in debt erased.

What Does The Limited Pslf Waiver Do

While qualifying employment is still required and borrowers must either have or obtain Direct Loans through consolidation, the Limited PSLF Waiver temporarily eliminates most of the PSLF Programs other rules. Through the waiver, some borrowers will receive loan forgiveness while others will get much closer to forgiveness. To summarize:

- Non-qualifying payments will now count. Months in which you failed to make a payment, paid late, paid the wrong amount, paid under the wrong repayment plan, or paid on a loan that was later consolidated will count towards forgiveness under the waiver.

- Payments on non-qualifying loan types can now count.Months in which you made payments on loan types that do not traditionally qualify for PSLF can count towards forgiveness under the waiver. However, you must apply to consolidate those loans into the Direct Loan Program by October 31, 2022.

- Although consolidating restarts the clock on loan forgiveness under traditional PSLF rules, payments made prior to consolidation will count towards forgiveness under the Limited PSLF Waiver.

You May Like: Do Auto Loan Inquiries Affect Credit Score

Limited Pslf Waiver: What Happens After The End Of The Waiver October 31 2022

The “limited PSLF waiver” refers to the time-limited changes to Public Service Loan Forgiveness Programrules that allowed borrowers to receive credit for past periods of repayment that would otherwise not qualify for PSLF. This opportunity ended on October 31, 2022 and beginning November 1, 2022,we went back to the normal program requirements for both PSLF

When Does The Clock Start For My 120 Loan Payments

You can begin making qualifying PSLF payments once the in-school deferment and grace period on your loans ends. If you want to start making payments right away, consolidate your loans and begin repayment immediately.

Warning: Consolidating loans can reset the clock on PSLF! Remember, consolidating your federal loans resets the clock on Public Service Loan Forgiveness. Dont consolidate if youve already made eligible payments under PSLF. The only exception is consolidating old FFEL or Perkins Loans – but this must be done before October 2022.

Recommended Reading: What Loan Can I Get Approved For

Learn About The Limited Public Service Loan Forgiveness Waiver

The Public Service Loan Forgiveness Program forgives the remaining balance on federal Direct Loans after borrowers have made 120 qualifying payments while working full-time for a qualifying employer. Last fall, the U.S. Department of Education announced a temporary, but significant waiver to the PSLF Programs rules. The waiver, called the Limited PSLF Waiver, allows borrowers to get credit towards loan forgiveness for past repayment periods that would not otherwise qualify for PSLF. This means borrowers can get closer to loan forgiveness faster. However,to qualify for the Limited PSLF Waiver and maximize its benefits, you may need to take certain actions by October 31, 2022. These actions may include applying to consolidate some or all of your loans and/or filing employment certifications.

What Permanent Changes Are Being Made To The Pslf Program

The Department of Education on Tuesday announced permanent changes to the Public Service Loan Forgiveness program, in an effort to expand student loan relief to more eligible borrowers. The permanent changes will take effect July 1, 2023.

All payments made by eligible public servants on income-driven repayment plans will receive credit for the entire time period their loans sat in repayment — even if they made late or partial payments, and regardless of the type of repayment plan.

- Any month in which loans were in an eligible repayment, deferment or forbearance status prior to consolidation

- Months where a borrower’s account was in at least 12 months of consecutive forbearance

- Months where a borrower’s account was in forbearance for at least 36 cumulative months in forbearance

- Any month spent in deferment prior to 2013.

Most borrowers will not have to make any moves to receive the above benefits. Their accounts will be automatically adjusted.

However, if you have ineligible loans — any federal loan that is not a Direct Loan or federally managed FFEL loan — you will need to consolidate your loans into a Direct Loan first. You will then receive credit for your previous repayment period.

For instance, if you made six years’ worth of payments on a loan before consolidating it into a Direct Loan, those six years’ worth of payments would be applied to your account.

Recommended Reading: Federal Home Loan Bank Of Atlanta

Sign Up For Daily News

Stay informed with WPR’s email newsletter.

The department clarified that full-time employment is now defined as 30 hours per week with more specific guidelines for adjunct faculty and lecturers.

The new regulations also expand the types of situations in which it’s OK for a borrower to defer or pause their payments. Before the change, deferment for things like cancer treatment or economic hardship could derail borrowers in the program.

Public Loan Repayment Resources

If you have worked in public service for 10 years or more, you may be eligible to have all your student debt canceled.

How do you qualify for Public Service Loan Forgiveness?

- Be employed by a qualifying employer

- Work full-time for that employer

- Have Direct Loans

- Repay your loans under an income-driven repayment plan

- Make 120 qualifying payments

What is a qualifying employer?

Qualifying employment for the PSLF Program isnt about the specific job that you do for your employer. Instead, its about who your employer is. Employment with the following types of organizations qualifies for PSLF:

- Government organizations at any level this includes the U.S. military

- Not-for-profit organizations that are tax-exempt under Section 501 of the Internal Revenue Code

- Serving full-time as an AmeriCorps or Peace Corps volunteer

Use the Department of Educations online search tool to determine if your employer counts and UCF counts as a qualifying employer.

What is considered full-time employment?

- For PSLF, you are considered full-time if you meet your employers definition of full-time or work at least 30 hours per week, whichever is greater.

What loans are considered Direct loans?

What repayment plan is required?

Don’t Miss: How To Check Student Loan Interest