What Is Loan To Value

When you start looking at the mortgages on offer to you, there will be several criteria set by each lender, mainly relating to your minimum required income for the loan amount, the minimum deposit you must raise and other criteria such as credit history and the number of working years you have left. One of the most important criteria is the lenders maximum Loan to Value ratio. So, what is Loan to Value?

As the name suggests, LTV is the maximum amount that the lender will consider loaning to you as a percentage of the value of the property. For example, if you were buying a property valued at £300,000 and you have £35,000 available for deposit you would need to borrow the remaining purchase price. In this case, the required loan would be £265,000.

If you have a loan of £265,000 on a property valued at £300,000, then the Loan as a percentage of the propertys value would be 88.33%. This is the Loan to Value Ratio. If a lender will lend up to a maximum of 90% LTV then you have met the criteria with a loan to value of 88.33%. But if you only had £25,000, the Loan to Value Ratio is 91.67% which is over the lenders 90% Maximum LTV Ratio. In this instance, you will either need to find another lender that will lend you money at a higher LTV Ratio or youll need to scrape together a bigger deposit.

What Is A Loan

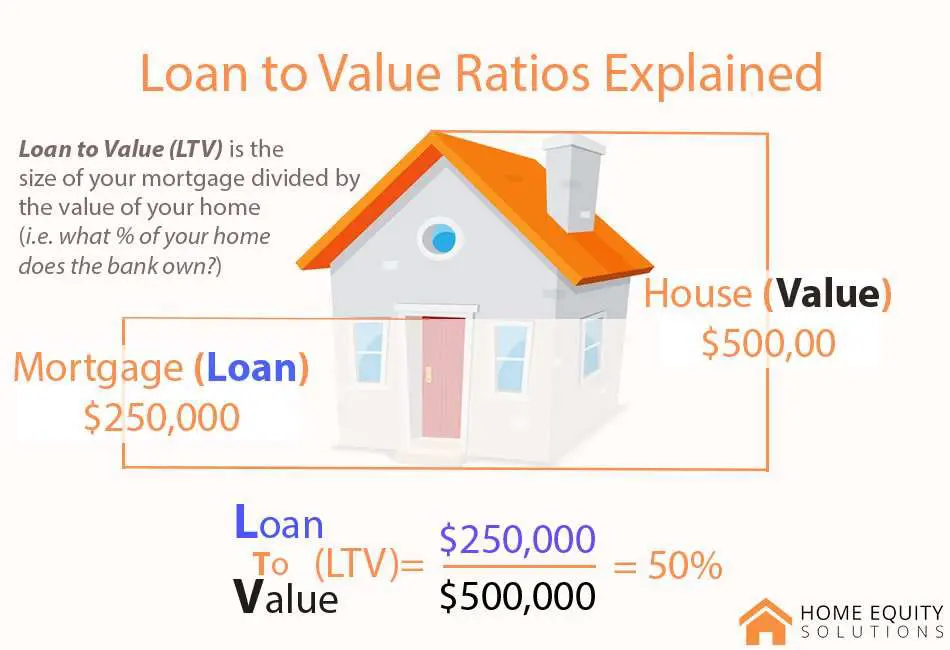

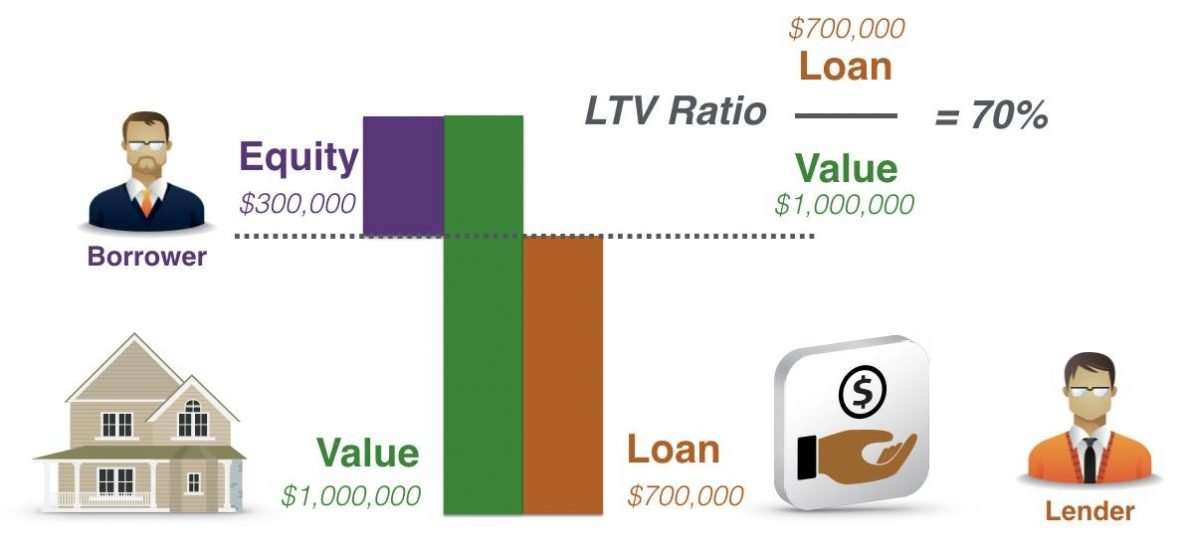

A loan-to-value ratio basically measures the loan amount against the value of the asset being purchased with the loan. The loan balance is divided by the value of the asset to calculate the loan-to-value ratio.

A higher LTV ratio means that you need a higher loan amount to pay for the purchase of the asset. Over time, your LTV will decrease as you continue making loan payments and as the assets value appreciates.

Do you know what the true cost of borrowing is? Find out here.

What Is A Typical Ltv

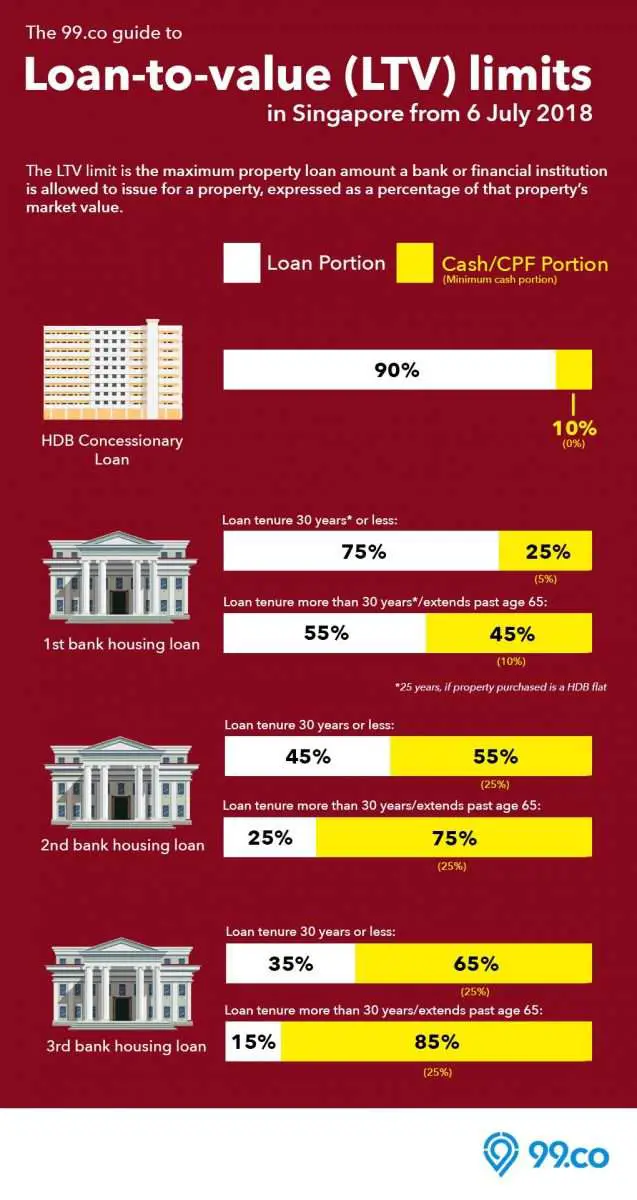

LTVs range rather considerably and are largely determined by the lenders risk appetite and the nature of the underlying asset.

If cash is being used as collateral , then a borrower can probably expect to get 100% LTV. Real estate also tends to support higher LTVs up to 95% for residential properties and generally upwards of 75% of appraised value for commercial properties. At the opposite end of the spectrum is inventory, which is frequently capped at 50% LTV.

When it comes to personal lending, rare or customized assets may command among the lowest LTVs. Fine art, wine collections, and collector vehicles may be used as collateral. Still, the niche appeal and limited secondary markets for these assets limit their upside, which equates to a lower LTV .

Recommended Reading: How Can You Refinance Your Car Loan

Choose A Less Expensive Home

If youre unable to make a larger down payment and are on a strict budget, the other option is to focus on less expensive homes. This will lower your LTV and might help you get a preferable loan option.

Remember, you already have the equation. That means you can manipulate the variables to get a lower, preferable LTV. Finding a home with a lower appraised value will improve your LTV ratio.

For example, if you know you only have $10,000 to use toward a down payment, this is how the price of a home can lower your LTV:

Why Your Ltv Ratio Matters

The higher your LTV ratio, the riskier your loan may appear to lenders. Also, when you make a smaller down payment, you have less equity or ownership in your property.

That can be problematic for the lender because if you default on a loan, the lender might not be able to recoup its loss by selling your property.

As a borrower, there are several ways a higher LTV ratio could affect you.

Calculate your equity by taking the amount your property is currently worth and subtracting the outstanding loan amount on the property.

Recommended Reading: How Do You Spell Loan

What If Your Loan

Having a high LTV ratio can affect a homebuyer in a couple of different ways. For one thing, if your LTV ratio is higher than 80% and youre trying to get approved for a conventional mortgage, youll have to pay private mortgage insurance . Fortunately, youll eventually be able to get rid of your PMI as you pay down your mortgage. Your lender must terminate it automatically when your LTV ratio drops to 78% or you reach the halfway point in your amortization schedule.

If your LTV ratio is too high, taking out a mortgage loan will also be more expensive. By making a small down payment, youll need a bigger loan. In addition to paying PMI, youll probably pay more interest.

A high LTV ratio can prevent a homeowner for qualifying for a refinance loan. Unless you can qualify for a special program , youll likely need to work on building equity in your home.

How To Use A Loan

Its all about walking into a lender, or applying online, with all you need to know to get the best terms possible. And calculating your loan-to-value will help you decide:

-

The loan term that works best for you. A 30-year fixed-rate loan will allow more affordable monthly payments, but youll pay a lot more interest over time. A 15-year fixed-rate mortgage means you pay less interest over the life of the loan your interest rate will be lower, too but your monthly payment will be considerably higher.

-

If an adjustable-rate mortgage might be a good option. If you have a high loan-to-value, you might be able to lower your interest rate by considering an ARM. This can be especially suitable for home buyers who plan on being in a home for only a few years.

-

Am I trying to buy too much house? A high loan-to-value may mean youre trying to buy more house than your down payment allows. Scaling back a bit on your dream home can make your down payment go farther and lower your LTV.

-

How much of a down payment should I make? Its a good question to ponder. If your LTV is below 80%, you wont have to pay mortgage insurance. That can save you quite a bit of money.

Also Check: Can I Include Closing Costs In My Fha Loan

How Does My Ltv Ratio Affect Remortgaging

Just as when you first buy a home, your LTV ratio will affect the choice and quality of the mortgage deals you will be offered. However, this time some additional factors are involved: how much of your mortgage you have already paid off, and how much your home has risen in value.

If you have been paying off your loan for a while, and your home has also gone up in price, then your LTV will be lower than it was when you first took out your mortgage. This means that better deals may now be available, with lower interest rates. Alternatively, you may be able to keep similar interest rates but borrow more money against your equity . Remortgaging therefore tends to be easier in a rising property market less so if prices are falling.

Ask your mortgage broker if you can get a better deal from your improved LTV ratio.

Which Loan To Value Ratio Should I Go For

With LTV ratio, a good rule of thumb is as low as you can go. The bigger your deposit in relation to your property value, the better mortgage deals you will be offered, the lower your repayments will be, and the less money youll repay overall. Its sad but true: the more money you have to buy a property, the less you need.

On the other hand, there can be some advantages to buying with a smaller deposit . For one thing, you should be able to buy sooner, get on the property ladder, save on rent and benefit from any increases in house prices. The longer you wait, the more house prices may rise out of reach unless you can save at a faster rate.

As with many things, its a balancing act. What you may be able to do is buy with a high LTV ratio and then try to reduce it step by step every time you remortgage. Remember that you may benefit from more income in the future so your first mortgage is only your first step.

Read Also: How To Refinance Sba Loan

How To Lower Your Ltv

Generally speaking, reducing LTV on your loans, especially on mortgage loans, means lower total costs over the life of the loan. Because there are only two variables that determine LTV ratiothe loan amount and the value of the assetthe approaches to reducing LTV are pretty straightforward:

- Make a larger down payment.Saving for a big down payment may test your patience if you’re really eager to get into a house or car, but it can be worth it in the long run.

- Set your sights on more affordable targets. Buying a home that’s a little older or smaller than the house of your dreams could allow your current savings to serve as a larger portion of the purchase price.

Whether you’re applying for an auto loan or a mortgage, it’s important to understand how your LTV ratio affects overall borrowing costs, what you can do to decrease LTV, and how doing so can save you money over the lifetime of a loan.

What Does A High Ratio Mean For The Borrower

Lenders calculate the LTV ratio to determine the risk involved in giving out the loan. The simple rule is: higher the LTV ratio, the higher the risk. For borrowers, this may arise as a difficulty in getting the loan approved.

If the lender approves the loan, the common criterion is that you pay a higher interest rate. You may also have to pay additional charges. A common example is the requirement of insurance. This secures the loan in case you are unable to pay. However, it increases the overall cost of your borrowing.

Also Check: How To See My Loan Balance

Fha Loan: Up To 965% Ltv Allowed

FHA loans are insured by the Federal Housing Administration, an agency within the U.S. Department of Housing and Urban Development .

FHA mortgage guidelines require a downpayment of at least 3.5%. Unlike VA and USDA loans, FHA loans are not limited by military background or location there are no special eligibility requirements.

FHA loans can be an especially good fit for first-time home buyers and buyers with less-than-perfect credit scores.

Why Loan To Value Is Critical

It all comes down to risk. If you are working with a high loan to value, lenders will see you as a client with a higher risk than someone who has a lower LTV. Mortgage providers look at loan to value to gauge how likely you are to default on your loan – the less equity you have, the higher the risk.

The reason for this seemingly blanket analysis is quite simple if you were to default on your mortgage and the property was sold to recoup the money, there is a greater likelihood that the lender would make a loss as your equity stake is so low.

This is because theres no guarantee the property will increase in value. If you default on a large mortgage and the market goes the wrong way, the lender will be left out of pocket…which is obviously something theyre not too keen on! In order to cover the risk, theyll up the interest on your loan, leaving you with a higher monthly repayment.

Read Also: How Do I Find Out Student Loan Balance

Usda Loan: Up To 100% Ltv Allowed

USDA loans are insured by the U.S. Department of Agriculture. USDA loans allow for 100% LTV, with no down payment required.

Many also know the program as Rural Housing. You can find USDA loans in rural parts of the country, but also in many suburbs.

Learn more about USDA financing and how to qualify here.

How To Calculate Your Loan To Value Ratio

Calculating your loan-to-value is simple. All you do is take your loan amount and divide it by the purchase price or, if youre refinancing, divide by the appraised value. Then multiply by 100 to get your LTV ratio.

X 100 = LTV

The loan-to-value ratio is always expressed as a percent. So if your result is 0.75, for example, your LTV is 75%.

Don’t Miss: How Long Until I Can Refinance My Home Loan

Make Extra Mortgage Payments

Can you afford to pay a little extra toward your mortgage before refinancing? Paying down more will decrease how much you owe on your home.

Before you make extra payments, check with your lender about any prepayment penalties. Lenders don’t usually penalize you for making small additional payments, but you could be charged a fee if you pay off a huge amount all at once.

Why Mortgage Lenders Care About Ltv

In short, if you have a low LTV, the mortgage lender is taking less of a risk and they reward that lower level of risk by giving you a preferential interest rate.

For example, if you have borrowed £190,000 to buy a £200,000 property , and then the value of the property goes down and you cant keep up repayments, theres a chance that the lender wont get all of their money back. The mortgage lender hedges this higher level of risk by making you pay more interest.

If you only need a mortgage of £150,000 to buy that same £200,000 property , theres a lot more wiggle room: the bank might be able to sell your home and make back most or all of its money.

Don’t Miss: Who Has The Lowest Car Loan Rates

Tips On Securing A Favorable Mortgage Rate

- For help with budgeting and saving, consider working with a financial advisor. A financial advisor can help you define your goals and reach them. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you cant make a reasonable down payment now, dont rush into the home buying game. Take some time to build up your funds so you can get a lower interest rate on your loan. Check out our reports on the best savings accounts and best certificate of deposit rates around.

How Ltv Is Used By Lenders

A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home equity loan, or a line of credit. However, it can play a substantial role in the interest rate that a borrower is able to secure. Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%.

A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. However, their interest rate may be a full percentage point higher than the interest rate given to a borrower with an LTV ratio of 75%.

If the LTV ratio is higher than 80%, a borrower may be required to purchase private mortgage insurance . This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. For example, PMI with a rate of 1% on a $100,000 loan would add an additional $1,000 to the total amount paid per year . PMI payments are required until the LTV ratio is 80% or lower. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

In general, the lower the LTV ratio, the greater the chance that the loan will be approved and the lower the interest rate is likely to be. In addition, as a borrower, it’s less likely that you will be required to purchase private mortgage insurance .

Recommended Reading: How To Make Personal Loan Agreement

Home Loan Programs That Dont Require An Ltv Ratio

You wont need to deal with LTV ratio restrictions if youre eligible for one of the following loan programs:

- An FHA streamline loan. If you already have an FHA loan insured by the Federal Housing Administration and hope to refinance, you may qualify for an FHA streamline loan, which doesnt require your homes value to be verified.

- A VA IRRRL. Military borrowers can refinance without an LTV ratio calculation if they already have a VA loan backed by the U.S. Department of Veterans Affairs and qualify for an interest rate reduction refinance loan .

- A USDA streamline loan. Borrowers who took out a USDA loan backed by the U.S. Department of Agriculture to buy a rural home can lower their payment with a USDA streamline loan that doesnt require either a home appraisal or an LTV ratio limit.

Should I Speak To A Mortgage Broker

Mortgage brokers remove a lot of the paperwork and hassle of getting a mortgage, as well as helping you access exclusive products and rates that arent available to the public. Mortgage brokers are regulated by the Financial Conduct Authority and are required to pass specific qualifications before they can give you advice.

Call or request a callback

Mortgage Advice Bureau offers fee free mortgage advice for Moneyfacts visitors that call on 0808 149 9177. If you contact Mortgage Advice Bureau outside of these channels you may incur a fee of up to 1%. Lines are open Monday to Friday 8am to 8pm and Saturday 9am to 1pm excluding bank holidays. Calls may be recorded.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Read Also: Who Has The Cheapest Car Loan Rates