How To Compare Rates For Home Equity Loan

The first thing you need to compare is their interest rates. As these will be the most determining factor. Especially when it comes to how much money you will end up paying back. If there are any fees required by either lender, you can use this information to find out if one of them may charge more than the other one. For example, bank A might require a 0.5% upfront origination fee while bank B does not charge anything extra. So obviously, they would be a better choice.

As far as points are concerned, both lenders have none. That means they are equal and depend on whether or not you want a down payment. And what kind of credit score is needed in order to qualify.

Lowest Home Equity Loan Rate

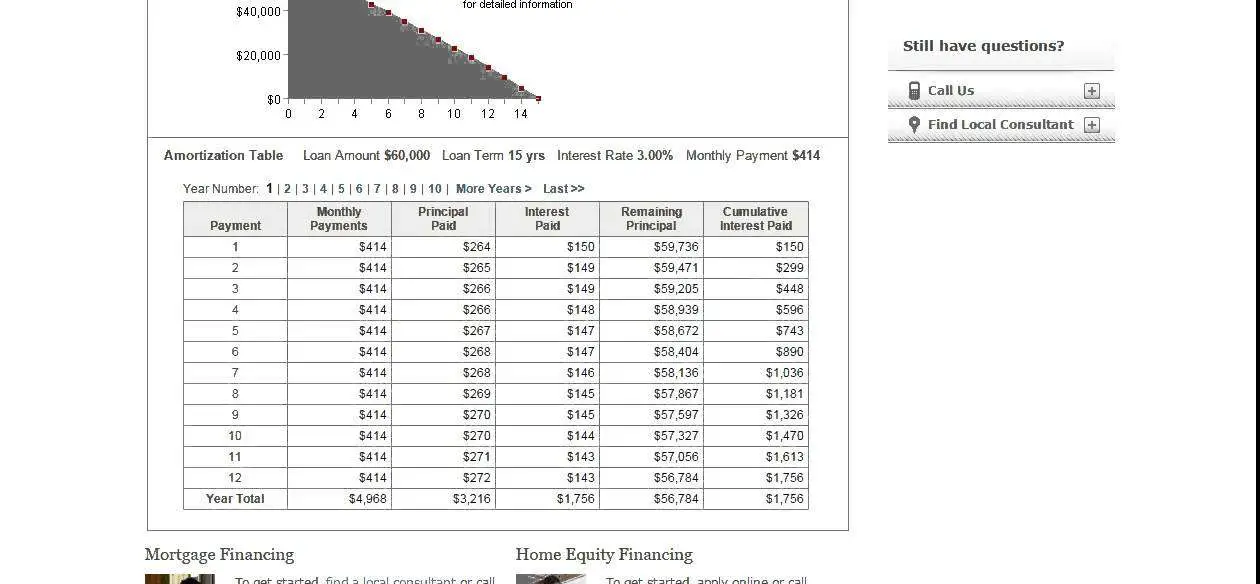

The Lowest Fixed rate 15 year home equity loan rate from Freddie Mac is currently 3.88% with 0 points as of this writing. With the same amount of money i.e.$100,000 and with the same fixed interest rate and fees. So you will end up paying back a total sum of $212,718 over 15 years or sooner. Only if you make extra payments each month against it.

With rates from both agencies being some of the lowest available today. So why not take out a home equity loan? You can even do an online application for free before deciding. Just keep in mind, if you owe more than your home is worth you may want to consider a refinance on your mortgage instead of taking out a second loan against it. You can compare rates from several lenders online and in much less time than it would take to go from bank to bank looking for the best deal.

Fixed Vs Variable Rates: Which Is Better

Theres no one right answer to whether you should opt for a fixed or variable rate home equity loan.

- Variable-rate loans are loans with the interest rate tied to a financial index. The rate usually starts below what a fixed-rate loan charges, but could go up or down over time. As the rate changes, your interest payments will change.

- Fixed-rate loans have the same rate over the life of the loan. While this may be higher than the starting rate on variable rate options, you dont have to worry about it increasing over time. These loans provide stability and certainty as youll know the required monthly payments and other costs upfront.

If you think interest rates could go down in the future, you may opt for a variable rate loanbut you run the risk of your rate going up and payments potentially becoming unaffordable. Variable rate loans could also be a good option if you plan to sell your home soon after borrowing as you could benefit from the introductory low rate and sell before rates go up. However, if you arent able to sell the home, you could end up with unaffordable payments.

If you want certainty and to know your costs up front, a fixed rate loan is a safer option.

Read Also: Usaa Credit Score Range

Loan Collateral And Terms

The equity in your home serves as collateral, which is why it’s called a second mortgage and works similarly to a conventional fixed-rate mortgage. However, there needs to be enough equity in the home, meaning the first mortgage needs to be paid down by enough to qualify the borrower for a home equity loan.

The loan amount is based on several factors, including the combined loan-to-value ratio, or CLTV ratio. Typically, the loan amount can be 80% to 90% of the property’s appraised value. Other factors that go into the lender’s credit decision include whether the borrower has a good , meaning they haven’t been past due on their payments for other credit products, including the first mortgage loan. Lenders may check a borrower’s , which is a numerical representation of a borrower’s .

Is A Heloc A Good Idea

A HELOC can be a good idea if used for home improvement projects that increase the value of your home. Because a HELOC lets you take out what you need when you need it, its best for ongoing projects or expenses.

A HELOC is not a good idea if you don’t have a steady income or a financial plan to pay off the loan. Since you use your home as collateral, if you fail to make the payments in full and on time, you risk losing your home.

Also Check: Bayview Loan Servicing Loan Modification

How To Find The Best Heloc Rates

To find the best HELOC rate, it’s critical to compare multiple lenders a rule of thumb is to get quotes from at least three companies so you can compare rates, fees and terms. Youll also want to try improving your credit score, clearing out existing debt and making additional mortgage payments to increase your home equity.

What Is A Good Heloc Rate

Home equity line of credit rates are determined by your financial situation and your credit score. If you have good credit, your HELOC rate could be around 3 percent to 5 percent. If you have below-average credit, you’ll likely fall within the 9 percent to 10 percent range.

The average HELOC rate, as of Dec. 15, 2021, is 4.27 percent. Generally speaking, any rate below the average would be considered a good HELOC rate.

Recommended Reading: Loaning Money To Your S-corp

How We Chose The Best Home Equity Loans

To narrow down our list of best home equity loans, we vetted each mortgage lender by evaluating them on the following criteria:

Loan features: We evaluated the types of loans offered, minimum and maximum loan amount, interest rates, loan terms and credit score requirements for each lender.

Price transparency: We preferred lenders that openly disclose loan costs, discounts, fees and other charges on their website.

Application process: We checked eligibility requirements and approval times. In addition, we compared application and evaluation fees, and whether application services were available online, by phone and/or in person.

Reputation and customer satisfaction: We looked into two main data sources: J.D. Power’s 2021 U.S. Primary Mortgage Servicer Satisfaction Study and complaint data as reported by the Consumer Financial Protection Bureau .

Which Gets Me Money Faster: A Heloc Or A Home Equity Loan

If you need money as quickly as possible, a HELOC will generally process slightly faster than a home equity loan. Multiple lenders advertise home equity loan processing timelines from two to six weeks, whereas some lenders advertise that their HELOCs can close in less than 10 days. The actual closing time will fluctuate based on the amount borrowed, property values, and the of the borrower.

You May Like: Car Loan Through Usaa

How Do Home Equity Loans Compare To Other Options

Home Equity Loan Vs. Cash-Out Refinance

Home equity loans arent the only way you can borrow against your home equity. You can also choose to get the money you need through a cash-out refinance.

While home equity loans enable you to take out a second mortgage on your property, cash-out refinances replace your primary mortgage. Instead of obtaining a separate loan, the remaining balance of your primary mortgage is paid off and rolled into a new mortgage that has a new term and interest rate.

With a cash-out refinance, you receive funds for the equity in your home, just as you would with a home equity loan. Unlike a home equity loan, you only have one monthly mortgage payment.

If you choose to get a cash-out refinance, you usually can secure a lower interest rate than with a home equity loan. The reason for the discrepancy in interest rates has to do with the order in which lenders are paid in the case of defaults and foreclosures.

Home equity loan rates are generally higher because second mortgages are only paid back after primary mortgages have been. As a second mortgage lender, theres a higher risk that the sale price will be too low for the lender to recoup their costs.

Conventional Loan Cashout Refinance

A conventional cashout refinance may be ideal for borrowers with good credit scores and more than 20% equity.

Fannie Mae and Freddie Mac set the rules for conventional cashout refinances.

If youve owned your home for a few years, chances are you qualify for this type of loan. Plus, if your current home is financed with an FHA loan, then you can get rid of unwanted mortgage insurance premiums .

Guidelines will vary depending on your lender, but you can expect to meet these requirements:

- More than 20% equity in your home

- Appraisal to confirm your homes value

- A credit score of at least 620

- Debttoincome ratio of 43% or less

- Loantovalue ratio of 80% or less

- Employment and income verification

The maximum loan amount for a conventional cashout refinance is currently $, and up to $ in highcost real estate markets.

Read Also: Can You Buy An Auction Home With A Fha Loan

Home Equity Loan Rates In 2021

A home equity loan can be a great way to access a considerable amount of money. These loans can help you cover home-improvement costs, pay off college debt or medical costs, or cope with unemployment and other misfortunes. Join us as we reveal who offers the most favorable home equity loan rates.

Average Home Equity Rates Over Time

While average home equity rates are significantly lower than they were 10 years ago, theyre trending upward. Take a look at how rates on home equity financing have changed over the last decade.

| Year | |

|---|---|

| 2010 | 6.75% |

Rates assume a loan amount of $25,000 and a loan-to-value ratio of 80% for a 15-year home equity loan.

Don’t Miss: How Long Does An Sba Loan Take To Get Approved

What Is The Three

Unlike other loans, such as personal loans, home equity loans must go through a closing period. During this period, all home equity loans are legally subject to a three-day cancellation rule, which states that you have the right to cancel your home equity loan until midnight of the third business day after you sign your contract. Changes to the contract, as well as funds disbursement, cannot occur during this time.

Check Out These Helpful Articles

footnote *Annual interest is calculated semi-annually, not in advance. All mortgage and Home Equity Line of Credit applications are subject to meeting Tangerine Banks standard credit criteria, residential mortgage standards and maximum permitted loan amounts. Conditions may apply. Interest rates are provided for information purposes only and are subject to change at any time without notice. The interest rate on your Tangerine Home Equity Line of Credit is set out in your Home Equity Line of Credit Agreement and is expressed as a variable interest rate per year equal to the Tangerine Prime Rate plus or minus an adjustment factor and will vary automatically when Tangerines Prime Rate changes. As of Mar 30, 2020, the Tangerine Prime Rate is . Prime Rate is the prime lending rate published from time to time by Tangerine and is subject to change without notice. You can find Tangerine’s current Prime Rate at tangerine.ca/en/rates .

Read Also: 1-800-689-1789

Bank Of America: Best Home Equity Line Of Credit For Low Fees

Overview: Bank of America offers HELOCs in all 50 states and Washington, D.C., and nixes a lot of fees that other banks charge. You can also shave 0.25 percent off your rate when you set up automatic payments from a Bank of America checking or savings account, up to 0.75 percent off for making an initial withdrawal and up to 0.375 percent off for being a Preferred Rewards client.

Why Bank of America is the best home equity line of credit for low fees: There are no application fees, no annual fees and no closing costs on lines of up to $1 million.

Perks: If you qualify for the entire 1.375 percent discount on your interest rate, youll save a lot over the life of your loan. Rates vary depending on , loan amount and other factors, but they may go as low as 4.4 percent APR in some states. As with some other lenders, you can convert some or all of your balance to a fixed-rate loan.

What to watch out for: The best rate discounts are reserved for Preferred Rewards members and those who make large draws from their HELOCs.

| Lender |

|---|

| Early closure fee of $450, plus taxes and fees, apply to accounts closed within 36 months |

How Does Equity Work When Buying A Second Home

You may be able to refinance your home loan and use your usable equity as security on a second mortgage to buy an investment property. A common rule of thumb is to look for an investment property priced at four times your usable equity, so your loan can cover the cost of the property plus stamp duty and other fees and charges.

Some property investors purchase multiple houses using this strategy, using the equity in one property as security to purchase the next, and so on. Keep in mind that this strategy can be risky if you find yourself unable to afford one loan, you could end up losing both properties.

Consider contacting a financial adviser and/or a mortgage broker before you look at buying an investment property with your home equity.

Recommended Reading: Advantage Auto Loans Legit

When Is A Heloc Better Than A Home Equity Loan

A HELOC is a better option than a home equity loan if:

- You need a revolving credit line to borrow from and pay down variable expenses.

- You want a credit line available for future emergencies but don’t need cash now.

- You are deliberate in your spending and can control impulse spending and a variable budget.

How To Calculate Interest On Home Loan

In general, home loans are long-term loans and it is important to figure out your overall interest liability towards the loan at the first place. You can calculate the same using one of the two methods listed below:

Read Also: Vehicle Loan Calculator Usaa

The Advantages Of Home Equity Loan

There are many benefits to take a home equity loan. Especially if its for something like remodeling your kitchen, bathroom, adding an addition to your house, paying off debt. Such as a credit card or any student loan or personal loan or maybe combined loan. And consolidating all of your debt into one monthly payment. HEL mortgage rates are often lower than other types of consolidation loans. Like payday loans and lines of credit . That can save you a lot of money if you qualify.

Find Out Before You Use Your Home As Collateral To Get Cash

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Recommended Reading: Is Prosper Com Legit

Home Equity Lending In 2021 What Homeowners Should Know

publishing team How We Make Money.

Historically low mortgage interest rates in the last year have led to a surge in refinances pushing another type of financial product off to the side.

For many homeowners, home equity in the form of home equity loans or lines of credit has historically been a go-to source of cash for things like home renovation, college tuition, and even debt consolidation.

But with mortgage rates so low, people are primarily accessing their home equity through mortgage refinancing. The number of cash-out refinance loans jumped more than 40% from 2019 to 2020, according to Dr. Frank Nothaft, chief economist at housing data firm CoreLogic.

At the same time, home equity loans and credit lines have been harder to qualify for, experts say, as lenders became more risk-averse and ratcheted up credit requirements.

Low mortgage rates wont last forever. With experts predicting rising rates in 2021, when will home equity lending be worth another look?

Heres what a few financial experts are predicting.

Home Equity Lines Of Credit

A home equity line of credit, or HELOC, is a credit line that gives borrowers access to a certain amount of funds based on the accumulated equity in their home.

Funds can be withdrawn during a so-called draw period during this time, you can choose to pay only interest or make payments to the principal as well. Draw periods often last about 10 years and are followed by a 20-year repayment period. You can pay the borrowed amount plus interest during repayment as either a lump sum or in installments.

Most HELOCs feature a variable interest rate, although some lenders offer the option of converting to a fixed rate.

If youre interested in borrowing for a one-time expense, getting a home improvement loan, personal loan or a credit card could be a better alternative than a HELOC. However, keep in mind that personal loans meant for home renovations arent tax-deductible, while home equity loans, HELOCs and home improvement loans are.

You May Like: How Long Does It Take Sba To Approve Loan