Sba Loans For Disaster Recovery

- Long term, low-interest loans from the U.S. Small Business Administration help many disaster survivors to return their disaster-damaged homes or businesses to their pre-disaster condition or better.

- Residents of Breathitt, Clay, Estill, Floyd, Johnson, Lee, Magoffin, Martin and Powell counties in Kentucky are eligible to apply for assistance from FEMA to help with the costs for damage and losses caused by the severe storms, flooding, landslides and mudslides that occurred .

- After you apply for disaster assistance, you may receive a letter from FEMA referring you to SBA. Submitting an SBA disaster loan application is a necessary step to being considered for other forms of disaster assistance.

- FEMA assistance that may be available if you submit the SBA loan application includes disaster-related car repairs, essential household items and other disaster-related expenses. You do not have to accept the loan, and it is free to apply. If you are approved for the loan and turn it down, you have six months to change your mind and re-activate the application if you discover additional damage or if your insurance settlement is not enough to cover your repairs. Give yourself the widest possible set of options. That could include an SBA loan.

- Up to 20 percent of your verified loss total can be added to your loan to fund mitigation improvements such as a safe room or storm shelter.

Ppp Loan Forgiveness Application

Business owners must complete the SBA loan forgiveness application to receive any leniency. The application contains four parts, including one optional section:

- PPP Loan Forgiveness Application

- Schedule A Worksheet

- Demographic Information Survey

The application itself will require basic information about your business, as well as a few other important numbers:

- SBA PPP Loan Number

- EIDL Application

Whether youre applying to receive full or partial forgiveness, you must complete this application.

The SBA also released a shorter PPP loan forgiveness application, SBA form 3508EZ. This is a simplified forgiveness application for businesses that meet the following criteria:

- Workers who are self-employed, and have no employees

- Business owners who kept salaries and wages consistent with pre-COVID earnings or reduced them by less than 25%, and didnt reduce employee hours

- Business owners who lost business due directly to health directives, and didnt reduce salaries or wages of employees by more than 25%

As mentioned above, business owners have up to 24 weeks to spend their funds on qualifying expenses and still apply for loan forgiveness. While the first round required businesses to spend at least 75% of their PPP funds on payroll and the other 25% on qualifying expenses, this has been changed. Businesses now have to spend at least 60% on payroll and the other 40% on qualifying expenses to achieve full forgiveness.

What Is Loan Forgiveness

Loan forgiveness is the process by which a lender discharges a borrowers obligation to repay their loan. Depending on the loan and nature of the cancellation, some or all of the outstanding loan balance may be forgiven. This is in contrast to grant money, which generally does not require repayment even in the absence of express forgiveness.

In the context of PPP loans, borrowers are eligible for loan forgiveness if they use the funds to cover designated expenses.

Don’t Miss: How To Transfer Personal Loan From One Bank To Another

Requirements For Ppp Loan Forgiveness

Loan forgiveness requirements are the same for first- and second-draw PPP loans. To receive full loan forgiveness, you need to maintain staffing and compensation levels during the covered period.

Additionally, money from your PPP loan must be spent on eligible expenses during the covered period. In order for your loan to be fully forgiven, at least 60% must be spent on payroll costs.

The covered period for most loans made in 2020 is 24 weeks after your loan is disbursed, but borrowers with loans issued before June 5, 2020, may opt for the original eight-week period. Business owners receiving a first- or second-draw loan in 2021 can opt for a covered period from eight to 24 weeks.

Additional Ppp Forgiveness Requirements

In addition to the PPP loan’s permitted uses, you must also adhere to some additional requirements:

- You have your choice of between eight and 24 weeks from the first distribution of any loan amount to spend your loan funds.

- Payroll costs must make up 60% or more of the amount forgiven. This includes the first three categories listed under permitted uses above.

- Non-payroll costs can make up no more than 40% of the amount forgiven and are defined as the last seven categories under permitted uses.

- To receive full forgiveness, you must retain all full-time-equivalent employees according to the baseline used to establish your loan, except as described in the Tip box above. You must do this within the covered period for your loan or by June 30, 2021, whichever comes first.

- The amount forgiven will also be reduced in proportion to any reduction in an employee’s salary or wages during the covered period greater than 25% of the average amount that employee made during the base period unless an exception applies.

- If you have any ownership interest in an S corporation, C corporation, partnership, or sole proprietorship , the maximum personal compensation you can count toward forgiveness for all companies you own is limited based on the length of the forgiveness period as a percentage of your 2019 or 2020 compensation, not to exceed $100,000. Health insurance and retirement plan costs are not part of this cap.

Recommended Reading: Quick Loans With Bad Credit

Ppp Amount Not Forgiven: Payback Required

Any part of your PPP loan that is not forgiven must be paid back, either immediately, in the case of non-permitted use, or in the form of a five-year loan at 1% interest. Loan payments on permitted use, including principal, interest, and fees are deferred until the SBA remits your forgiveness amount to you or, if you do not apply for forgiveness, for 10 months from the end of your loan-forgiveness-covered period.

An example of a permitted but not forgivable use would be utility costs that push your non-payroll expenses over 25% of the amount forgiven. Another example would be interest on non-mortgage debt in place on Feb. 15, 2020.

Second Draw Ppp Loans

If you have previously received a PPP loan, certain businesses are eligible for a Second Draw PPP Loan.

Notice: PPP ended May 31, 2021

The Paycheck Protection Program , a loan designed to provide a direct incentive for small businesses to keep their workers on payroll, ended on May 31st, 2021. Borrowers may be eligible PPP loan forgiveness.

SBA also offers additional COVID-19 relief.

Loan Details

PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP Loan with the same general loan terms as their First Draw PPP Loan.

Second Draw PPP Loans can be used to help fund payroll costs, including benefits. Funds can also be used to pay for mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations.

Maximum Loan Amount and Increased assistance for Accommodation and Food Services Businesses

For most borrowers, the maximum loan amount of a Second Draw PPP Loan is 2.5x average monthly 2019 or 2020 payroll costs up to $2 million. For borrowers in the Accommodation and Food Services sector , the maximum loan amount for a Second Draw PPP Loan is 3.5x average monthly 2019 or 2020 payroll costs up to $2 million.

Who May Qualify

A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

How and When to Apply

Read Also: Can You Add To An Existing Loan

Qualifications For Sba Loan Forgiveness

One of the main features of the coronavirus relief programs is the ability to have the loans forgiven. However, although your application was approved and you received the funds, that doesnât automatically mean your loan will be forgiven. Each program comes with its own set of forgiveness qualifications.

Sba Loan Forgiveness Program Resources & Updates For Small Business

Listen To This Article

To apply for the second round of PPP funding, . To learn about other flexible business financing options you may qualify for,

This post was last updated with new details about the second round of the PPP loan on February 3, 2021.

As a business owner, you may remember when the Paycheck Protection Program was first introduced. There were many uncertainties about who could qualify and funds ran out quickly as applications piled up.

The good news is that the federal government has recently approved another $284 billion for a second round of PPP funding. The announcement comes at a time when many small businesses continue to struggle and are in need of assistance to weather the new shutdowns and restrictions.

Many business owners are especially concerned about what the second round of PPP loans means for loan forgiveness. If youre wondering whether your business will still qualify for loan forgiveness, youre not alone. Thankfully, information is more readily available this time around and guidelines are clearer than ever before.

Take a look at this guide on SBA loan forgiveness to learn whether your business will qualify and how to apply.

Don’t Miss: Same Day Bad Credit Loan

Getting Ready To Apply

The SBA is working on an online SVOG application platform. Until the platform is up and running, the SBA suggests that interested entities:

- Register under the Data Universal Numbering System , which provides a unique nine-digit business identification number.

- Register in the System for Award Management .

- Gather documents that confirm number of employees and monthly revenues, floor plans, copies of contracts, and any other information that seems pertinent.

Sba Disaster Assistance Loan

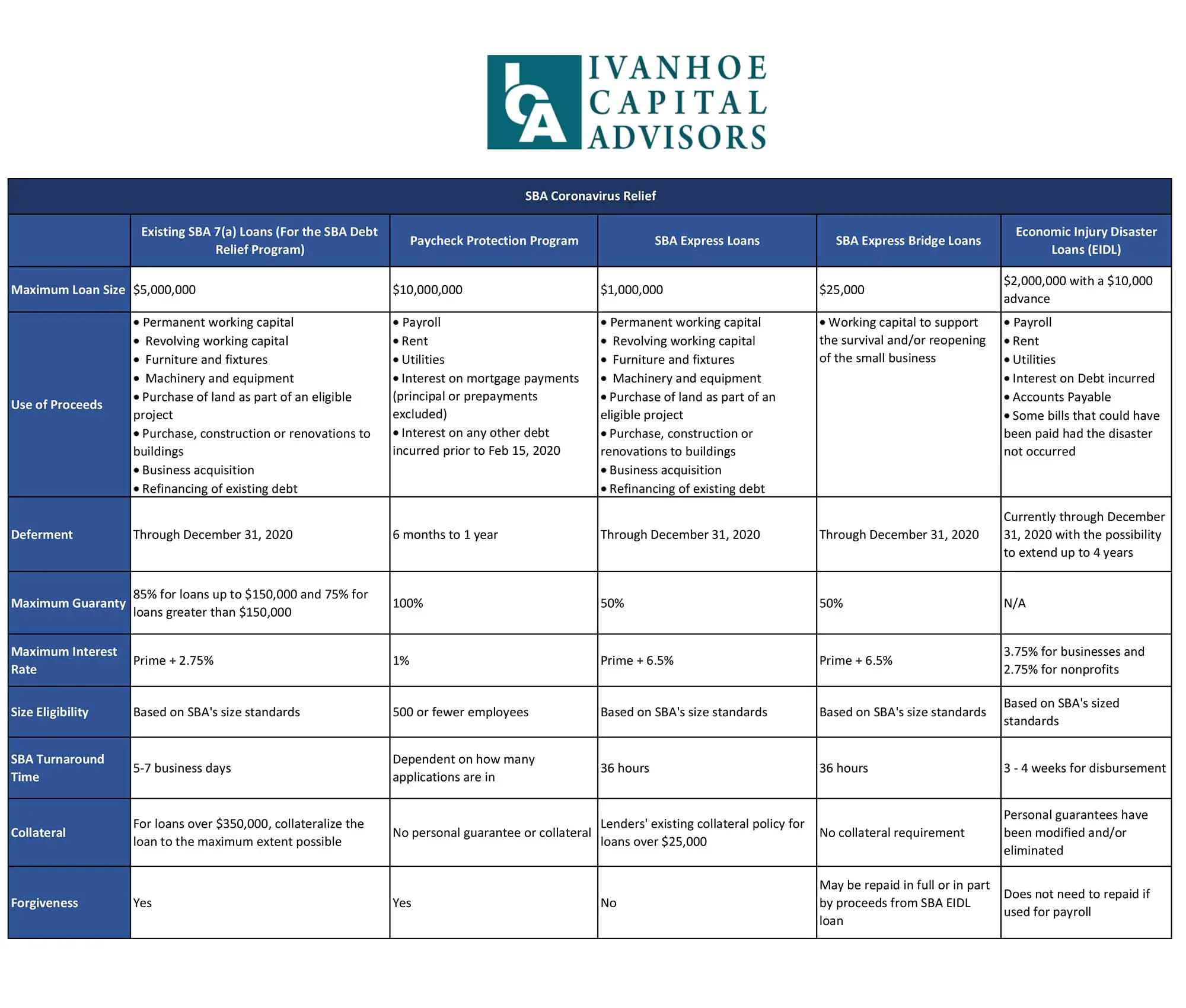

Our nations small businesses are facing an unprecedented economic disruption due to the Coronavirus outbreak. On Friday, March 27, 2020, the President signed into law the CARES Act, which contains emergency relief resources for American workers and small businesses.

Update 3/24/2021: The U.S. Small Business Administration is increasing the maximum amount small businesses and non-profit organizations can borrow through its COVID-19 Economic Injury Disaster Loan program.

Starting the week of April 6, 2021, the SBA is raising the loan limit for the COVID-19 EIDL program from 6-months of economic injury with a maximum loan amount of $150,000 to up to 24-months of economic injury with a maximum loan amount of $500,000.

Businesses that receive a loan subject to the current limits do not need to submit a request for an increase at this time. SBA will reach out directly via email and provide more details about how businesses can request an increase closer to the April 6 implementation date. Any new loan applications and any loans in process when the new loan limits are implemented will automatically be considered for loans covering 24 months of economic injury up to a maximum of $500,000.

View details or apply to EIDL on the SBA website.

Recommended Reading: How To Lower Student Loan Repayment

New Funding For One Old Program And Two New Ones

The SBA now offers three programs struggling businesses can use to obtain forgivable operating funds provided they qualify. Amounts up to $10 million are available, depending on the program, circumstances, and qualifications.

Keep in mind that, with similar limits, previous advances averaged just $3,459 in 2020 and forgivable loans averaged only $100,729. The new programs are designed to offer more relief and to target smaller businesses as well as those in low-income areas.

The CAA, 2021 amends the Coronavirus Aid, Relief, and Economic Security Act to provide full $10,000 advances to qualifying businesses, up to $10 million dollar grants to shuttered venues, and as much as $10 million in first-time PPP loans .

There is no application process for a Targeted EIDL Advance. The SBA will reach out to you by email if you qualify.

If Your Loan Was For $150000 Or Less

The vast majority of borrowers fall under this category. Those business owners can apply for PPP loan forgiveness one of two ways.

Through your lender. Your PPP lender will typically contact you with instructions on how to apply when your covered period ends . Some will even pre-fill your application with the necessary information, making forgiveness a breeze.

Through the SBA. If your PPP lender is one of the more than 1,400 participating in the SBAs direct forgiveness program you can apply using the SBAs PPP Direct Forgiveness Portal.

However you apply, youll answer the same set of questions as those on those on SBA Form 3508S. You do not need to detail how the funds were spent and, if it’s your first PPP loan, you dont need to submit any receipts, payroll records or additional documentation. For second-draw loans, borrowers need to show the required revenue loss before their loan can be forgiven.

Read Also: What Do I Need To Get Home Equity Loan

Eidl Loan Forgiveness Update For 2022

EIDL loans cannot be forgiven.

However, EIDL loans do have a deferment period. Any EIDL loan approved in 2020, 2021, and 2022 can be deferred up to 30 months from the date of the note. Full or partial payments can be made during this time but are not required. Interest will continue to accrue during the deferment.

Register Now For National Small Business Week

National Small Business Week celebrates the contributions of Americas entrepreneurs and small business owners. This years NSBW will recognize the small businesses who have navigated the coronavirus pandemic while supporting their employees and communities. There will be a number of presenters providing retooling and innovative practices for entrepreneurs as our nations small businesses look to pivot and recover towards a stronger economy.

Don’t miss this event on September 13 – 15!

Read Also: Can Parent Claim Student Loan Interest For Non Dependent

Get Your Application Documents Ready

Not every loan will have the same requirements, but in many cases, youll need to pull together the same kind of documents. A business plan is an important part of your application: Youll want to describe your business and its products or services, define and analyze your market and articulate your management structure.

Take a look at the SBAs Loan Submission Checklist to get an idea of what youll need to apply here are some commonly required documents:

- Business debt schedule

- Personal financial statement

- Current income statement and balance sheet

- Cash flow projections for one year

- Business valuation

- Three years worth of personal and business tax returns

- One year of personal and business bank statements

Find All The Information You Need About Business Financing Growth The Ppp Loan & More

If youre looking for a reliable source of information about how to navigate your business in uncertain times, youve come to the right place. At National, we take pride in helping small business owners make educated and informed decisions. Check back here to learn about the latest updates to the PPP program, and learn more about growing your business.

For guidance on how your small business should go about obtaining PPP loan forgiveness, be sure to contact your financial advisor or accountant.

Also Check: What Is The Maximum Conforming Loan Amount In California

Shuttered Venue Operators Grant Program

The Shuttered Venue Operators Grant program was established under the CAA, 2021 as part of the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act. The program includes $15 billion in grants to shuttered venues, to be administered by the SBAâs Office of Disaster Assistance.

Eligible applicants may qualify for 45% of their gross earned revenue, with a maximum amount available of $10 million per grant, and $2 billion is reserved for eligible applicants with up to 50 full-time employees.

Shelley Brown From The Us Small Business Administration Breaks Down How To Apply For Federal Loans And Grants

Every second week, experts from NFIBs Research Center and Small Business Legal Center create an in-depth webinar on the topics small business owners care about. These webinars are a crucial resource for any owner looking to stay informedabout federalprograms, taxes, regulations, and more. The webinars are always completely free.

NFIB Legal Center Senior Executive Counsel Beth Milito and Executive Director of NFIBs Research Center Holly Wade hosted this weeks webinar and were joined by a special guest: Shelley Brown, a Lender Relations Specialist with the U.S. Small Business Administration.

The webinar focused on the numerous federal programs created to help owners weather damages caused by the COVID-19 pandemic. While the flagship Paycheck Protection Program and the Restaurant Revitalization Fund are both out of funds and closed to new applications, there are still several programs that owners can take advantage of. Shelley focused on two: the Economic Injury Disaster Loan and the Shuttered Venue Operators Grant .

Shelley explained that in April 2021, the SBA increased the EIDL loan calculations from a 6-month maximum loan amount to a 24-month maximum loan amount. In other words, the maximum EIDL loan has increased from $150,000 to $500,000. Theres no need to request an increase if a business EIDL loan is increased, then the SBA will contact the owner directly.

Shelley then discussed several other programs including:

Read Also: How To Switch Student Loan Servicers

Ppp Loan Tax Treatment

The IRS has ruled that any forgiven part of a PPP loan is exempt from being taxed as a “discharged debt.” This means you do not have to declare the forgiven part of your loan as income when you file taxes for 2020 in 2021.

The CAA further provides “full deductibility of ordinary and necessary business expenses that were paid with a forgiven or forgivable PPP loan.”

The Rules For Which Expenses Can Be Forgiven And Which Wont

The application also contains more precise information about which expenses are forgivable. These forgivable expenses have recently been expanded to include:

- Protection equipment

- Certain operational expenses

This SBA loan forgiveness program is open to businesses that allocate at least 60% of the funds toward payroll during the 24 week covered period.

However, the SBA has put some measures in place to accommodate businesses with a regimented payroll schedule. Payroll costs incurredbut not yet paidmay also be eligible for forgiveness. If your payroll plan doesnt align with the 24 week covered period that begins when you receive your SBA PPP loan, then you may be able to file for an alternative payroll covered period.

As the SBA established earlier, PPP loans allow for only $100K per employee. This amount includes both salary or wages and paid leave costs.

However, other employee-related cash expenses, such as health insurance, retirement plans, and state/local taxes, are not included in this $100K per employee allowance.

For small business owners, self-employed individuals, and independent contractors, compensation is also capped at $100K annually. You would calculate your loan amount based on your 2019 payroll divided by 12, or your monthly average payroll. This figure times 2.5 equals your PPP loan amount. If you still need help navigating this calculation, be sure to reach out to your financial advisor or lawyer.

Read Also: Does Spouse Have To Be On Va Loan