Top Reasons Why Your Massachusetts Sba Eidl Loan Was Denied

Massachusetts SBA has approved over 65,757 EIDLs worth $6,209,574,382 so far, and is still evaluating reconsideration requests for Massachusetts loan applications that have been denied.

Your EIDL loan application may have been rejected by the SBA in Massachusetts, and there could be various reasons.

Here are some of the top reasons that result in denial of your Massachusetts SBA EIDL loan application. You can go through them, avoid making those mistakes and get your Massachusetts SBA EIDL loan approved.

Understanding Sba’s Economic Injury Disaster Loans Program

Updated September 27, 2021 new information in bold

The Small Business Administrations Economic Injury Disaster Loan program offers relief to eligible small businesses and nonprofits impacted by COVID-19, including charitable organizations such as churches and private universities.

After previously limiting the loans to $150,000, SBA announced in late March 2021 a new maximum loan amount of $500,000, effective April 6.

In September 2021, the limit was raised again to $2 million. The change was part of a set of policy updates that took effect Sept. 8, which also included new acceptable uses of the loan funds, an extension of the deferment period, and more. SBA said it would begin approving loans greater than $500,000 on Oct. 8, 2021.

SBA has announced that the last day that applications may be approved is Dec. 31, 2021 , so interested businesses should file theirs as soon as possible to allow time for processing and approval.

Businesses can qualify for these COVID-19 disaster loans regardless of whether they have suffered property damage, and can use the funds to help meet working capital needs and cover operating expenses as they recover from the pandemics impact.

Read on for an overview of the EIDL program and how to qualify and apply, as well as what to know in cases where Paycheck Protection Program proceeds must be used to refinance EIDLs. For more information, see SBAs updated EIDL guidance as of Sept. 8, 2021.

ELIGIBILITY

USE OF FUNDS

Economic Injury To Your Alachua County Business Operations In Florida

For Alachua County small businesses, companies, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations, the SBA offers Economic Injury Disaster Loans to help meet working capital needs caused by the disaster. Economic Injury Disaster Loan assistance is available regardless of whether the business suffered any physical damage to property.

Also Check: Usda Loan Forgiveness Update 2022

Deadline To Request Sba Eidl Loan Increase Or Reconsideration Is May 6

The deadline to request a U.S. Small Business Administration Economic Injury Disaster Loan loan increase or reconsideration is Friday, May 6. This is for existing borrowers or those who have previously submitted an application and would like to make a request for reconsideration.

As of Jan. 1, the SBA is not able to accept applications for new COVID-19 EIDL loans or advances.

The COVID-19 EIDL portal will close on May 16. Borrowers should download their loan documents from the portal prior to this date.

COVID-19 EIDL loans are offered at very affordable terms, with a 3.75% interest rate for small businesses and 2.75% interest rate for nonprofit organizations, and a 30-year maturity. The maximum loan amount is $2 million. The SBA began approving loans greater than $500,000 on Oct. 8, 2021.

In March, the SBA provided an additional deferment of principal and interest payments for existing COVID EIDL borrowers for a total of 30 months deferment from inception on all approved COVID EIDL loans. Interest continues to accrue during the deferment period and borrowers may make full or partial payments if they choose.

You May Like: How Does Icing An Injury Help

Sba Loan Deadlines For The Alachua County Florida Declared Disaster Declaration #17644 And #17645

Physical Damage Loan Application filing deadline is 11/28/2022.

Economic Injury Disaster Loan Application filing deadline is 06/29/2023.

Read the official SBA disaster for Alachua County here.

Business Owners in Alachua County, for speed and personalized attention, Schedule Your Free Disaster Loan Consultation

You May Like: When Will I Get My Loan Money For School

Will The Sba Application Be The Basis Of Referrals To Other Grant Programs

Yes. Submitting the application makes it possible for you to be considered for additional grants. If you apply for an SBA low-interest disaster loan and are not eligible, this may open the door to additional assistance from FEMA. If SBA denies the loan application, you may be eligible for additional FEMA grant assistance to replace essential household items, replace or repair a damaged vehicle, cover storage expenses, or meet other disaster-related needs your Pike County, Kentucky home or business has suffered.

Read Also: Does Health Insurance Cover Work-related Injuries After Settlement

Small Business Administration Update

ALL COVID EIDL BORROWERS – DOWNLOAD LOAN DOCUMENTS BY MAY 16Your access to the RAPID COVID EIDL portal ends on May 16. ARE YOU INTERESTED IN A LOAN INCREASE?You may be eligible for an increase in your SBA COVID-19 Economic Injury Disaster Loan amount, subject to SBA analysis. If you are interested and you have not reached your maximum eligibility, please apply by May 6, 2022, which is the last day to submit any loan increase or reconsideration requests for COVID EIDL. Each request is processed in the order received and is subject to availability of funds. The steps to request an increase are:

Confirm your loan eligibility and review the FAQs.

Log onto your Account on the SBA Portal to submit a loan modification request.

Complete the portal steps and submit relevant documents, including a new version of your IRS Form 4506-T for COVID EIDL.

Respond to SBA requests for signature and documents . The failure to sign and submit documents prior to funds being exhausted/rescinded will result in no increase.

MONTHLY PAYMENT SET YOUR REMINDERYou are responsible for your COVID EIDL monthly payment obligation beginning 30 months from the disbursement date shown on the top of the front page of your Note. During this deferment:

PO Box 958, Billings, MT 59103

Tel: 259-3525 | Fax: 245-9694

Recommended Reading: Does Refinancing Start Your Loan Over

Illinois Sba Eidl Loan Increase Request

Illinois EIDL disaster loans have been approved over 148,880 small businesses and companies in the State of Illinois amounting to over $11,686,960,630 in Illinois EIDL loans processed as of 12/23/21. If your Illinois business entity has already received a US Small Business Administration loan, you may be eligible for more COVID-19 Economic Injury Disaster Loan money from the EIDL program in Illinois.

You can follow the process and request an Illinois SBA EIDL loan increase, up to the current $2,000,000 maximum, based on your maximum eligibility from your 2019 tax return figures for your business in Illinois.

Illinois EIDL loans were previously limited to $150,000, and then raised to $500,000. On 9/8/21, the SBA increased the Illinois EIDL loan limit from $500,000 to the current $2 million.

Am I Eligible For An Economic Injury Disaster Loan

If you answer yes to all three questions and have less than 500 employees, theres a very good chance youre eligible for a COVID EIDL.

However, you should confirm you fall within the SBAs size standards before you start applying. Youre eligible for an EIDL if youre:

- An individual who operates a sole proprietorship, with or without employees

- An independent contractor

- A business categorized as a small business according to the SBA size standards

- All other agricultural enterprises are excluded

NEW | In August 2021, the SBA expanded COVID EIDL eligibility to include the hardest-hit industries. Why? Applications for the restaurant revitalization fund exceeded the amount of funding that was available and the program quickly ran out of money. More than 175,000 businesses didnt receive the funds they needed.

*An affiliate is a business that you control or a business you have 50% or more ownership.

You May Like: Do You Have To Be Married To Use Va Loan

Eidl Program Update From The Sba:

No member details found.

Dear COVID EIDL Borrower:Are You Interested in a Loan Increase?You may be eligible for an increase in your SBA COVID-19 Economic Injury Disaster Loan amount . If you are interested, please apply now because COVID EIDL funds are expected to be exhausted this month. Requests are processed in the order received and are subject to availability of funds. The steps to request an increase are:

Monthly Payment Set Your ReminderYou are responsible for your COVID EIDL monthly payment obligation beginning 30 months from the date shown on the top of the front page of your Note. During this deferment period:

- You may make voluntary full or partial payments without prepayment penalties at gov Home select Make a SBA 1201 Borrower Payment

- Interest will continue to accrue on your loan during the deferment

- If you do not make voluntary payments during the deferment, a final balloon payment will be due on your loan at maturity

You May Like: New Orleans Personal Injury Lawyers

Summary And Conclusion Of The Hurricane Ian Disaster In Alachua County Fl

To apply for financial assistance and relief due to your Alachua County, Florida business being financially damaged by Hurricane Ian on 9/23/2022 and continuing, there are important SBA deadlines for when you need to submit your new application, increase request, or reconsideration request.

For the Alachua County, Florida Declared Disaster Declaration #17644 and #17645, the loan application filing deadline for physical damage is 11/28/2022. The economic injury disaster loan application filing deadline is 06/29/2023.

This is something you can possibly do yourself by visiting the official government FEMA and SBA websites.

You May Like: Wells Fargo Car Loan Number

Alachua County Florida Disaster Assistance From Fema

If your Alachua County, Florida business was impacted by Hurricane Ian, and is located in one of the communities approved for assistance from the Federal Emergency Management Agency , you can apply for disaster assistance.

Check to see if Alachua County, Florida is approved by FEMA by visiting DisasterAssistance.gov or by calling 1-800-621-3362 between the hours of 7am to 11pm Eastern Standard Time seven days a week.

For other possible Alachua County, Florida disaster assistance resources, or to apply for assistance from FEMA, visit the official FEMA website.

Incomplete Massachusetts Eidl Application

Make sure to proofread your Massachusetts application before submitting it. Any errors on paper will lead them to believe that you didnt take the time to review everything beforehand. Also, remember to include all necessary documents such as bank statements, wrong name, wrong address, leases, and tax forms in order for them to process your Massachusetts application successfully.

Read Also: Personal Injury Settlement And Medicaid Eligibility

You May Like: Which Bank Is Best For Construction Loan

Are Sba Loans Available For Businesses And Nonprofits Of Any Size

Yes. Due to the Hurricane Ian declared disaster, Alachua County, Florida businesses of all sizes and private nonprofit organizations may borrow up to $2 million to repair or replace damaged or destroyed real estate, machinery and equipment, inventory and other business assets. The SBA can also lend additional funds to businesses and homeowners to help with the cost of improvements to protect, prevent or minimize the same type of disaster damage from occurring in the future.

For small businesses, small agricultural cooperatives, small businesses engaged in aquaculture and most private nonprofit organizations of any size in Alachua County, Florida, the SBA offers Economic Injury Disaster Loans to help meet working capital needs caused by the disaster. Economic injury assistance is available to businesses regardless of any property damage.

Population Of Alachua County In Florida

Alachua County has a population of 279,238 residents , which is a change of 0.3% in population from the 2020 Census numbers. The State of Florida has a current total population of 21,781,128. This is a 1.1% change in the number of residents in FL.

The Federal Information Processing System Code for the State of Florida is 12000. The FIPS code for Alachua County, FL is 12001

Read Also: Can I Refinance My Santander Car Loan

Where Do I Apply

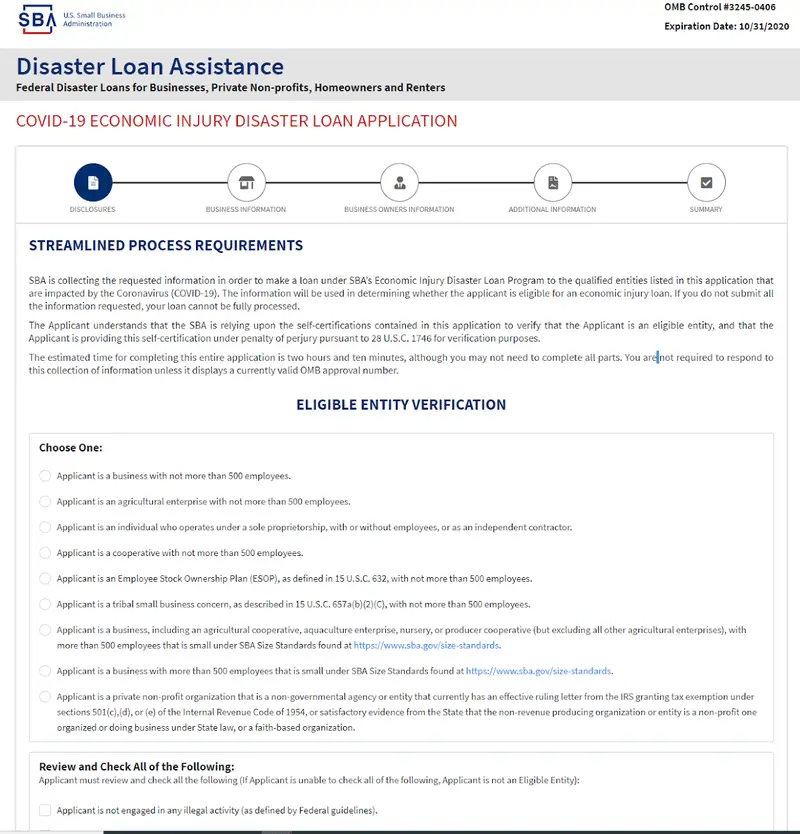

You apply for an EIDL directly on the SBAs website, here. The SBA estimates itll take you about two hours to complete the application.

The SBA takes several weeks to one and a half months to approve or decline loans. Dont reapply if you dont hear from the SBA. Instead, check the status of your application by logging into your account in the SBA portal. If youd like your application to move quickly, respond quickly to the SBAs requests for information.

An SBA loan officer may contact you by telephone or email. Dont interact with any email address that doesnt end with @sba.gov.

Eidl Loan Increase And Program Updates

At the start of September 2021, the SBA published updates to its COVID EIDL program, including a loan cap increase.

The program updates are as follows:

- The maximum loan cap increased from $500,000 to $2 million.

- You can now use funds to pay for payment or prepayment of commercial business debt.

- You can now use funds to pay for regularly scheduled federal debt payments.

- The first payment is now automatically deferred to 30 months .

- Simplified affiliation requirements: You are considered an affiliate of any business you control or have at least 50 percent ownership in.

- Expanded eligibility to businesses in industries most affected by the pandemic codes).

Most of the changes went into effect on September 8, 2021, but applicants requesting more than $500,000 had to wait until October 8, 2021 for the SBA to begin approving.

As a small business owner, you have access to more funds after this update and can also use those funds for debt payments.

However, you may not use the funds to expand your business, make prepayments on a federal loan, or start a new business.

Don’t Miss: Find People Who Loan Money

Illinois Sba Eidl Loan Increase Request Guidelines

Here are some terms and rules when you apply for an Illinois SBA EIDL loan increase:

- 30-year term with a 3.75% fixed rate for business and 2.75% for nonprofits.

- SBA will record a UCC filing for a loan amount over $25,000.

- No real estate collateral is required for any loans below $500,000.

- May use funds to pay off other business loans or business debt.

Critical Next Step For Business Owners To Receive Covid

This truly is the last chance for companies to receive pandemic related SBA EIDL funds. By doing an increase filing, or a reconsideration appeal to overcome being denied previously. In either case, speed is needed. Business owners should seek expert help immediately to file by the SBA May 6th deadline.

This truly is the last chance for companies to receive pandemic related SBA EIDL funds. By doing an increase filing, or a reconsideration appeal to overcome being denied previously. In either case, speed is needed. Business owners should seek expert help immediately to file by the SBA May 6th deadline, said Stewart.

Read Also: What Is Origination Fee In Personal Loan

Sba Disaster Loan Alternatives To Consider

You can find traditional and non-traditional loans to get your business out of a precarious situation. However, youll need to do your due diligence to ensure youll be able to pay off any new debt you take on.

Below are the four best disaster-assistance funding options for your business to consider:

Sba Eidl Disaster Loans $115 Billion Estimated Still Available

SAN FRANCISCO, CA / ACCESSWIRE / February 27, 2022 / The U.S. Small Business Administration’s Economic Injury Disaster Loan program continues to process and approve COVID EIDL small business loans in 2022. Eligible companies wanting to do an increase request or loan modification to their existing SBA loan , and small businesses that have received a decline letter in the past six months or less, still can access funds. Recent research points to an estimated $115 billion in EIDL funds that may still be available.

Good news for eligible small business owners and companies that are still able to access SBA EIDL disaster loan funds in 2022. Image Credit: 123rf / Rikke.

“After doing some deep dive research, we’ve estimated there may be as much as $115 billion in COVID related SBA EIDL funds still available as of late February. This is only an estimate based on data we’ve uncovered,” said Marty Stewart, Chief Strategy Officer of Disaster Loan Advisors .

The DLA Strategic Advisory Team are SBA loan consultants that specialize in assisting business owners with multiple company entities or locations, to help navigate the SBA EIDL loan program for maximum EIDL qualification. Companies that received prior SBA EIDL loans that need an increase or loan modification , as well as EIDL loan reconsideration requests for those businesses that have been denied.

Top 5 Questions Small Business Owners are Asking About the SBA EIDL Program

CONTACT:

You May Like: How To Get Out Of Car Loan Early

Eidl Loan Increase Requests: How To Apply Before Sba Deadline

SAN FRANCISCO, CA / ACCESSWIRE / May 2, 2022 / Economic Injury Disaster Loan increase requests will be accepted by the Small Business Administration through the end of this week. The SBA has signaled the popular EIDL loan program is coming to an end for pandemic related funding. For company owners, principals, executives, and managers wondering how to apply for an EIDL loan increase for each business entity and location, urgency is crucial. Loan modification increases are still available for up to $2 million, however not for long. Professional assistance is recommended for those who do not know how to go about applying for an increase.

There is an urgent last chance SBA deadline to file for an EIDL loan increase modification request. Image Credit: 123rf / Stokket.

“The EIDL increase request deadline is very urgent. It is the last chance to get EIDL loan funds before they run out. We are offering fee-based professional help for business owners who do not know how-to do increase requests themselves, are short on time, and just want the highest and best shot at getting a possible yes. Business owners who need speed should schedule a consultation call asap,” said Marty Stewart, Chief Strategy Officer at Disaster Loan Advisors .

How To Apply for an EIDL Loan Increase the Easy Way

According to the SBA, the steps to request a loan increase are:

What if Your EIDL SBA Portal “Request More Funds” Button is Not Showing?

EIDL Loan Increase Request by Email: How to Maximize Your Chances