Do You Pay Back Unsubsidized Loans

Yes, you have to pay back an unsubsidized loan. But you arent required to start making monthly loan payments until after a six-month grace period after you graduate.

However, keep in mind that interest starts accruing when your loan is disbursed. For this reason, some choose to make interest payments while theyre still in school.

If you choose not to pay the interest of an unsubsidized loan while youre in school or during your grace period, your lender will apply it to your loan balance after you leave school. For example, if you have $2,000 in unpaid interest after graduating school, your lender will add that to your loan amount. This means you will start paying interest on that interest.

What Are The Differences Between Subsidized And Unsubsidized Student Loans

Halona Black

If you are considering taking out student loans to pay for your education, know that you are not alone. The truth is that most students today need loans to finance their college educations, and itâs important to know what loan programs are available to you and the benefits they offer in the long run.

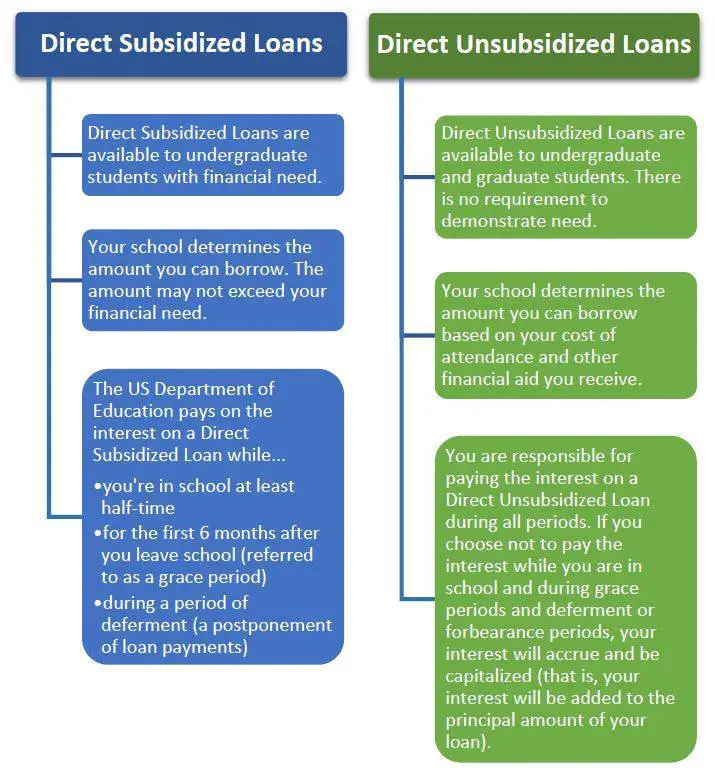

The U.S. government offers several student loan programs, and direct subsidized and direct unsubsidized loans are among the most common. Direct subsidized loans are available to undergraduate students and do not collect interest while borrowers are enrolled in college, or while loans are deferred or in forbearance after graduation. Direct unsubsidized loans start to collect interest while students are still enrolled in college.

Unlike private loans, direct loansâwhether subsidized or unsubsidizedâdo not require a or a cosigner in order to qualify.

Knowing the difference between both subsidized and unsubsidized direct loans is important because it can affect the amount of interest you pay, your overall loan balance, and the repayment program you enroll in once you are no longer in school.

Eligibility: Subsidized Federal Student Loans

Eligibility requirements for subsidized federal student loans include:

- You’re a U.S. citizen.

- You demonstrate financial need.

- You’ve applied or enrolled as an undergraduate student. Grad students are not eligible for subsidized loans.

- You’re enrolled or plan to enroll at least half-time at a school that participates in the federal student loan program.

Recommended Reading: What Is Bridge Loan Financing

What Happens If You Never Pay Off Your Student Loans

Let your lender know if you may have problems repaying your student loan. Failing to pay your student loan within 90 days classifies the debt as delinquent, which means your credit rating will take a hit. After 270 days, the student loan is in default and may then be transferred to a collection agency to recover.

Federal Student Loans Vs Private Loans

Although federal student loans are the most common source of education funding for students, there are alternatives in the form of private student loans. Private lenders, unlike the federal government, offer loans based on your risk as a borrower.

You must complete an application that shows your financial ability to repay the loan, your credit history and score, and in some cases, your income.

If you cannot meet the requirements of a private student loan on your own, you may have an opportunity to add a cosigner to the loan to strengthen the application. Private student loans may be beneficial because they can often cover more than the loan limits of federal student loans. However, there is no option for subsidized loans with private lenders.

You May Like: Can Closing Costs Be Included In Va Loan

Interest Rates And Payments

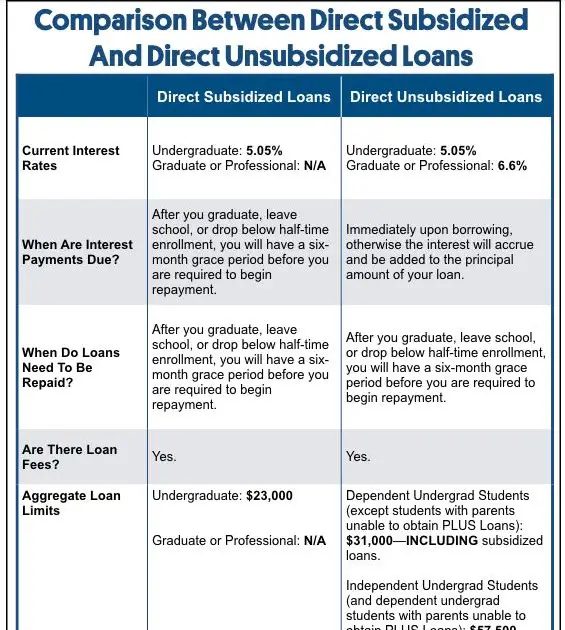

Interest rates on both types of student loans are set by the U.S. government and are fixed for the life of the loan. With subsidized student loans, the government pays the interest accrued on your loan as long as you are in school at least half-time . That means your loan balance stays the same while you’re in school: If you borrow $10,000 at the beginning of the year, at the end of the year you still owe $10,000.

With unsubsidized loans, you are responsible for paying the interest on the loan right awayeven while you’re enrolled in school, even during any loan deferment period, and even during the six-month grace period after graduation before you have to start repaying the balance of the loan.

What if you can’t pay the accrued interest at that time? It may be hard to do on a student budget. If you don’t pay the accrued interest, it gets added to the principal . Unfortunately, that means by the time your loan grace period is over after graduation, your loan balance could be significantly larger than the amount you originally borrowed.

What Does Unsubsidized Loan Mean

Unlike subsidized loans, unsubsidized loans start accumulating interest from the instant the money is disbursed. In addition, as the borrower, interest payments are your responsibility. Although you can decide to hold off on making interest payments until you’ve finished school and passed the six-month grace period, the accumulated interest will be added to your total balance. Therefore, you’ll be paying interest on interestan unfavorable financing option, especially if you’re going through financial hardship.

The good news is unsubsidized loans are available to undergraduate and graduate students, opening the door for further education to more people. There’s also no requirement to prove financial need. Your school will determine your qualifying loan amount based on the cost of attendance and any scholarships and grants you may have received.

How much can you borrow?

The maximum undergraduates can borrow for direct unsubsidized loans ranges from $5,500 to $12,500, depending on dependency status and year in school. Graduate students, as well as professional students, have an annual loan limit of $20,500.

When it comes to unsubsidized student loans, you have several choices:

- Direct Unsubsidized Loans

- Direct PLUS Loans

- PLUS loans from the Federal Family Education Loan Program

You’ll need to do your due diligence on each type to figure out which is right for you.

So, what makes you eligible?

Don’t Miss: How Banks Determine Mortgage Loan Amounts

What Is A Subsidized Loan

A Direct Subsidized Loan is a type of federal student loan that undergraduate students can receive by showing financial need. Theyre less expensive than Direct Unsubsidized Loans because interest doesnt accrue on them during certain time frames. The U.S. Department of Education pays interest on subsidized loans while the borrower is enrolled at least half time in school, during a six-month grace period after graduation and during other deferment periods.

Your school decides how much you can borrow based on the cost of attendance, your demonstrated financial need, your year in school and any other financial aid you receive. You can borrow a maximum of $23,000 in Direct Subsidized Loans over the course of your education, though limits cap out at $5,500 a year. Graduate and professional students cant borrow subsidized loans.

The federal government sets federal student loan interest rates, and the rates may change each school year. For the 2021-22 academic year, undergraduate students have a 3.73 percent interest rate on Direct Subsidized Loans. For 2022-23, this will rise to 4.99 percent.

What Is A Direct Subsidized Loan

The government pays interest on a subsidized loan while youre enrolled in school at least half time. If youve already graduated and put your loans into deferment or forbearance, the government also covers interest on your subsidized loans.

While students are not required to pay interest on a direct loan while in school, interest begins to accrue immediately.

Either someone needs to pay that interest, or that interest is added to the original amount of the loan, Peter Bielagus, a financial author and speaker, told Student Loan Hero.

If a student takes a $10,000 direct subsidized loan as a freshman, four years later, the loan balance will still be $10,000 because the government pays your interest costs.

Direct subsidized loans are designed for lower-income, undergraduate borrowers. According to the Department of Education, your school determines the amount of direct subsidized loans youre eligible for, and the amount borrowed via a subsidized loan cannot exceed financial need.

| Federal student loan limits for dependent undergraduate borrowers |

|---|

| Direct subsidized loans |

| Note: Federal loan borrowing limits for independent and graduate students are greater. |

Don’t Miss: Can You Build With An Fha Loan

Overview: Key Differences Between Subsidized And Unsubsidized Loans

|

Subsidized |

||

|

No need to demonstrate financial need |

||

|

Amount you can borrow |

Up to $3,500 – $5,500, depending on your year in school |

Up to $5,500 to $7,500, depending on your year in school |

|

Who can borrow |

Undergraduate, graduate and professional students |

|

|

How interest accrues while youre in college |

U.S. Department of Education covers interest payments while in college and during the following grace period |

Interest accrues, unless the student pays interest costs while in college and during the following grace period |

Repaying Your Federal Student Loans

Typically, you can select or be assigned a repayment plan when you first begin repaying your student loan. You can choose a standard, graduated, or extended payment plan. All borrowers are eligible for the standard and graduated repayment plans. But you must have more than $30,000 in outstanding direct loans to qualify for an extended repayment plan.

If you enroll in the standard plan, your monthly payment will be a fixed amount that ensures your loans are paid off within 10 years for direct loans or 10â30 years for consolidation loans. With the graduated repayment plan, payments start lower and increase gradually, usually every two years. The timeframe for paying off your loans is the same as with a standard plan.

You can change repayment plans at any time at no cost. Contact your loan servicer if you want to discuss repayment plan options or change your repayment plan.

Read Also: Am I Eligible For Usda Loan

What Exactly Is An Enthusiastic Unsubsidized Education Loan

A keen unsubsidized financing is a kind of federal student loan getting university otherwise job university. New unsubsidized student loan means once financing fund have good borrowers membership, the eye initiate accruing while youre in school and once you log off. Consumers have the effect of the entire number of date one as a result of the life of the financing. This can include when you are at school and through the elegance episodes.

So far as cost options go, a borrower might want to spend the money for desire recharged per month. You can let it include on the an excellent prominent matter in which case they increases the total cost off the borrowed funds. A recently available Sallie Mae study discovered that step three into the 10 college students fool around with financing from the authorities to cover school.

Who they are to possess: Unlike Subsidized Head Student loans, unsubsidized loans do not require a debtor to own economic must be considered. Educational funding are accessible to individuals who be considered. Although not, simply undergraduate children that have monetary you want is generally eligible for a good Lead Backed Financing.

How to qualify: Unsubsidized money are typically available to graduate and you may professional college students as well. Because they do not explore financial you want given that a criteria, he has got various other conditions out-of attract.

Should i pay back unsubsidized otherwise sponsored loans very first?

Which Type Of Loan Is Right For Me

The Bureau of Labor Statistics projects a 9% job growth for registered nurses between 2020 and 2030. These professionals earned a median annual salary of $77,600 as of 2021. Even for students pursuing careers with above-average salaries, like nursing, borrowing money for school can produce a certain amount of anxiety.

The pros of direct subsidized student loans include deferred interest until six months after graduation and an increased amount of allowed borrowing for each subsequent year of study. You may also be able to negotiate repayment in the future if necessary.

The cons include graduating with debt and the fact that interest begins accruing six months after graduation, whether you have a job or not. The amounts you can borrow are also relatively low.

The pros of unsubsidized loans include fixed interest rates and not having to demonstrate financial need in order to qualify. The cons include amassing debt that will come due as soon as you graduate.

For nursing students, choosing between or both loan types depends on individual need and relative risk aversion regarding the amount of debt they want to take on after graduation.

Don’t Miss: What Is Down Payment Required For Conventional Loan

Difference Between Subsidized And Unsubsidized Loans: Everything Explained

Pareeshti Rao

May 28, 2021

It is quite common for students to get confused between choosing a subsidized loan vs an unsubsidized loan. While some say subsidized loans are better and more convenient, unsubsidized loans have their set of benefits too! You must be filling out your application form and dreaming of a big future ahead! Education loans contribute majorly to a vast majority of students funding their college education. That is when your knowledge of subsidized vs unsubsidized student loans plays a key role in helping you decide your college financing. This article contains everything you need to know the difference between subsidized and unsubsidized loan.

Subsidized Vs Unsubsidized Loans: Key Differences

Most student borrowers fund their education with low-interest loans called direct loans because you borrow them directly from the U.S. Department of Education .

average return of 397%

Those loans are either subsidized or unsubsidized. Subsidized loans are for students with financial need, whereas financial need doesnt factor into unsubsidized loans.

But thats not the only difference. And a closer examination of those differences reveals why you should always max out your subsidized loans before taking on unsubsidized ones.

Don’t Miss: Best Rates On Auto Loans

Subsidized Vs Unsubsidized Loans: Which Is Better

Subsidized loans are the safest initial option for borrowers since the federal government pays the interest on your loans, leaving you with less money to spend out of your pocket. However, some borrowers are unable to establish the financial necessity required to qualify for this type of loan, leaving unsubsidized loans as their sole alternative.

How To Repay Subsidized And Unsubsidized Student Loans

You can technically start making payments on either type of student loan as soon as you’d like. But you generally don’t need to as long as you’re enrolled at least half-time. There’s also a six-month grace period after you graduate, leave school or fall below half-time status. After that, you’ll start making equal monthly payments over the 10-year standard repayment plan.

If you need to, you can look into other repayment plans: The Education Department offers extended repayment plans that go as long as 30 years, a graduated repayment plan where payments start out low and increase over time, and also income-driven repayment plans that reduce your payment to a percentage of your income.

Before you start paying your student loans, consider your situation and research your options to determine the best approach for you.

Don’t Miss: Chase Auto Loans Phone Number

Is It Better To Get Subsidized Or Unsubsidized Loans

As you can see, subsidized student loans have some key advantages over their unsubsidized counterparts. However, both varieties of federal direct student loans have some pretty important benefits when compared with other methods of borrowing money such as personal loans or private student loans. Here are some of the most important examples:

- Neither type of federal direct student loan has any credit requirements. Private loans and personal loans typically have minimum credit standards or require a cosigner.

- Federal direct student loans are eligible for income-driven repayment plans such as Pay As You Earn and Income-Based Repayment. These limit your monthly student loan payments to a certain percentage of your discretionary income and forgive any remaining balance after a certain repayment period .

- Federal direct loans may be eligible for Public Service Loan Forgiveness and/or Teacher Loan Forgiveness if the borrower’s employment and repayment plan meet the program’s standards. On the other hand, private student loans never qualify for these programs.

- You have the ability to obtain a deferment or forbearance on federal student loans, which can allow you to temporarily stop making payments during tough financial times. Some private loans have their own forbearance programs, but the federal options are generally far superior.

Who Qualifies For A Direct Subsidized Loan

In order to qualify for a Direct Subsidized Loan, you must submit the FAFSA application. Because there is a limited amount of funding available each year for subsidized student loans, only those applicants who demonstrate a certain level of financial need will be eligible for these loans.

Beyond this, you must be enrolled as an undergraduate student at least half-time at a qualifying educational institution. You do not need to pass a credit check or have a cosigner to qualify.

Read Also: Who To Call About Student Loan Garnishment

Subsidized Vs Unsubsidized Student Loans: Which Is Best

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

How Unsubsidized Loans Work

These loans operate in a similar fashion to a loan from a bank or private lender. But because theyre offered by the federal government, they often offer lower interest rates and fees.

However, these loans also have maximum borrowing limits, so additional loans are often needed. For example, the maximum loan limit for a first-year college student is $5,500, which is generally not enough to fund an entire academic year. Many students opt to take private student loans to cover any additional tuition gaps that remain after scholarships, grants, and federal student loans.

Also Check: Does The Va Loan Cover Land