Can I Send You A Document Electronically

Yes, send selected documents to us online to:

- Provide proof of payment on your account

- Change a name on the vehicle title

- Transfer a vehicle title to a different state

- Change an account holder name on your auto loan

Sign on and select the Upload Documents icon from your auto loan. Select the reason for your upload and the type of document and follow the steps to complete the process.

Keep these upload guidelines in mind:

- Attach accepted file formats: PDF, JPEG, JPG, PNG, or GIF

- Upload no more than 25 files and 25 MB total

- Make sure your files are not encrypted or password-protected

- Make sure your documents are clear, legible, and include all pages even blank ones

We will review your documents and contact you if we need additional information.

Message From Wells Fargo Bank

The name Wells Fargo is forever linked with the image of a six-horse stagecoach thundering across the American West, loaded with gold. The full history, over more than 160 years, is rich in detail with great events in Americas history. From the Gold Rush to the early 20th Century, through prosperity, depression and war, Wells Fargo earned a reputation of trust due to its attention and loyalty to customers. Today in the 21st Century, with extensive and diversified financial services, the Wells Fargo name once again extends Ocean-to-Ocean,Over-the-Seas, and, of course, online.

Wells Fargo is a leading auto lender with more than 12,000 dealer relationships nationwide. Ask if Wells Fargo financing is an option when purchasing for your next vehicle.

What Happened To Wells Fargo Auto Insurance

In 2017, San Francisco-based Wells Fargo, one of the largest banks in the U.S., announced its design to exit the personal insurance space, which included homeowners, renters, and auto insurance, and focus mainly on banking, investments, and lending. As a result, the firm does not currently feature any home or auto insurance programs on its website. In some states, though, the parent company, Wells Fargo & Company, may still offer some insurance products through non-bank affiliated insurance agencies.

The last few years have seen Wells Fargo having to fight a number of high-profile legal and operational battles, including a fake accounts scandal, multiple renters insurance violations that led to the company giving up its California insurance license for three years, and a class action lawsuit involving the auto insurance program and customers who had taken out an auto loan from the company.

Before it was shut down in September 2016, the Wells Fargo auto insurance program, called Collateral Protection Insurance , worked like this. If you had financed your vehicle with a car loan from Wells Fargo Auto, a subdivision of Wells Fargo bank, you may have been required by your loan agreement to maintain comprehensive and collision physical damage insurance, naming Wells Fargo as loss payee or lienholder. The cost of the insurance policy was passed on to the borrower to be paid separately or along with the premium with interest.

Recommended Reading: What Are Good Loan Companies

How Do I File A Claim Or Use My Aftermarket Product

Contact the coverage provider for information on how to file a claim or how to use the product their contact information is listed on the aftermarket product contract. Your coverage provider will let you know if they will reimburse you for expenses or if they will pay the expenses at the time a covered service is performed. They will also explain other conditions, such as requiring that the maintenance be performed at the dealership where you purchased the vehicle.

Wells Fargo Auto Loan How To Apply

Saving for a car can take a long time, thats where a Wells Fargo Auto Loan can help. A loan can help you get the vehicle you want fast. You can then pay for the car in installments instead of one big chunk.

Auto loans today are available, with nominal interest rates and minimal requirements. Wells Fargo is one of the top financial services companies in the US, offering easy and quick auto loans to deserving customers.

You dont have to bury yourself under the burden of indiscriminate interest rates associated with other sources of loan. Let us have a look at the auto loan products of Wells Fargo, and how you can apply for a loan.

You May Like: How Much Construction Loan Can I Afford

Average Car Loan Apr By Credit Score

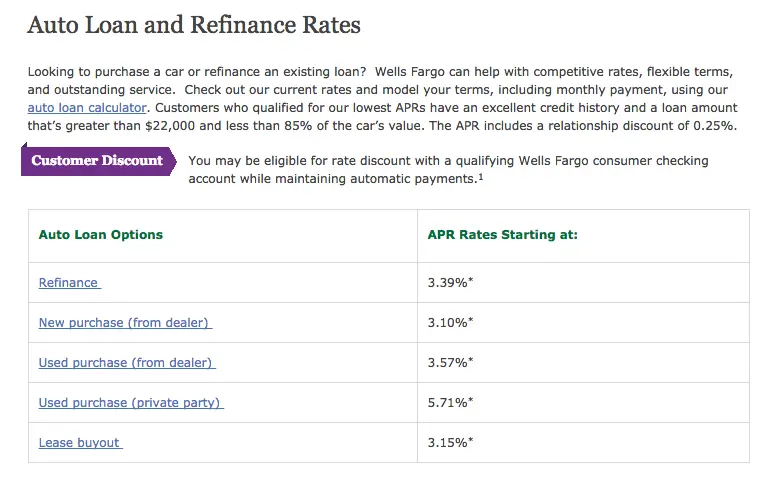

Below, you can see average APRs for different credit score ranges. This data comes from the Experian State of the Automotive Finance Market report for the second quarter of 2021. It includes finance data from many auto lenders, not just Wells Fargo.

You can see that people with excellent credit find can find rates below 3.0 percent for new car loans from other lenders, but Wells Fargos rates start at 3.9 percent. This means Wells Fargo might not offer the best rates for every situation, which is why we recommend comparing multiple offers when you shop.

What We Love About Wells Fargo Auto Loans

Wells Fargo offers flexible auto loans, giving you the option to buy a new or used car from a dealer or in a private transaction. This lack of restrictions makes it very easy for you to shop around to find the best deal on a car. Keep in mind that if you make a private transaction, you have to finalize the loan in-branch.

The banks loans are also flexible. You can choose a term up to 72 months and may not need to provide any down payment to secure the loan. Wells Fargo banking customers can also enjoy an interest rate discount that will save them money over the life of their loan.

Read Also: Is Parent Plus Loan Federal

Wells Fargo Auto Loan Bbb Better Business Bureau

Wells Fargo Auto Loan BBB has had a file at the Better Business Bureau since 1978.

Unfortunately, they do not have a BBB rating but do have a staggering 4199 complaints in the past three years.

Wells Fargo BBB complaints tend to be financial related with claims of fees being charged outside of the contract or loan payments continued to be debited from customers accounts after being paid off.

The Wells Fargo BBB Reviews generally point to a company that wants your business so long as it is all of the online and of the automated variety.

Wells Fargo BBB reviews and customer complaints are not taken seriously by the company as most go without a response which may be why they do not have a rating.

Wells Fargo Customer Reviews And Reputation

Wells Fargo is not rated or accredited by the BBB, though it does have a BBB customer review score of 1.1 out of 5 stars. However, this number is based on fewer than 400 reviews, which represents a tiny fraction of Wells Fargos overall customer base.

The handful of positive Wells Fargo reviews mention positive customer service experiences. Negative Wells Fargo reviews report issues with account closures, problems with autopay, and the Wells Fargo online banking service providing inaccurate information. One BBB customer complaint reads:

Wells Fargo not reporting payment history to credit bureaus. I have made several attempts to Wells Fargo to provide current payment history to three credit bureaus with no success.

– Anonymous via BBB

Recommended Reading: Where To Get Loan With Collateral

Key Things To Know About Wells Fargo Personal Loans

- Loan Amounts: $3,000 – $100,000

- Repayment Periods: 12 – 84 months

- : 660+

- Late Fee: $39 late fee

- Origination Fee: $0

For more information, check out the full Wells Fargo review on WalletHub.

Does a Wells Fargo personal loan affect your credit score?

Yes, a Wells Fargo personal loan does affect your credit score, both when you apply and during the entire time that you are paying the loan off. Initially, a Wells Fargo personal loan will affect your credit score in a negative way, but the long-term impact can be very positive, assuming you repay the loan on schedule.read full answer

Discrimination Against Female Workers

In June 2018, about a dozen female Wells Fargo executives from the wealth management division met in Scottsdale, Arizona to discuss the minimal presence of women occupying senior roles within the company. The meeting, dubbed “the meeting of 12”, represented the majority of the regional managing directors, of which 12 out of 45 were women. Wells Fargo had previously been investigating reports of gender bias in the division in the months leading up to the meeting. The women reported that they had been turned down for top jobs despite their qualifications, and instead the roles were occupied by men. There were also complaints against company president Jay Welker, who is also the head of the Wells Fargo wealth management division, due to his sexist statements regarding female employees. The female workers claimed that he called them “girls” and said that they “should be at home taking care of their children.”

Read Also: How To Pay Back Perkins Loan

How Do I Defer A Payment

A payment deferment pushes out your due date and extends the loan maturity date.

ExampleIf your payment due date is scheduled for March 15, 2022, and you were approved for a one-month deferment, your next payment date would be April 15, 2022. If your maturity date is January 15, 2023, and you are granted a one-month deferment, your maturity date will be February 15, 2023.

Where Do I Find My Account Number

![[Warning Government Action] Wells Fargo Auto Loan Review (2020) [Warning Government Action] Wells Fargo Auto Loan Review (2020)](https://www.understandloans.net/wp-content/uploads/warning-government-action-wells-fargo-auto-loan-review-2020.png)

Your 10-digit auto loan account number can be found in the following places:

Welcome Letter

Your account number is provided with the loan details in the welcome letter that you receive in the mail after your new loan is funded.

Account Statement

Your account number is at the top of your monthly statement and on the payment coupon at the bottom of the statement.

Online

To view your complete account number, sign on, select your auto loan from Account Summary, and then select the account number on the Auto Loan page.

Phone

If you are unable to find your auto loan account number, please call us at 1-800-289-8004.

You May Like: Where Does Federal Student Loan Money Come From

Wells Fargo Auto Loan Review

Considering financing a vehicle through Wells Fargo? This review explains everything you need to know about Wells Fargo auto loans, including loan details, minimum qualifications, and the application process. Well also take a look at Wells Fargo reviews from customers.

Finding the best auto loans can save you thousands of dollars in the long run, so be sure to weigh your options before signing the dotted line. To learn if a Wells Fargo car loan is the right choice for your vehicle, continue reading.

Up to 722.25%

- Low rates for good credit customers

- Strong industry reputation

- Average monthly savings of $150

- Work with a personal loan concierge to compare options

- A+ BBB Rating

- A leading provider in refinance loans

- A+ BBB rating

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

- Average monthly savings of $145

- Online Application

Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

Availability: Select dealerships across the United StatesLoan Types: Purchase loans for new and used vehiclesBetter Business Bureau Rating: Not rated

Discrimination Against African Americans In Hiring

In August 2020, the company agreed to pay $7.8 million in back wages for allegedly discriminating against 34,193 African Americans in hiring for tellers, personal bankers, customer sales and service representatives, and administrative support positions. The company agreed to provide jobs to 580 of the affected applicants.

Read Also: How To Take Loan From 401k To Buy House

What Credit Score Is Needed For A Wells Fargo Auto Loan

Wells Fargos website doesnt list what credit score is necessary to qualify for an auto loan. However, as with any lender, youre more likely to be approved if you have good or excellent credit with a credit score of 670 or higher. If you have bad credit history, consider getting a co-signer to increase your chances of being approved for a new loan.

What Are The Interest And Fees

Wells Fargo auto loans come with one of the most competitive interest rates in the auto loan segment. However, the exact rate of interest and your monthly payments will depend on a number of factors.

These factors include your The catch here is that the interest rates on new vehicles are generally lower as compared to used or second-hand vehicles.

Another important factor that will determine your interest rate is your overall credit score. What this means is that if your credit score is low, you still can get the loan but at a higher interest rate.

You May Like: What Is The Minimum Income For Fha Loan

Does A Late Payment Affect My Credit

If your payment is 30 or more days late, it may show up on your credit report as a late payment. The degree to which a late payment affects your credit score can depend on things like how many days past due the payment is, how recently you’ve been past due, and how frequently youve made late payments.

Review your credit report regularly to help you know where you stand. Request a free copy of your credit report from annualcreditreport.com or from each of the nationwide consumer reporting agencies: Equifax, Experian, TransUnion, and Innovis.

Wells Fargo Auto Loan Application Requirements

When youre ready to apply for Wells Fargo car loans, make sure you have the following information on hand:

- Information about yourself, such as your social security number

- Information on citizenship

- Your current and former addresses, as well as your residential details

- Your gross monthly income, past employer, and present employer are all factors to consider.

- Make and model, year of production, mileage, VIN, and condition of the vehicle

The dealer that sells the automobile will inform you about the vehicle when you apply for new or used Wells Fargo car loans. This information is required when refinancing with Wells Fargo and trading directly with Wells Fargo.

Have information regarding your current loan on hand as well. Wells Fargo offers lower refinancing loan credit ratings, so even if your credit score isnt perfect, you can get approved.

However, if you have a bad credit score, your Wells Fargo car loans will almost certainly have a higher interest rate. If your credit score is poor, consider applying for a loan with a co-applicant who has a higher credit score. With you, a co-applicant will apply for and open the loan.

You might be able to acquire a reduced rate if you have a co-applicant. Even if your credit score is too low for you to get approved on your own, a co-applicant can assist you to get approved.

Don’t Miss: Does Refinancing Car Loan Hurt Credit

Average Car Loan Rates By Credit Score

Below, you can see average APRs for different credit score ranges. This data comes from the Experian State of the Automotive Finance Market report for the first quarter of 2022. It includes finance data from many auto lenders, not just Wells Fargo.

You can see that people with excellent credit find can find rates below 3.0 percent for new car loans from other lenders, but Wells Fargo’s rates start at 3.9 percent. This means Wells Fargo might not offer the best rates for every situation, which is why we recommend comparing multiple offers when you shop.

What Is A Routing Number

In the US, banks and other financial institutions use routing numbers to identify themselves. They’re made up of 9 digits, and sometimes called routing transit numbers, ABA routing numbers, or RTNs.

The Federal Reserve Banks need routing numbers to process Fedwire funds transfers. The ACH network also needs them to process electronic funds transfers like direct deposits and bill payments.

Find Wells Fargo routing numbers for:

Recommended Reading: Where To Get Startup Business Loan

Wells Fargo Routing Number For Ach Transfers

The ACH routing number will have to be included for sending an ACH transfer to any Wells Fargo account.To send a domestic ACH transfer, youll need to use the ACH routing number which differs from state to state. To find your ACH routing number, check the table above.

You’ll need to include the ACH routing number when sending an ACH transfer to any Wells Fargo account.

Wells Fargo Auto Loan Calculator

There are a few things you need to know before you start the vehicle loan process, and the Wells Fargo car loan calculator is a terrific resource.

The current Wells Fargo car loans interest rates should be known, and the Wells Fargo Auto Loan Calculator will assist you in determining how much of a loan and payment you can afford.

Read Also: When Does Ppp Loan End

How Do I Read My Auto Loan Statement

Your auto loan statement provides timely information about your account, such as your payment amount due and payment activity. Find out more about how to read your statement .

You can access up to 12 months of electronic statements by enrolling online. Sign on, select your auto loan from Account Summary, and then Enroll in eStatements.

Wells Fargo Bank Auto Loan Details

Wells Fargos 11,000 partner dealers may help you get Wells Fargo car loans. You cant apply directly to Wells Fargo, but you may have a network distributor forward your finance application to them.

When other lenders provide pre-approved auto loans, an offer with your maximum APR and loan amount that you can take with you when buying a car, this is a disadvantage.

Some lenders may even issue you a check, which you can hand over to the business. However, there are compelling reasons to retain Wells Fargo car loans in the race:

Recommended Reading: How Much Business Loan I Can Get