If You Have A Plan 4 Loan And A Plan 2 Loan

You pay back 9% of your income over the Plan 4 threshold .

If your income is under the Plan 2 threshold , your repayments only go towards your Plan 4 loan.

If your income is over the Plan 2 threshold, your repayments go towards both your loans.

Example

You have a Plan 4 loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Plan 4 monthly threshold of £2,083 and the Plan 2 threshold of £2,274.

Your income is £317 over the Plan 4 threshold which is the lowest of both plans.

You will pay back £28 and repayments will go towards both plans.

Average Student Loan Payments

An appropriate monthly payment is based on multiple variables. The indebted students income is a significant factor in determining monthly payments. The total debt and interest rate as well as the borrowers repayment timeline may all affect the dollar amount of their monthly payments.

- $393 is the average monthly student loan payment.

- 10% of your gross income should go toward paying off debts according to federal guidelines.

- $393 is 10% of $47,160.

- 36% of income is the maximum amount that should go toward paying off debt according to the same federal guidelines $393 is 36% of $13,100.

- Financial experts and the federal government list 10 years as the ideal timeline for paying off undergraduate student loan debt.

- The mean starting salary for among all new graduates is $55,800.

- 10% of the mean starting salary is $465.

- The most commonly used federal student loans have an interest rate closer to 3%.

- The average debt per borrower is $36,140 the majority of undergraduate borrowers owe less than $30,000.

- The average debt per enrolled student is $30,000. These are the only parameters available for some historical data.

| Monthly Payment |

|---|

| $34,800 |

Add In Private Student Loans And Potentially Parent Plus Loans

One difference with private loans is that they generally have set repayment terms such as 3 years, 5 years, 10 years, or even 15 years.

If the student is unsure what their repayment terms are on their private student loans, they need to contact the lender to find out payment terms and interest rates.

If you cosigned for your student, then as a backup, make sure youve planned enough space in your monthly budget to make payments yourself if they cant after graduation.

When you cosign a loan, the lender sees the loan as yours as much as the students. And the payment history gets reported on your credit report as well as the students.

Also Check: Amortization Schedule For Auto Loan

Who Needs To Start Repaying

You may need to start paying back your OSAP loan six months after your study period ends.

Youll be making payments to the National Student Loans Service Centre , not to OSAP.

You dont need to start paying back your OSAP loan if your school confirms your enrolment for the next study period and we approve your application for one of the following programs:

- OSAP for Full-Time Students

If you received loans through the OSAP micro-credentials program, learn about repayment for micro-credentials programs.

How To Calculate Student Loan Interest

To see how to calculate student loan interest in practice, get out your pen and paper and follow along using the following example. Not a math person? Our student loan interest calculator below does the calculation for you.

For this example, say you borrow $10,000 at a 7% annual interest rate. On a 10-year standard repayment plan, your monthly payment would be about $116.

1. Calculate your daily interest rate . Divide your annual student loan interest rate by the number of days in the year.

.07/365 = 0.00019, or 0.019%

2. Calculate the amount of interest your loan accrues per day. Multiply your outstanding loan balance by your daily interest rate.

$10,000 x 0.00019 = $1.90

3. Find your monthly interest payment. Multiply your daily interest amount by the number of days since your last payment.

$1.90 x 30 = $57

For a student loan in a normal repayment status, interest accrues daily but generally doesnt compound daily. In other words, you pay the same amount of interest per day for each day of the payment period you dont pay interest on the interest accrued the previous day.

You May Like: How To Get An Aer Loan

How To Get The Best Deals On Your Loan Payments

Your monthly loan payment is just a result of the loan amount, the interest rate, and the length of your loan. Salespeople and lenders can make a low monthly payment seem like youre getting a good dealeven when youre not.

For example, some auto dealers want you to focus solely on your monthly payment, which is why they often ask how much you can afford each month. With that information, they can sell you almost anything and fit it into your monthly budget by extending the life of the loan.

It is better to negotiate a lower purchase price than a lower monthly payment. Lowering the sales price decreases one of the three components of the total loan cost.

Stretching out your loan means youll pay more in interest over the life of the loan, increasing the total cost of the loan. Plus, longer-term loans might be riskier: When they’re used by buyers with lower credit to finance larger amounts, there’s a greater risk of default.

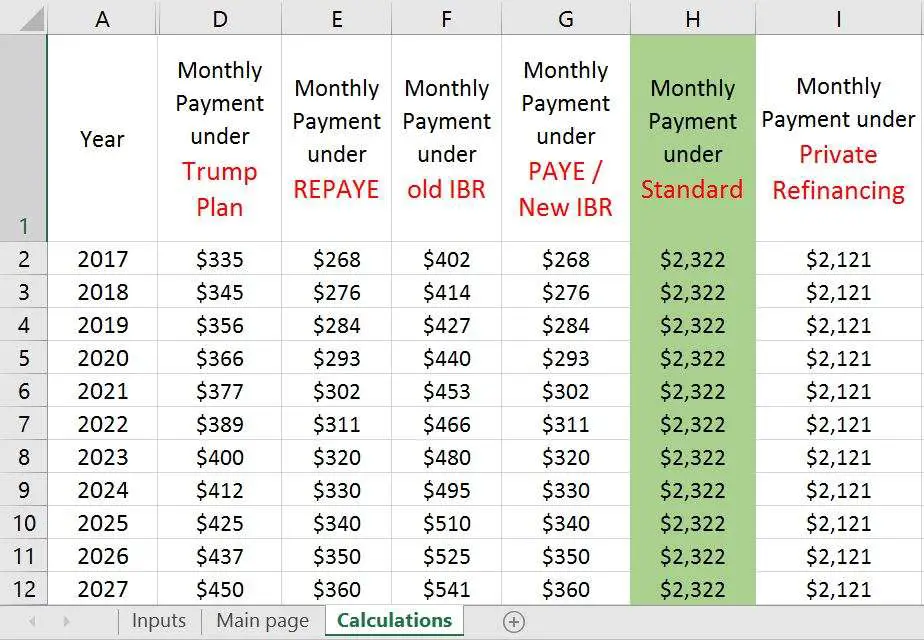

Student Loan Repayment Options

It is not uncommon for new graduates to struggle to repay their student loans. Unfortunate circumstances such as flaccid job markets or recessions can exacerbate situations. For federal student loans, there are some alternative solutions that can aid in dwindling down student loan payments. Income-based repayment plans can potentially cap the amount that students repay each month based on available income if they find that their student loans become increasingly harder to pay off. These plans prolong the life of the loans, but they relieve the burden of large monthly payments. There are also graduate repayment plans that slowly ramp up monthly payments over time, presumably in conjunction with projected salaries as people progress through their careers. Extended graduated repayment plans allow borrowers to extend their loans for up to 25 years. For some income-linked plans, in the end, the remaining balance may be forgiven, especially for those in public services.

The major repayment plans for federal student loans are listed below.

| Plans | |

| Low-income borrowers with Federal Family Education Loans | No |

* Loan forgives tax-free after 120 qualifying loan payments for these in public services. It is not income tax-free and only forgives at the end of the loan term for others.

Recommended Reading: How Long For Sba Loan Approval

How Extra Payments Pay Off Loans Faster

Say, for example, you borrow $20,000 in student loans with an interest rate of 5%. Your monthly payment for 10 years would be $212 and you would pay $5,440 in interest.

What if you paid $100 a month more toward that loan? Your monthly payment would rise to $312 but you would pay about $2,000 less in interest and be debt-free nearly four years earlier.

The more payments you can tack on, the less youll pay in interest and the closer youll get to freedom from student debt. If it feels like you have no cash to spare, try making biweekly student loan payments instead its a simple way to trick yourself into making one full extra payment each year.

The standard repayment plan takes 10 years to pay off a student loan. But repayment can last longer if you change your repayment plan for example, income-driven options can last up to 25 years.

You can pay off a student loan as quickly as you’re financially able to. There’s never any penalty for prepaying a student loan, and paying off your loan quickly will result in paying less overall.

You can calculate your student loan payoff date based on your current loan balance, the loan’s interest rate and the amount you pay each month. If you’re on an income-driven repayment plan, your student loan will be paid off when the amount you owe is paid in full or your repayment term reaches its end, whichever happens first.

Which Repayment Plan Is Right For Me

Determining which repayment plan to select depends on several factors. First, check which plans you qualify for. The U.S. Department of Educations website lists in detail the eligibility requirements for each plan.

Your income, family size and personal circumstances must also be taken into account. For example, if your income is low relative to your debt, then an income-driven plan may give you a monthly payment that is easier to handle.

If you plan on pursuing PSLF, then the standard repayment plan isnt a good option, since youll pay off your loans before you can take advantage of forgiveness. The governments student loan repayment calculator, called the Loan Simulator, can help you assess your situation and determine which plan makes the most sense for you.

Also Check: Aer Loans

Average Undergrad Student Loan Payment

- Standard repayment plan $305

- Graduated repayment plan $344

- REPAYE $389

The average student loan debt for recent graduates with a bachelors degree is $29,000. Lets say youre paying the average student loan interest rate of 4.53% for undergrads and enroll in the standard 10-year repayment plan, your monthly payments will be $305.

| Repayment plan | |

|---|---|

| 7 years, 9 months | $35,236 |

| Monthly payments for bachelor’s degree debt of $29,000 at 4.79% average interest rate for undergraduates. REPAYE assumes starting salary of $55,660, the median for younger workers with bachelor’s degrees |

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Also Check: What Car Loan Can I Afford Calculator

Who You Need To Repay

You may have loans or lines of credit that you need to repay to the government and/or your financial institution.

In some provinces and territories, Canada Student Loans are issued separately by the federal and provincial or territorial governments. This means that you could have more than one loan to pay back.

Verify your contracts to determine where your debt comes from and where you need to repay it.

Consider Parent Plus Loans When Calculating Monthly Payments

While Parent PLUS loans dont belong to the student, you should calculate your payments on these loans on a semester-by-semester basis.

If you are unprepared to repay them, the student may be able to pick up a part-time job or they can apply for more scholarships.

Another option is for the student to transfer to a school where you dont have to borrow so much.

The good news is, schools offer new scholarship awards in sophomore, junior, and senior year of college. Students need to check in regularly with their financial aid office and the department for their major.

A student may qualify for a scholarship from their major that is only available in their 2nd or 3rd year.

They can also go to the financial aid office on campus to ask about additional grant and scholarship money.

Also Check: How To Reclassify A Manufactured Home

Already Borrowed Here Is How You Can Decrease Your Student Loan Rates

If youre one of the millions of borrowers who already has student loan debt, you are not out of luck in terms of managing your repayment effectively.

You may consider refinancing your federal or private student loans to obtain a lower interest rate on your debt through a private lender. Doing so creates a much rosier picture for your total student loan payments and it may help reduce your monthly obligation immediately.

However, refinancing federal student loans to a private loan removes all federal protections such as income-driven repayment plans, forgiveness opportunities, and more.

To help better manage your student loan payments for federal loans, consolidation may also be beneficial. The Direct Consolidation Loan from the federal government allows you to combine multiple loans under a single, new loan.

This will not lower your total interest, but it will allow you to take advantage of income-driven repayment plans or an extended repayment plan that can ease the cash flow burden each month.

Talk to your loan servicer to learn more about federal consolidation. To see what your payments would be under the most popular income-driven plan, the Income-Based Repayment Plan , check out our IBR Calculator.

If you are looking to refinance your student loans with a private lender to lower your interest rate, check out some of the following highly-rated partners of ours.

Compare Student Loan Refinance Companies

Class Of 2021 Student Loan Payments

Because student loan interest rates are at historic lows, current students may reasonably expect to pay off their student loan debts within the recommended 10-year timeline.

- Between $354 and $541 is the ideal monthly payment for a newly graduated Bachelors degree holder.

- 2.75% is the interest rate for Direct Subsidized and Unsubsidized federal student loans to undergraduate borrowers.

- Undergraduates of public institutions owe an average of $29,500 per enrolled student.

- $42,500 is a low-end starting salary for a new graduate with a Bachelors degree.

- $73,800 is a high-end salary.

- $64,900 is the average annual salary for a recent graduate with a Bachelors degree.

- $52,000 is the median salary for new graduates with Bachelors degrees.

Undergraduate Class of 2021 Student Loan Payments

Average Payments on a Low-End Starting Salary| Monthly Payment |

|---|

| $50,400 |

Also Check: What Car Loan Can I Afford Calculator

How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

Your Student Loan Repayment Term

Your loan repayment term is the number of years you have to pay it back. Federal loans generally have a standard repayment schedule of 10 years.2 For , the repayment term can range anywhere from 5-20 years, depending on the loan. You’ll be given a definite term for your loan when you apply.

Interest rates for federal and private student loans

The average interest rate will be different for federal student loans and private student loans. Federal student loans have a single, fixed interest rate, which means that your loan’s rate doesn’t change over time.

You may have noticed that there’s a range of interest rates associated with a private student loan. Private student loans are . That means the rate you’ll be offered depends on your creditworthinessand that of your cosigner, if you have onetogether with several other factors. When you apply for a loan, you’ll be given an interest rate, either , depending on which is offered and which type of rate you’ve chosen.

How much you’ll need to borrow for college

If you’re wondering for collegewhether it’s a public university or private universitythe can help. You can search for college costs and also build a customized plan based on your own situation.

Don’t Miss: Is Bayview Loan Servicing Legitimate

Change Your College Budget When Needed

Beyond applying for new scholarships, an excessive amount of student loan debt can be a signal to rebudget.

Textbooks are a highly flexible expense.

A member of our told us she spent a total of $500 on books for two masters degrees because she was able to buy and then resll them on Amazon.

In comparison, school bookstores rarely pay a good buy-back price. Plus, your school could have retired that edition of the book while another school hasnt. Thus, the resale value could be better in a different locale.

Students can get budgeting help for all aspects of their budget from the student money management department or a credit union financial counselor on campus.

They may help them find ways to save on food, entertainment, or housing.

For instance, a change in meal plans can save several hundred dollars per semester.

How Long Will It Take To Pay Off My Student Loans

How long itll take you to pay off your student loans depends on your repayment plan, income, and other factors.

A standard 10-year repayment plan is 120 months, assuming you can make regular minimum monthly payments. But if you can pay more than the minimum monthly payment, or make extra payments, you could significantly cut that down. Most lenders wont penalize you for paying off your student loan early either if you do pay more than the minimum each month.

On the other hand, if youre having trouble keeping up with your monthly payments, you could opt for an income-driven repayment plan. IDR plans are an option if you have federal student loans, but are not offered by most private student loan lenders.

Read Also: How To Get An Aer Loan