Help From Your Lender

If your seller isnt interested in covering your closing costs, your lender might be. Heres how that works.

There are many ways to price a mortgage. For instance, heres what you might see on a rate sheet for a 30-year fixed mortgage:

| Rate | |

| 3.250% | 4.000 |

The rates with negative numbers have whats called;rebate pricing.;Thats money that can be rebated to the borrower and used for things like closing costs.

So if you have a $100,000 loan with a three percent rebate , you get $3,000 from the lender to cover your closing costs.

How can lenders do this? They do it by offering you a higher interest rate in exchange for an upfront payment now. So, youd get 3.75 percent if you paid the normal closing costs, while 4.125 percent would get you a three percent rebate. If you only keep your loan for a few years, you can come out ahead with rebate pricing.

What Is An Fha Loan And How Does It Work

https://money.com/what-is-an-fha-loan/

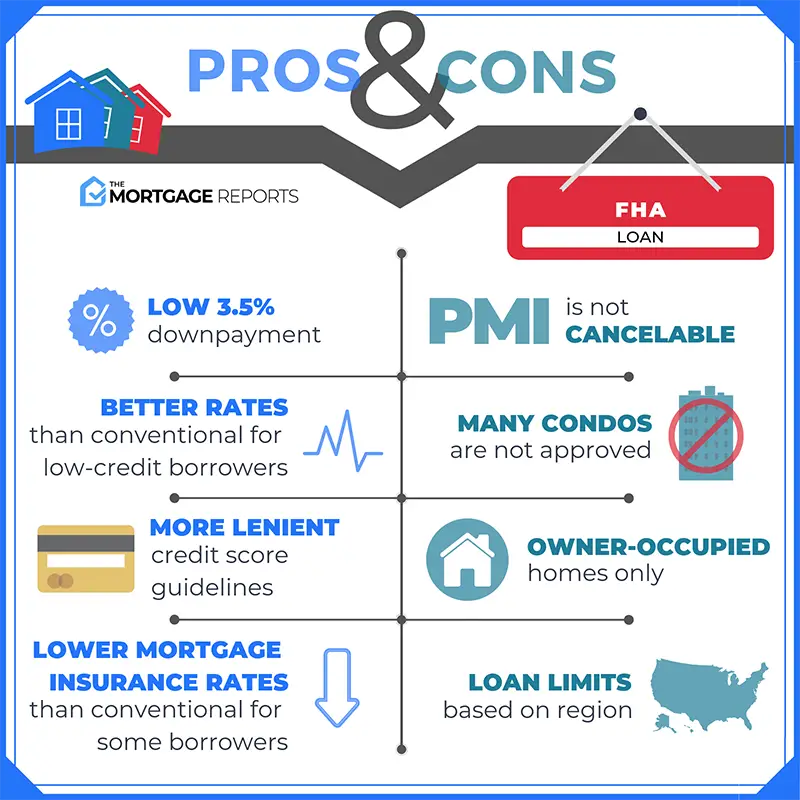

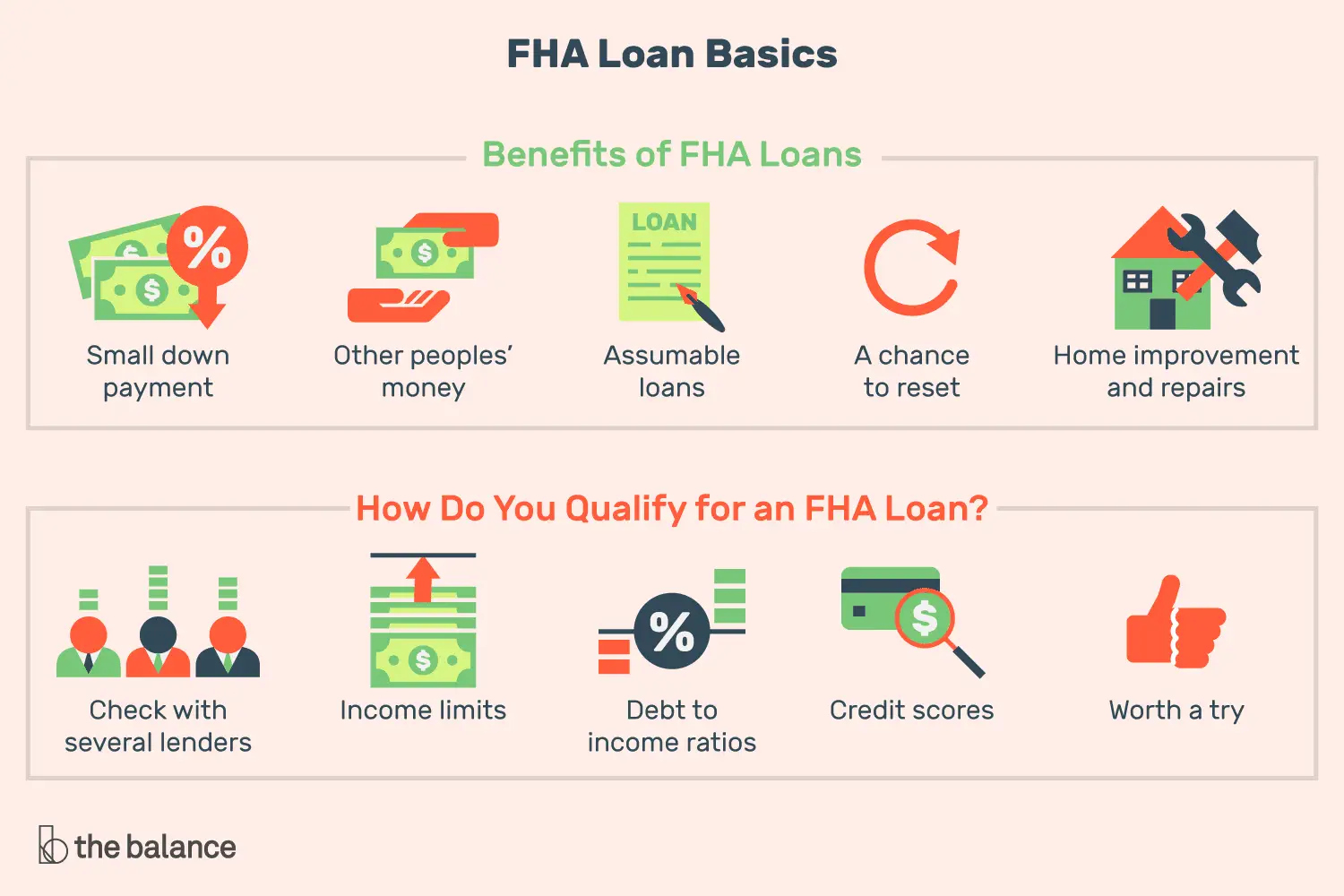

An FHA loan is a mortgage backed by the Federal Housing Administration, a subsidiary of the Department of Housing and Urban Development.

The FHA loan program is designed to help people with poor credit purchase homes with low down payments and more flexible income requirements than conventional mortgages.

Upfront Fha Mortgage Insurance Premium

In addition to annual MIP, FHA loans also require an upfront mortgage insurance premium of 1.75% of the loan amount. The upfront mortgage insurance premium goes into an escrow account and paid to The Department of Housing and Urban Development at closing. In some cases, you may be able to roll UFMIP into your loan.

Read Also: Can You Add Onto An Existing Loan

No Down Payment: Va Loans

The VA loan;is a no-money-down program available to members of the U.S. military and surviving spouses.

Backed by the U.S. Department of Veterans Affairs, VA loans are similar to FHA loans in that the agency guarantees loans for borrowers who meet VA mortgage guidelines.

VA loan qualifications are straightforward.

Most veterans, active duty, and honorably discharged service personnel are eligible for the VA program. In addition, home buyers who have spent at least 6 years in the Reserves or National Guard are eligible, as are spouses of service members killed in the line of duty.

Some key benefits;of the VA loan are;:

- No down payment requirement

- Below-market mortgage rates

- Bankruptcy and other derogatory credit information does not immediately disqualify you

- No mortgage insurance is required, only a one-time funding fee which can be included in the loan amount

In addition, VA loans have no maximum loan amount. Its possible to get a VA loan above current conforming loan limits, as long as you have strong enough credit and you can afford the payments.

What Will Fail An Fha Inspection

Structure: The overall structure of the property must be in good enough condition to keep its occupants safe. This means severe structural damage, leakage, dampness, decay or termite damage can cause the property to fail inspection. In such a case, repairs must be made in order for the FHA loan to move forward.

Also Check: Which Bank Gives Loan For Land Purchase

Us Department Of Agriculture Loans

The USDA offers several attractive loan programs. Most are limited to rural areas, and to people who have average or below-average income. If you live outside of an urban or suburban area, it pays to learn if you qualify for a USDA loan.

USDA Loan Insurer

Guaranteed by the U.S. Department of Agriculture, USDA loans do not require a down payment. USDA loans are designed to encourage rural development.

USDA Loan Insurance Cost

USDA loans have an upfront fee and annual fee. The upfront fee is 2 percent of the loan amount. The annual fee, paid monthly, is 0.4 percent of the loan amount. USDA fees are lower than FHA fees.

How Do I Get A House With No Money

A no down payment mortgage allows first-time home buyers and repeat home buyers to purchase property with no money required at closing except standard closing costs. Other options, including the FHA loan, the HomeReady mortgage and the Conventional 97 loan offer low down payment options with a little as 3% down.

Also Check: How To Get An Fha Loan With No Money Down

How Much Of A Down Payment Do You Really Need To Buy A House

Article originally published August 20th, 2014. Updated October 29th, 2018

Looking to get your foot in the door ? If youre a renter whos tired of paying someone elses mortgage, now may be the time to pursue the American dream of homeownership. In fact, the days of needing a 20% down payment are long gone.

While you can always elect to put down the full 20% or more, there are now many alternatives available. Heres what you want to know if buying a house is in your future.

In the mortgage industry, 20% down is considered the benchmark down payment for looking strong on paper as a home buyer. While this a general standard for financial strength, it is by no means a requirement, nor is it necessarily expected.

However, keep in mind that your purchase offer amount your buying power drives negotiation. How strong you are on paper does help, but when you make an offer to buy a home, the seller of the property has no idea of your financial strength other than what your real estate agent tells them and;whats on your pre-approval letter.

Featured Topics

The;price;dictates whether youre in the game for the house, or whether youll continue to be on the search.

So, lets say you dont have 20% down for a home. While there are many benefits to having more equity in the home youre buying, that doesnt mean youre out of the running for becoming a homeowner.

There are options for lower down payments.

Find a Home Loan That’s Right for You

Down Payment Assistance Programs And Gifts

Rules for FHA loans are easier than most when it comes to the source of your down payment. So you may be able to accept the whole amount from a down payment assistance program or as a gift.

Still, its important to remember lenders may impose stricter standards than the FHA minimums outlined here. So that last bit of advice stands: shop around for a more sympathetic lender if yours has strict rules over down payment assistance and gifts.

Read Also: How To Stop Loan Payments

Can I Get An Fha Loan With A High Debt

FHA loans allow for higher debt-to-income ratios . Your DTI is calculated by comparing your debt payments and your before-tax income. Fannie Mae and Freddie Mac Conventional mortgage programs allow debt-to-income ratios between 36 and 43 percent.

FHA maximum DTIs are:

- 31% of gross income for housing costs

- 43% of gross income for housing costs plus other monthly obligations;

The average DTI for closed FHA purchases in was;41 percent ;FHA will allow ratios as high as 50 percent. Though higher ratios are allowed,;youll need one or more;compensating factors;like a high credit score or a down payment exceeding the minimum.

What Are Closing Costs In A Mortgage

Closing costs, including prepaids, are fees that must be paid to finalize your mortgage loan. Your mortgage loan covers a percentage of the sales price of the property youre purchasing while closing costs cover the costs that accumulate during the homebuying and mortgage loan process. Youll receive a Loan Estimate t at time of application and a Closing Disclosure three days before your scheduled;closing day from your lender. These documents include details of your loan and an itemized list of closing costs.;

Don’t Miss: How To Figure Out Loan Amount

What Is A Debt

A persons debt-to-income ratio is the percentage of their gross monthly income spent to cover debts such as a mortgage, student loans, car loans, credit cards, etc.; Lenders take your DTI into consideration because its often a strong indicator of how likely you are to have a hard time paying your bills.

To qualify for an FHA loan, you cannot spend more than half of your gross income on debt; that is, a DTI of 50% or more.; In some cases, a person may qualify with such a DTI.; In general, however, lenders will want to see your debt-to-income ratio be no greater than 43%.

Other Loan Options To Consider

If you have high credit scores but are having a hard time raising a down payment of 20% of the purchase price, FHA loans are not your only option. Consider some of these alternatives:

- Freddie Mac Home Possible loan: Freddie Mac, as the Federal Home Loan Mortgage Corporation is popularly known, devised the Home Possible loan to lower the barriers to homeownership. Down payments start at 3% and can come from family, employer assistance, a secondary loan or “sweat equity.” The minimum credit score requirement is 660 , but if you or a co-applicant lack a credit score, you still could qualify through an alternative underwriting process.

- Fannie Mae 97 LTV loan: The Federal National Mortgage Association, better known as Fannie Mae, authorizes two categories of mortgage loans that require minimum down payments of 3% :

- The Fannie Mae Home Ready 97 LTV loan is designed for low-income borrowersspecifically those with incomes below 80% of their local area median income as designated by the U.S. Census Bureau.

- The Fannie Mae Standard 97 LTV loan is open to any borrower, provided at least one applicant is a first-time homebuyer and all applicants have credit scores. If all applicants for Fannie Mae LTV loans are first-time homebuyers, at least one must complete a homeowner education program.

Don’t Miss: Is Jumbo Loan Rates Higher

Down Payment On Your Primary Residence

Down payment requirements for your primary residence, or main home, can vary.

Conventional Loan: Conventional loan requirements for primary residences are totally up to the individual lender. Some lenders might require you to have 5% down, while other lenders may only require 3%. If you have a credit score thats above 620 points, your lender may give you access to lower down payment loan options.

FHA Loan: With an FHA loan, youll need a down payment of at least 3.5%. To be able to put down the minimum 3.5% FHA down payment, youll need a credit score of 580 or higher. If your credit score is between 500 and 579, youll be required to put down at least 10%. The minimum credit score required by Rocket Mortgage® is 580.

VA Loan:You dont need a down payment to qualify for a VA loan. There are specific length-of-service requirements that determine your eligibility, and your discharge reason also plays a role. You can view complete service requirements for the VA loan program on the Department of Veterans Affairs website.

If youre the spouse of a military member or veteran who died in service or from a service-related disability, you may also be eligible for a VA loan. Full eligibility requirements for spouses are also available on the VA website.

Summary Of Money’s Guide To Fha Loans

- The FHA doesnt lend money, FHA-approved lenders do, but the FHA is responsible for settling the debt if you dont pay.

- The most common type of FHA loan is the Basic Home Mortgage Loan 203.

- To apply for a 203 loan, you need a credit score of at least 580 for a 3.5% down payment or 500579 for a 10% down payment.

- Unlike conventional mortgage loans, the down payment can come from your own savings, gift funds or government programs.

- You must pay monthly mortgage insurance premiums and an upfront mortgage insurance premium upon the origination of an FHA loan.

- Categories

Don’t Miss: Should I Get An Unsubsidized Student Loan

What Disqualifies An Fha Loan

According to the Department of Housing and Urban Development , you need a credit score of at least 500 to be eligible for an FHA loan. If you fall well below this range, you might be denied for an FHA loan. In fact, bad credit is one of the most common causes of denial for any type of mortgage loan.

Yes Or No For Down Payment Sources

What if you can’t come up with the entire down payment on your own? Lenders will require the full amount of money as the required down payment, but friends, family, and employers can make a down payment gift to you that reduces your financial burden. That money is required to be verified by the lender as having come from an approved source.

The FHA doesn’t just list who may give such a gift–it also has rules discussing who MAY NOT provide gift funds for an FHA loan down payment. The gift donor may not be a person or entity with an interest in the sale of the property, such as the seller, real estate agent, or the builder.

FHA loan rules are specific and clear in these areas to insure fairness and to preserve the integrity of the home buying process with FHA loan funds.

Don’t Miss: How To Use Va Loan For Investment Property

What You Can Do If You Dont Meet Fha Requirements

If youre initially ineligible for an FHA loan, here are a few strategies that can help improve your chances:

Rates and terms vary greatly across lenders. So if youre considering getting an FHA loan, make sure you shop around for mortgages first.

If youre still not sure what loan is best suited for your home purchase, Credible Operations, Inc. can help you compare many mortgage options and get pre-approved. Even though we dont offer FHA loans, you can compare other mortgage options from multiple lenders.

Credible makes getting a mortgage easy

Delaware Fha Loans Overview

FHA is the Federal Housing Administration which is governed by HUD .

It is rare that a home buyer will put down 20% on a home these days. First Time Home Buyers are more likely to go for more affordable low or no down payment mortgages; these mortgages are also popular with repeat buyers.; One of the biggest low-down payment mortgage program in Delaware is the FHA loan from the Federal Housing Administration.

In fact, FHA Loans are so popular that around 1 in 5 U.S. buyers uses it to finance a home purchase. Delaware home buyers can make down payments of just 3.5 percent with an FHA Loan. The more relaxed underwriting standards and low mortgage rates make it a great choice. With rates rising, the FHA continues to gain popularity.

Download the PDF Flyer: Delaware_FHA_Loans

Recommended Reading: Can I Get Home Equity Loan On Investment Property

What Kind Of Property Can I Buy With The Fha 15% Down Payment Loan

Eligible properties covered by the 1.5% down payment FHA loan are:

- 1 to 2 unit primary residences

- Manufactured Housing

- FHA Approved;Condos

- Townhomes/PUDs

Refer to the general;Utah FHA loan program;guidelines for additional details, or email me your questions at;. For a quick reply, you can also text me at;801-473-3154.

How Much Down Payment Do You Need To Buy A Home

By: Pamela Garcia on September 20, 2021

Down payments are seen as a barrier to homeownership by many. However, this concept is often misunderstood. Contrary to popular belief, you may not need to use your entire savings to buy a home.;

Heres what you need to know about the down payment for your dream home.

Recommended Reading: Can You Ask For More Federal Student Loan

Types Of Fha Home Loans

There are a number of different types of FHA loans. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that youre getting the right type of loan. If none of the following loan types match your goals, you might want to consider another government-backed FHA loan alternative.

Lets take a look at a few different FHA loan classifications.

Is An Fha Loan Good For You

If you stumbled upon this article as a result of an Internet search you did, its quite possible that you are that excited home buyer who just found out that an FHA loan might help you buy that home for which you did not meet the requirements with a regular, conventional loan.

If you are that person, what you heard is right. An FHA loan does offer you that advantage.;

It does? Even if I dont have very good credit? Yes, absolutely.

Recommended Reading: Is Prosper Personal Loan Legit

How Long Do Borrowers Have To Pay Fha Mortgage Insurance

The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date.

For loans with FHA case numbers assigned on or after June 3, 2013:

Borrowers will;have to pay mortgage insurance for the entire loan term if the;LTV is greater than 90% at the time the loan was originated. If your LTV was ;90% or less, the borrower will pay;mortgage insurance for the mortgage term or 11 years, whichever occurs first.

| Term |

|---|