Decide Where To Apply For A Small

Banks, alternative online lenders and other sources offer business loans. The best place to apply for a small-business loan will usually be wherever you qualify for the lowest interest rate. But the following questions should also influence your decision:

-

How good are your finances? Bank and SBA loans typically offer the most competitive interest rates. Those low rates come with strict qualifications though: Youll likely need at least two years in business, strong annual revenue and good credit to qualify for funding. If you have bad credit or cant otherwise hit those marks, your best bet may be to apply for a small-business loan from an online lender.

-

What type of funding do you need? Multiple types of business loans are available, but not from every lender. If youre buying heavy-duty machinery, for example, a lender with dedicated equipment financing may make sense. For ongoing working capital, consider a business line of credit you can draw from as needed. If you want to apply for an SBA loan, you can find participating lenders using the agencys lender match tool.

-

When do you need the loan? If you need financing in a hurry, you may want to prioritize online lenders. These lenders may have automated processes that let them review applications quickly and offer fast business loans. If you can wait for more than a few days, SBA Express loans may offer quicker turnaround times than other federal options but similar benefits, like competitive rates and flexible terms.

Faq: Small Business Loans

Securing a small business loan can be challenging to navigate if you donât know the ropes. As a business owner, youâve got better things to do than spend weeks learning the intricate details of lending. Thatâs where we can help. At National Funding, we know youâre busy, so we make it easy to understand your financing options. Get the answers you need now by looking through our most frequently asked questions about small business financing.

Sba 8 Business Development Loans

Each year, the governmentaimsto give out at least 5 percent of all federal contracting dollars to disadvantaged small business owners. One of the mechanisms they use to achieve that goal is the SBAs 8 Business Development program.

Businesses approved for the program can earnsole-source government contractsof up to $4 million for goods and services and $6.5 million for manufacturing.

To qualify for 8 financing, small businesses must be at least 51 percent owned by a U.S. citizen entrepreneur who is socially or economically disadvantaged. Owners must have less than $4 million in assets and a personal net worth of $250,000 or less; their average adjusted gross income over the previous three years needs to be $250,000 or less, too. Owners must also manage day-to-day operations and their business needs to have a track record of successful performance.

To find out whether youre eligible for an 8 Business Development loan, clickhere to visit the SBAs Am I Eligible? page.

Don’t Miss: Should I Pick Variable Or Fixed Rate Student Loan

No Federal Grants For Businesses

The federal government does not offer grants for starting or growing a business. It only provides grants for nonprofit and educational institutions. These organizations focus mainly on medicine, technology development, and other related fields. Find out more about federal grants.

Some state and local programs offer business grants. They usually require you to match the funds. Or, they may expect you to combine the grant with other forms of financing, such as a loan.

Understand The Challenges That Veteran

Despite the large number of small business owners that are veterans, overall, business ownership is down for veterans.

Since 2001,;only 4.5 percent of service members;have started their own business. In comparison, almost half of the veterans of World War II started their own business.

In a;report by Syracuse University,;researchers concluded that access to capital was one of the biggest challenges for veteran entrepreneurs. Most veteran business owners agreed that lack of access to capital limited their ability to grow. At least part of the reason is that the current G.I. bill, unlike the previous one, doesnt provide low-interest loans to;start a veteran-owned business.

Veteran-owned small businesses make up an important part of the U.S. economy, but they also provide havens for returning veterans who benefit from working for someone that understands them. This makes it especially important for veterans to be aware of their financing options.

Also Check: How To Calculate Maximum Loan Amount Fha Streamline

How To Apply For Small Business Loans

With the advent of technology, it is now easy to apply for small business loans online. You can apply for affordable small business loans online on our website or download our mobile App easily from Google Play Store. Just follow the following steps know the process to apply for small business loans:

So, what are you waiting for? Apply for affordable;small business loans with ZipLoan, get funds within a few working days, and provide your business the much-required boost!

Keep Up With Your Online Presence If You Want A Small Business Loan

Many small business loan lenders like to keep up with the businesses that they lend money to. This may include taking a look at the information available online about your business.

Keep up with your online presence, which can help to improve what your lender sees. Update your website periodically as appropriate. If you make use of social media sites, review your presence there.

You should also take a look at any recent reviews that you have received on your website as well as other websites such as Yelp. Make any changes, such as adding new information or deleting outdated information, as appropriate.

Securing the funds you need to start and run your small business can help you to not only succeed, but flourish. It may seem difficult, at first, to get a loan. But if you know where to look, and what type of loan you need, you can find a small business loan that is best suited to your business and your specific needs.

With a bit of preparation, you can greatly increase your chances of getting that small business loan and bringing your small business to the next level!

You May Like: Can I Pay Off Personal Loan Early

Fast Loans: Small Business Financing In Months

- SBA loan: A government-backed loan with A-list name recognition. SBA loans are beloved for their enviable rates and loan terms.

- Business term loan: A classic. The loan most people think about when they say small business loan.

- Commercial mortgage: Financing for your office, storefront, restaurant, or other commercial property. Use it to buy, build, expand, remodel, or refinance.

- Business acquisition loan: Need capital to purchase an existing business or franchise? Look no further.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How Much To Loan Officers Make

Understand The Terms Of The Proposed Loan

If you have applied for more than one small business loan, you dont have to accept the first offer that arrives. In fact, it is best to compare the terms of your proposed loan and compare them to one another and make sure that they make sense for your business.

Take a close look at the small business loan rates, and whether they are fixed or variable. Ask yourself the following questions before you accept the loan terms:

- How often is the interest payable?

- What is the origination fee ?

- Are there any other costs or fees associated with the loan ?

- Is there any type of collateral required ?

- Do you need to present periodic statements or other documents throughout the duration of your loan period?

- Are there any types of limitations on how the money from your small business loan can be used?

- Can you repay your loan early without penalty ?

Understanding the terms of your small business loan will help you to ensure that you choose the best one for your needs, and that it helps you to achieve your specific goals.

Smartfinancesolutionsnet Im In Chapter 7 Bankruptcy Any Point In Applying For An Sba Loan

Find the best financial services for you at: SMARTFINANCESOLUTIONS.NET – I’m in chapter 7 bankruptcy, any point in applying for an SBA loan? – I’m exploring options for funding a small restaurant venture, but have 6 years to go before the bankruptcy is removed from my credit history. Do I have any chance to qualify for an SBA loan once my credit score is improved, if I apply while the bankruptcy is on my record? –

Thanks! Share it with your friends!

Also Check: When To Apply For Ppp Loan Forgiveness

Heres What Clix Has To Offer Features Andbenefits Of Business Loan

Large Loan Amounts

We have SME business loans ranging from Rs 550 lakhs to meet every business need.

Collateral-Free Loan

We understand your ambitions and this is why we cater to your financing needs by providing you with quick and unsecured business loans.

Flexible Repayment

We understand that your business goals cant be timed and hence were flexible choose a repayment period from 12 to 36 months .

Minimal Documentation

You deal with enough paperwork every day, so we keep ours to a minimum and help you get SME loan with ease.

All set out to take the commercial world with a storm? Lack of finances is the last thing youd want to stand between you and your business ambition.

We dont believe any business ambition is too big or small. Whatever be your business requirement, be it small business loans, new business loans, business expansion loan or instant business loan, we have got you covered.

List Of Coronavirus Small Business Loan And Grant Programs

BROOKLYN, NEW YORK – MARCH 16: A lone customer lingers over a coffee in a normally crowded cafe that … is transitioning to only servicing to go orders on March 16, 2020 in Brooklyn, New York.

Editors note: We are updating this story regularly as more federal, state and local program details become available. Last update: April 10, 2020.

Small businesses have been hit hard by mandatory closures and safety measures required to slow the spread of the coronavirus .;

Businesses have a growing number of resources and relief programs to turn to, including many new provisions included the stimulus package enacted by Congress. Many small businesses have so far encountered roadblocks getting federal assistance, but there are other sources of funding to consider, including grants and emergency loans from states, cities and community organizations.

Below is a list of federal, state and lender-specific support to pursue, which will be updated to include programs as theyre released and refined. Return to this page regularly.

Don’t Miss: When To Take Home Equity Loan

I Am A Sole Proprietor Can I Use The Loan To Pay My Own Salary

According to an SBA regulation published April 16, independent contractors and sole proprietors can calculate their payroll by adding up wages, commissions, income, or net earnings from self-employment or similar compensation.

An published by the Treasury Department lists owner compensation replacement among the allowable costs for a PPP loan. The exact amount of your loan could depend in part on how much you spend during that period, according to the Treasury Department.

Don Cole, chief executive of Bethesda, Md.-based Congressional Bank, says the Treasury Departments decision to include owner compensation replacement essentially means they can keep a portion of it as the equivalent of paying themselves a salary.

Black Entrepreneurship Knowledge Hubclosed

The;Black Entrepreneurship Knowledge Hub;will conduct research on Black entrepreneurship in Canada. It will help identify barriers to success and opportunities for growth. The Hub will be led by not-for-profit Black-led community and business organizations in partnership with educational institutions.

ISED is currently reviewing the concepts and will communicate with applicants in the weeks to come.

You May Like: What Is Escrow In Mortgage Loan

Economic Injury Disaster Loan Advance

Small business owners in all 50 states, Washington, D.C., and U.S. territories were able to apply for an Economic Injury Disaster Loan Advance of up to $10,000 as part of the application process for an EIDL loan. The loan advance did not have to be repaid, and you didnt actually have to be approved for an EIDL loan to receive the advance; however, the amount of the loan advance was deducted from total loan eligibility.

The EIDL Advance program ended July 11, 2020, due to lack of funds. A new EIDL Targeted Advance program was created with passage of the Consolidated Appropriations Act , 2021.

Free Small Business Bank Checklist

Know you need a small business bank account but don’t know where to start? Download our FREE small business bank checklist to set yourself for success!

Your email address will be used by Simply Business to keep you posted with the latest news, offers and tips. You can unsubscribe from these emails at any time. Simply Business

I love writing about the small business experience because I happen to be a small business owner – I’ve had a freelance copywriting business for over 10 years. In addition to that, I also head up the content strategy here at Simply Business. Reach out if you have a great idea for an article or just want to say hi!

This content is for general, informational purposes only and is not intended to provide legal, tax, accounting, or financial advice. Please obtain expert advice from industry specific professionals who may better understand your businesss needs.

You May Like: Which Student Loan Accrues Interest While In School

What Do You Need Out Of A Business Loan

Find a solution that fits the unique needs of your business from short-term operating loans to long-term financing to help secure the future of your business.

Short-Term and Operating Loans

For Businesses With Everyday Borrowing Needs

- Looking to cover short-term gaps in their cash flow

- Planning to make significant business purchases or improvements

- Looking for easy access to extra operating funds

For Businesses With Substantial Financing Needs

- Looking to purchase equipment or property

- Aiming to expand operations

Nevertheless Simply Putting An Application Online Isnt Enough

A small business owner shouldnt have to be a financial expert to complete a loan application; and small business lenders are embracing a new paradigm to provide business owners with efficient access to the capital they need to build growing businesses that strengthen communities and create jobs.

Additionally, a safe and secure online applications process is important to business owners whether theyre borrowing $5,000 or $500,000. At OnDeck, your loan application is protected by encryption and Transport Layer Security protocol to ensure your sensitive information is securely sent to OnDeck.

Also Check: Can You Refinance An Fha Loan

Faster Loans: Small Business Financing In Weeks

- Business line of credit: The capital you need, when you need it. Only pay interest on what you use.

- Equipment financing: Specifically designed to finance equipment, this loan can help you purchase the commercial fridge, tractor, or computer equipment you need.

- Startup loan: Financing based on personal credit to help accelerate business growth.

Q: What Federal Loans Or Financing Options Are Available

|

;·;;;;;;;; Crowd-sourced loans of up to $15,000 at a 0% interest rate. ·;;;;;;;; See more details and apply here. 3);;;;;Jewish Free Loan Association ;·;;;;;;;; No-interest loans up to $36,000, regardless of religious affiliation. ·;;;;;;;; Borrowers must have 2 guarantors, credit scores of 580 or better, demonstrated need, and the ability to repay the loan. ·;;;;;;;; See more details and apply here.; You may find additional private loan offerings in the Additional Resources section below, particularly in the crowdsourced community resource guides. **Note that as the community resource guides are constantly updated by members of the public, you should independently verify the reliability of any programs listed.** |

Don’t Miss: Can You Refinance Your Car Loan With The Same Company

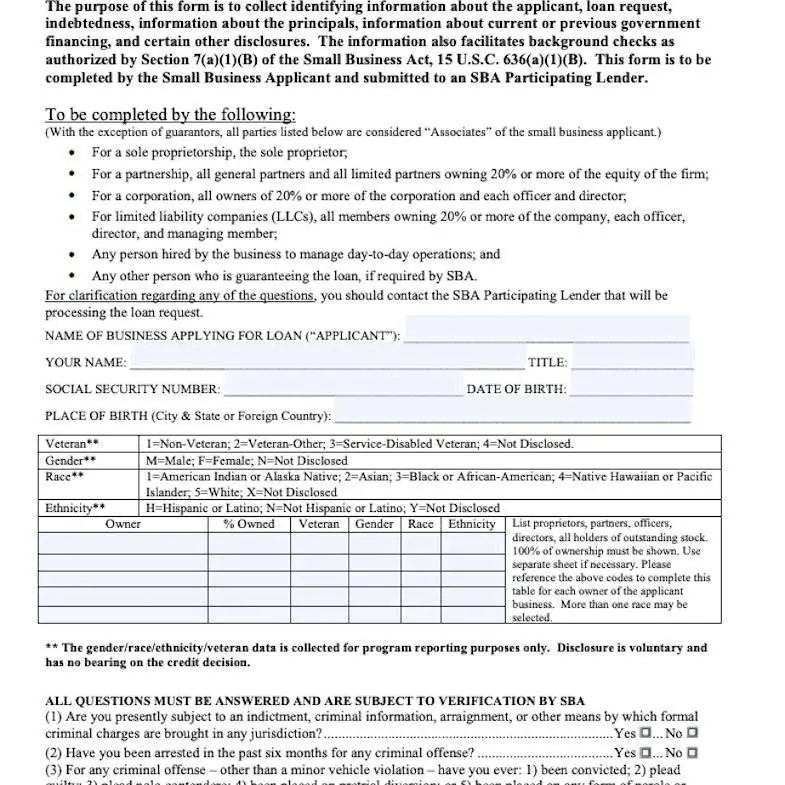

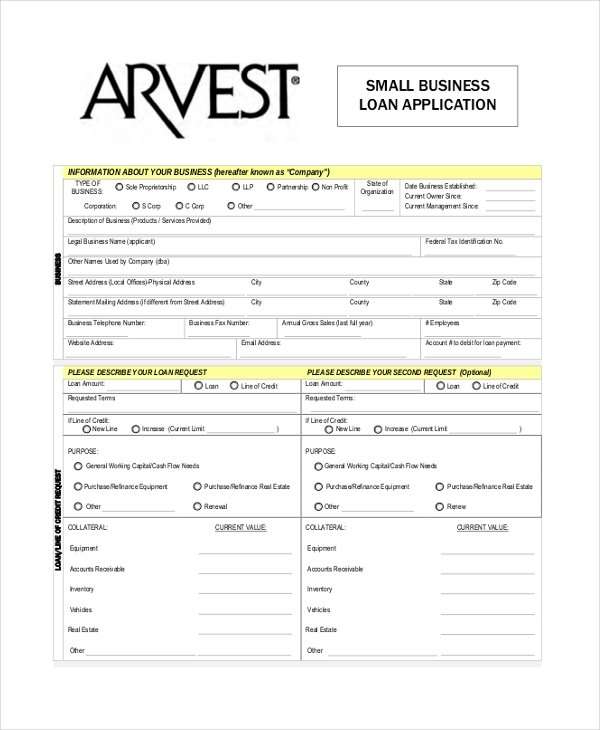

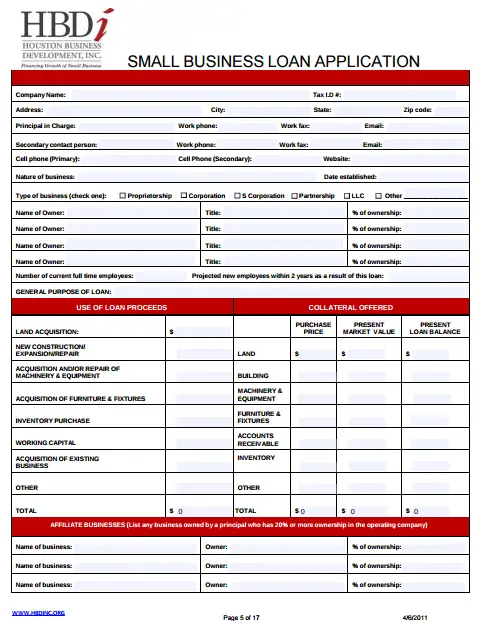

Gather Needed Business Loan Documentation

Business loan documentation is all the things generally required to have when applying for most small business loans. You need to have these items collected ahead of time to make the process of applying for a small business loan much easier.

Here are some items you may need to gather together before applying for a business loan:

- Loan application form

Recommended: Have bad credit, or dont know if you even have credit, learn how to get a business loan with bad credit.

Here are some things to keep in mind when applying for a small business loan:

Important Disclosures And Information

Small Business Administration collateral and documentation requirements are subject to SBA guidelines.

You must be 18 years old or otherwise have the ability to legally contract for automotive financing in your state of residence, and either a U.S. citizen or resident alien .

Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Commercial Real Estate products are subject to product availability and subject to change. Actual loan terms, loan to value requirements, and documentation requirements are subject to product criteria and credit approval. For Owner-Occupied Commercial Real Estate loans , a loan term of up to 15 years and owner occupancy of 51% or more are required. Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Subject to credit approval. Some restrictions may apply.

Small Business Administration financing is subject to approval through the SBA 504 and SBA 7 programs. Loan terms, collateral and documentation requirements apply. Actual amortization, rate and extension of credit are subject to necessary credit approval. Bank of America credit standards and documentation requirements apply. Some restrictions may apply.

You May Like: Is It Easy To Get Loan From Credit Union