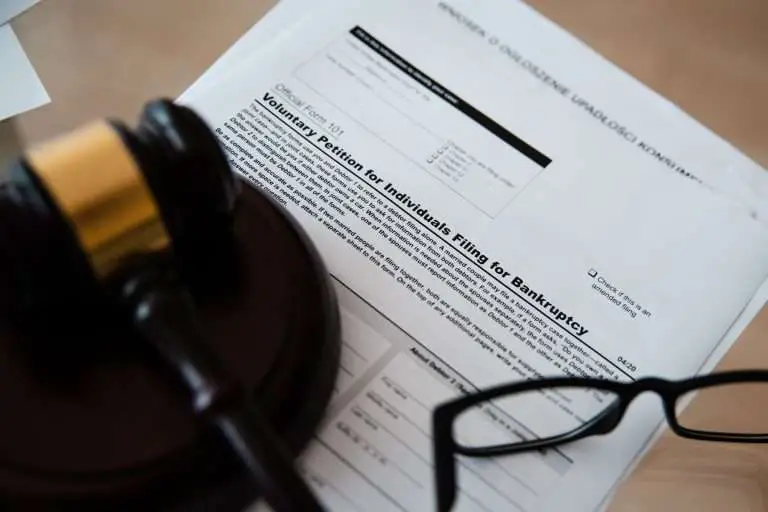

If You Declare Bankruptcy

If you declare bankruptcy, you still have to pay your OSAP loan. This means you must continue to make a regular monthly payment.

Apply to the;Repayment Assistance Plan if you cant make these monthly payments.

If youve been out of;studies for more than five years, you can ask a bankruptcy court to have your;OSAP;loan included in your discharge. Contact your bankruptcy trustee for help.

Stopping A Future Payment On Your Debit Or Credit Card

If you agree that someone can take a payment from your credit or debit card at a future date, known as a continuous payment authority, you can cancel the payment before it is taken. This applies to:

- one-off payments, for example to pay back a payday loan

- regular payments, such as payments for a gym membership or magazine subscription.

The rules about cancelling future card payments do not apply to card purchases for goods or services, such as in a shop or paying a hotel bill.

This page tells you about when you can stop a card payment, how to stop card payments and what to do if the card provider doesn’t put things right.

Engage In Debt Management Planning Processes

If youre not sure what to do and youre dealing with much more than a single payday loan gone wrong, consider debt management planning. This lets you engage with a professional organization that works with you and your creditors. Debt counselors help you create a working budget and catch up on financial matters so you no longer need payday loan organizations.

Don’t Miss: How To Apply For Fha Loan In Illinois

When You Cannot Pay Off Your Payday Loan

- Read this in:

Options on what to do when you can’t pay off your payday loan on time. #0601EN.

- Contents

I cannot pay off my payday loan. What will happen?

The payday lender has your check. It can cash it on the date payment is due. If you do not have enough in your account, your check will bounce. Your bank and the payday lender will both charge you a fee.;

Some payday lenders might try to cash the check several times. Each time the check bounces, the bank will charge you an overdraft fee.;

Some types of government benefits normally cannot be garnished by a debt collector. Payday loans are different. By writing a check on your account or authorizing the payday lender to remove money directly from the account, you give the payday lender permission to take money out of your account no matter what types of funds are in the account.

At some point, the payday lender might send your debt to collections.; In the end, you may owe the amount you borrowed, plus the fee, overdraft charges, bounced check fee, possible collections fees, and possible court costs if the payday lender or collection agency sues you.

-

Most internet payday loans and loans from tribal lenders are void in Washington.

-

Contact the WA State Department of Financial Institutions right away if you are having problems with an online lender. DFI probably cannot help you if the lender is a tribal lender.

Do I Need To Do Anything To Get The 0% Interest Rate If I Have Eligible Loans

No action is required to receive the 0% interest rate if you have eligible loans.

Tip for Navient customers: You can see the interest rates on each Loan Details page in your online account. Loans reflecting a 0% interest rate are eligible for the COVID-19 emergency relief. Remember, this adjustment is retroactive to March 13, 2020.

Recommended Reading: How To Apply For Direct Loan

May I Repay My Loan Early

We encourage our clients to repay their loans early, so that you absolutely can. There is certainly simply a $19 repayment that is early and you also pay only the attention as much as the date associated with payment.

Can my partner make an application for a loan too?

Your spouse would need to meet also our criteria, but so long as they are doing, they are welcome to apply.

Which importance can you accept as money?

We could do loans for individuals from the benefits that are following

- Orphans Advantage

- Sole Moms And Dad Help

- Supported Residing Re Payment

- NZ Superannuation

I cannot spend the money for payment, exactly what do i really do?

If your were to think youre not able to create your payment, you ought to get in touch with us as quickly as possible. Weve different choices to assist you, dependent on your circumstances.

Free 15 Minute Consultation

Under the CARES Act, Congress enacted a;foreclosure moratorium;that allows for borrowers with loans backed by the federal government to withhold payments and defer interest for 6 months while preventing any foreclosure activity by any servicer of a Federally back mortgage loan for at least 90 days.;

What If I Have A Private Loan?

If your loan is not federally backed, then you have to take extra care and communicate with your lender as to what options are available for you.

While some private lenders initially referenced deferment and or forbearance options for borrowers, we still do not have a clear definition or direction as to what happens if a borrower misses their mortgage payments.

As a result, you need to get any discussions you have with your lender in writing.

Private lenders are not necessarily offering the same deferment or forbearance options as federally backed loans.

Equity Legal LLP

Recommended Reading: What To Do If Lender Rejects Your Loan Application

How Student Loan Interest Is Calculated

The way interest on student loans is calculated is slightly different from how it’s calculated on most other loans. With student loans, interest accrues daily but is not compounded . Instead, your monthly payment includes the interest for that month and a portion of the principal.

Hereâs an example of how it works:

- Loan total: $20,000

- Daily interest rate = .07/365 = 0.00019 or 0.019%

- Daily interest amount = $20,000 x 0.019% = $3.80

As you make payments on your loan, the balance goes down, as does the daily interest amount. But when your loan is in deferment, the daily interest amount remains the same until you begin repaying the loan since the interest is not capitalized until the end of the deferment period.

Include Payments In Your Budget

Build your student debt payments into your budget and make payments that are larger than the minimum payments. You can also speak with your financial institution about setting up automatic payments.

When planning your budget and automatic payments, make sure you know when your payments are due. Remember that if you have more than one loan or line of credit, you may have more than one payment due date.

Read Also: What Are Assets For Home Loan

Forbearance Deferment Or Modification

What is the difference between a forbearance and deferment or a loan modification?

- A;forbearance;is designed to put a pause on payments where you are having difficulty making payments such as the current situation resulting from the COVID-19 pandemic.;

- In a traditional forbearance, interest will continue to accrue, and when the forbearance period ends the lender will calculate a new monthly mortgage payment that takes into consideration the higher principal balance resulting from the missed payments and new interesting charged on the new principal balance.;;

Banks have not been clear as to what options will be available to borrowers as a result of missing mortgage payments. This is the major cautionary issue to be aware of because as some borrowers have received communications that their full three months of payment will be owed when their 60-90 days is up.

Ask For An Extended Payment Plan

If youre currently caught with a payday loan you cant pay back on time, find out if your state requires payday lenders to work with consumers on extended payment plans. These plans let you make payments over time on the loan instead of taking out another expensive payday loan you may not be able to pay in two weeks.

The National Conference of State Legislatures provides a breakdown of state laws governing payday lenders. You can refer to this resource to find out if an extended payment plan is an option for you.

Don’t Miss: How Much Do I Pay For Student Loan

Private Student Loan Deferment

To defer a private student loan, you’ll need to contact your lender. Many offer some form of deferment or relief if you are enrolled in school, serving in the military, or unemployed. Some also provide deferment for economic hardship. As with unsubsidized federal loans, in most cases, any deferment of a private loan comes with accrued interest that will capitalize at the end of the deferment period. You can escape this by paying the interest as it accrues.

Forbearance is another way to put off repayments for a period of time. But, as with deferment, it’s only a temporary fix. An income-driven repayment plan may be a better option if you expect your financial difficulty to continue.

Contact Your Private Lender

Private student loan borrowers have far fewer options since private lenders arent required to offer the same protections that the federal government does. Your ability to pause or lower payments differs greatly depending on your private lender.

Still, many lenders do offer forbearance and other repayment programs, often called loan modification, that can reduce your interest rate or bill. Call your lender and ask about your options, specifically for postponing payments in a way that wont cause interest to accumulate and be added to your balance later. Some banks that provide student loans also may be offering coronavirus-specific relief.;

Related:Student Loan Refinancing Rates From Up To 10 Lenders

No matter the type of student loans you have, its crucial to let your lender know as soon as youre unsure youll be able to pay your bill. That will help protect you from the consequences of student loan default, which can include ruined credit and withheld wages if you fall behind on federal loans for more than nine months.;

Its a lot to consider during an overwhelming time. But know there are ways to get help with student loans when you need the flexibility to put your money toward the essentials.

Read more:

Recommended Reading: Can You Take Out More Than One Student Loan

How To Stop Student Loan Tax Garnishment

Feb 17, 2021 6 ways to avoid a student loan tax offset · 1. Stay on top of repayments · 2. Stay in touch with your servicer · 3. Apply for deferment or;

Apr 2, 2021 3 steps if youre wrongfully in student loan tax offset. You can prevent the offset from occurring right away by taking the following steps. You;

The Department of Education previously stopped the collection of defaulted federally held student loans, including garnishment of wages and the offset of tax;

Jun 7, 2020 If youre in default on your federal student loans, theres a very good chance your tax refund will be offset. To avoid a tax offset, you can;

Selling The Car Or Transferring The Loan

One option that you can choose, should the cost of the loan payments become more than you can handle, is to attempt to sell the car or transfer the loan to another buyer. If you manage to find a friend or family member that is able to take on the loan payments, its possible for you to get a new contract and sign it over to that person. However, this is not always an option with some lenders, banks and financial institutions included, because their protocols for borrowers can be strict. Since the lender is already taking a financial risk when letting someone borrow from them, they might not want to take on another, in case the new signer also fails to keep up with payments. In fact, if you dont make sure that this new borrower signs all documents over to themselves, making them legally bound to the contract in your place, you will still be held responsible should they default on the loan.

You May Like: What Is The Average Auto Loan Interest Rate

Refinance Your Student Loans Today

Now that you know how to go back to school with student loans without worrying about your payments, you can think about what works best for you.;

If you decide that student loan refinancing makes more sense than deferring your payments, you can get a rate quote from ELFI without affecting your credit score.;Use ELFIs Student Loan Refinancing Calculator* to find out how refinancing will affect your monthly payments and your total repayment cost.;

Determine Your Cars Current Market Value

If youre thinking about trying to get out of your car loan contract because of the possibility of it becoming upside-down, its a good idea to get an estimate of the cars current market value, before jumping to any conclusions.

You can likely find a number of websites that will calculate the value of your car, based on certain criteria like the make, model, color, etc. However, if you can also get a basic estimate by checking the mileage, going over the cars various features and what shape its in, then look at used car classifieds and websites to see what cars similar to yours are currently going for. Once youve done this, calculate the approximate amount of your loan payments, making sure to factor in the interest costs, weighed against your income. If your loan payments add up to more than the car is worth, you might want to consider other options.

Check out this article about how to avoid car loan debt. ;

Read Also: Does Home Loan Include Furniture

Student Loans Are On Hold Should You Pay Anyway

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Help for current students: Emergency COVID-19 relief for students

Payments are currently suspended, without interest, for most federal student loan borrowers through January 2022. This policy does not apply to private student loans.

» MORE:Federal student loans are paused until Jan. 31, 2022

Borrowers can still make payments to lower their debt during this period of suspended payments, called a forbearance. According to the latest federal data, a total of 500,000 borrowers continued making payments during the pause.; Contact your servicer if you have further questions.

Make no mistake: This is a pause on payments, not forgiveness. Your debt will be waiting for you when repayment begins at the end of the forbearance, unless the policy changes again. While the Biden administration has said it plans to push for expedited $10,000 forgiveness for all federal borrowers, few observers believe such a bill could be moved through Congress quickly.

Until then, heres how to decide what to do next.

Apply For Disability Discharge

No one wants to imagine the worst happening, but sometimes it does. Fortunately, if you become disabled and cant pay back your student loans, the Total and Permanent Disability Discharge program can wipe the slate clean.

The program is available to most federal student loan borrowers, but not all types of loans qualify. To apply, youll need to fill out an application and provide documentation proving that you are totally and permanently disabled.

Recommended Reading: What Is The Role Of Co Applicant In Home Loan

Why Did I Receive A Letter About Interest

We provide a periodic interest statement to all federal borrowers in a forbearance, in case you would like to pay some or all of your unpaid interest. Unpaid interest on your FFELP loans will not be capitalized at the end of the short-term coronavirus forbearance. We encourage you to make payments during a forbearance but it is not required. To confirm the current status of your loans, log in to your Navient.com account and view your Loan Details.

If You Dont Repay Your Loans

If you don’t make your loan payments, you will be in;default.

An OSAP loan is considered to be in default when no required payments have been made for 270 days.

Being in default means:

- your debt will be turned over to a collection agency

- you will be reported to a credit bureau

- you could be ineligible for further;OSAP;until the default is cleared

- your ability to get a car loan, mortgage or credit card can be affected

- your income tax refund and;HST;rebate can be withheld

- interest will continue to build up on the unpaid balance of your loan

Your OSAP debt will only be erased when you have paid it off in full.

You May Like: How To Get Sba 7a Loan

What Happens If You Stop Paying Your Student Loans

If you stop making payments on your student loans, the first consequence will be late fees. Late payments will also show up on your credit report and impact your credit score. On-time payments are the biggest factor in your credit score, so several late payments could devastate it.

After a few months of nonpayment, youll default on your student loans, which will also damage your credit score. If you don’t get out of default, the government could garnish your wages and seize your tax refunds. Your credit score will continue to drop, which will make it harder to get credit, apply for housing and more.

If you can’t afford your federal student loan payments, try switching to an income-driven repayment plan or applying for a deferment or forbearance plan. The first method will lower your monthly payment to a more manageable level, while the second will pause your payments entirely for a specified amount of time.