The Bottom Line Do You Need A Va Loan

Borrowing money can help you achieve a lot financially when you use them strategically. Yet you may be better off using other mortgage alternatives than the VA loan if you have excellent credit history and enough money for a down payment. You can avoid paying the PMI for a conventional mortgage entirely if you make a 20% down payment, and you will own more equity to pay off the mortgage sooner than when you’re stuck with a VA loan.

However, if your goal is to pay less money in originating the mortgage and you’re eligible for a VA loan, then go ahead. Make sure you use the most of your VA benefit by purchasing a home that costs over $144,000. That way, you can access your bonus entitlement and still use the remaining entitlement for other VA loan purchases if you wish. You’ve sacrificed for your country, and you deserve your VA benefits.

What Is The Max Entitlement For A Va Loan

September 26, 2018 By JMcHood

The VA offers lenders a guaranty for the VA loans that they write and fund. This guaranty promises the lender 25% of the loan amount should the borrower default. Thats a promising guaranty for lenders, as the average homebuyer doesnt put 25% down on a home.

If the VA guarantees the loans, though, just how much will they guarantee? Is there a max entitlement?

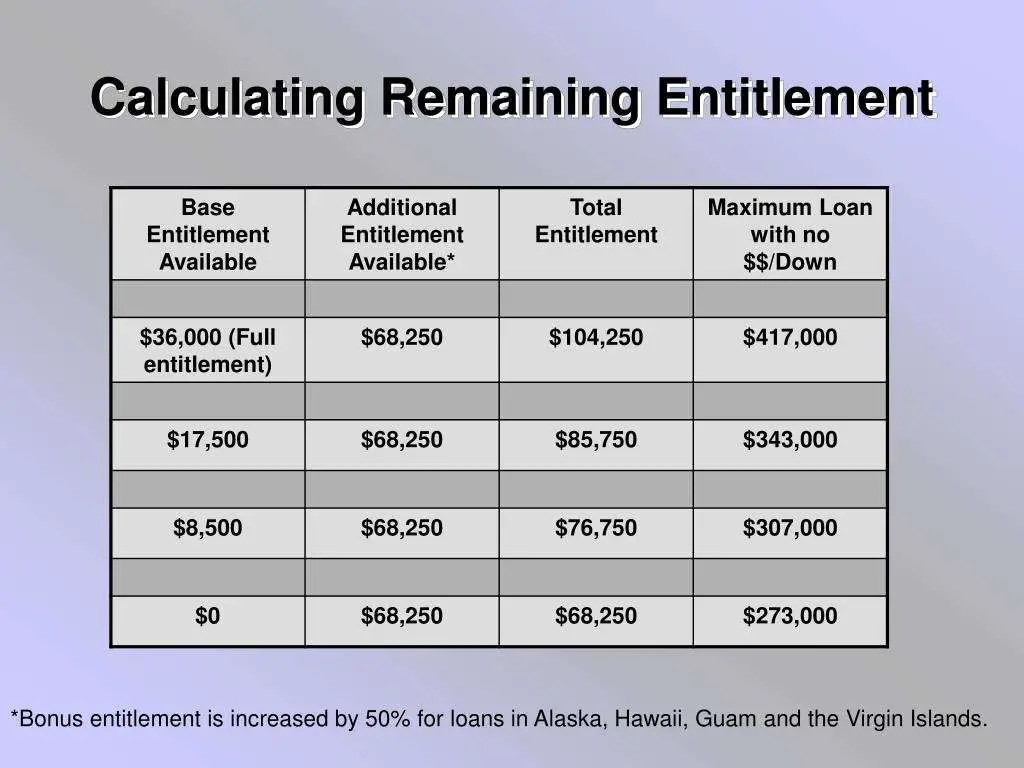

The VA does have a maximum entitlement. It may vary slightly by year, as it is dependent on the maximum conforming loan limit. But, there are two types of entitlement you should know about basic and bonus entitlement.

Do Va Loans Require Pmi

In contrast to most competing mortgage low-down payment options, you could be accepted for a VA home loan without private mortgage insurance . PMI is generally necessary on basic loans from the Federal Housing Administration and other lenders that offer a merely one-fifth or less on the mortgage of a home. To learn more about FHA loans and requirements, check out our detailed FHA loan guide.

The costs associated with loans that require PMI can leave homeowners strapped with high costs over the course of a residential occupancy. For example, a borrower who places a down payment of 3.5 percent on a property valued at $200,000 would pay a monthly mortgage insurance premium of $100. By contrast, VA borrowers are not required to pay that.

Read Also: How Much Car Can I Afford For 300 A Month

Interest Rates: Are They Different Or The Same When You Refinance Loans

Homeowners refinance home loans to secure better interest terms and rates. As a VA loan holder, you could reduce your interest rates through the Interest Rate Reduction Refinance Loan program. In order to qualify for the IRRL, you would need to refinance your pre-existing VA loan with a newer one. With the IRRL, you do not need credit or underwriting to qualify, nor would you pay any money up front. Basically, your pre-existing fees are usurped by a new VA loan and the interest is modified to cover the lenderâs expenses.

Can I Transfer Entitlement To Someone Else

Its possible for the balance on a VA home loan to be transferred to another party. Known as VA loan assumption, this process allows a Veteran to sign the loan debt over to someone else, even if they are a civilian. Lenders have to approve of loan assumption before it can go forward, and there may be a VA funding fee involved.

Its important to note that while your loan balance can be transferred to any financially qualified borrower, your benefits cannot. Benefits can only be transferred in certain circumstances, such as to a non-remarried spouse of a service member who died as a result of military service.

Don’t Miss: Usaa Auto Loan Rates

Va Loan Limit Questions & Answers

VA loans are valuable home financing tools for veterans, but they can be confusing for first-time home buyers and even seasoned home owners. Alexandra Hopkin, a financial planner for MilitaryPlanners.com who specializes in financial guidance for military members and their families, offers straightforward answers to some commonly asked questions about VA loans and what they mean for their borrowing options.

Va Loan Entitlement And Partial Eligibility

Learn how the VA calculates your remaining VA Loan Entitlement and how it impacts your VA loan benefit.

Every Veteran whos eligible for a VA mortgage enjoys a certain level of entitlement a dollar amount that the Department of Veterans Affairs is willing to repay a lender if you fail to make your payments.

Are you planning to buy a home or refinance with a VA loan? Heres how your entitlement could play a role.

Don’t Miss: Usaa Auto Loan Payment Calculator

What Is A Va Loan Entitlement

VA entitlement is one of the most important aspects of buying a home as a Veteran. Its a confusing topic for pretty much everyone who is new to it, especially when you consider how high the stakes are as a first-time homebuyer. Understanding the fundamentals of entitlement makes navigating the VA home loan process and getting the housing youre looking for much more straightforward.

Are There Any Entitlement Differences For A Veteran With Disabilities

The VA offers several home loan benefits for veterans with disabilities. The first factor that a service-related disability affects is loan eligibility. Veterans who have been discharged for a service-connected disability do not need to meet the minimum service requirements of 90 days of active duty during wartime and 181 days during peacetime to earn their VA loan entitlement. The six years of service requirement for those in the Selected Reserve or National Guard are also waived.

Another main benefit for disabled Veterans is that they are exempt from paying the VA Funding Fee. This fee is applied to all new loans and refinances and is typically 2.15% of the loan amount for first-time military borrowers. This fee is set to increase to 2.3% in 2020. In addition, Veterans who receive compensation for their service-connected disabilities can have this income considered by the lender when determining their debt-to-income ratio. Finally, those with disability income may be eligible for property tax exemptions.

Don’t Miss: How Much Car Payment Can I Afford Based On Salary

Get Prequalified And Obtain A Preapproval Letter

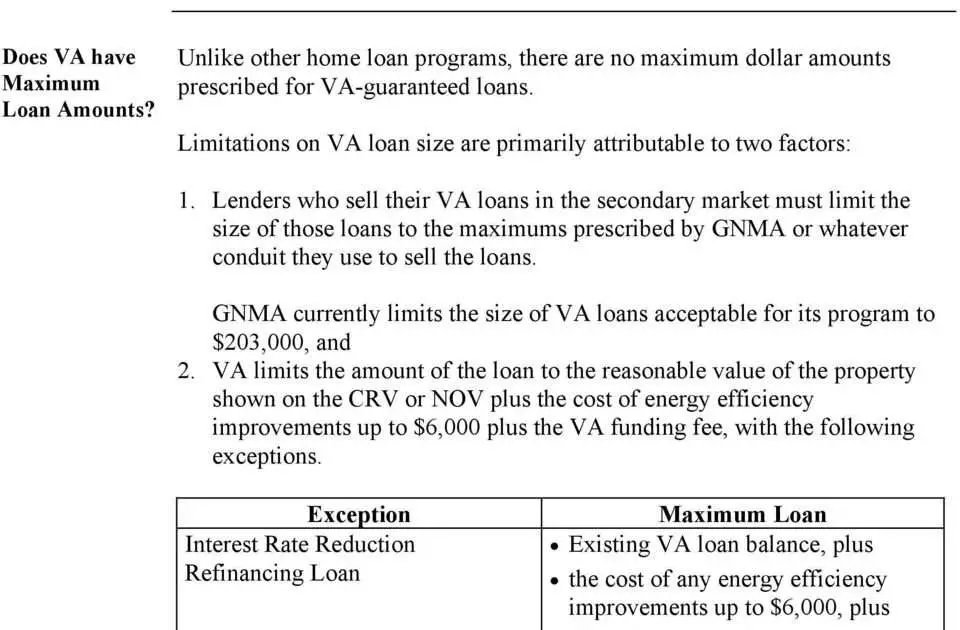

The VA doesn’t limit how much you can borrow, but there is a maximum amount that the VA will guarantee if you default on your loan. That is why you must assess how much you can afford to pay for a home. You can use the home affordability calculator for this assessment.

Mortgage prequalification is an evaluation of your creditworthiness, indicating whether you meet the minimum VA home loan requirements and how big that loan may be. Prequalification is an essential step for those who aren’t sure whether they’re financially ready for homeownership.

If you are unsure about your financial capability to pay off a mortgage, it may be a wiser decision to rent. Before using the VA loan calculator, you can use our rent calculator to determine what is affordable rent for you. But, if you’re confident in your finances or have already been prequalified, then you want to get preapproved instead.

A mortgage preapproval letter is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the lender has evaluated your credit history. Getting preapproved for a mortgage:

- Helps you shop for homes within your means, and it signals you’re a serious buyer when you make offers with a preapproval letter and

- Helps you find a mortgage lender that can work with you to select VA home loan rates and other terms suited to your needs if you decide to switch mortgage providers.

Are There Va Loan Home Occupancy Requirements

Once you secure a home through a VA loan, you will probably be required to move into that residence within two months of the purchase. The VA wants approved borrowers to use the program for primary residences, asking that you settle into your new address within eight weeks of purchase.

Exceptions may apply in certain cases where the applicant cannot move into the new house at the time of purchase. For example, if a married VA holder is deployed at the time of purchase or during the weeks that immediately follow, the spouse can occupy the house on the holderâs behalf.

Read Also: California Mortgage Loan Originator License

How Does A Va Loan Work

The VA loan is provided by VA-approved banks, credit unions, and mortgage companies. But the rules for eligibility and guidelines for qualifications are provided by the Department of Veteran Affairs, which also guarantees up to 25% of the loan amount for lenders. That way, lenders can offer favorable VA loan rates to borrowers.

Restoring Your Va Loan Entitlement

If youve previously taken out a VA loan, you can have your entitlement fully restored by paying back the loan and selling the property attached to the loan. You may also qualify for a one-time entitlement restoration if youve paid back your loan but havent sold the property attached to the loan.

If you dont have full entitlement and dont qualify for a one-time restoration, you can figure out how much remaining entitlement you have by using the formulas we discussed above.

Essentially, you cant use entitlement thats already tied up in an active loan, but once your entitlement has been restored, typically by repaying your loan and selling your home, youre free to reuse your full entitlement benefit.

You May Like: Fha Mortgage Insurance Cut Off

How To Calculate The Va Loan Entitlement

So how can you know exactly how much your entitlement will be? First, determine whether you have full or reduced entitlement. If you have full entitlement, you wont need to worry about making entitlement calculations the VA will back however much your lender is willing to lend with no down payment.

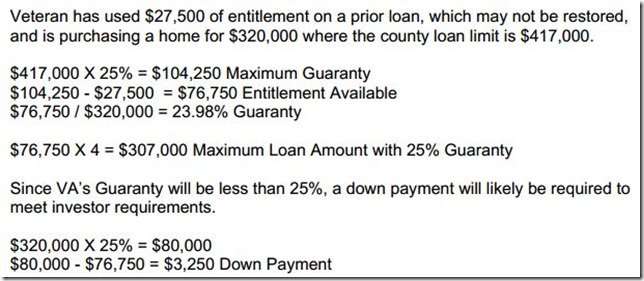

If you have reduced entitlement, the VA will back 25% of your loan. To calculate your entitlement, use the following equation:

Loan amount × 0.25 = entitlement youve already used

The Va Entitlement Explained

One of the most confusing things about VA loans is what is known as the entitlement. While the concept itself is fairly straightforward, the way it’s set up is almost guaranteed to make your head spin.

It doesn’t help that the VA’s own explanations of its benefit programs can be overly technical. In fact, the Home Loans section of the VA web site doesn’t really explain what the entitlement is – they just sort of start talking about it and let you figure it out along the way.

Not only that, but it’s similar but not identical to something called the VA guaranty. And that’s not clearly explained either.

Recommended Reading: Rv Payment Calculator Usaa

Va Entitlement Explained: Basic & Bonus Loan Entitlements

There are many different aspects of VA loans that you should understand before entering into a loan agreement, one of which is VA entitlement. The VA entitlement is the amount of a home loan the Department of Veteran Affairs will cover if you default on your loan. Essentially, this is the amount the lender can count on recouping if you cant uphold your loan terms. The basic VA entitlement is 25% or $36,000, however, the amount of entitlement you are awarded depends on a variety of factors, and is often much higher nowadays.

While thats the simplified explanation, there is much more to VA loan entitlement, including how its determined, how much an entitlement amounts to, and how the amount of your VA entitlement impacts your loan. In this post well cover the basics of VA entitlement and how it applies to borrowing with a VA home loan, so you can more confidently navigate the loan application process.

Va Entitlement Has Two Sections: Basic And Bonus

In case youre qualified for the VA home loan program and have never utilized the program, at that point you have basic and bonus VA entitlement. The $36,000 figure many see on their Certificate of Eligibility alludes to a part of entitlement known as basic. This is the VAs most extreme assurance for loans up to $144,000. In certain significant expense regions as far as possible is higher, and the measure of bonus entitlement is higher too.Check out my favourite picks-

When added to basic entitlement, bonus entitlement gives qualified veterans enough VA backing for a loan of up to $417,000, or more insignificant expense zones. A VA loan official can help figure the most extreme home loan sum for which the VA will give its assurance dependent on how much entitlement a borrower has accessible. As a dependable guideline, the most extreme loan sum for loans over $144,000 is multiple times the measure of full entitlement. The computation for full entitlement in many zones of the nation resembles this:

- basic entitlement is $36,000 x 4 = $144,000

- bonus entitlement is $70,025 x 4 = 280,100

- $144,000 + $280,100 = $424,100

In some significant expense territories of, for example, California, New York, New Jersey, and different states this count can be higher to give qualified veterans the possibility to buy a home in accordance with more extravagant lodging.

Recommended Reading: Upstart Second Loan

Why Choose Socal Va Homes

We know you have a choice when it comes to picking a VA home loan lender. Thats why the team at SoCal VA Homes works tirelessly to help you make your homeownership a reality. If youre looking for a property in Southern California, you already know that competition is fierce and care needs to be taken to make your offer attractive. Thats why were dedicated to those who serve. SoCal VA Homes is Veterans helping Veterans achieve their homeownership goals. Contact them online or call today!

Can I Still Use My Remaining Entitlement If I Had A Home Foreclosed

Depending on the source, VA loans have been cited as having the lowest foreclosure rate out of any type of home loan in the United States. Foreclosures and short sales do happen on occasion. Military borrowers who lose their home in a foreclosure sale can still be eligible for another VA home loan down the line. Veterans typically have a waiting period after a foreclosure to be eligible, and this waiting period can change from time to time.

Once eligible for another VA loan, Veterans can put their remaining entitlement toward a new property. Because the original loan was not paid off in full or transferred to an eligible borrower, full entitlement restoration is unavailable. Still, the ability to put any remaining entitlement to good use can go a long way for Veterans looking to bounce back from foreclosure.

Don’t Miss: Usaa Car Loan Rate

How To Calculate Bonus Va Entitlement

You dont really need to worry about entitlement if youre using your VA loan benefit for the first time. But for additional uses, some of your VA loan entitlement will be tied up in your original VA loan if you havent repaid it in full.

You use at least a portion of your entitlement when you buy a home with a VA loan. The amount is typically a quarter of the loan amount, which reflects the VAs 25% guaranty.

Lets say you purchased a home three years ago for $300,000 and used $75,000 of your VA entitlement, and youre looking to use your VA loan benefit to purchase a second home.

The maximum entitlement for most counties in the country is currently $161,800, which is a quarter of the standard VA loan limit .

Here’s how VA lenders determine your remaining entitlement and potential down payment needs:

- = remaining entitlement

- $161,800 – $75,000 = $86,800 in remaining entitlement

- x 4 = max purchase price with $0 down

- $86,800 x 4 = $347,200 max purchase price with $0 down

Why Does My Certificate Of Eligibility State That This Veteran’sentitlement Is 36000

The $36,000 is not the maximum loan amount you can obtain. Rather, it means that if you default on a VA home loan for less than $144,000, the VA promises to pay your lender up to $36,000. For loan amounts over $144,000, the VA promises to pay your lender up to 25% of the loan amount.This line on your COE contains information for your lender. It states that you have full entitlement.

Also Check: Typical Student Loan Debt

Va Entitlement For A Second Va Home Loan

The VA loan program entitles qualified military homebuyers to a 25% guaranteeessentially backing the $0 down loan to reduce the risk for VA lenders. This guarantee means that even in the event of a default, lenders will retain 25% of the original loan amount.

The funds provided for this guarantee are called entitlement. The basic VA loan entitlement is $36,000 and a second tier of entitlement is also available, generally set at $91,600. For most VA homebuyers, that means a total of $127,600 is available to cover the 25% guarantee. Buyers in high-cost counties will see higher limits.

Lets take a look at how VA entitlement comes into play when youre hoping to get a second VA home loan.

What Lenders Do If You Exceed The Va Loan Limit

So what if you fall in love with a home priced well above the VA loan limit for the county in which it’s located? You aren’t excluded from using a VA loan to buy the property, but you’ll need to come up with a down payment. The amount of your down payment is based on the difference created by your VA loan entitlement amount, VA loan limit and the home’s purchase price.

Say you want to purchase a single unit home in Ohio’s Franklin County, which has a VA loan limit is $417,000. Assuming you have a full VA loan entitlement, the VA agrees to a 25 percent guaranty to your lender, essentially lowering the risk your lender bears by ensuring it will be repaid the amount backed by the VA.

If you default on your loan, the remaining loan balance not paid by the VA guaranty is left to your lender to absorb. Because of this risk, the lender may require that you make a down payment to finance a portion of the loan. Typically, your lender will require a down payment based on the difference in the VA loan limit and the home’s purchase price. Suppose that instead you decide to buy a home priced at $500,000 an amount that exceeds the county’s VA loan limit. You can still finance your purchase using a VA loan, but your lender may require a down payment of 25 percent of the difference. In this case, the difference is $83,000, so you agree to make a $20,750 down payment before your lender will approve the VA loan.

Also Check: The Mlo Endorsement To A License Is A Requirement Of