What Is A Mortgage Loan Originators Salary

A mortgage loan originators salary will depend on several factors, including the company they work for, their level of experience and how many home loans they close per month.

If the MLO is a broker, they may be paid by their clients or by commission from the lender they partner with to close the loan. If the MLO is a loan officer, theyll typically be paid an hourly rate or salary along with a commission earned per loan.

You Get A Flexible Schedule

One of the best advantages of becoming a mortgage loan originator is that you get a flexible schedule. What does that mean? You get to choose your own hoursbasically whatever suits you. As a matter of fact, you can choose the time you spend in the office and time you spend working remotely. For example, a commercial loan officer is prone to spend a lot of time away from the office and more time communicating with their clients on the phone or electronically. However, most loan officers have meetings from time to time and other events on weekends and holidays. Still, more often than not, loan officers are generally able to determine their own schedule.

According to the U.S. News & World Report, loan officers are ranked as above average in categories such as schedule flexibility while maintaining a normal life. Ultimately, this means that many loan officers are able to distinguish a fine line between a comfortable life and work.

Other Professional Mortgage Titles

There are a plethora of jobs within the mortgage industry, and each position provides vital services to help the mortgage loan process along. While many of these positions are interconnected, each job has its own responsibilities, rules, and regulations.

- Loan Officer

- A Loan Officer, often referred to as a Mortgage Loan Officer, works as a representative of a credit union, bank, or other financial institution. They help borrowers through the mortgage application process and will also assist consumers and small business owners with a wide variety of secured and unsecured loans.

You May Like: Fha Loan Refinance

Out Of State Applicants

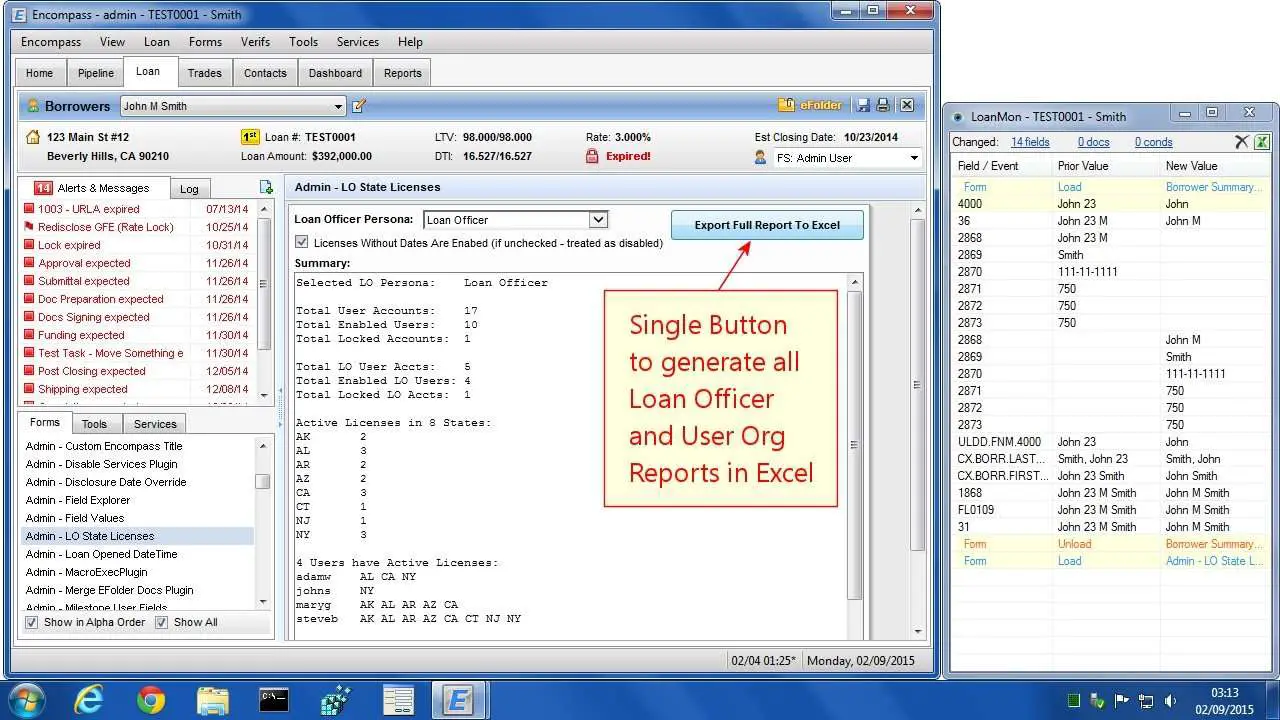

All applicants requesting a Mortgage Loan Originator license endorsement from the Department of Real Estate must hold a current DRE real estate license. The real estate license must be issued by DRE prior to submitting a MLO license endorsement request through NMLS.

Out of State Residency / Out of State Licensure

- Residency in California is not a requirement to become licensed.

- California does not have reciprocity with any other state to allow a waiver of any requirements to obtain a real estate license.

Individual MLO License Endorsement

- Individuals must hold either a current Salesperson or Broker real estate license

- For a guide to qualifying for either a Salesperson or Broker examination and obtaining a real estate license, you may review: Examinees

Company MLO License Endorsement

- Sole Proprietor: To conduct mortgage loan origination activities as a Sole Proprietor, the applicant must first hold a current Broker real estate license. To qualify for the Broker examination and obtain a Broker real estate license, you may review: Brokers Examination

- Corporation: A Corporation must first hold a current Corporation real estate license. To apply for a Corporation real estate license, you may review: Corporations

- Note: DRE does not license Limited Liability Companies or Limited Partnerships .

What Does A Mortgage Loan Originator Do

Mortgage loan originators must have a comprehensive knowledge of lending products, banking industry rules and regulations, and the required documentation for obtaining a loan.

Loan officers evaluate, authorize, or recommend approval of loan applications for people and businesses, according to the U.S. Bureau of Labor Statics.

This requires excellent interpersonal skills.

A good loan officer makes his or her clients feel at ease during the process, while still educating them on their decision.

Borrowing money can be a nerve-wracking experience. A good loan officer makes his or her clients feel at ease during the process, while still educating them on their decision.

Mortgage loan officers also collect and verify all required financial documentation from applicants.

Theyll use this information to determine if a mortgage borrower is qualified for a loan from the standpoint of credit-worthiness, income, and assets. Theyll also help borrowers decide which type of loan is right for them based on their finances and purchase price.

The profession involves a lot of paperwork and managing logistics throughout the loan process.

You May Like: How Long Does Sba Take To Approve

How Is A Mortgage Loan Originator Different From A Mortgage Broker

A mortgage loan originator differs from a mortgage broker is that the mortgage loan originator works for a bank or financial institution. A mortgage broker works independently, shopping around the different banks and lenders to find you a suitable mortgage arrangement. This means a mortgage broker is not obligated to any particular financial institution. However, a mortgage broker may not be able to offer the range of services you might find at a bank.

How To Choose A Mortgage Loan Originator

Because a loan officer is such a key player in the home loan process, knowing how to choose one is essential to ensure you get the best mortgage with the best possible experience.

In addition to assisting you with your loan application, a good loan originator will have a diverse skillset.

With a proper balance of industry knowledge, communication skills, and integrity, a mortgage originator can make the complexities of a mortgage loan seem much easier and the process a lot smoother.

The best way to know youre working with a good loan officer is to do a little homework on him/her or their company.

Even with all the recent advances put in place by the Consumer Financial Protection Bureau to protect mortgage borrowers, it can still be possible to work with an unscrupulous lender.

Thats why loan officers with honesty and integrity and are a must.

The best way to know youre working with a good loan officer is to do a little homework on him/her or their company.

Fortunately, thanks to technology, its easier than ever to do some quick due diligence.

A short amount of time spent online can tell you a lot. Check out social media and online review sites. You can learn a lot here, as its difficult for a loan officer and/or their company to avoid negative reviews.

Although technology makes it so you practically never even have to speak with a loan officer, you still should. If you cant meet face-to-face with your loan officer, suggest a Zoom meeting.

Also Check: Can You Refinance An Fha Loan

Mortgage Loan Originator Licensing

As of July 31, 2010, a license is required for all residential mortgage originators. This includes owners of mortgage broker companies if they interact with consumers in processing mortgage applications. Originators employed by depository institutions are exempt. Visit our forms and requirements page for application forms and details.

Veterans reimbursement for licensing exams

Veterans taking a state licensing examination required by the department can be reimbursed for the cost of the exam. .

The Residential Mortgage Board approves or disapproves regulations proposed by the Commissioner of Finance with respect to mortgage brokering. The board also hears and determines appeals from denials or revocations of mortgage broker licenses or decisions of the Commissioner pertaining to mortgage brokering.

Do You Need A Degree To Be A Loan Originator

Loan officers typically need at least a bachelor’s degree, preferably in a business-related field such as finance, economics or accounting. Mortgage loan officers need a mortgage loan originator license, which requires passing an exam, at least 20 hours of coursework and background and credit checks.

Recommended Reading: Usaa Car Loan Bad Credit

Understanding The Difference Between Mortgage Brokers And Loan Originators

With so many different titles and jobs within the mortgage industry, its easy to confuse the responsibilities that each holds. While Mortgage Loan Originators and Mortgage Loan Officers are essentially the same role, they differ largely from a Mortgage Broker. The main difference between these titles is that Mortgage Brokers are employed by a Sponsoring Broker, while Mortgage Loan Originators and Officers are employed by a bank or mortgage company. Both Mortgage Brokers and MLOs are licensed nationally by the Nationwide Multistate Licensing System . This guide will dive deeper into what a Mortgage Broker is and what makes that title different from other mortgage professionals.

How Are Mortgage Brokers Paid

Mortgage Brokers are paid through commissions and fees, often charging around 1-2% of the loan amount. This commission will be added to the loan amount or paid upfront by the borrower or the lender, and it is negotiable. Mortgage Brokers are required to disclose all fees upfront, and theyre only able to charge the amount disclosed. Unless they are paid upfront, Mortgage Brokers are often paid after the deal is closed.

For example, a Broker sells a $500,000 loan. With their 1-2% fee, they stand to earn $5,000-$10,000 on that loan.

In July of 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act was put in place to overhaul financial regulation in response to the Great Recession. This Act restructured how Mortgage Brokers are paid and put laws in place to protect clients, who previously had very little protection. Within the Dodd-Frank Act you can find Title XIV, the Mortgage Reform and Anti-Predatory Lending Act, which states that Mortgage Brokers cannot:

- Charge hidden fees

- Tie their pay to the loans interest rate

- Be paid by both the borrower and the lender

- Receive compensation for directing clients toward an affiliated business

Also Check: What Happens If You Default On A Sba Loan

Is A Mortgage Loan Originator The Same As A Loan Officer

You might hear the terms mortgage loan officer or loan officer used interchangeably with mortgage loan originator, but there is a slight distinction between the two. A loan originator can refer to the entity or institution that initiates the loan, and also to the individual professional who works with you. A loan officer strictly refers to the individual that helps you through the mortgage application process, ensuring that all documents are completed properly and submitted in a timely manner.

Are You Licensed For That

Part 1

Part 2

Part 3

Back in the old days, it was really easy to work in the mortgage industry and have all the conversations you wanted because most states did not have licensing. In fact, I remember the first license I ever had to get was a Wisconsin license. They had their own state license. And as a loan officer who did business in many different states, I had to get a Wisconsin license. So I was like, “What is this?”

Then I had to go take a test. And basically, anybody that called us– and I worked in California. Anybody that called in from Wisconsin, we got a referral from Wisconsin, or whatever, it would have to go to one of the licensed Wisconsin people which I thought was great because I was one of four people to have the license. But back then, that was the only state we had to worry about. And now, it’s every state.

And we really like that. It’s just an easy way to make sure that you don’t ever do unlicensed activity. And some states look at that and say, “Yeah. You’re talking to borrowers. You do need a license.” So it’s a good thing to do to say, “Whoever talks to the borrowers needs a license.”

But, let me break down a couple different things in the definition of loan originator or what you would need a license for. I’m going to break down those things and try and give you enough so that you know where that line is.

That’s all I’ve got you guys. Have a great day.

Additional Reading:

You May Like: Refinance Student Loans Usaa

Myth #: You Can Study By Taking Practice Tests Online And Memorizing The Answers

Many students believe that adequate preparation for the test just means that they have to memorize the questions.

Honestly, students that rely on memorization of the questions and answers will have a tough time passing this exam. You need to truly understand the content in order to pass

For example, knowing that you must send out early disclosures within 3 days of the application or that TILA is Regulation Z is not enough to earn you a 75% on this exam. Knowing RESPA, TILA, or HMDA is just the Tip of the Iceberg!.

Instead, the test will contain situational questions that will require you to understand both how and why TILA and RESPA interact with each other. Memorization of the material means nothing if you dont have a deep understanding of the content itself.

What Do Mortgage Loan Originators Do

Mortgage Loan Originators guide prospective homeowners through the mortgage approval process from the beginning of their loan application to closing on the property itself. They will take into account the clients credit score, mortgage rates, and different lenders when originating a loan. MLOs gain a wide variety of knowledge on different types of mortgage loans and use this information to help their clients choose the best loan for their specific situation.

Don’t Miss: Do Mortgage Loan Officers Get Commission

How To Get Mortgage Originator License

Asked by: Mr. Carter Mills DDSBasic Mortgage Loan Originator Licensing Requirements

Does A Mortgage Loan Originator Need A License

When you’re taking financial advice from someone, it’s reasonable to want them to be licensed and to be able to trust that they have the know-how to back up what they’re talking about. In the mortgage industry, this can be handled a couple of ways.

Every state has different requirements for mortgage loan officers and brokers. There’s state-level licensing required for someone to be able to originate mortgages. These include certifications or licenses that an individual loan officer must have and licenses that must be maintained by the institution funding the loan.

For nationwide banks, there are federal registrations, but non-bank lenders and local originators will have their MLOs licensed at the state level.

Lenders are also required to comply with the Secure and Fair Enforcement for Mortgage Licensing Act of 2008, or the SAFE Act. This act requires that federal and state licensing for MLOs be published in the Nationwide Mortgage Licensing System and Registry .

The NMLS directory allows clients to check on the licensing and registration details of individual lenders and their MLOs to make sure they’re properly licensed.

Also Check: Typical Motorcycle Loan

Mortgage Loan Originator: The Lending Institution

While the term mortgage loan originator can refer to the person originating your mortgage loan, it can also mean the institution responsible for funding that loan. In the mortgage industry, loans are made through either bank or non-bank lenders.

Some mortgage loans are funded by traditional banks who hold your checking and savings accounts, lines of credit and other investments. Meanwhile, non-bank lenders like Rocket Mortgage specialize in mortgages.

Regardless of which institution initially funds your loan, it’s probably not the end of the line. Very few banks or other lenders hold a ton of loans in their portfolio to collect payments over the life of the loan because they prefer to get money on a quicker basis to make more loans.

To help accomplish that goal, the majority of mortgage loans are backed by one of several major mortgage investors, including Fannie Mae and Freddie Mac, as well as the Federal Housing Administration and the Department of Veterans Affairs . Loans that meet these institutional investors’ standards are insured by them before being packaged into mortgage-backed securities and sold on the bond market.

Its worth noting that your lender can hold onto the servicing rights of your loan even after its sold to an investor. This means that they continue to collect your payments and manage your escrow account on a monthly basis. You would also still contact them if you were going to have trouble making your payments.

How To Choose The Right Mortgage Loan Originator For You

When youre seeking a mortgage, you have the ability to compare and choose between mortgage lenders and loan originators. It can be tempting to go with the first one you contact you might even be impressed with the persons offer or pitch. Borrowers who dont shop around before choosing a mortgage, however, can lose money. In fact, almost half of all homebuyers skip the rate-shopping process, according to a Freddie Mac study. You could save an average $1,500 over the life of your loan by obtaining at least one extra rate quote, the study shows, or an average of $3,000 by getting five quotes.

Fortunately, its easy to compare mortgage rates and lenders with Bankrate. Take time to find the best mortgage lender, and be sure to consider offers carefully, including comparing the APR and fees and any additional perks a loan originator shares with you.

If you run into a hard pitch, stand your ground. Politely request a quote and let the loan originator know you might circle back when youve reviewed all of your options. Although it can be an uncomfortable conversation to decline an offer or ask for more time, your mortgage is a significant financial commitment, and it pays to be thorough.

Ultimately, the right mortgage loan originator will have your best interests in mind, and create a smooth application and closing experience for you.

Don’t Miss: What Happens If You Default On An Sba Loan