Make A Payment Even If Its Late

If youre already late on a payment, its not too late to salvage the situation. When does your student loan go into default exactly? Well, federal student loans are considered to be delinquent as soon as you miss a payment, but they dont officially go into default until theyre unpaid for 270 days. That means you might have time to fix the situation before your loans have defaulted.

Private student loans, on the other hand, dont have quite this much of a buffer. Since private lenders treat them similarly to other loans, private student loans can go into default as soon as they go unpaid.

Either way, if you have the money to make a payment, make it right now. Federal lenders report student loan delinquency at 90 days or more. Private lenders will report it to the credit bureaus, too, but call your lender and explain that you want to make a payment to get back on track as soon as possible.

Who Is More Likely To Default On Student Loans

Rajashri Chakrabarti, Nicole Gorton, Michelle Jiang, and Wilbert van der Klaauw

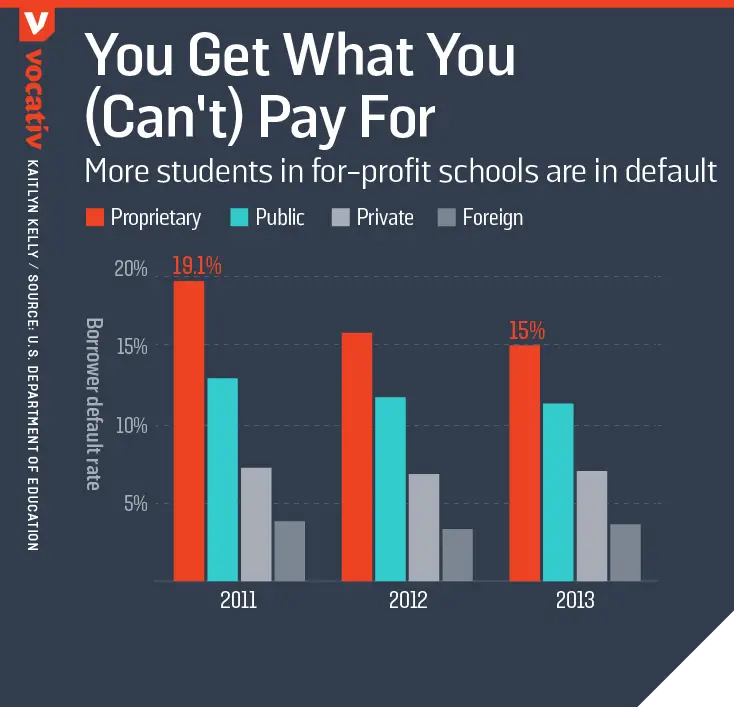

This post seeks to understand how educational characteristics and family background relate to the incidence of student loan default. Student indebtedness has grown substantially, increasing by 170 percent between 2006 and 2016. In addition, the fraction of students who default on those loans has grown considerably. Of students who left college in 2010 and 2011, 28 percent defaulted on their student loans within five years, compared with 19 percent of those who left school in 2005 and 2006. Since defaulting on student loans can have serious consequences for credit scores and, by extension, the ability to purchase a home and take out other loans, its critical to understand how college and family characteristics correspond to default rates.

To better understand the determinants of student loan default, we ask the following questions in this blog post:

- Do default rates differ by college type?

- How do default rates of dropouts compare to those of graduates, and does this relationship vary by degree program?

- Does default vary with college major?

- Does college selectivity matter for this relationship, and for student loan default more generally?

- Are students from less advantaged backgrounds more likely to default than students from more advantaged backgrounds?

Easier Path To Loan Forgiveness

Borrowers on the existing REPAYE plan are eligible to have any remaining loan balances forgiven after 20 years of monthly payments for undergraduate loans or 25 years for graduate or professional study loans.

Biden’s proposal would consider the borrower’s original loan balance to determine forgiveness eligibility. Those who borrowed $12,000 or less would be eligible for loan forgiveness after 10 years of monthly payments. Every $1,000 borrowed above that amount would add one year of payments before forgiveness eligibility.

Additionally, the proposed change would allow borrowers who enter deferment for a variety of reasons, such as military service or cancer treatment, to still earn credit for payments toward forgiveness. Currently, only economic hardship deferments allow borrowers on income-driven repayment plans to continue their progress toward forgiveness.

Borrowers may also consolidate their loans without resetting their progress toward forgiveness. Currently, borrowers on REPAYE plans who consolidate their loans lose any progress they had made toward forgiveness.

For instance, a borrower who had made 100 monthly payments and then consolidated their loans would have to start over, according to the Federal Student Aid website.

The new plan would give borrowers a weighted average of credit for payments before consolidation, so not all their progress would be lost.

Read Also: How To Get Business Loan With No Money

Other Income Based Repayment Plans Will Be Phased Out

The Education Department indicated that it intends on phasing out the remaining income-driven plans.

To further simplify repayment, the Department would phase out new enrollments for student borrowers in the Pay As You Earn and Income-Contingent Repayment plans and limit the circumstances where a borrower can later switch into the Income-Based Repayment plan, according to an Education Department fact.

Senior administration officials confirmed that borrowers already in one of the above plans can remain in that plan if they choose. They just might not be able to return to one of these plans later if they decide to switch to the new REPAYE plan.

For Private Loans Talk To Your Lender

Private student loans generally dont come with income-driven repayment plans, but youre not without options. Talk to your lender to see what financial hardship programs it offers. Its likely that forbearance will be one of them, but the lender might also offer other plans that lower payments for a longer period of time.

Also Check: How Often Can I Use My Va Loan

Drawbacks Of Student Loan Rehabilitation

- Its a one-time opportunity. You can only go through student loan rehabilitation once. If you default on your loans again, student loan rehabilitation isnt an option.

- It takes longer to get out of default. Student loan rehabilitation requires nine monthly payments within 10 consecutive months before the default ends. Other methods, such as consolidation, may be faster.

- Involuntary payments dont count toward rehabilitation. Involuntary payments, such as wage garnishments, dont count toward the nine required payments for rehabilitation.

Whats Next For Student Loan Borrowers

The new version of the REPAYE plan is not available quite yet. The Education Department has published final regulations, and will allow for a public comment period lasting for 30 days. It is possible that the department could further revise the plan after the public comment period.

There is no firm release date as of yet, according to administration officials, but the hope is that the plan will be available to borrowers later this year.

Also Check: What Happens If You Don’t Pay Back Student Loans

Private Student Loan Default Statutes Of Limitation

Statutes of limitation or SOL begin running after the DLA, or date of last activity, on your credit report. This is usually the last payment made prior to an account defaulting. Making a payment will restart SOL. There are many other things that can restart statutes of limitation such as acknowledging that you owe the debt each state has different statutes. Usually the SOL period will be anywhere from 3-7 years, with some states even being up to 10 years for written contracts. States may use either or written contract statutes of limitation for private student loans.

Ive heard from quite a few people who were trying to wait out SOL and instead ended up with a lawsuit which usually means they also lost the chance to settle for as low as possible in the collection cycle. The best deals usually come prior to placement with a law firm and litigation. Waiting out SOL is a coin toss, and a high risk strategy. Generally, smaller accounts have a better chance of staying off the radar, while larger accounts will be the target of focused collection activity and legal action. This is just a general rule though, and some lenders will sue on even very small balances like clockwork.

How To Avoid Defaulting On Student Loans

Of course, even if you can get yourself out of student loan default, the default can still impact your credit score and loan forgiveness options. Thats why its generally best to take action before falling into default. If the student loan payments are difficult for you to make each month, there are things you can do to change your situation before your loans go into default.

First, consider talking to your lender directly. The lender will be able to explain any alternate student loan repayment plans available to you. For federal loans, borrowers may be able to enroll in an income-driven repayment plan. These repayment plans aim to make student loan payments more manageable by tying them to the borrowers income. This can make the loans more costly over the life of the loan, but the ability to make payments on time each month and avoid going into default are valuable.

You May Like: Loans Online No Credit Check Instant Approval

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Happens If I Default On A Federal Student Loan

If your loan holder is unable to obtain payment from you for 270 days, they will take steps to place the loan in default and attempt to collect on the loan.

Default is the failure to repay a loan according to the terms agreed to in the promissory note. For most federal student loans, you will default if you have not made a payment in more than 270 days.

If you havent made a payment on your federal student loan for 270 days , and you have not made arrangements with your lender or servicer that do not obligate you to make those payments , you are probably in default.

During the months in which you have failed to make payments on your federal student loans, your servicer must exercise “due diligence” in attempting to collect the loan – your servicer must make repeated efforts to locate and contact you about repayment.

If you have not received a letter from your servicer and you believe you may be in default, contact your servicer immediately. Ask about repayment options and find out if it is possible for you to avoid default.

Once your federal student loan goes into default, you could face a number of consequences:

- Your wages may be garnished without a court order

- You can lose out on your tax refund or Social Security check

If you are behind on your federal student loan payments and being contacted by a debt collector, you may be able to arrange repayment options to get out of default.

Read Also: How To Convert Va Loan To Conventional

Biden Announces New Student Loan Plan: 8 Big Details On Forgiveness And Payments

WASHINGTON, DC August 24, 2022: US President Joe Biden delivers remarks regarding student loan … forgiveness in the Roosevelt Room of the White House on Wednesday August 24, 2022. Education Secretary Miguel Cardona joined.

The Washington Post via Getty Images

The Biden administration has released proposed regulations governing a new federal student loan repayment for borrowers that will be based on their income. The plan will lower payments for millions, according to Education Department, and will speed up student loan forgiveness for many, as well. The plan is being released just as the administration ramps up the IDR Account Adjustment a separate initiative that will bring millions of additional borrowers closer to student loan forgiveness under income-driven repayment plans.

Today the Biden-Harris administration is proposing historic changes that would make student loan repayment more affordable and manageable than ever before, said U.S. Secretary of Education Miguel Cardona in a statement on Tuesday. These proposed regulations will cut monthly payments for undergraduate borrowers in half and create faster pathways to forgiveness, so borrowers can better manage repayment, avoid delinquency and default, and focus on building brighter futures for themselves and their families.”

Heres what borrowers need to know.

Collection Fees That Increase Borrowers Costs

The Department of Education and collection agencies can charge borrowers who default as much as 25 percent of principal and interest while interest continues to accrue. And government agencies and debt collectors may also charge fees associated with wage garnishment and U.S. Treasury Department withholdings, known as offsets, from borrowers Social Security, federal income tax refunds, or other federal payments .

Also Check: 10000 Personal Loan Bad Credit

When Does Student Loan Default Happen

Default is when a loan isnât paid according to the terms of the loan. There is a difference between a student loan that is delinquent and one that is in default. A student loan is delinquent as soon as a monthly payment is past due, but is not necessarily in default. If the borrower continues defaulting on payments, then the student loan will go into default.

The number of days of non-payment for a student loan to move into default depends on the type of loan you received and the terms of your loan. Many federal student loans are considered in default after 270 days of missed payment. Some private student loans consider a loan in default after 90 days of missed payments. Your loan servicer can give you the details about your student loan.

What Does Student Loan Default Mean

Going into default means you have fallen behind on monthly loan payments. But there are different thresholds for assigning a default status to a student loan depending on the type of loan you have.

The Federal Student Aid website explains that federal loans become past due or delinquent immediately after you miss a single payment. The delinquent status remains in place until you catch up on all overdue payments. If a loan remains delinquent for 90 days or more, the servicing organization is likely to report it to the credit bureaus, according to the Federal Student Aid website. Continuing to remain delinquent from this point forward may trigger a default status.

For private student loans, you may not have quite as much leeway before the servicer takes action. A missed payment may be reported to credit bureaus in as little as 30 days. And default may follow after that.

For federal student loans, you are considered in default once your payment is 270 days past due, which is about nine months, explains Leslie Tayne, debt relief attorney and founder of Tayne Law Group. “For private student loans, the timeline varies. However, its common for private student loans to go into default after 120 days.

Don’t Miss: What Is The Average Personal Loan Amount

What Is Student Loan Default

Student loan default means you did not make payments as outlined in your loans contract, also known as its promissory note. Default timelines vary for different types of student loans.

-

Federal student loans. Most federal student loans enter default when payments are roughly nine months, or 270 days, past due. Federal Perkins loans can default immediately if you dont make any scheduled payment by its due date.

-

Private student loans. The Consumer Financial Protection Bureau states that private student loans often default after three missed payments, or 120 days total, but check your loans promissory note to know the specific timing. Some private loans default after one missed payment.

Student Loan Rehabilitation After Default

Student loan rehabilitation is a way to get your student loans out of default status. It is a one-time opportunity. After your loan is successfully rehabilitated, not only will default status be removed, youâll also be eligible for deferment, forbearance, repayment plan options, loan forgiveness, and able to receive federal student aid again.

The process starts with contacting your loan holder to discuss a student loan rehabilitation plan and providing documentation of your income. For a William D. Ford Direct Loan Program and a Federal Family Education Loan , your payment for loan rehabilitation will be 15 percent of your annual discretionary income, divided by 12.

Discretionary income has a complicated equation â but it can be understood as the standard way for your Direct Loan or FFEL lender to figure out what you can afford to pay.

You can estimate your monthly payment under loan rehabilitation before calling your lender. Letâs say your adjusted gross income is $45,000 and you have a family of 4. For 2021, the federal poverty guideline is $26,500. First, we take $26,500 multiplied by 150% and get $39,750. Then we subtract that number from your income. The difference between $45,000 and $39,750 is $5,250. Then we take 15% of $5,250, which is $787.50. Then, we divide that number by 12 to come up with a monthly payment of $65.63.

You May Like: What Kind Of Loan Do You Get For An Rv

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Ways To Get Out Of Student Loan Default

If you didnt make payments on your federal student loans and are now in default, dont get discouraged. It may seem like an overwhelming situation, but you have multiple options for getting out of default. Remember, its in your best interest to act quickly to resolve the default, because the consequences of default can be severe.

1-877-825-9923 TTY for the deaf or hard of hearing

Read Also: Student Loan Forgiveness After 20 Years

Do You Have A Complaint About A Collection Agency

The notices and other tactics get worse the longer you are delinquent. If the delinquency goes on for nine months, your loan holder will declare you in default. If you are having trouble making payments, contact your lender sooner rather then later. If you are starting to have problems, you should work with your loan holder to postpone payments or figure out another way to get temporary relief. It is your responsibility to notify your loan holder if you move to a new address.

The governments extraordinary collection powers kick in only after you default. You will not be eligible for new federal student loans or grants if you are in default on a federal student loan.