What Permanent Changes Are Being Made To The Pslf Program

The Department of Education on Tuesday announced permanent changes to the Public Service Loan Forgiveness program, in an effort to expand student loan relief to more eligible borrowers. The permanent changes will take effect July 1, 2023.

All payments made by eligible public servants on income-driven repayment plans will receive credit for the entire time period their loans sat in repayment — even if they made late or partial payments, and regardless of the type of repayment plan.

- Any month in which loans were in an eligible repayment, deferment or forbearance status prior to consolidation

- Months where a borrower’s account was in at least 12 months of consecutive forbearance

- Months where a borrower’s account was in forbearance for at least 36 cumulative months in forbearance

- Any month spent in deferment prior to 2013.

Most borrowers will not have to make any moves to receive the above benefits. Their accounts will be automatically adjusted.

However, if you have ineligible loans — any federal loan that is not a Direct Loan or federally managed FFEL loan — you will need to consolidate your loans into a Direct Loan first. You will then receive credit for your previous repayment period.

For instance, if you made six years’ worth of payments on a loan before consolidating it into a Direct Loan, those six years’ worth of payments would be applied to your account.

Are Pslf Applicants Still Eligible For Biden’s Cancellation

President Biden announced a plan to cancel up to $20,000 in student loan debt for federal borrowers.

Borrowers with qualifying loans who are seeking PSLF can still qualify for Biden’s debt relief.

PSLF borrowers who are already enrolled in an income-driven repayment plan are likely to be among those who receive cancellation automatically since the Department of Education already has their income information.

Borrowers who are likely to receive Bidens cancellation automatically may also choose to opt out if they’re concerned about, for example, state tax implications. Any borrowers who are pursuing PSLF and wont receive cancellation automatically will need to apply.

Work Full Time For A Qualifying Employer

Eligibility in the program depends less on the type of work you do and more on who your employer is. Qualifying employers can include:

-

Government organizations at any level.

-

501 nonprofits.

-

AmeriCorps or the Peace Corps.

-

Nonprofit organizations that dont have 501 status but provide a qualifying public service as their primary purpose.

-

Religious organizations.

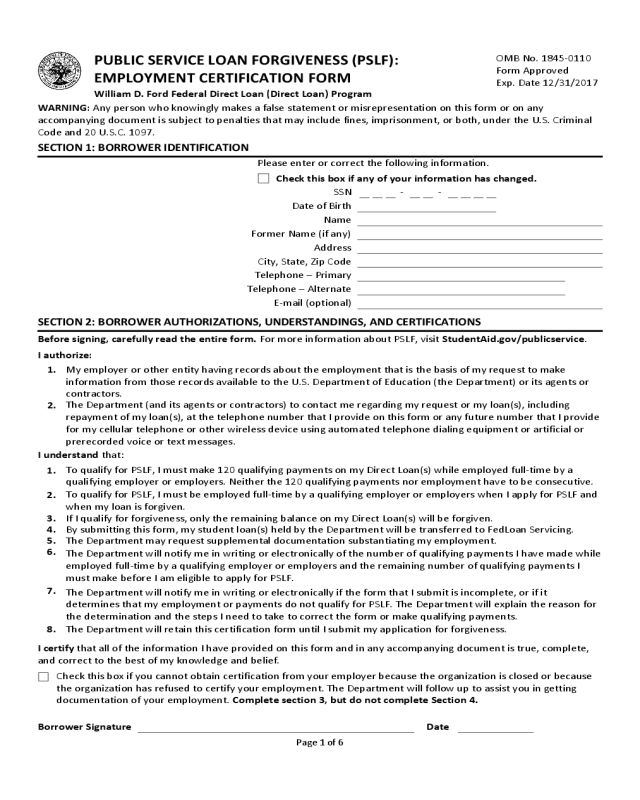

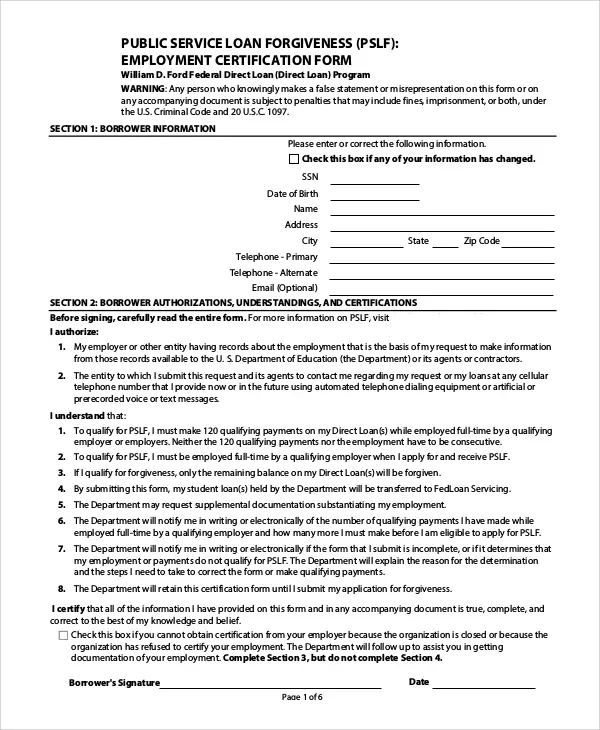

Complete an employment certification form to confirm that your employer qualifies. Send the form to MOHELA Servicing, the contractor that currently oversees PSLF for the department. When the form is processed, your loans will be transferred to MOHELA to be serviced going forward.

Submit a new form annually, or whenever you change jobs, to make sure youre on track for forgiveness. Youre not required to submit the form every year, but its a good idea to do so for your records. You can also apply for forgiveness once youre eligible and certify your employment retroactively.

You must work for your qualifying employer full time, which amounts to at least 30 hours per week. If you work part time for two qualifying employers and your time averages at least 30 hours per week, you might still be eligible.

Also Check: How Does The Va Home Loan Guarantee Work

Public Service Loan Forgiveness: The Deadline To Apply Is Today

Time is running short. The limited waiver expires tonight.

The deadline is fast approaching for teachers, first responders, firefighters, government workers and other public servants to file applications for the limited Public Service Loan Forgiveness waiver.

Eligible public service officials who have worked in a qualifying position for 10 years or more can receive full loan cancellation through the PSLF. A temporary waiver with expanded benefits was introduced in and expanded upon in , making forgiveness more accessible for millions of borrowers. The waiver includes more loan and repayment plan types that were previously excluded from the PSLF program. Borrowers with loans in forbearance can also apply.

If you haven’t started on your PSLF limited waiver application yet, the steps you need to take right now aren’t as time-consuming as you might think. And, you don’t have to fully complete the process to make the deadline. Instead, you must complete the application through the PSLF Help Tool portal by the end of the month. If you hold FFEL, Perkins or other qualifying federal loan types, you’ll need to apply to consolidate them into Direct Loans and fill out the PSLF application before 8:59 p.m. PT on Oct. 31.

After Years Of Public Service Some Still Cant Claim Student Loan Forgiveness

Applicants stamped with a “denied” stamp.

Delphine Lee / NPR

A short-lived program in the early 2000s allowed married couples to consolidate their student loans for a lower interest rate. Now, many are missing out on thousands of dollars in loan forgiveness.

Teachers, firefighters and government workers are clamoring to disentangle their student loans from those of their spouse in time to erase their debt with Public Service Loan Forgiveness . President Biden revamped the program last October, but in order to receive the benefits including forgiveness for student loans after 120 qualifying payments borrowers must have their paperwork in by October of this year.

“We keep getting these notices about, ‘Hey, the Public Service Loan Forgiveness waiver, you could qualify. Try it,’ ” says Becki Vallecillo, a long-time kindergarten teacher in Anderson, S.C. “And it’s heartbreak every single time.”

Vallecillo and her husband, Eric, found out early on that they don’t qualify. As a kindergarten teacher and a school counselor they meet every criterion, but one: Their loans are consolidated.

She’s been on the phone many times with her loan servicer. “The last time I did it, I literally was in tears by the end. I had spent like four hours on a Saturday getting transferred and bounced around: ‘Go to this website, do this paperwork, talk to this person,’ ” Vallecillo says. But the answer is always the same.

Also Check: How To Get An Fha Loan With No Money Down

Are Direct Plus Loans Eligible For Pslf

Yes. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Direct PLUS Loans are made to graduate and professional students. Direct PLUS Loans made to parents may need to be consolidated.

Still have questions?

Please visit The Department of Educations Office of Federal Student Aids FAQ page.

Why Are Tiaa And My Employer Providing This Service

At TIAA, we recognize that student debt is a tremendous source of stress for many people and gets in the way of other financial goals, like owning a home and saving for the future. Thats why we started working with Savi, a tech company that can help ease the burden of student debt.

Savi provides a free, no-commitment calculator you can use to assess your situation. You can call into their support center with any questions. If you want help complying with deadlines and completing paperwork, you can engage Savi for a small fee to act as your concierge. As your advocate, Savi will alert you to any potential issues or opportunities you may not have considered. Isnt it refreshing to have someone in your corner?

1 2021 Savi Solutions PBC, as of 12/31/21. These estimates may not be typical of all participants.

Testimonials were submitted to Savi online.

Savi and TIAA are independent entities. A portion of any fee charged by Savi is shared with TIAA to offset marketing costs for the program. In addition, TIAA has a minority ownership interest in Savi. TIAA makes no representations regarding the accuracy or completeness of any information provided by Savi. TIAA does not provide tax or legal advice. Please contact your personal tax or legal adviser.

This material is being provided for educational purposes only and does not constitute a recommendation or advice. You should carefully consider your unique circumstances before making any decisions regarding your student loans.

Also Check: Loans You Don’t Pay Back

Follow Up With Your Servicer

Once you submit the PSLF form, the company that services your loan may change to MOHELA, the servicer that manages accounts for borrowers pursuing PSLF. If you dont know who services your student loans, you can find out by visiting the U.S. Department of Educations Federal Student Aid website. Through this website you can access information about your federal student loans, including your federal student loan servicer.

The Student Debt Relief Program

Biden, following through on a campaign promise, announced the debt-relief program on Aug. 24, 2022, pointing to the Higher Education Relief Opportunities for Students Act as the basis for his executive authority to forgive student loans in particular, a provision that allows the Education Department to waive or modify federal student loan programs in order to ensure that recipients of student financial assistance are not placed in a worse position financially because of a national emergency, such as the coronavirus pandemic.

There is precedent for the use of the HEROES Act in response to the pandemic, said Dan Urman, a law professor at Northeastern University, who pointed to the current pause on student debt payments.

To be fair pausing and canceling are not the same thing, Urman said, but I would say were talking about a degree of difference.

Recommended Reading: Home Loans For First Responders

Have The Correct Type Of Loans Or Consolidate

Only loans that are part of the federal direct loan program are eligible for PSLF. Private student loans arent eligible.

You can consolidate other types of federal student loans Federal Family Education Loan loans or Perkins loans to make them PSLF-eligible.

If you qualify for Perkins loan cancellation, which offers forgiveness after five years of public service, pursue that option and dont consolidate your Perkins loans. You can still participate in PSLF with your other federal student loans.

How Is The One

For the most part, the PSLF Limited Waiver, which ended on Oct. 31, 2022, and the One-Time Adjustment are very similar. However, there are two differences:

- If you are retired or no longer working for a qualifying employer, you cannot receive forgiveness through the Adjustment.

- If you previously received Teacher Loan Forgiveness, the Adjustment will not give you credit toward PSLF for that period of service.

Read Also: How To Get Pmi Off Fha Loan

Giving Federal Employees Credit

The Department of Education will begin automatically giving federal employees credit for PSLF by matching Department of Education data with information held by other federal agencies about service members and the federal workforce. These matches will help the Department of Education identify others who may also be eligible but cannot benefit automatically, like those with FFEL loans.

Student Loans: Public Service Loan Forgiveness Applications Must Be Submitted By Oct 31 2022

Eligible Veterans, active-duty service members and others can erase their student loans through the Public Service Loan Forgiveness program.

The program removes the burden of student debt on public servants, making it possible for many borrowers to stay in their jobs, and entices others to work in high-need fields.

Also Check: What Loan Will I Qualify For

Confirm That You Have Qualifying Full

For your employment to count towards PSLF you need to work full-time for a qualifying employer.

Part-time employment will also count if you work a combined average of at least 30 hours per week for two or more qualifying employers at the same time.

What is a qualifying employer? A qualifying employer includes the government , a nonprofit organization that is tax-exempt under Section 501 of the Internal Revenue Code, or a nonprofit organization that provides certain types of public services.

You can verify that your employer qualifies for PSLF by using the U.S. Department of Educations PSLF Employer Search Tool. If the Search Tool doesnt find your employer, it might be because no one with your employer has applied for PSLF before. It is still possible that the employment qualifies for PSLF. You can learn more about the requirements for qualifying employment on the U.S. Department of Educations website.

What does full-time mean? You must work at least 30 hours per week or the number of hours your employer considers full-time, whichever is greater. For example, if you worked 32 hours per week but your employer considered 40 hours per week to be full-time, your employment will not qualify. However, borrowers who had more than one qualifying part-time job at the same time can meet the full-time requirement if they worked a combined average of at least 30 hours per week.

What Is The Public Service Loan Forgiveness Program

Available to full-time employees of U.S. federal, state, local, or tribal government or not-for-profit organization, this program forgives the remaining balance on your Direct Loans after you have made 120 monthly payments under a qualifying repayment plan.

For a limited period of time, borrowers may receive credit for payments made on Direct Loans, regardless of loan type, repayment plan, or the payment was made in full or on time. You must have worked full-time for a qualifying employer when prior payments were made. If you were employed in more than one part-time job at the same time, you will be considered full-time if you worked a combined average of at least 30 hours per week. You can receive credit only for payments made after Oct. 1, 2007, since that is when the PSLF program began. If you havent already, you must file a formOpens in a new window for any period for which you may receive additional qualifying payments.

If you have Federal Family Education Loan Program loans, Federal Perkins Loans, or other types of federal student loans that are not Direct Loans, you must consolidate those loans into the Direct Loan program by Oct. 31, 2022.

Don’t Miss: How To Get Loan At 18

Big Student Loan Interest Benefits Under Bidens New Plan

One of the biggest benefits of Bidens new repayment plan is that interest will no longer accrue in excess of a borrowers calculated student loan payment.

The Department estimates that as many as 70 percent of borrowers on existing IDR plans have seen their balances grow after entering those plans due to interest accrual exceeding the amount of a borrowers payment, according to the Education Department. In many cases, even borrowers making all required payments see their balances grow because the payment they can afford is lower than the accrued interest. Under the Departments proposed regulations, borrowers wont see their balances balloon while theyre making regular payments, including those who have a $0 payment.

In other words, borrowers who are underwater on their monthly payments would not see their balances increase due to interest accrual under the new REPAYE plan.

Over 360000 Educators And Public Service Workers Received $24 Billion In Student Loan Forgiveness Through The Limited Pslf Waiver

Thanks to the advocacy of educators and due to efforts by the Biden Administration, many of these issues have been fixed. While the Limited Waiver expired on October 31, 2022, PSLF is still here for educators and other public service workers. NEAs student debt experts have created tools designed to help educators through the PSLF application process. Check them out below!

- Higher Education Faculty, Including Adjunct/Contingent

Read Also: How To Qualify For Bridge Loan

Golden Globes 202: Abbott Elementary The Banshees Of Inisherin Win Big

Rather than create a fifth plan, which was the Education Departments original proposal, the new plan will instead overhaul the REPAYE plan, essentially replacing the existing version of that plan with a new one. Created in 2016, the REPAYE plan in its current form provides borrowers with payments tied to 10 percent of their discretionary income . Borrowers can receive student loan forgiveness under REPAYE after 20 years if they only have undergraduate loans, or 25 years if they have any graduate school loans.

Identify Your Federal Loan Types To See If You Need To Consolidate

Borrowers can have several different types of federal loans, including Direct Loans, Federal Family Education Loans , and Perkins Loans. Some federal loans are even owned by private companies or schools. To qualify for the One-Time Adjustment, borrowers with federal loan types that are not Direct Loans must apply to consolidate those loans into the Direct Loan Program by May 1, 2023.

- Parent PLUS Loans are not directly eligible for the One-Time Adjustment for PSLF purposes. However, Parent PLUS Loans that were previously consolidated into a Direct Consolidation Loan will receive credit for repayment periods after the consolidation. Additionally, if Parent PLUS Loans are or were consolidated with student loans that the parent took out for their own education, the entire resulting Direct Consolidation Loan can receive credit under the Adjustment based on the parents student loans.

Heres how to see whether your loans are Direct Loans, FFELs, or Perkins Loans:

- Log in to your Federal Student Aid Account at studentaid.gov. If you havent already set up an FSA ID, please create one.

- Once logged in to studentaid.gov, you will see your account dashboard as pictured below, which shows your total federal loan balance.

- Next to “My Aid,” click “View Details.”

- Scroll down the page to the section entitled “Loan Types.” In the Loan Types section, you will see different categories of loans as shown below.

Recommended Reading: How Much Do You Need Down For Fha Loan

Do I Qualify For Loan Forgiveness Under The Pslf Expanded Waiver

The waiver only applies to federal loans, which make up the vast majority, or more than 90%, of total student loan debt. Borrowers in public service jobs may be able to receive forgiveness for FFEL, federally backed loans made through private lenders, Perkins loans and other nonstandard or non-income-driven repayment plans for federal loans under the expanded waiver .

Borrowers can also receive credit for previous payments and periods of employment, such as active military duty, that they wouldn’t have qualified for in the past.

The easiest way to figure out if you qualify is to apply for the limited waiver.