How Do Personal Loan Rates Work

A personal loan rate determines your total annual cost of borrowing based on interest . Lenders use personal loan rates to offset their risk in lending, as more risky borrowers typically pay higher rates.

Once a lender sets your personal loan rate based on your creditworthiness, it uses that rate to calculate your monthly payments. You must repay the lender based on this rate, which you agree to before taking out the loan.

The basic concept is pretty simple. But in order to fully understand how personal loan rates work, you need to know what determines how high or low they are.

A Closer Look At The Average Interest Rates For Personal Loans

In Singapore, the interest rates that borrowers pay on personal loans depend on individual loan providers. This is why you should consider working with loan comparison sites to help you check the bank with better terms and conditions. When focusing on interest rates, you need to appreciate that it is broken down into two groups, effective interest rate, and annual flat rate.

Average Consumer Snapshot: Personal Loan Balances

Though overall personal loan debt saw growth in 2020in continuation of the six-year trendthe average amount each consumer owes only increased by only 1%, according to Experian data.

As of Q3 2020, consumers owed an average of $16,458 in personal loans, up $199 from $16,259 in 2019. This year’s increase in individual average personal loan debt comes on the heels of several years in which average consumer balances went down. In 2018 and 2019, average personal loan balances per consumer shrank by 1% and 0.5%, respectivelya decline that occurred while overall personal loan debt increased.

The contrast between overall growth and declining individual balances is likely explained by the increasing number of personal loan accounts, which has been the trend since 2013, according to Experian data. With more accounts, overall debt balance can grow while the average balance remains about the same. Since 2013, the total number of personal loan accounts has grown 90%, from 22 million to 43 million in Q3 2020.

You May Like: Usaa Bad Credit Auto Loans

Payday Loans Are The Only Option For Some Americans

Payday loans are a form of alternative financial service that provide fast cash and have a short repayment period. The problem with payday loans is the high cost that can trap borrowers in a vicious cycle.

As of 2019, there were 33 states that still allowed payday loans and did not regulate the interest rate.

Interest rates on payday loans at the time ranged from 154% in Oregon to 677% in Ohio. The fees and interest on payday loans are different from traditional loans and end up costing the borrower far more.

The Board of Governors of the Federal Reserve System issued a report on the economic well-being of U.S. households in 2019, with supplemental data from April 2020. The report showed that 2% of Americans would need to use a payday loan, deposit advance, or overdraft to cover a $400 emergency expense. Twelve percent of Americans would not be able to pay the $400 expense by any means.

An earlier project from The Pew Charitable Trusts reported that 69% of Americans use their first payday loan for recurring expenses, such as utilities, credit card bills, rent or mortgage payments, or food. That fact debunks the common perception that payday loans are short-term solutions for unexpected expenses.

What Credit Score Do You Need For A 100 000 Loan

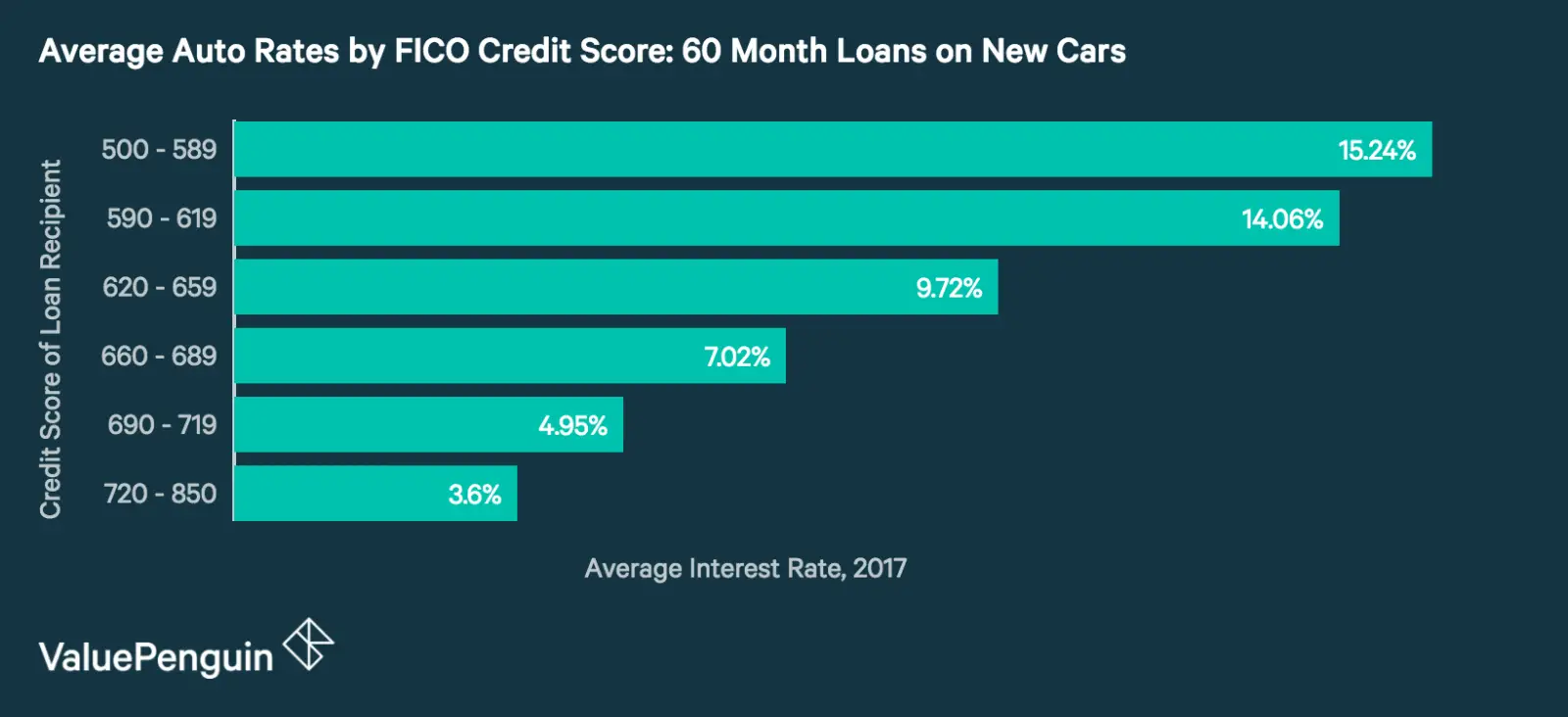

To qualify for a $100,000 personal loan, you should have a score of at least 720, though a score of 750 or above is ideal. Before you apply for a large personal loan, check your credit score so you know what kind of loan terms you’re likely to qualify for. To do so, use a free online credit service.

Don’t Miss: Unsubsidized Loan Definition

With A Fixed Rate Loan

- You know for the duration of your loan the exact payment amount you will be making each month.

- Your interest rate is locked in for the duration of your termup to 5 years.

- You could choose an amortiztion and payment schedule that meets your budget.

- You could switch to variable rate loan or pre-pay your loan at any time without penalty.

Compare Offers To Find The Best Loan

When searching for a personal loan, it can be helpful to compare several different offers to find the best interest rate and payment terms for your needs. With this comparison tool, you’ll just need to answer a handful of questions in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your .

This tool is provided and powered by Even Financial, a search and comparison engine that matches you with third-party lenders. Any information you provide is given directly to Even Financial and it may use this information in accordance with its own privacy policies and terms of service. By submitting your information, you agree to receive emails from Even. Select does not control and is not responsible for third party policies or practices, nor does Select have access to any data you provide. Select may receive an affiliate commission from partner offers in the Even Financial tool. The commission does not influence the selection in order of offers.

You May Like: Does Advance Auto Rent Tools

Average Personal Loan Debt By State

From a regional perspective, the latest data from Experian shows that Americansâ average personal loan balances increased by 4% or more in 17 U.S. states. In addition, 27 states recorded an increase in their average personal loan balances, while 24 states recorded a decrease.

Borrowers in Washington , Oregon , and South Dakota have the highest average personal loan debt. In contrast, borrowers in the District of Columbia , Hawaii , and Georgia have the lowest average personal loan debt.

In addition, borrowers in Kentucky , Nebraska , and Nevada recorded the highest YoY percentage increases in their average personal loan debt. In comparison, borrowers in the District of Columbia , New Jersey , and Vermont recorded the highest YoY percentage decreases.

| State: |

| 6% |

Personal Loan Interest Rates By Lender

Interest rates on unsecured personal loans typically range between 5% and 36%.

Banks and credit unions will offer competitive personal loan rates, but some of the lowest you can find are from online lenders, especially those that cater to creditworthy borrowers.

If you have a lower credit score, you will also have more luck with online lenders, as some will accept borrowers with scores as low as 580, and sometimes lower. In the table below, we take a look at the rates offered on an unsecured personal loan by a variety of online and traditional lenders.

| Lender/Lending Platform |

|---|

You May Like: Usaa Credit Score For Auto Loan

Good Interest Rate On A Personal Loan By Credit Level

- For excellent credit: You may be able to get interest rates as low as 4% – 7%. Thats where the majority of lenders set their minimums.

- For good/fair credit: Youre unlikely to get the lowest interest rates available, nor should you have to pay lenders maximums. Look at lenders credit score requirements the higher your score is above their minimum, the better your chances of getting a lower rate.

- For bad credit: You probably wont find rates lower than 25% to 36% from a bank or online lender. But personal loans from federal credit unions are capped at 18%.

If youre planning on consolidating debt, a good interest rate on a personal loan is one thats significantly lower than the rates on your existing debt. But as you compare personal loan interest rates, dont neglect other terms.

A low interest rate might not be as great as it seems if you also have to pay costly fees to go along with it. For example, many lenders charge origination fees of 1% to 6% of the loan amount as an extra cost for opening the loan.

What Will The Regular Payments Be Like

That brings us to the next topic, the payments themselves. As we said, during the application process, you and your lender will agree upon a payment schedule, which youll stick to until your loan is paid back. Although its possible, most borrowers dont plan on paying back their whole loan right away. Depending on the size of the loan, it may take a number of months, even years to pay back in full, and the entire time, interest will apply. So, the frequency of your regular payments is one of the first elements that need to be determined.

Again, when it comes to how they regulate their payment schedules, every lender is different. However, most lenders offer the following general payment options:

- Monthly

- Weekly

- Bi-weekly

The Interest Rate

Every loan comes with an interest rate, an extra amount of money that will be added to your regular payments. The interest rate is established so that your lender can earn a profit from your use of their services. The percentage they charge varies in accordance with the full amount of the loan, as well as how good your credit is and how much youre borrowing in the first place.

So, before you apply, always consider your other general expenses, as a high-interest rate can certainly affect your finances. Do you have a mortgage or car loan to pay for? What about your other debts? Another consideration to take into account has to do with your and interest rate youll be given because of it, which well discuss in a moment.

You May Like: Capital One/auto Pre Approval

What Is The Average Personal Loan Interest Rate In Singapore In 2021

Are you looking forward to taking a personal loan in Singapore? One of the most important factors to consider is the interest rate or the cost of the loan. Your primary goal should be identifying a personal loan provider with a low-interest rate because it directly impacts the total amount payable by the close of the loan term. All about the loan interest rate in Singapore.

To help you identify the best personal loan, it is prudent to start by answering the main question, “What is the average personal loan interest rate in Singapore?” This post takes a closer look at personal loan interest rates in Singapore to help you understand how they are determined. You will also learn the best way to pick the best personal loan provider in Singapore.

What Credit Score Do You Need To Get A Personal Loan

Because different lenders have different criteria for making personal loans, it is possible to get a personal loan with a lower credit score. However, having a FICO® Score of 670 or higher will give you many more options, including more lenders to choose from, lower interest rates and better loan terms. If your credit is fair or poor, lenders will consider you a riskier borrower. You may still be able to get a personal loan, but you’ll likely have to accept a higher interest rate and fees.

In addition to your credit score and credit history, lenders assessing your financial responsibility will also consider the amount of savings or other assets you have available, how stable your income is and how much of your income goes to debt . If you have no savings and half of your income is going to pay off credit card debt, you’ll be viewed as a bigger credit risk than someone who has a hefty savings account and little to no credit card debt.

You should check your credit score and review your credit report before applying for a personal loan. If you’re worried that your score will keep you from getting a personal loan, here are some things you can do to improve your credit score:

Once you get a personal loan, making your payments on time and in full will help maintain your positive credit score.

Read Also: Usaa Used Car Loan

Personal Loan Debt Increases In Some States Falls Elsewhere

Across the U.S., the country was split when it came to how consumers’ average personal loan debt changed in the past year. Consumers in 27 states saw their balances grow in 2020, while personal loan debt balances fell in the remaining 23 states and the District of Columbia.

Among the states where consumers’ balances increased, nearly two-thirds17 statessaw amounts owed grow by 4% or more. Two states saw double-digit percentage growth.

Of the states where consumer balances decreased, a little over half16 statessaw a decrease of less than 4% and only two saw double-digit percentage declines. Notably, in the 10 states that saw balances drop the most, consumers’ average FICO® Scores were consistently above the national average of 710a potential nod to the ability higher-score holders had in paying down debt over the past year.

| Average Personal Loan Debt by State |

|---|

| State |

| +6.2% |

Nearly half of all states and the District of Columbia saw their average personal loan balance drop in 2020. The nation’s capital saw the biggest drop by far, nearly doubling the decrease seen in the second-ranked stateNew Jersey. Vermont, Connecticut and North Dakota followed closely behind New Jersey to round out the states with the top five biggest decreases in debt.

| States With Largest Drop in Personal Loan Debt |

|---|

| State |

What Is The Average Small Business Loan Amount

Owning a business can be costly, and unexpected expenses tend to come up. For small business owners in need of extra funds, small business loans could be a great option. There are many factors to consider when choosing a small business loan lender, such as eligibility requirements, loan amount options and repayment terms.

Small business owners can also take out loans through the US Small Business Administration . The SBA helps small business owners get loans from traditional and some untraditional lenders. To decide what is right for you, consider the average loan amounts available for each type of small business loan and lender.

Also Check: How Long Does The Sba Loan Take To Process

Key Terms To Know About Personal Loans

Annual percentage rate is the interest rate on your loan plus all fees, calculated on an annual basis and expressed as a percentage. Use the to compare loan costs from multiple lenders.

An origination fee is a one-time, upfront fee that some lenders charge for processing a loan. The fee can range from 1% to 10% of the loan amount, and lenders typically deduct it from your loan proceeds.

The debt-to-income ratio divides your total monthly debt payments by your gross monthly income, giving you a percentage. Lenders use DTI along with credit history and other factors to evaluate a borrower’s financial ability to repay a loan.

Lenders that offer pre-qualification typically do so using a soft credit check, which allows you to see rates and terms you qualify for without affecting your credit score. If you accept the loan offer, the lender will perform a hard check to confirm your information. Hard checks knock a few points off your credit score.

About the author:Annie Millerbernd is a personal loans writer. Her work has appeared in The Associated Press and USA Today.Read more

Interest Rates On Personal Loans

The interest that is charged on personal loans has varied wildly over the years, with the interest rates on £10,000 loans being consistently lower than those on £5,000 loans.

£5,000 loans

£5,000 loans reached their peak interest rates in 2012, with an average of 13.2%. In 2017, the average was over a third lower at 8.4%.

Interest rates at the moment are historically low. The rate for £5,000 loans is currently at 7.80% and its been at an average of 7.86% for all of 2020. In 2019, the average was slightly lower at 7.84%, the lowest rate in over a decade.

| £705 |

Which regions have the highest amount of outstanding personal loans?

We looked into how much each region in the UK owes in personal debt. London is unsurprisingly in the lead, with over £6 billion in outstanding personal loans. The South East follows closely in second with over £5.7 billion outstanding. The North East has the smallest amount of personal loan debt, with just under £1.6 billion.

Also Check: Refinancing Fha Loan Calculator

Can I Get A Loan With A 611 Credit Score

The most common type of loan available to borrowers with a 611 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, so with a 611 FICO, you will definitely meet the credit score requirements. … We can help match you with a mortgage lender that offers FHA loans in your location.

What You Can’t Use Your Loan For

We don’t offer Personal Loans for a number of purposes including:

- the purchase of property or land including holiday homes and apartments

- purchasing a joint stake in a property or buying out a joint owner

- mortgage deposit

- gifting funds to third parties to support the purchase of a property, including mortgage deposit, stamp duty and solicitors fees

- gambling

- spread your repayments over 1 to 5 years for Personal Loans of £15,000 and less

- spread your repayments over 1 to 8 years for Personal Loans of over £15,000

- the first repayment is due 1 month from drawdown, or 3 months from drawdown if you take a repayment holiday

- repayments will be taken monthly from your nominated current account

Debt consolidation considerations

- if you’re using any part of this loan to pay off or reduce existing loans/debts , it’s important to consider not just the interest rate and monthly repayments, but also the term of this loan compared to the remaining term of your existing loans/debts

- spreading your payments over a longer term means you could end up paying more overall than under your existing arrangements, even if the interest rate on this new loan is less than the rates you’re currently paying

- you should also consider if any early repayment charges apply and if this form of borrowing is appropriate for your circumstances

Interest

- at the beginning of the loan we work out the interest you’ll pay over the whole period of your loan and add this to your loan balance

Early repayments

Read Also: How To Transfer A Car Loan To Someone Else