How Does Your Ltv Affect Your Refinancing

Your LTV ratio is one of the most important factors that impacts your ability to refinance. For example, your lender may be more hesitant to accept a refinance application with an LTV ratio above 80%. You might end up paying higher fees and mortgage insurance as a result.

Your LTV ratio also helps determine your interest rate. Homeowners refinancing with high LTVs usually dont qualify for the lowest mortgage refinance rates.

The LTV ratio is only one of several factors that affect your ability to refinance. Some other important factors that impact your loan APR and monthly payment include:

- Debt-to-income ratio

| Jumbo loans | 80% |

Fannie Mae and Freddie Mac conforming loan limits allow a maximum 95% LTV ratio for a standard refinance on a single-family home. But, if you seek a cash-out refinance, your maximum LTV drops to 80%. The threshold is lower for second homes and investment properties.

The requirements for a home equity loan and HELOC are similar to a cash-out refinance, though some lenders may only require 15% equity, or 85% CLTV. Still, to qualify for the best interest rates, youll want to aim for a CLTV ratio of 80% or less.

Save Up For A Bigger Down Payment

If it turns out your LTV ratio is high and you would be required to pay mortgage insurance and/or have a higher interest rate, you could consider taking a step back instead of moving forward. That doesnt mean you shouldnt buy a home but taking a bit more time to save for a larger down payment can be a huge cost savings up front and through the life of your loan!

Tips To Lower Your Ltv Ratio

There are ways to lower your loan-to-value ratio, which may ultimately help you build more equity in your property.

- Increase your down payment: If your loan-to-value ratio is relatively high, it may be a good idea to increase your down payment before you take out a loan. If you dont have enough money to do that, consider waiting until you can save more.

- Lower your purchase price: If you dont have a big enough down payment and cant wait to save more, you can decrease your LTV by selecting a car or home that costs less. Compromising a bit on things like square footage or mileage could make you financially stronger in the long run.

- Get your home reappraised: Ideally, your home will appreciate over time its possible for the value to go up significantly within a few years of buying it. If you want to refinance your home or take out a home equity loan or line of credit, a reappraisal can help you get a better idea of your homes value and your equity in your home. It could also give you an idea of whether your LTV has decreased enough to request to have your PMI removed.

Recommended Reading: 600 Credit Score Auto Loan Interest Rate

Fannie Mae And Freddie Mac

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. However, they require mortgage insurance until the ratio falls to 80%.

For FHA, VA, and USDA loans, there are streamline refinancing options available. These waive appraisal requirements so the home’s LTV ratio doesn’t affect the loan. For borrowers with an LTV ratio over 100%also known as being “underwater” or “upside down”Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance are also available options.

What Is The Maximum Loan

The maximum LTV for an uninsured mortgage is 80%, while the maximum LTV for an insured mortgage is 95%.

A low LTV ratio means that it would be more likely for your mortgage lender to recover the amount of the mortgage should you default, even if housing prices fall. A low LTV also gives you flexibility by having more equity in the home. This would allow you to take out asecond mortgageor when you need to borrow against your equity, such as through aHome Equity Line of Credit .

The Bank of Canada classifies mortgages into two types: high-ratio mortgages and low-ratio mortgages.

Read Also: Can You Refinance With Fha Loan

Ltv Requirements For Refinancing Fha Loan

Loans that are backed by the FHA will allow you to refinance in many situations beyond what conventional lenders will allow. FHA has a program that will allow you to do a streamline FHA refinance if you already have a loan from FHA. This type of refinance is only for getting a better rate on your home loan. You cannot pull out cash with a streamline refi through FHA.

The good thing about the FHA streamline refinance is you do not need a new appraisal, and your credit and income are not usually checked. All of this means that you can often get this refinance done in only a few weeks. FHA streamline refinancing also can happen even when you have negative equity, meaning you owe more on the home than it is worth.

To qualify for a streamline refinance through FHA, there are some requirements:

- The loan must be current this is not a program for people behind on their loan.

- Cash out cannot be more than $500.

- Closing costs cannot be added onto the loan amount

- Mortgage insurance has to be extended to the new loan

- Lenders can offer no closing cost refinances, but they can put a higher rate on the loan

If you want to pull out cash with an FHA refinance, you will need an LTV of 85%, and all new loans do require mortgage insurance. The standard rate and term refinance program is available up to 96.5% LTV.

Conventional Loan: Up To 97% Ltv Allowed

Conventional loans are guaranteed by Fannie Mae or Freddie Mac. Both groups offer 97 percent LTV purchase mortgages, which means you will need to make a downpayment of 3 percent to qualify.

97 percent loans are available via most mortgage lenders, and private mortgage insurance is often required.

As compared to an FHA loan, conventional loans to 97 percent LTV are advised for homeowners with high credit scores. In most other cases, FHA loans are preferred.

You May Like: California Loan Officer License

How To Impact Your Ltv

One of the best ways to help reduce your loan-to-value ratio is to pay down your home loans principal on a regular basis. This happens over time simply by making your monthly payments, assuming that theyre amortized . You can reduce your loan principal faster by paying a little bit more than your amortized mortgage payment each month .

Another way to impact your loan-to-value ratio is by protecting the value of your home by keeping it neat and well maintained.

Why Is Ltv Important

For lenders, the loan-to-value ratio is one factor that might play into the risk that the mortgage represents. A higher LTV means the lender may have to put more money on the line. It could also mean a higher chance of loss if you fall behind on mortgage payments.

Lower LTVs lessen the risk for lenders because theres usually a smaller chance of financial losses should you default on the loan. As such, borrowers with lower LTVs generally get more favorable loan terms including lower interest rates.

Recommended Reading: Usaa Auto Loan Eligibility Requirements

Invest In Home Improvements

You could increase your home value by making significant improvements, such as remodeling your kitchen or fixing the roof. Just ask yourself which will save you more money in the long run: Paying for improvements to secure a better deal on refinancing, or paying more to refinance now?

Understanding your LTV ratio can prepare you for the refinancing process, and hopefully get the best deal possible.

What About A Combined Loan

Our financial calculators are provided as a free service to our members. The information supplied by these calculators is from various sources based on calculations we believe to be reliable regarding their accuracy or applicability to your specific circumstances. All examples are hypothetical and are for illustrative purposes, and are not intended to provide investment advice. TDECU does not accept any liability for loss or damage whatsoever, which may be attributable to the reliance on and use of the calculators. Use of any calculator constitutes acceptance of the terms of this agreement. TDECU recommends you to find a qualified professional for advice with regard to your personal finance issues.

- Routing Number: 313185515

Recommended Reading: Usaa Classic Car Loan

High Ltv Mortgage Refinances

Consider these homeownership programs when you have a higher LTV ratio and are finding it difficult to qualify for a conventional refinance:

Josh Patoka is a personal finance authority and a contributor to Credible. His work has been published on Fox Business and several award-winning personal finance blogs including Well Kept Wallet, Wallet Hacks, and Frugal Rules.

Whats Behind The Numbers In Our Loan

This calculator helps you unlock one of the prime factors that lenders consider when making a mortgage loan: The loan-to-value ratio. Sure, a lender is going to determine your ability to repay including your , payment history and all the rest. But most likely, the first thing they look at is the amount of the loan youre requesting compared to the market value of the property.

An LTV of 80% or lower is most lenders sweet spot. They really like making loans with that amount of LTV cushion, though these days most lenders will write loans with LTVs as high as 97%.

Lets see how your LTV shakes out.

Don’t Miss: Conventional 97 Loan Vs Fha

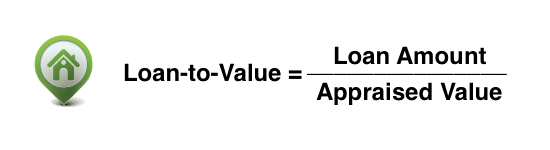

How To Calculate Ltv

Loan-to-value ratios are easy to calculate: just divide the loan amount by the most current appraised value of the property. For example, if a lender grants you a $180,000 loan on a home thats appraised at $200,000, youll divide $180,000 over $200,000 to get your LTV of 90%.

Heres a more visual representation of the calculation:

LA/APV = LTV ratio

Where LA= Loan Amount and APV=Appraised Property Value

|

Prospective Home |

In this example, the LTV is fairly high, which signals a higher risk to the lender. A 90% LTV may come with higher interest rates and mortgage insurance.

Significance Of Loan To Value Ratio For Home Equity Loans And Helocs

The 2008 recession and its aftermath brought LTV and CLTV ratios into the spotlight and made lenders more stringent when it comes to requirements for home equity loans and HELOCs. Thats because many lenders ended up underwriting loans for homes that were underwater. When borrowers defaulted, secondary lenders were unable to recoup their money, as many foreclosures only recouped the lower value of the original loan. Today, home equity loans and LTVs/CLTVs are intertwined banks and borrowers know that a good combined loan-to-value ratio means a borrower is less likely to default on a loan.

In general, many lenders use a CLTV of 80% as a rule of thumb when it comes to extending loans to borrowers. While high CLTV loans and refinance opportunities exist, these may come with high-interest rates and stipulations including carrying mortgage insurance. Knowing your LTV and CLTV ratios can help you understand your home equity loan and HELOC options and may help determine how much equity you wish to tap.

Making sure your credit score is as good as possible can also help you lock into the most competitive rates and terms from lenders.

Don’t Miss: Fha Refinance Mortgage Calculator

How To Lower Your Loan

Try one of these steps to knock your LTV ratio down and boost your home equity.

- Get a gift for a bigger down payment. A family member, employer or friend can contribute a gift to use toward your down payment amount and closing costs.

- Make extra principal payments. Your LTV ratio drops with every mortgage payment. If you make even one extra payment each year, youll lower the LTV ratio faster.

- Pick a shorter-term loan. If your budget can handle a higher monthly payment, a 15-year fixed mortgage will lower your LTV ratio more quickly than a 30-year loan.

- Buy a less expensive home. Choosing a home at the lower end of your down payment budget can help you avoid a high-LTV ratio loan.

Your Ltv Ratio And Private Mortgage Insurance

Your loan-to-value ratio will also determine whether you have to pay private mortgage insurance. For conventional loans, borrowers who want to avoid paying private mortgage insurance will need to make a down payment of 20 percent of the value of the home. FHA purchase loans will allow you to have a loan-to-value ratio of up to 96.5 percent. USDA, VA and other specialty loan types may allow for a 100 percent LTV for a purchase loan.

Don’t Miss: Refinance Fha Loan To Conventional Calculator

Loan To Value Analysis

Loan to value is an important metric that categorizes borrowers. Though it is not the only metric that determines high-risk borrowers, it indicates how risky a loan is, and how the borrower will be motivated to settle the loan. It also determines how much borrowing will cost the borrower. The higher the loan to value ratio, the more expensive the loan.

Key factors that affect the loan to value ratio is the equity contribution of the borrower, the selling price and the appraised value. If the appraised value is high, that means a large denominator and hence a lower loan to value ratio. It can also be reduced by increasing the equity contribution of the borrower and reducing the selling price.

A major advantage of loan to value is that it gives a lender a measure of the level of exposure to risk he will have in granting a loan. The limitation of loan to value is that it considers only the primary mortgage that the owner owes, and not including other obligations like a second mortgage. A combined loan to value is more comprehensive in determining the likelihood of a borrower settling the loan.

Ltv Requirements On Va Loans

The VA product are similar to FHA financing. You can get a streamlined VA refinance if you just want to get a lower interest rate. There is no need for a new appraisal and there is no credit or income check when you apply. This loan is not for pulling out cash. One advantage over FHA refinance loans is that you do not need to pay mortgage insurance.

You May Like: Fha Limits Texas

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Refinance Options For Borrowers With A Loan To Value Ratio Over 100%

Borrowers with an extremely high loan-to-value ratio are considered upside-down on their mortgage, i.e., the value of their house is less than their loan amount. Although this is not ideal, you may still be able to refinance. Special refinancing programs exist for borrowers with a loan-to-value ratio over 100 percent. The most common high loan-to-value refinance program is the HARP Refinance program. If you have a FHA loan and have a high loan-to-value ratio, you may be eligible for a FHA streamline loan. You can shop for FHA streamline loans on Zillow. For information on other high loan-to-value loan programs please check out our underwater mortgage page.

You May Like: How Long Does The Sba Loan Process Take

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

What To Know About Loan To Value Ratio

Have you had your eye on a shiny new car lately?Are you ready to make your dream of owning a home a reality? Do you want to take advantage of the equity in your home to make some much needed repairs?

If your answer is yes to any of the questions above, youve probably thought about how these purchases will impact your monthly budget. But have you thought about how the amount of money you need to borrow compares to the value of your purchase? If not, you may want to start because loan to value is one of the factors lenders will consider when deciding whether to approve you for a loan.

What is a loan to value ratio?

The relationship between the amount of money you borrow, and the value of your purchase is also known as your loan to value ratio. If you have a high LTV ratio, it means you have little to no equity in the product youre buying. If you have a lower LTV ratio, it means you have a greater amount of equity in your purchase. The larger your down payment is, the lower your LTV will be.

How do I calculate loan to value ratio?

Easily calculate loan to value ratio by dividing the amount of your loan by the value of the item youre purchasing. For example, if youre buying a house thats been appraised for $300,000, and you take out a loan for $240,000, your LTV will be 80 percent. .

Your LTV and home loans

Your LTV and auto loans

Recommended Reading: How To Apply For A Second Loan With Upstart