Is There More Student Loan Forgiveness Coming

Part of President Joe Bidens campaign pitch was that he was going to offer some sort of forgiveness to student loan borrowers, but as of April 2021, Biden hasnt sorted that question out.

He told a February CNN Town Hall meeting that Im prepared to write off a $10,000 debt, but not $50,000, but has not followed up on that with any legislative proposal.

Instead, a month later, he asked Education Secretary Miguel Cardon to prepare a report that details a presidents authority to cancel $50,000 in student loan debt without approval from Congress.

According to student loan expert Mark Kantrowitz, the $10,000 cancellation would wipe out all student loan debt for about 14.5 million borrowers. The $50,000 cancellation would erase debt for about 36 million borrowers.

One thing to be aware of is that currently, whatever amount of loan is forgiven is counted as taxable income. That may change as new legislation comes out and possibly changes loan forgiveness programs.

Loan Forgiveness For Doctors

The healthcare professions, especially physicians, dentists, pharmacists and mental healthcare workers, have several options, both national and local, to receive loan forgiveness.

The requirements and the amount forgiven vary dramatically, depending upon which program you enter. Check out the links to see the amount of loan forgiveness available and requirements for Army doctors Indian Health Services, National Institute of Health, as well as state-by-state programs.

Quebec Loan Remission Program

Under the Quebec Loan Forgiveness Program, you can get up to 15% of your provincial student loan forgiven if you finish your studies within a specified period or youve received a bursary from the Loans and Bursaries Program for each year of your studies.

The specified period of study is normally:

- 27 months for a college-level technical program

- 24 months for an undergraduate university program, over a 3-year period

- 32 months for an undergraduate university program, over a 4-year period

- 16 months for a masters program without a thesis

- 20 months for a masters program with a thesis

- 32 months for a doctorate program

Eligibility Requirements For The Quebec Loan Remission Program

To qualify for this provincial loan forgiveness program, you must:

- Have been granted a bursary under the Loans and Bursaries during each award year of your studies

- And, have finished an education program that results in an undergraduate degree within the specified study period. Loan remission may also be possible for past college studies, as long as they pass requirements.

- Or, have finished a college-level training program that results in a Diploma of College Studies within the specified study period.

Check out how your student loans can affect your credit.

Also Check: How Long Does The Sba Loan Take

All You Need To Know About Student Loans And The Cares Act Expiration

The CARES Act was passed shortly after businesses were forced to close in March 2020 as a precaution against the outbreak of coronavirus. The federal program provided widespread assistance programs to help in times of national emergency. In addition to multiple rounds of direct stimulus, payments CARES also expanded unemployment benefits for independent contractors and

Student Loan Forgiveness Programs

Income-driven repayment forgiveness. The federal government offers four main income-driven repayment plans, which allow you to cap your loan payments at a percentage of your monthly income. When enrolled in one of these plans, your remaining loan balance will be eligible for forgiveness after 20 or 25 years, depending on the plan. These plans are most beneficial for those with large loan balances relative to their income. Only 32 borrowers have received loan forgiveness through income-driven repayment forgiveness, according to the National Consumer Law Center. This forgiveness was made tax free retroactive to Dec. 2020 through the end of 2025, as part of the March 2021 American Rescue Plan. However, most borrowers will not qualify for forgiveness through income-driven repayment until the early 2030s.

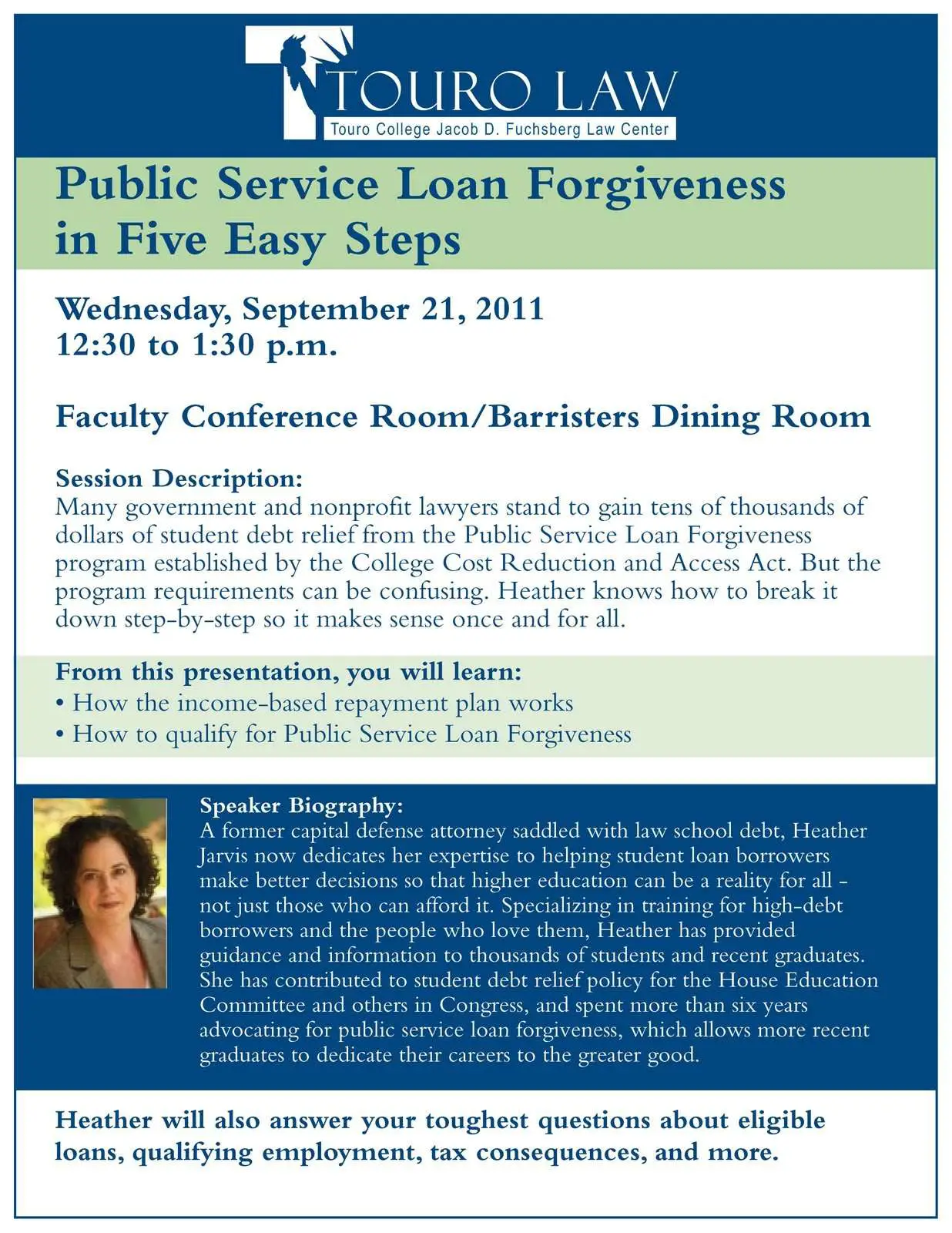

Public Service Loan Forgiveness.Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal student loans. Eligible borrowers can have their remaining loan balance forgiven tax-free after making 120 qualifying loan payments. Until Oct. 31, 2022, the Education Department has expanded which payments on federal student loans count toward PSLF through a limited waiver now, payments on FFEL and Perkins loans, late payments and payments made on any repayment plan will retroactively count as qualifying payments.

» MORE: How to get loan forgiveness through borrower defense to repayment

Also Check: Bayview Loan Servicing Reviews

Student Loan Forgiveness For Doctors And Nurses In Canada

Eligible family doctors, residents in family medicine, nurse practitioners, and nurses can get Canada Student Loan forgiveness through the federal government. However, only the federal portion of the loan can be forgiven .

Eligibility For Student Loan Forgiveness For Doctors and Nurses in Canada

To qualify for this type of Canada Student Loan forgiveness, you must:

- Have a Canada Student Loan thats in good financial standing

- Be working as an eligible medical professional in an under-served or remote region with a lack of proper healthcare .

- Have been employed for at least one consecutive year in an underserved or remote community and provided at least 400 hours of in-person service.

- Submit an this application

Eligible Medical Professionals

To qualify for Canada Student Loan forgiveness, you must be one of the following medical professionals :

- Family

- Nurse Practitioner

- Family Medical Resident

You may get Canada Student Loan forgiveness for nurses and family doctors and if you are:

- Enrolled in full-time studies

- Repaying a student loan

- In your non-repayment period

If your loan is in its repayment period, your monthly payments are still mandatory. That said, youre allowed to work as an eligible medical professional in more than one remote or under-served community and with multiple employers if you perform at least 400 in-person hours over a maximum period of 12-months.

Check out what happens to your student debt when you die.

Limited Waivers For Pslf Applicants

Under the limited waiver, any payments made toward your federal loans, regardless of the payment plan youve been on, will count toward PSLF. Previously, only payments made on certain repayment plans would qualify.

If you made payments in the past that were rejected because they werent considered on time, those will now count toward PSLF.

Any payments made on Federal Family Education Loan or Perkins loans after 2007 will retroactively count toward PSLF. Previously, payments on these loans were not counted toward PSLF.

If you have consolidated your non-direct loans prior to the limited waiver period, the payments made prior to consolidation will also count toward PSLF.

For members of the military, any time spent in active duty will count toward PSLF, regardless of whether loan payments were paused or not during that time.

If you have applied to PSLF in the past and been denied, the Education Department said that it will be reviewing rejected applications. The Department will also be reaching out to borrowers who can now receive forgiveness under PSLF but havent applied to make sure theyre aware of the temporary rule changes.

Also Check: Conventional 97 Loan Vs Fha

Targeted Eidl Advance: Qualifications

If you are in the first groupthose who applied for and received an EIDL Advance of up to $9,000you may qualify for a Targeted EIDL Advance if you:

- Are located in a low-income community, as defined in section 45D of the Internal Revenue Code and

- Can demonstrate you suffered a more than 30% reduction in revenue during an eight-week period beginning on March 2, 2020, or later. You will be asked to provide proof of the more-than-30% revenue reduction.

If you are in the second groupsomeone who applied for an EIDL Advance on or before Dec. 27, 2020, but did not receive oneyou must meet the qualifications above plus one more:

- You must have 300 or fewer employees.

Any business that would normally be eligible for the EIDL program would potentially be eligible, including sole proprietors, independent contractors, and private, nonprofit organizations. Agricultural enterprises are not eligible.

All applicants may be asked to provide an IRS Form 4506-T, which gives the SBA permission to request your tax return information.

The SBA cautions against submitting a duplicate COVID-19 EIDL application. Only prior applicants will be considered for the Targeted EIDL Advance.

Loan Forgiveness For Nurses

Registered nurses, nurse practitioners and members of nursing faculty, who work in high-need population areas or areas where there is a critical shortage could qualify to have up to 85% of their loans forgiven under the NURSE Corps Loan Repayment Program.

Qualified candidates can have 60% of their student loans forgiven for working two years in an underserved area. Another 25% could be forgiven for working three years.

Some states also offer loan repayment assistance. Go to the Loan Forgiveness for Nurses website to see if yours is one of the 33 states that has one and what the eligibility requirements are.

Don’t Miss: Student Loans Fixed Or Variable

Best 7 Ways To Reduce Your Student Loan Interest Rate

How can you reduce the interest rate on student loans? This is a crucial question student loan borrowers need to ask in order to save money. Your student loan payments can be very expensive if you are like most student loan borrowers. There are many ways to lower your student loan interest rate. Here are

How To Get Your Student Loans Forgiven: Three Paths

Cancelling student loan debt is a popular subject in todays climate, but its been a popular topic for more than 20 years and 45 million people still owe $1.7 trillion.

That could change if Biden and Congress reach some sort of compromise on how much to cancel and qualifying requirements.

In the meantime, option No. 1 for student loan forgiveness is having a job that serves the public good. If youre a teacher or police officer or firefighter or social worker or health care worker or government employee who kept up with payments for 10 straight years, youve got a good shot. If you are a sign spinner or pet psychic, forget it.

Option No. 2 is through a repayment plan that is based on your income. You will still have to pay a large chunk of your debt over a long period, but under the current laws, a portion will be forgiven at the end.

Those options are available for federal student loans.

Option No. 3 is called a discharge and its available for federal or private loans, but you probably dont want to go there. A discharge is when you cant repay the loan for a variety of reasons, like death, disability, fraud, identity theft or bankruptcy.

Recommended Reading: Usaa Refinance Student Loans

Parent Plus Loan Forgiveness

Parent borrowers are eligible for forgiveness under the other existing forgiveness programs, including PSLF, repayment plan forgiveness, Total and Permanent Disability, and the death of you or the child for whom you borrowed.

- Who qualifies: Parents who borrowed PLUS Loans for their childâs undergraduate studies.

- Which loans are eligible: All Direct Loans, FFEL Loans, and, if consolidated, Parent PLUS Loans and Federal Perkins Loans.

- How to apply: Check the program youâre seeking forgiveness under for application details.

- How long until loans are forgiven: The time period for your loans being forgiven depends on which program youâre seeking forgiveness, discharge, or cancellation under. Check that program for details.

Teacher Loan Forgiveness Is Another Option To Get Student Loan Forgiveness

The Teacher Loan Forgiveness program helps teachers get student loan forgiveness. However, the amount of student loan forgiveness is less Teacher Loan Forgiveness than it is through the Public Service Loan Forgiveness program. As a teacher, you can earn up to $17,500 of federal student loan forgiveness. To qualify, you must:

- have been employed as a full-time teacher for five complete and consecutive academic years

- been employed at an elementary school, secondary school or educational service agency that serves low-income students.

Recommended Reading: How Long Does Sba Loan Take To Process

To Make It Happen You Need To Follow Procedures Very Carefully

The Consolidated Appropriations Act , 2021, signed into law Dec. 27, 2020, provides renewed funding for Paycheck Protection Program forgivable loans, money for a new type of Economic Injury Disaster Loan advance, and funding for a new grant that targets shuttered venues.

Guidance from the Small Business Administration describes how to get part or all of your PPP loan forgiven as well as what you need to do to take advantage of the new EIDL and shuttered venue grant programs.

+ Student Loan Forgiveness Programs That Discharge Loans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Find the latest

-

Will PSLF work for you now? Key forgiveness updates

-

Get ready for February: What to know as payments restart

-

Keep your guard up: How to spot a student loan scam

Student loan forgiveness might seem too good to be true, but there are legitimate ways to get it through free government programs.

The following options are available only to borrowers with federal student loans. Some programs have very specific requirements that make them difficult to qualify for, but income-driven repayment plans are open to most borrowers.

» MORE:What are the odds Ill get student loan forgiveness?

The information below is about existing student loan forgiveness programs. Learn more about the potential for Biden Student Loan Forgiveness.

Youre not eligible for federal student loan forgiveness programs if you have private loans, but there are other strategies for managing private loan debt.

Don’t Miss: How Long For Sba Loan Approval

Qualifying For Pslf Under Limited Waiver Programs

The limited waiver applies to borrowers with direct loans, those who have already consolidated into a direct loan, and those who consolidate into a direct loan by Oct. 31, 2022.

While grad PLUS loans are included under the limited waiver, parent PLUS loans are not.

Some federal loans are not direct loans. If you have FFEL or Perkins loans, for instance, you will need to consolidate your loans into a direct consolidation loan before October 31, 2022. You will then need to verify that you work for an eligible employer and submit a PSLF form also before Oct. 31, 2022.

If you already hold direct loans, there is no need to consolidate. Rather, you just need to verify you work for an employer eligible for the program and then submit a PSLF form through your loan servicer before Oct. 31, 2022.

Find the latest

-

Keep your guard up: How to spot a student loan scam

Federal Student Loan Holders Who Are In Default

You May Like: Bayview Mortgage Modification

Student Loan Forgiveness Vs Student Loan Discharge

Although their end results are similar, student loan forgiveness is not quite the same as student loan discharge. A loan discharge immediately stops the borrowers obligation to repay the debt . In some cases, a discharge may also entitle a borrower to receive a refund of payments previously made on a loan.

Loan discharge often occurs when the borrower , dies, or becomes permanently disabled. There can also be situations in which a loan is discharged because the educational institution was guilty of fraud. With discharges, borrowers are relieved of the requirement to pay their federal student loans if its proven, for example, that the educational institution misled the student in a meaningful way. Most loans can be discharged in the following situations:

- Closure of the school during the time of study

- School violation of state laws

- Falsification of the loan qualifications by the school

- Use of identity theft on someone elses part to secure the loan

- Failure of the school to refund required loans to the lender

If You Go Back To School

Once the Governments have contributed to your principal payment, you cannot receive additional student loans or grants until your existing loans are paid in full. However, you can still get interest-free status for your existing student loans if you return to school.

Once you have received a RAP-PD benefit and 5 years have passed since you have left school, you may not be eligible to receive further provincial loans and grants from some provinces until your loan from that jurisdiction is paid in full. Please contact your province for more information. This does not apply to the federal part of your loan.

Don’t Miss: Usaa Apply For Auto Loan