Save On A Mortgage Loan

A mortgage is often the most important amount of money a person will borrow in their life. âAt National Bank, the maximum amortization period for a mortgage loan is 30 years,â explains Louis-François Ãthier. âHowever, most people choose to pay off their home over 25 years.â

This 5-year difference will save you a lot of money. A mortgage loan of $200,000 amortized over 25 years rather than 30 reduces the total interest paid by $38,000. The online calculator allows you to do simulations with different amortization periods.

In most cases, however, it is better to exercise caution by opting for a longer period, which is what Louis-François Ãthier recommends. âThe shorter the amortization, the higher the periodic payments. You need to ensure that your budget allows for this.â

Above all, even if you have chosen a longer term, you can always opt for accelerated repayment. âThese options go directly to the return of capital and thus reduce the length of amortization and the interest,â explains Ãthier. âWhen you have a little extra in your budget, itâs very beneficial.â You can make an additional payment, make an early repayment or even increase the amount of your payments. Because certain restrictions apply, depending on the type of loan, speak with your advisor to establish the best strategy.

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Amortizing Loans Reduces Lender Risk

Loan repayment is subject to terms and conditions agreed upon by lenders and borrowers as loans originate. The amount of each payment, the length of the repayment term, and the interest percentage applied to the loan represent the basis for car loan repayment schedules, which consumers use to budget for future purchases.

Loans are structured in different ways, each carrying distinct advantages for lenders and debtors. Balloon loans, for example, require interest only payments for a particular term, before the entire loan principal balance comes due. Because a large part of the financing comes due all at once, toward the end of a loan period, balloon or bullet loans are very risky to lenders. It is just too easy for borrowers to limp along with interest payments, only to falter when the mother lode comes due.

To limit risk and help borrowers budget for payments mortgages, car financing, and other high-dollar loans are amortized, or spread out, over the course of long-term repayment. Amortized payments are associated with the original sum borrowed, or principal amount. The amount to be repaid is broken into manageable chunks, due each billing period. Interest is then added to each amortized principle payment, comprising the total required payment for each billing period.

Once created, amortization schedules hold true until one or more of the variables used to create them changes.

Recommended Reading: California Mortgage Loan Originator License

Kako Mogu Saznati Preostali Iznos Kredita Za Automobil

Slino, kako se izraunava amortizacija kredita? Kako izraunati amortizaciju. Trebat e ti da svoju godinju kamatnu stopu podijelite sa 12. Na primjer, ako je vaa godinja kamatna stopa 3%, tada e vaa mjesena kamatna stopa biti 0.25% . Takoer ete pomnoiti broj godina trajanja zajma s 12.

Kako mogu saznati iznos otplate kredita? Formula za procjenu isplate hipoteke je sljedea: M = P / P = iznos glavnice zajma. i = mjesena kamatna stopa. n = broj mjeseci potrebnih za otplatu kredita.

Car Loan Emi Calculator Frequently Asked Questions

Que. How much time does it take to use the calculator?

Ans. If you have the details with you , it takes only a few minutes.

Que. Can I avail myself a car loan to buy a used vehicle?

Ans. Yes, almost all major financial institutions provide loans for used vehicles. Also, the calculator provided on this page can act like a used car loan EMI calculator to determine the EMIs. However, ensure that the used model comes with the necessary documentation.

Que. What is the typical tenure of a car loan in India?

Ans. In India, most car loans run for 1 to 5 years, although certain new plans to run for up to 7 years. The lower the tenure, the higher the EMIs you need to pay.

Que. Do I need a co-guarantor for a car loan?

Ans. It is not mandatory to have a co-guarantor. However, if you do not meet the eligibility criteria on your own, you may need one.

Que. Can my car loan application be rejected?

Ans. On occasion, your car loan application may be rejected if you do not fulfill the minimum eligibility criteria or if there is a mistake in your documentation. Besides, your CIBIL score has to be 750 or more at all times.

Recommended Reading: Usaa Mortgage Credit Score

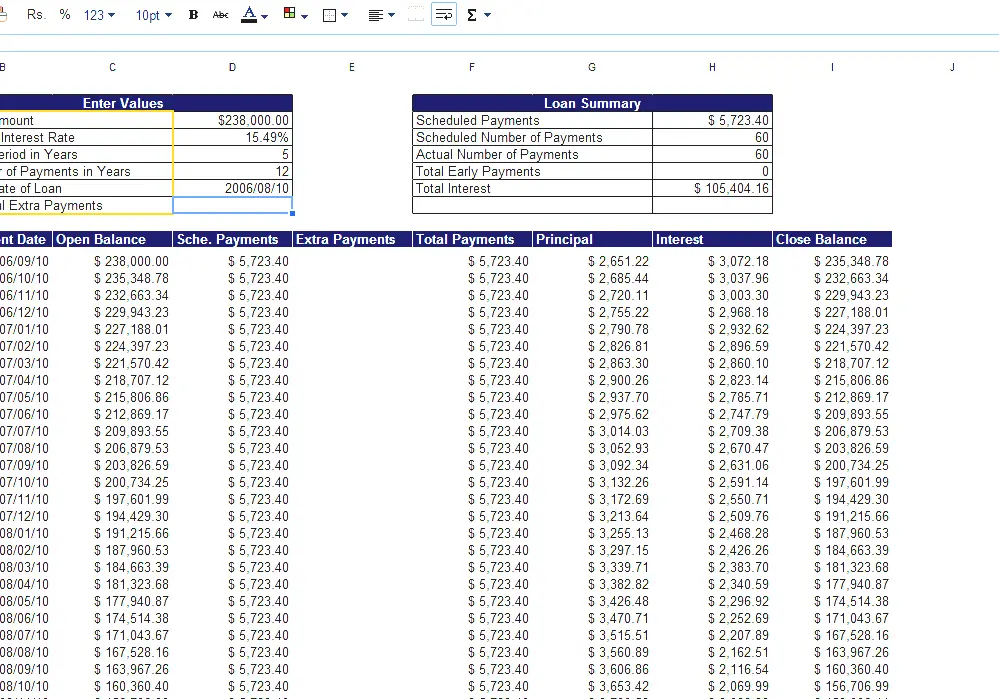

Importance Of Mortgage Amortization Calculator Excel

The modifying sheet has never been so effective and easy by the availability of these templates. Just get your free copy of them and check out the fields mentioned on it in case of other fields require selecting another column is really easy.

Low-interest amounts are possible if monthly mortgages are paid on time and it does require car loan amortization calculator excel.

You can check out the specific formula for it and apply it in the given templates. Accurate information can make your living easy!

Calculating Auto Loan Payments

Also Check: My Car Loan Is Not On My Credit Report

Auto Loan Amortization Schedule Excel

In the event, you have taken a loan for buying a house or for buying an automobile, paying it back is easy with Auto Loan Amortization Schedule Excel.

This is available in an excel tool and free of cost. To tell the truth, getting your own vehicle is now a necessity and therefore people are getting it through the installments process.

Moreover, once you have taken the loan, you need to return it back on a monthly basis as well. Notably, that is the place a car loan calculator proves to be useful.

By the same token, the loan is returned back with actually a process is known as, amortization schedule. You can calculate it yourself, it can be confusing. Additionally, In any case, computing installment sums and arranging a calendar can be precarious.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Does Usaa Do Auto Loans

Gather The Information You Need

There are 3 main things you need when calculating amortization. These are the principal amount of the loan, the interest rate, and the loan term. You also need the amount of the monthly payment amount. For the purpose of our example, the loan details are as follows:

- The principal amount outstanding is $100,000. This means in the formula, P = $100,000

- The interest rate is 6% per annum . The monthly interest rate r= 6%/12 = 0.005%

- The loan term is 3 years , so n = 36

When you put these values into the formula, you get the repayment amount

The actual amount of your payment will stay the same for the duration of the loan. But the principal and interest portions will change. The interest portion is high in the beginning, with a lesser percentage going back toward the principal amount. Now you have everything you need to calculate amortization for the duration of your loan. Lets move on to the next step.

News Result For Auto Loan Amortization Calculator With Extra

Using Your 401 to Pay off a MortgageYour browser indicates if you’ve visited this link

Investopedia

loancalculator

OppLoans Personal Loans Review 2022Your browser indicates if you’ve visited this link

Forbes

loanalternativeextra

Best Small Business Loans Of 2022Your browser indicates if you’ve visited this link

Forbes

Extraloanalternative

Income Share Agreements Can Help Pay for College, but Experts Recommend Maxing Out Federal Student Loans FirstYour browser indicates if you’ve visited this link

Time

loansalternativeextra

If You’ve Fallen Behind on Your Mortgage, a Loan Modification Could Help. Here’s How It’s Different From RefinancingYour browser indicates if you’ve visited this link

Time

loan

Best Medicare Advantage Plans in TexasYour browser indicates if you’ve visited this link

NerdWallet

alternativeextras

Medicare Advantage Plans in MichiganYour browser indicates if you’ve visited this link

NerdWallet

alternative

New Residential Investment Corp. Announces Fourth Quarter and Full Year 2021 ResultsYour browser indicates if you’ve visited this link

Benzinga.com

Also Check: Transferring Car Loan To Another Person

Amortization Of Intangible Assets

Amortization can also refer to the amortization of intangibles. In this case, amortization is the process of expensing the cost of an intangible asset over the projected life of the asset. It measures the consumption of the value of an intangible asset, such as goodwill, a patent, a trademark, or copyright.

Amortization is calculated in a similar manner to depreciationwhich is used for tangible assets, such as equipment, buildings, vehicles, and other assets subject to physical wear and tearand depletion, which is used for natural resources. When businesses amortize expenses over time, they help tie the cost of using an asset to the revenues that it generates in the same accounting period, in accordance with generally accepted accounting principles . For example, a company benefits from the use of a long-term asset over a number of years. Thus, it writes off the expense incrementally over the useful life of that asset.

The amortization of intangibles is also useful in tax planning. The Internal Revenue Service allows taxpayers to take a deduction for certain expenses: geological and geophysical expenses incurred in oil and natural gas exploration, atmospheric pollution control facilities, bond premiums, research and development , lease acquisition, forestation and reforestation, and intangibles, such as goodwill, patents, copyrights, and trademarks.

Consider All Aspects Of The Loan

The monthly payment is the best indicator of how the car loan will impact your budget. It can give you a reality check on whether you can afford the vehicle. And though this figure is the easiest to understand, it isn’t the only number to be aware of.

It is also important to be aware of how much the loan will total, how much of a down payment you’re making, and how long the loan will be. The general rule for each of these is as follows:

Your loan payment should be no more than 15% of your take-home pay. The loan term should ideally be less than 72 months, and you should aim for a down payment of at least 10% or consider GAP insurance.

Keep in mind that everyone’s situation will be different, so these recommendations are not set in stone. Furthermore, these figures will differ for those who lease, so take a look at our articles for information specific to that scenario.

When you obtain a monthly payment, be it from a price quote, negotiation or advertised special, make sure you are aware of all the numbers behind it. What good is a low payment if it takes you 84 months to pay off the loan? Is the selling price for the car a good deal? What about the trade-in amount the dealership is offering for your car? Ask for the “out-the-door” figures from your salesperson and review them before making a decision.

Also Check: Usaa Used Cars

What Are Car Loans And How Do They Work

Auto loans are secured loans that use the car youre buying as collateral. Youre typically asked to pay a fixed interest rate and monthly payment for 24 to 84 months, at which point your car will be paid off. Many dealerships offer their own financing, but you can also find auto loans at national banks, local credit unions and online lenders.

Because auto loans are secured, they tend to come with lower interest rates than unsecured loan options like personal loans. The average APR for a new car is anywhere from 3.24 percent to 13.97 percent, depending on your credit score, while the average APR for a used car is 4.08 percent to 20.67 percent.

Calculating First Months Interest And Principal

Also Check: Aiq Ellie Mae

Je Li Bolje Plaati Kredit Dva Puta Mjeseno

Dvotjedne utede postiu se jednostavnim plaanjem polovica vaeg mjesenog plaanja auto kredita svaka dva tjedna i svaki esti mjesec plaate 1.5 puta vie od vae mjesene uplate auto kredita. Uinak vam moe utedjeti tisue dolara kamata i oduzeti vam godine kredita za auto.

Hoe li otplata automobila natetiti mom kreditu? Rano otplata zajma za automobil moe privremeno utjecati na vau kreditnu ocjenu, ali glavna je briga kazne prijevremene otplate koje naplauje zajmodavac. Oni to rade kako bi nadoknadili novac koji e izgubiti ne naplatom dugorone kamate na va zajam. Obavezno provjerite sa svojim zajmodavcem prije nego to izvrite prijevremenu otplatu.

Can I Pay Off An Amortized Car Loan Early

Yes, you can pay off your car loan early if you want to. This will save you money in interest payments over the life of the loan. However, you may have to pay a penalty for doing so.

Its essential to read the terms of your car loan agreement carefully to find out if there is a penalty for early payoff. If there is, youll need to weigh the cost of the penalty against the amount of money you will save in interest by paying off the loan early.

Recommended Reading: Auto Loan Amortization Formula

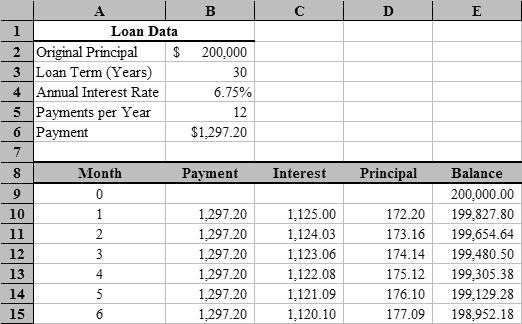

Interests And Reimbursement Of Capital

Even if payments are equal, the portion that pays the interest on a loan is reduced progressively as the capital balance decreases. This is the principle of diminishing interest. If you take a look at the amortization table, you will notice that the parts corresponding to the capital repayment and interest payment vary from one deadline to the next.

The amount allocated to interest is at its maximum for the first payments and then gradually decreases. For a loan amortized over a long period, such as a mortgage loan, payments during the first year are used to pay interest rather than repay capital.

For example, if you borrow $200,000 at 5.49% over 25 years to buy a house, only around the 12th year will you begin to pay more capital than interest. On the other hand, with a personal loan of $20,000 at 10.15% over 5 years, the capital repayment will exceed the interest starting with the first payment.

âItâs a simple mathematical question,â says Louis-François Ãthier. âThe longer the amortization, the less the loan is repaid quickly and the more interest there is to be paid. The shorter it is, the less you pay for it.â