Average Student Loan Interest Rate

Federal student loan interest rate depend on the type of loans you’re eligible for. Most students use federal loans to finance their education, but there is also the option to instead use private lenders also, some who borrow under a government program may later switch to private lenders to refinance or consolidate their loan. Each federal student loan has a universal fixed interest rate set by Congress every year. Credit score is not a factor for federal student loans, in contrast to most other loan types. Instead, the rate you’ll pay varies by the type of loan you’re getting, your income range and whether you are an undergrad or going to graduate school.

| Loan Type |

|---|

*Parent of Undergraduates

How Do I Get A Car Loan

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.

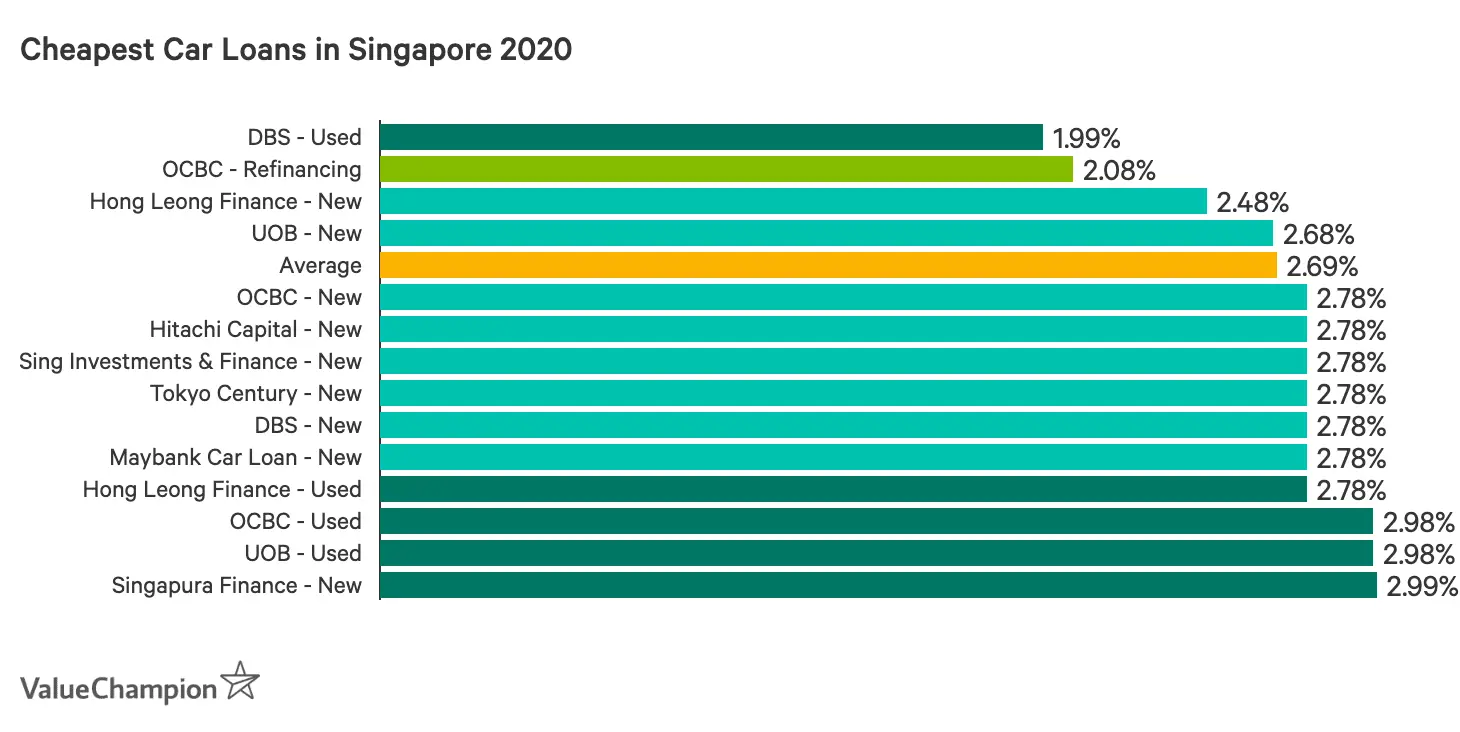

Average Rates For Auto Loans By Lender

Auto loan interest rates can vary greatly depending on the type of institution lending money, and choosing the right institution can help secure lowest rates. Large banks are the leading purveyors of auto loans. , however, tend to provide customers with the lowest APRs, and automakers offer attractive financing options for new cars.

Don’t Miss: How Do I Refinance My Car With Bad Credit

The Kia Sonet Gtx+ Automatics Launched In India At A Price Point Of Rs1289 Lakh

The Kia Sonet was launched recently in India. However, the price tags of the top-variant models of the car were not revealed at the time of the launch. The automakers have recently revealed the prices of the petrol and diesel variants of the top-spec model.

The Kia Sonet GTX+ will be available in both petrol and diesel variants and will come with automatic transmission setups. Both the cars have been priced at Rs.12.89 lakh . As per the latest revelations of the prices, the petrol range of the car now starts at Rs.6.71 lakh and goes up to Rs.12.89 lakh and the diesel variant starts at Rs.8.05 lakh and goes up to Rs.12.89 lakh. There is a total of 17 different trims of the car on the basis of the engine, trim, and so on. The two petrol unit variants of the car churns out 83 hp and 120 hp respectively. The diesel unit is a 1.5-litre setup which churns out 100 to 115 hp of max power and 240 Nm to 250 Nm of peak torque.

30 September 2020

The Right Credit Score

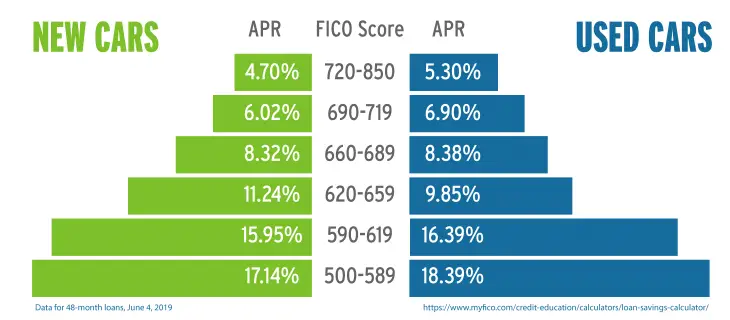

Im assuming you think that you have a FICO credit score in the 620 to 629 range.

You may have a credit score of 623 but it may not be a FICO score and your true credit score could be much higher!

A while back, the three big credit agencies Experian, TransUnion, and Equifax, joined forces created a new credit scoring model they called VantageScore.

There credit scoring model doesnt produce the same results as the FICO model because it is newer and weighs consumers credit histories a bit differently.

But, heres the thing

Most lenders dont use a Vantage credit score when determining the best rates for an auto loan.

They used the FICO credit scoring model, in fact, over 90% of lenders use FICO to obtain your credit score and determine your interest rate.

However, most FREE CREDIT SCORES are VantageScores.

So, if you think you have a credit score around 625, you may actually have a FICO credit score of 675, who knows?

The only way you would know is to go to MyFICO and get your FICO credit scores for Experian, Equifax, and TransUnion.

It could save you thousands of dollars in a lower interest rate loan!

Also Check: Usaa Car Loans Reviews

Apply For Financing At Honda North Today

Now that you understand what is a good interest rate for a car loan, let the finance experts at Honda North help you through the financing process. They will treat you with respect and patiently answer all of your questions. Head into the dealership to see our extensive inventory of new and preowned Honda models and take a look at more helpful auto finance tips on how you can lease a used car. lets go for a test drive around Burlington or Lawrence. Contact us today!

Average Small Business Loan Interest Rate

The average small business loan interest rate from a traditional lender, generally a bank or credit union, ranges from 3% to 5.5%. Loans financed by an online lender may have interest rates that range from 6% to more than 100%. The interest rate largely differs by the type of lender and the loan product.

The most common lenders are banks, although there are an increasing number of other options from online and alternative lenders. Because these newer options are subject to fewer regulations for their small business loans , they offer a wider range of interest rates based on your business’ credit score, financial statements, and even your personal credit score.

The table below shows the types of lenders and their average annual interest rates, assuming the borrower has a good credit score.

| Type of Lender |

|---|

| Invoice Factoring | 13.00% – 60.00% |

Most consumers apply for term loans that are either given by banks, including Small Business Administration backed loans, or by alternative lenders. With a term loan, you borrow a sum of money upfront and pay it back monthly for a set number of years. Other common loans include a line of credit, which gives the borrower access to a certain amount of funds at any given time a merchant cash advance, an advance based on future revenues of a business and invoice factoring, in which invoices are sold for a lump sum of cash to improve cash flow and reduce debt.

You May Like: Defaulting On Sba Loan

What To Know Before Applying For An Auto Loan

When looking for a car loan, it’s best to shop around with a few lenders before making your decision. This is because each lender has its own methodology when approving you for a loan and setting your interest rate and terms.

Generally, your credit score will make the biggest impact in the rates offered. The higher your credit score, the lower APR you’ll receive. Having a higher credit score may also allow you to take out a larger loan or access a broader selection of repayment terms. Choosing a longer repayment term will lower your monthly payments, although you’ll also pay more in interest overall.

If you’ve found a few lenders that you like, see if they offer preapproval going through this process will let you see which rates you qualify for without impacting your credit score.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: How To Find Student Loan Number

Student Loan Private Lenders

When you’re looking to finance your education, it’s best to use all available federal loan options before you apply for a private student loan. Unlike federal loans, any private student loans require you to make payments while you are in school, and they also tend to be more expensive than federal loans. Interest rates for private loans either can be fixed or variable, depending the type of loan. The average student loan interest rate has a wide range but some lenders offer interest rates as low as 2%, and rates can run as high as 18%, based on credit score. Any undergraduate, graduate, or parent can apply for a private loan. Approval for student loans involves a credit score and history check. Due to most students’ lack of credit history, it helps to apply with a cosigner, typically a parent, to increase the likelihood of approval.

| Loan Type | |

|---|---|

| Private Loan Refinancing** | 2.57% – 8.24% |

*Range taken from six popular private lenders

**Fixed and variable rate range taken from six popular private refinancing lenders

Receive Personalized Financing At Mercedes

Now that you know the answer to the question, What is a good rate on a car loan, our finance center can help you move forward with the pre-approval and financing processes. If you have additional questions or want to find out what counts as good mileage on a used car, dont hesitate to contact us! Youre also welcome to visit us near Stamford and New Canaan for in-person assistance.

You May Like: Can You Buy A Manufactured Home With A Va Loan

Getting The Best Car Interest Rates

Ultimately, the most useful thing that you can do to get the best interest rate on a car is to come prepared. The best way to do this is to look up your credit history and subsequent credit score. A higher credit score signifies to lenders that you have a history of paying your bills on time, which results in a lower interest rate and vice versa.

Middletown Honda continues to explain that aside from checking your credit score, you should also prepare for your search for the best car loan by shopping around and getting pre-approved by several lenders. This will allow you to get quotes on different interest rates and make an informed choice when comparing your options. Additionally, per U.S. News, preapproval simplifies the entire negotiation process because it allows you to avoid one of the car salesman’s favorite tactics: confusing buyers by breaking the loan down into monthly payments. There are several strategies that will help you come prepared and ensure that you are getting the best interest rate on your car, such as:

Once you are armed with this information, you are better equipped to negotiate because you know what you can expect and what’s fair.

Ways To Reduce Your Auto Loan Interest Rate

With a credit score between 620 and 629, you are going to qualify for non-prime loans at a much higher interest rate than if you were able to increase your credit score to 700+.

Because you are so close to receiving prime credit score rates it may make sense to consider spending 30, 60, or 90 days building your credit.

The time and money spent would put you in a lower risk bracket and open the doors to much more financial freedom and better opportunities.

You can start by checking out our 90 day Credit Sprint for a personalized credit building plan. I know it works because I personally increased my credit score over 100 points in under 60 days.

Another option to get a vehicle loan with a lower interest rate would be to ask a family member to co-sign on the loan.

The co-signer would become the primary borrower and you would be the secondary borrower.

They would be responsible for making the payments on the loan if you failed to do so, but you would qualify for an auto loan based on their credit score and not yours.

If you know someone with a good credit score, it may not hurt to ask them to be your co-signer.

Additional Auto Loan Resources

Don’t Miss: Patelco Refinance Auto Loan

The Cost Of Bad Credit

Let’s look at how higher interest rates affect a car loan, using an example. Let’s say you’re buying a used car, and the loan is for $14,000 with a term of 60 months . Check out how different auto loan interest rates influence the monthly payment and overall cost of the car:

| Monthly Payment | |

| $8,395 | $22,395 |

Using the average used car loan interest rates from the first table, you can see that as credit scores drop and the interest rate increases, the total cost of financing goes up dramatically.

What Is The Average Interest Rate On A Car Loan

The average interest rate for a three-year loan varies depending on whether you buy new or used. The average ranges from 3% to 4.5% for new carspartly because new car buyers tend to have better-than-average credit. But the average used car loan interest rate is significantly higher, at roughly 8.5%.

You may receive a different offer depending on your credit score and the lender. The best way to compare auto loan interest rates is to explore your options and choose the offer that makes the most sense for your finances.

Read Also: Va Loan Mobile Home Requirements

Apply For Financing At Sam Leman Automotive Group

If you need assistance with automotive financing, you can trust the experts at the Sam Leman Automotive Group. Apply for financing in advance to expedite the process. We look forward to helping you drive home to Bloomington-Normal, Peoria, or Champaign in the vehicle of your dreams. Contact us today for more information or use our car payment calculator.

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Best Overall: Penfed Credit Union

PenFed Credit Union

- As low as 0.99%

- Minimum loan amount: $500

PenFed Credit Union provides some of the best rates available. It also has flexible loan amounts and a number of auto loan options for members. Even though membership is required, a disadvantage for some, PenFed makes the requirements to join fairly straightforward.

-

Offers new, used, and refinance loans

-

Loan amounts from $500 to $100,000

-

Provides rate discounts for using its car buying service

-

Borrow up to 110% on new and used vehicles

-

High minimum loan amount for longer terms

-

Excellent credit history required for lowest rates

-

Membership in the credit union is required

Our top pick for auto loan rates, PenFed Credit Union, offers some of the lowest rates available.

At PenFed, rates for 36-month refinance loans start as low as 1.79%. Deep discounts are available for members who use the credit union’s car buying service, with rates starting as low as 0.99% APR for a new car and 1.99% APR for a used vehicle.

You’ll have to become a member of the credit union, but the requirements to join are fairly easy to meet. Car loans from PenFed start as low as $500 and move up to $100,000, a wide range that beats out many of the lenders we surveyed.

Average Interest Rates By Term Length

Most banks and credit unions provide payment plans ranging from 24 to 72 months, with shorter term loans generally carrying lower interest rates. The typical term length for auto loans is 63 months, with loans of 72 and 84 months becoming increasingly common. The higher APRs of longer term auto loans, however, can result in excessive interest costs that leave borrowers upside downthat is, owing more on the auto loan than the car actually costs.

Heres a closer look at average interest rates across various loan terms for those with the strongest credit.

| Auto Loan Term | |

|---|---|

| 72 Month | 4.45% |

While longer term loans allow for a lower monthly payment, the extra months of accumulating interest can ultimately outweigh the benefit of their lower short term cost, especially for the consumer purchasing an older used car whose value will depreciate quickly.

Terms of 72 and 84 months are also usually available only for larger loan amounts or for brand new models.

For example, when paid over the course of 48 months, a $25,000 loan at a 4.5% interest rate will result in monthly payments of $570 and a total cost of $27,364. When paid over the course of 84 months in $348 monthly payments, this same loan at the same interest rate costs a total of $29,190 more than $1,800 pricier than at 48 months. For higher interest rates, the difference between short and long term payments will be even greater.

Recommended Reading: Does Va Loan Work For Manufactured Homes