Pay Off In 6 Years And 2 Months

The remaining term of the loan is 9 years and 10 months. By paying an extra $150.00 per month, the loan will be paid off in 6 years and 2 months. It is 3 years and 8 months earlier. This results in savings of $4,421.28 in interest payments.

If Pay Extra $150.00 per month

| Remaining Term | 6 years and 2 months |

| Total Payments |

| 9 years and 10 months |

| Total Payments |

| $11,188.54 |

Public Service And Teacher Loan Forgiveness

Public Service Loan Forgiveness is available after 10 years of qualifying payments and employment, only for Direct Loans . The Teacher Loan Forgiveness Program is available for loans in both the Direct and FFEL programs. All federal loans issued since July 1, 2010 are Direct Loans. Teachers with Perkins loans may be eligible for a loan cancellation if they meet certain requirements. More information for teachers can be found at studentaid.gov.

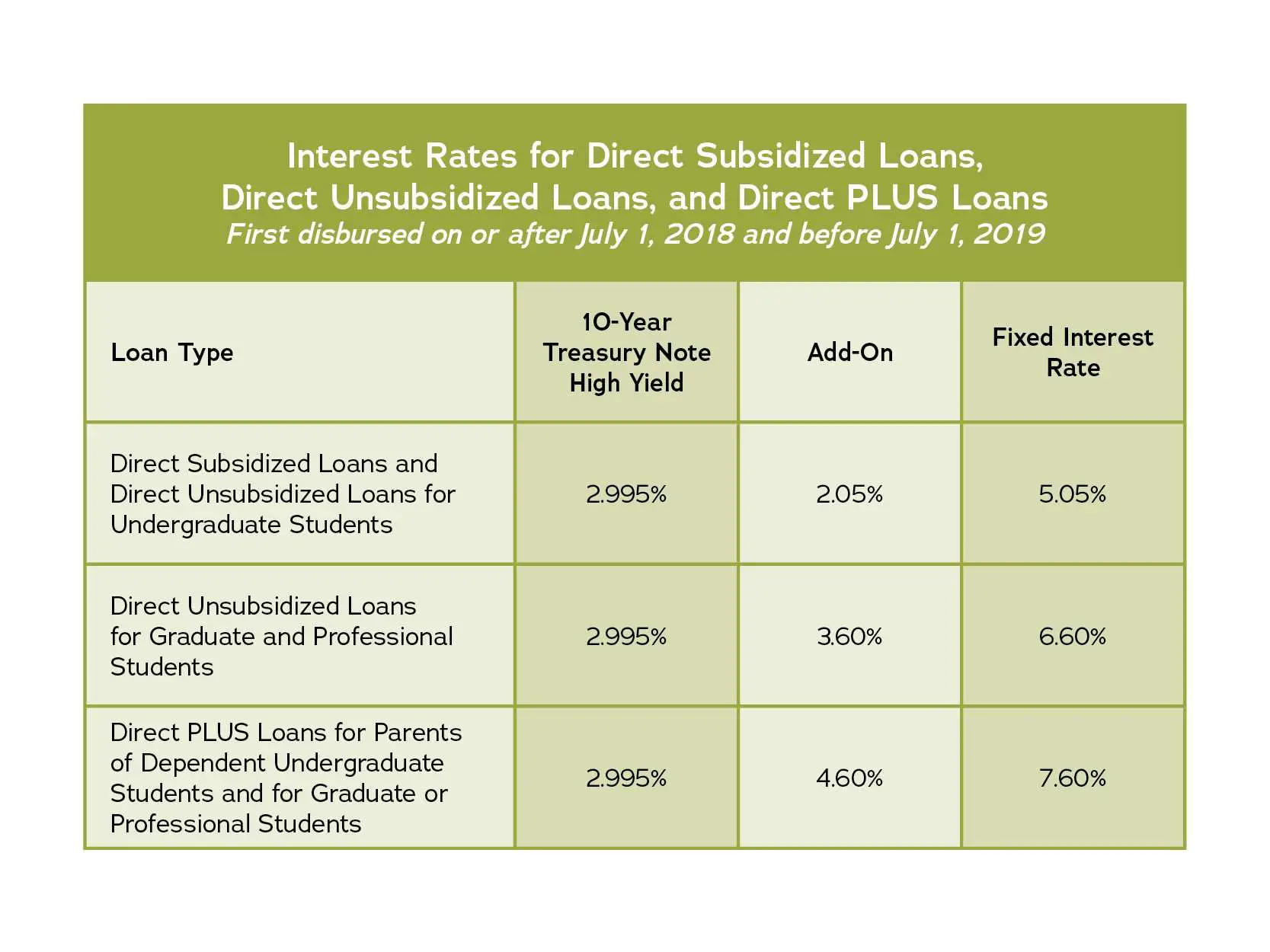

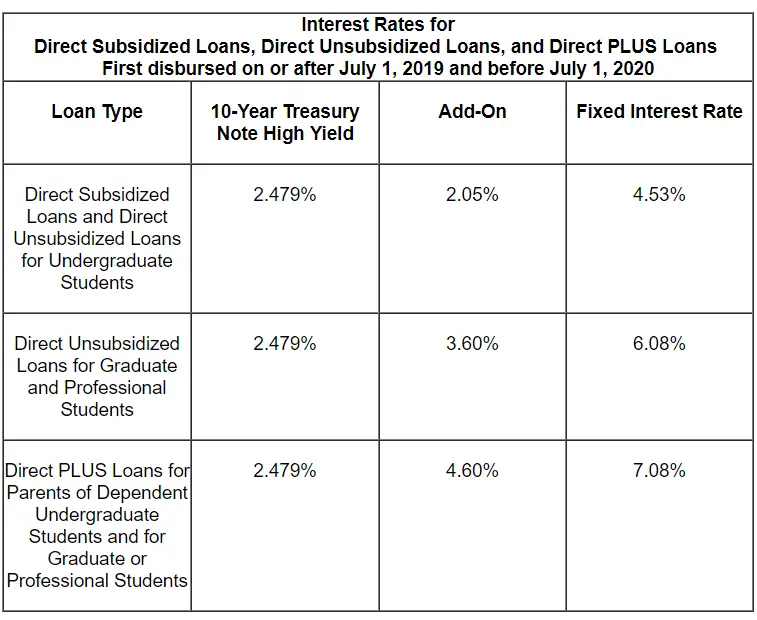

Direct Subsidized Or Unsubsidized Loan Interest Rates

Interest rates for Direct Subsidized or Unsubsidized Loans vary depending on loan type, when the loan was first disbursed, and your degree status .

| Period loans first disbursed |

|---|

| Contact your loan holder to determine the interest rate |

Military service members may be eligible for reduced interest rates.

If you need more information about the interest rate for your student loans, contact your loan holder. If you aren’t sure which institution or servicer holds your loans, locate your loan holder.

You May Like: Does Va Loan Work For Manufactured Homes

Interest Rates For Direct Loans First Disbursed Between July 1 2021 And June 30 2022

Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2013 have fixed interest rates that are determined in accordance with formulas specified in sections 455 through of the Higher Education Act of 1965, as amended .

The interest rate is determined annually for all loans first disbursed during any 12-month period beginning on July 1 and ending on June 30, and is equal to the high yield of the 10-year Treasury notes auctioned at the final auction held before June 1 of that 12-month period, plus a statutory add-on percentage that varies depending on the loan type and, for Direct Unsubsidized Loans, whether the loan was made to an undergraduate or graduate student. Loans first disbursed during different 12-month periods may have different interest rates, but the rate determined for any loan is a fixed interest rate for the life of the loan.

For each loan type, the calculated interest rate may not exceed a maximum rate specified in the HEA. The maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students, 9.50% for Direct Unsubsidized Loans made to graduate and professional students, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

Direct Loan Master Promissory Note

Once the Federal Direct Loan has been awarded and guaranteed, the Department of Education will send you a notification to complete the MPN. Loan funds will not be disbursed until the borrower completes the MPN.

You are only required to complete an MPN one time as it can be used for up to 10 years of borrowing for educational expenses. A new MPN must be signed is if you cease enrollment for one full academic year or if your MPN has expired after 10 years. Each academic year, all students using the MPN will be notified of their loan eligibility. You may accept, reduce, or decline your loan by logging into your financial aid account in SharkLink.

Read Also: Usaa Auto Loan Approval Odds

How Do I Get This Loan

You apply using the FAFSA or Renewal FAFSA, just the way you would for other federal student aid. Then you complete a promissory note provided by the school or the U.S. Department of Education. The promissory note is a binding legal document when you sign it youre agreeing to repay the loan under certain terms. Read the note carefully and save it.

The Math Behind Increasing Outstanding Student Loan Balance

Using the earlier example, if the original loan balance is $10,000, the simple interest rate is 2.75%, no payments are made during the approximately 45-month period of undergraduate studies and the subsequent 6-month grace period , the amount of accrued interest at the beginning of the repayment period would be:

$10,000 x x 1,551 days = $1,169

This interest will be added to the principal, so the loan balance for repayment will become $11,169 . If any repayment is missed or deferred, the amount of installment will further get added to the loan.

Let us try and consider a simplified real-life situation where the student borrows $5000 each of unsubsidized loans in the first, second, third, and fourth year of undergraduate study, and the interest rate remains the same.

Rate of interest = 2.75%

Simple interest for 51 months = $5,000 x x 1,551days = $584.50

Rate of interest = 2.75%

Simple interest for 39 months = $5,000 x x 1,186days = $446.78

Rate of interest = 2.75%

Simple interest for 27 months = $5,000 x x 821days = $309.28

Rate of interest = 2.75%

Simple interest for 15 months = $5,000 x x 456days = $171.78

At the end of the 51-month period, the outstanding student loan balance will become

$20,000 + + + + = $21,512.34

Recommended Reading: What Do Mortgage Loan Officers Do

Private Student Loan Interest Rates

If you’re looking for the best student loans to finance your college education, we always recommend that you start by looking at federal student loans first. Federal loan types offer the same fixed interest rate for every borrower and provide multiple repayment plans, which aren’t typically offered by private lenders. However, if you’ve already taken out federal student loans but are still falling short of affording your dream college, then it may make sense to look at private student loan lenders to supplement your federal loans.

With that in mind, interest rates on private student loans can vary widely from lender to lender and also fluctuate based on several other factors, such as your credit score. We looked at five different private lenders to give you an idea of what your average student loan interest rate range may be on a private loan. Unlike federal student loans that have fixed rates, private loan interest rates are set by the lender and can vary based on a number of factors, including if you have a cosigner and the amount borrowed.

Fixed Interest Rates For Direct Loans First Disbursed On Or After July 1 2021 And Before July 1 2022

| Loan type | |||

|---|---|---|---|

| Direct Subsidized loans and Direct Unsubsidized loans | Undergraduate | 3.73% | 1.057% for loans first disbursed on or after Oct. 1, 2020, and before Oct. 1, 2022 |

| Direct Unsubsidized loans | Graduate or professional | 5.28% | 1.057% for loans first disbursed on or after Oct. 1, 2020, and before Oct. 1, 2022 |

| Direct Plus loans | Parents and graduate or professional students | 6.28% | 4.23% |

As you navigate the additional education costs, here are a few more things to know about federal student loans.

Also Check: Is Bayview Loan Servicing Legitimate

What Increases Your Total Student Loan Balance

We frequently receive emails from borrowers who have much larger balances on their debt than what they originally borrowed. This issue is so common that nearly half of all student loan borrowers have an increased balance after 5 years. In some cases, missed payments and late fees can explain the larger balances.

Student Loan Refinance Rates

If you already have student loans and are looking for better rates, refinancing could be a good option for you. However, if you plan to refinance your federal student loans, first consider the benefits you would be giving up, including income-driven repayment plans and student loan forgiveness. Still, you can explore student loan refinance lenders to see what would make the most sense for your student loans.

Keep in mind that interest rates are largely determined by your credit score, which indicates your ability to pay back the loan. If your credit score is not very high, you won’t qualify for the lowest rates available and should consider working to improve your credit score before applying or using a cosigner. Below, we’ve listed some of the best student loan refinance lenders and their rates.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Don’t Miss: How Can I Get An Rv Loan With Bad Credit

How Is Interest Calculated For Federal Student Loans

A daily interest formula determines how much interest accrues on your federal student loans between each monthly payment.

The simple daily interest formula looks like this:

Outstanding Principal Balance x Interest Rate Factor = Daily Interest Amount

- Outstanding principal balance: The remaining amount of principal left on your loan

- Interest rate factor: Your loans interest rate divided by the number of days in the year

Sample Daily Interest Rate Calculation

Xavier has an outstanding principal balance of $11,500 for his Direct Grad Plus loan with a 5.30% interest rate.

Interest rate factor = .053 / 366 = 0.000145 or 0.0145%

Daily interest: $11,500 x 0.000145 = $1.67

Each day, Xaviers loan balance grows by $1.67. When Xavier makes his monthly student loan payment, it covers the portion of the principal he owes, as well as the $1.67 per day interest that accrued since his last payment.

How Do You Pay Back Subsidized Loans

You can pay back your subsidized loan anytime. Still, most students begin paying their loans back after they graduate, and the loan payment is required six months after graduation, known as the “grace period” when the government continues to pay the interest due on the loans.

When your loan enters its repayment phase, your loan servicer will place you on the Standard Repayment Plan, but you can request a different payment plan at any time. Borrowers can make their loan payments online via their loan servicer’s website in most cases.

You May Like: Texas Fha Loan Limits 2020

Federal Student Loan Interest Rates Set To Rise For 2021

Federal student loan interest rates are considerably lower than they used to be. In fact, borrowers paid 6.80% on Direct Unsubsidized loans for the 2012-13 school year, which seems unfathomable right now considering our low-rate environment.

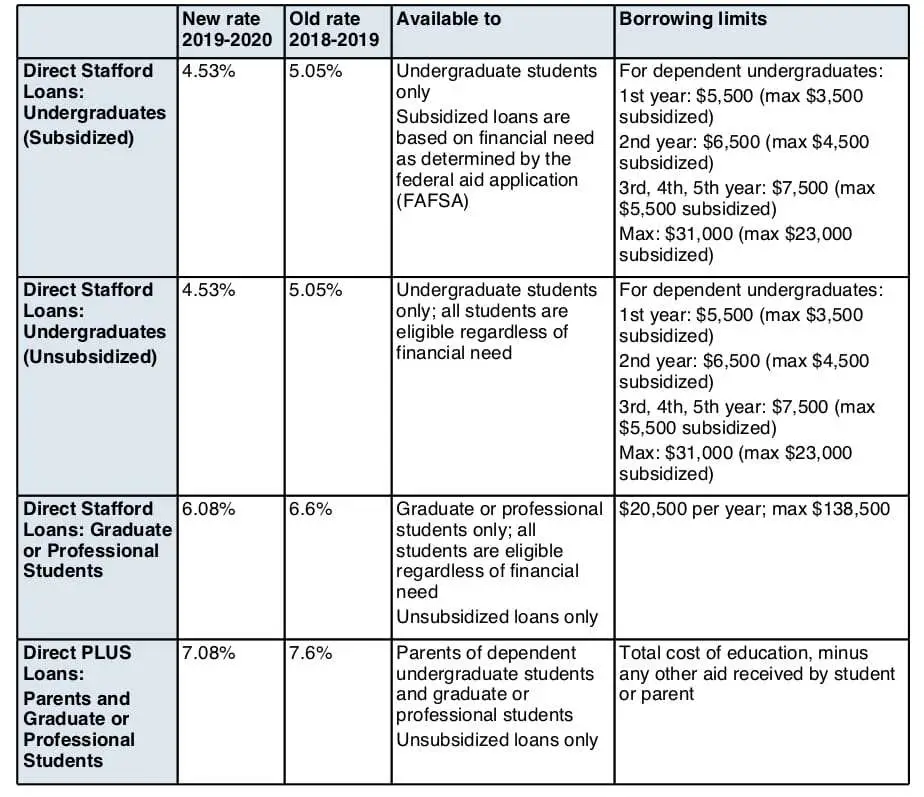

For Direct Subsidized Loans and Direct Unsubsidized Loans for undergraduate students disbursed on or after July 1, 2020, and before July 1, 2021, current rates are set at 2.75%. Meanwhile, graduate and professional students with Direct Unsubsidized Loans are paying 4.30%, and parents and graduate or professional students with Direct PLUS loans are paying 5.30%.

Every year, May brings along another change to federal student loan rates for July through June the following year. The rates are announced in June based on the May Treasury auctions, so we can know right now what the rates will be.

The new rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2021, and before June 30, 2022 will be as follows:

- Direct Subsidized or Unsubsidized Undergraduate Loans: 3.734%

- Direct Unsubsidized Graduate Loans: 5.284%

- Direct PLUS Loans: 6.284%

What do these new rates mean for you as a borrower? Maybe nothing, but it depends on the type of loans you have and other details of your situation.

Coin stack step up graph with red arrow and percent icon, Risk management business financial and … managing investment percentage interest rates concept

getty

The Bottom Line

What Is A Subsidized Loan

As the name implies, direct subsidized loans are a type of federal student loan that come with a subsidy for borrowers, making them one of the cheapest loan options available. The direct in their name comes from the William D. Ford Federal Direct Loan Program, the U.S. Department of Education initiative that makes these loans available. You may also see direct loans referred to by their old name, Stafford loans.

As soon as you take out a subsidized loan, interest starts accruing, but the government pays it on your behalf. As is true for most federal student loans, you are not required to make any paymentson interest or principalwhile in school or for six months after leaving school. That means that on a subsidized loan, there will be no interest to add to the principal when those six months are up, so youll only repay the original amount you borrowed.

The government covers the interest on a subsidized loan during the following periods:

- While youre in school at least half-time

- During your six-month grace period, which occurs after you graduate, leave school or start attending less than half-time

- During periods of deferment, a type of payment-postponement period youre eligible for when youre unemployed, are undergoing cancer treatment, meet income guidelines qualifying you for economic hardship and in certain other circumstances

Read Also: Usaa Auto Refinance

How To Calculate Apr

Now that we have the fees for each loan type, the next step to finding the APR is to estimate the monthly payment amount. Rather than breaking out the calculator or pen and paper, open excel or google sheets and type the following formula:

=PMT

Where:

- rate is the interest rate divided by 12

- nper is the number of payment periods, or months, you will make payments on the loan to repay it

- pv is the present value, or principal, of the loan

Now you can use that payment figure to calculate the APR in excel using the following:

=RATE

- nper is the same number of payment periods you used before

- pmt is sht monthly payment figure you calculated above

- pv is the principal amount

Direct Loan Interest Rates For 2021

On May 12, 2021, the Treasury Department held a 10-year Treasury note auction that resulted in a high yield of 1.684%. The chart below shows the interest rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2021 and before July 1, 2022.

Interest Rates for Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans First disbursed on or after July 1, 2021 and before July 1, 2022

Loan Type |

Don’t Miss: How To Transfer Car Loan To Another Person

Federal Direct Student Loan

Students will receive consideration for a Federal Direct Student Loan by completing the FAFSA and the funding comes directly from the federal government to the university. Students planning on borrowing a subsidized, unsubsidized or PLUS Loan for the first time are required to complete a Federal Direct Loan Master Promissory Note and Federal Direct Loan Entrance Counseling. Graduate students are eligible only for unsubsidized loans.

Applying For A Stafford Loan

Apply for a Stafford loan by completing a Free Application for Federal Student Aid form. This application is also used to determine if youll receive a Perkins loan, another type of federal student loan.

If you are not eligible for any federal student aid, look into private education loans to finance your education. No matter what your financial situation or credit history, you should be able to find a loan to help you pay for your own or your childs higher education.

Also Check: Genisys Loan Calculator

How The New Federal Loan Rates Impact Existing Student Loans

Heres how you can expect the new federal student loan rates to affect existing loans:

- Fixed-rate loans: If you have fixed-rate federal loans, your rates will remain the same over the life of your loan. This also means your payments wont ever change unless you sign up for a different repayment plan.

- Variable-rate loans: While new federal student loans come with fixed rates, you might have variable-rate federal loans if you borrowed before June 1, 2006. Unlike fixed rates, variable rates can fluctuate depending on market conditions which means your rate might change in the future. If you have questions regarding your variable rate, youll need to contact your loan servicer for details.

If you have excellent credit, you might be able to get a lower interest rate by refinancing your federal student loans. This could save you money on interest and even help you pay off your loan faster. You also have the option to switch from a variable rate to a fixed rate or vice versa through refinancing.

However, while you can refinance both federal and private student loans, refinancing federal student loans will cost you your federal benefits and protections so be sure to weigh your options carefully.

Keep in mind:

If youre thinking about refinancing federal loans, its likely a good idea to wait until after Jan. 31, 2022.

Use our calculator below to see how much you can save by refinancing your student loans.

Step 1. Enter your loan balance

Amount You Can Borrow

The U.S. Department of Education limits the dollar amount of subsidized and unsubsidized loans you can get each academic year . They also limit the total amount you can borrow over your graduate or undergraduate career . The limits vary based on your class statusthat is, whether you’re a freshman, junior and so onwhether your parents claim you as a dependent on their tax return, and whether or not your parents are eligible for a direct PLUS loan.

Currently, dependent students whose parents aren’t eligible for direct PLUS loans are limited to borrowing an aggregate of $31,000 in subsidized and unsubsidized student loans over four years of college only $23,000 of that amount can be in subsidized loans. Check out the U.S. Department of Education website to get the complete details on annual and aggregate loan limits and see what you may be qualified to borrow.

Don’t Miss: Does Fha Loan On Manufactured Homes