Heloc Cash Out Refinance Or Home Equity Loan

Before you tap your home equity, decide which loan option is right for you

Your home is your biggest asset. It can also be a good source of money to do things like pay for college, pay for home improvements, or consolidate high-interest debt. That’s because you can borrow against the value of your home equity to get cash when you need it.

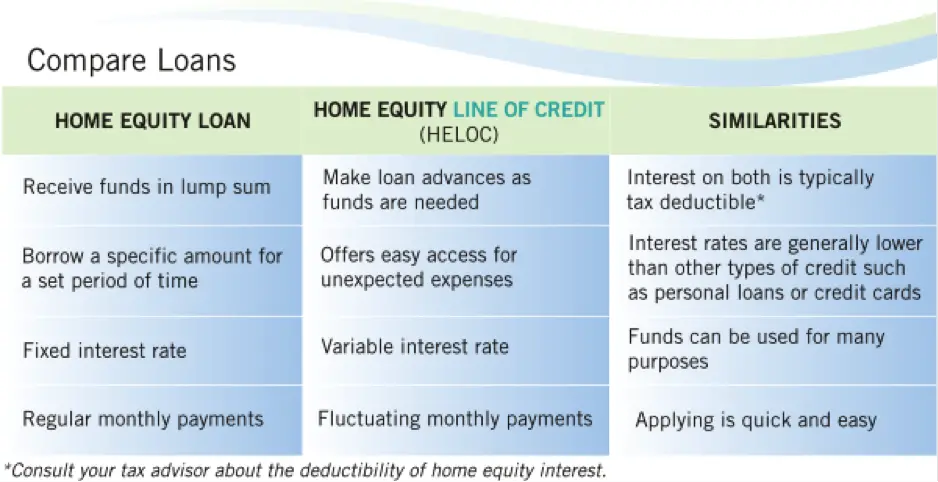

There are three ways to do this. You can get a home equity line of credit also known as a “HELOC”. You can get a cash out refinance, where you replace your current mortgage with a new mortgage for a higher amount and get the difference in cash at closing. Or you can get a home equity loan which is sometimes called a “second mortgage”. There are advantages and disadvantages to each one. We’ll explain the differences between these loans to help you choose the right one for your needs.

Which Is Better: A Cash

If refinancing wont lower your interest rate, you may want to consider a home equity line of credit or home equity loan instead. These are sometimes called second mortgages, but they wont replace your mortgage or change your mortgage terms.

A home equity loan gives you a lump-sum payout and uses your home as collateral. A HELOC also uses your home as collateral, but you can borrow money as needed until youve maxed out the line of credit or the draw period ends .

While the interest rate on a home equity loan or HELOC might be higher than what youd pay on a cash-out refi, you wont lose your current mortgage rate, and you might not have to pay as much in closing costs. You should crunch the numbers to figure out which option is best for you.

How You Receive Your Funds

Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage, including closing costs and any prepaid items any remaining funds are yours to use as you wish.

Home equity line of credit lets you withdraw from your available line of credit as needed during your draw period, typically 10 years. During this time, youll make monthly payments that include principal and interest. After the draw period ends, the repayment period begins: Youre no longer able to withdraw your funds and you continue repayment. You have 20 years to repay the outstanding balance.

Read Also: Commitment Fee On Mortgage

Are There Risks Associated With Home Equity Loans

Simply put, yes. Home equity loans are riskier than conventional refinances. But, for the financially responsible and disciplined, risk can be lessened.

Home equity loans mean you are borrowing against your home. The less equity in your home means less padding if something happens, and your homes value lessens. Borrowing against your home can also be risky should something happen to your income.

Using the equity youve tapped, in a smart way, is important for eliminating the risk associated with home equity loans.

Refinancing without a home equity loan carries less risk, especially if a borrower secures a fixed-rate loan. When done appropriately, conventional refinancing allows a homeowner to save money on their monthly mortgage payments, and/or offers better loan terms. Terms of a refinance are transparent from the beginning, so as long as a borrower can meet their financial obligations, the deal should be seamless.

Personal Loans Are Unsecured Putting Your Home At Less Risk

Secured borrowing happens when you provide security for a loan. You offer collateral and give the lender permission to repossess or foreclose on it if you default on the loan.

With a mortgage, your home is the collateral. A first or primary mortgage is usually the big one that you borrowed to buy the home. And you may have one or more second mortgages that are also secured on your home.

So, with these, youre quite literally putting your home on the line. And its at risk if you fail to keep up payments.

A personal loan is a type of unsecured borrowing.

A personal loan is a type of unsecured borrowing. The lender has no direct access to seize a particular asset.

There are advantages and disadvantages to this. Rates are typically higher for unsecured borrowing. Plus, the lender can demand repayment by other means if you stop making payments.

*TheMortgageReports and/or our partners are currently unable to service the following states MA, NV

Read Also: Usaa Car Loans Review

What Is A Cash Out Refinance

When you get a cash out refinance, you get a new mortgage. You pay off your current mortgage and replace it with a new one for a higher amount, taking out the difference in cash as a lump sum at closing. You get all the money at one time with a cash out refinance and cannot get additional money in the future from the loan. Because a cash out refinance involves getting a new mortgage, you will need to complete a new application, document your current finances, and pay a new set of closing costs.

Cash out refinances can be good choices if you know how much money you need. If you want to consolidate higher interest debts and loan payments you might choose a cash out refinance. If you are planning to complete home renovations and improvements, and know how much they will cost, you might also choose a cash out refinance. You may pay for college with cash out refinances too.

An advantage of cash out refinances is that you can also change the terms of your mortgage with them. For example, when interest rates are falling, you can use a cash out refinance to get money from your home equity and change your interest rate at the same time. You can switch from an adjustable rate to a fixed rate mortgage or change the number of years you have to pay back your mortgage with a cash out refinance too.

Pros of a cash out refinance:

Cons of a cash out refinance:

Applying For A Home Equity Loan Or Refinance

As with any mortgage application, youll need to provide many financial and personal documents during the application process for both a home equity loan and a refinance. These often include W-2 statements, proof of employment history, your Social Security number, and more. You may also need information like your most recent mortgage statement, proof of your homes valuation, any liens against your home, and more.

Recommended Reading: What Credit Bureau Does Usaa Use For Auto Loans

Equity Comes With Low Rates Tax Incentives

Home equity loans typically have lower monthly payments because their rates are lower than rates on personal loans, and theyre repaid over a longer period.

Home equity loan rates fluctuate between about 3% and 5%, while personal loan rates start around 6%. Rates on home equity loans are lower because theyre secured with your home, while personal loans dont usually require collateral. With either loan, your credit score, income and the loan term factor into the rate you receive.

Because personal loans and home equity loans both have fixed rates and payments youll know when you get the loan how much your monthly payment will be over the life of the loan. If you’re financing a home improvement project, you can usually deduct interest from a home equity loan or HELOC on your taxes, which isn’t the case for personal loans.

Greiser says personal loans can work for homeowners who dont want to use their equity or havent built up enough equity but do have enough cash flow to make the monthly payments.

» MORE: Best personal loan rates

Repayment terms are another factor in the loans affordability. You often repay a home equity loan over five to 15 years, while the typical personal loan term is two to seven years. Some personal loan lenders offer longer repayment terms of 12 to 15 years on home improvement loans.

If You Want To Tap Into Your Home Equity A Cash

Cash-out refinancing lets you take out a new mortgage for more than you owe on your existing one and keep the difference in cash. The amount you may qualify for depends in part on how much equity you have in your home.

You might use the money to invest in home improvements, consolidate high-interest debts or pay for other pressing needs but a cash-out refi isnt always your best option.

Well walk through how a cash-out refinance works, when it might make sense to consider and what alternatives you should weigh.

Read Also: How To Transfer Car Loan To Another Person

Confused About Home Equity

Current Mortgage Term and Rate: 5-year fixed at 3.50%

Years into Term: 1 year

Objective: Access equity for a kitchen remodel

Last year, Harry bought his first home. Fortunately, he was able to make a large down payment, so he already has a good amount of equity in his home. Unfortunately, his kitchen is seriously outdated and needs a massive renovation.

With the renovation expected to last eight months, Harry has decided to get a home equity line of credit to finance his kitchen remodel. This lets him access equity as he needs it.

Through a HELOC, Harry can access up to 80%* of the value of his home less what he currently owes on his mortgage. This means Harry can access $20,000 of equity:

Home Value x 80% Outstanding Mortgage = Available Equity$400,000 x 80% $300,000 = $20,000

*Its important to note that the HELOC amount cant exceed 65% of the homes value, but $20,000 ÷ $400,000 = 5%, which is much less than 65%.

Opening a HELOC is a good option for Harry, because the cost of refinancing would be very high. According to our mortgage refinance calculator, he would have to pay a $5,875 prepayment penalty to refinance.

A HELOC also gives Harry access to a revolving line of credit, so he can borrow money as he needs it throughout his kitchen renovation project. Note that Harry will now have to make a monthly HELOC payment, in addition to his existing mortgage payment.

Benefits Of Refinancing With A Home Equity Loan

If youre looking to refinance your mortgage for a lower rate, different loan terms or to get cash out of your home to use for any expenses, a home equity loan refinance may be for you. As mentioned, some HELs dont require cash at closing, which can represent significant savings, and you can put more towards the principal amount. In addition, home equity loans dont require mortgage insurance and may be up to 100% tax deductible under certain circumstances. Consult a tax advisor to learn more.

The best time to refinance your mortgage using a home equity loan is when you:

- Have significant equity

- Obtained your original first or second mortgage when rates were higher

- If you plan to sell your home in the next few years and can afford the monthly payment

- Will save more overall by reducing some fixed costs

Discover Home Loans offers mortgage refinance loans from $35,000 to $200,000 and no mortgage insurance is required. Your maximum loan amount is based on your credit score and combined loan-to-value . Usually, CLTV, which is your home equity loan plus your current mortgage balance divided by your homes value, must be under 90%.

Recommended Reading: How To Transfer Car Loan To Another Person

Change Your Term Or Get A Different Mortgage

Sometimes your needs change and you may have to pay off your mortgage faster or switch your mortgage type. If you get a bonus at work and want to put it towards your mortgage, consider refinancing into a term with more prepayment privileges, such as an open mortgage. Or, if interest rates have dropped, and you plan to stay in your home for the long haul, you can refinance to a fixed-rate mortgageOpens a popup. to lock in the lower rates.

You May Like: When Do I Pay Back Student Loan

Home Equity Takes Time To Build

If youre a new homeowner, you might not yet have enough equity in your home to borrow from, says Ryan Greiser, owner and certified financial planner at Opulus, a financial advisory firm based outside of Philadelphia.

Equity is the amount you owe on your home subtracted from its current value. Building it can take years, depending on how quickly you pay down your mortgage and how much your home value increases.

» LEARN MORE: How a home equity loan works

Lenders typically let you borrow up to about 80% of your equity with a home equity loan.

The amount you get with a personal loan, on the other hand, is often based solely on your creditworthiness and finances. These loans are available in amounts up to $100,000, but youll need strong credit and low debt compared to your income to qualify for the largest loans.

Both personal and home equity loans come in lump sums, so having a good idea of how much you’ll need before you apply is important. You cant easily go back and borrow more if you misjudge.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Using Home Equity Lines Of Credit To Invest

Some people borrow money from a home equity line of credit to put into investments. Before investing this way, determine if you can tolerate the amount of risk.

The risks could include a rise in interest rates on your home equity line of credit and a decline in your investments. This could put pressure on your ability to repay the money you borrowed.

Your Choice Based On Your Situation

Sometimes a personal loan is the smartest choice. Sometimes its not. At least you now know how to decide.

So get going. Explore the deals on offer and do the math to see which will cost you least, both each month and over the lifetime of the loan.

*TheMortgageReports and/or our partners are currently unable to service the following states CA, MA, NJ, NV, RI, WI

Read Next

Popular Articles

Resources

You May Like: Where To Get Best Car Loan Rates

Refinancing Vs Home Equity Loan: An Overview

Your home is not just a place to live, and it is also not just an investment. Your home can moreover be a handy source of ready cash to cover emergencies, repairs, or upgrades, obtained either through a mortgage refinancing or via a home equity loan.

Refinancing pays off your old mortgage in exchange for a new mortgage, ideally at a lower interest rate. A home equity loan gives you cash in exchange for the equity you’ve built up in your property as a separate loan.

Refinance Vs Home Equity: Which Is Right For You

There are a number of things to think about before deciding whether to refinance or borrow against the equity in your home.

Don’t Miss: How To Get Pmi Off Fha Loan

Apply For Your Mortgage Refinance With Confidence

Taking out any of these loans will affect the way you handle paying your mortgage going forward. Depending on which choice you make, your monthly payment can go up or down, or the length of your loan could change.

Be sure to reach out to a financial professional you trust if you need help choosing between using your homeâs equity or refinancing your loan to better terms.

Still looking for the right rate? We’re here to help.

What Are The Risks And Costs Of Refinancing

Make sure you factor in fees before you decide if refinancing is right for you. You need to pay appraisal costsOpens a popup., legal fees and possible prepayment charges. If you switch lenders, you may have to pay a discharge fee. Also, be aware that taking out home equity comes with risks. For example, if you switch from a fixed-rate mortgage to a variable-rate mortgage, you may deal with rising interest rates and higher monthly payments in the future.

You May Like: What Are Assets For Home Loan

Read Also: How Do I Refinance An Auto Loan