Home Equity Loans In Bc Canada How Do They Work

Home loans in BC, Canada usually create asecond mortgage charge against the borrowers house and reduce the actual homes equity.

Most highHELOCs ask for an outstanding credit balance and a reliable proof of income. Bad creditloans on the other hand, are secured by a lower LTV and are a lot easier to qualify for.

A home equity loan is usually, but not always, for a shorter term than a 1st Mortgage.

Reputation & Customer Support

To measure the consumer experience, we’ve looked at two main data sources, the total Consumer Financial Protection Bureau complaints, and the total CFPB complaints/originations. The Consumer Complaint Database collects complaints on a range of consumer financial products and services, and sends them to nearly 3,000 companies in order to give them a chance to respond. They dont verify all the facts alleged in these complaints, but they do take steps to confirm a commercial relationship between the consumer and the company.

It’s important to keep in mind that larger lenders will naturally have more complaints. In light of this, looking at the ratio of complaints to number of originations is a better indicator of how many complaints they receive for each loan they handle. This number is computed by dividing the total complaints by the number of loan originations and then multiplying by 100. Data reflects all mortgage-related complaints and is from the year 2013, the latest data available for both metrics.

Some Of The Disadvantages Of Using Your Home Equity

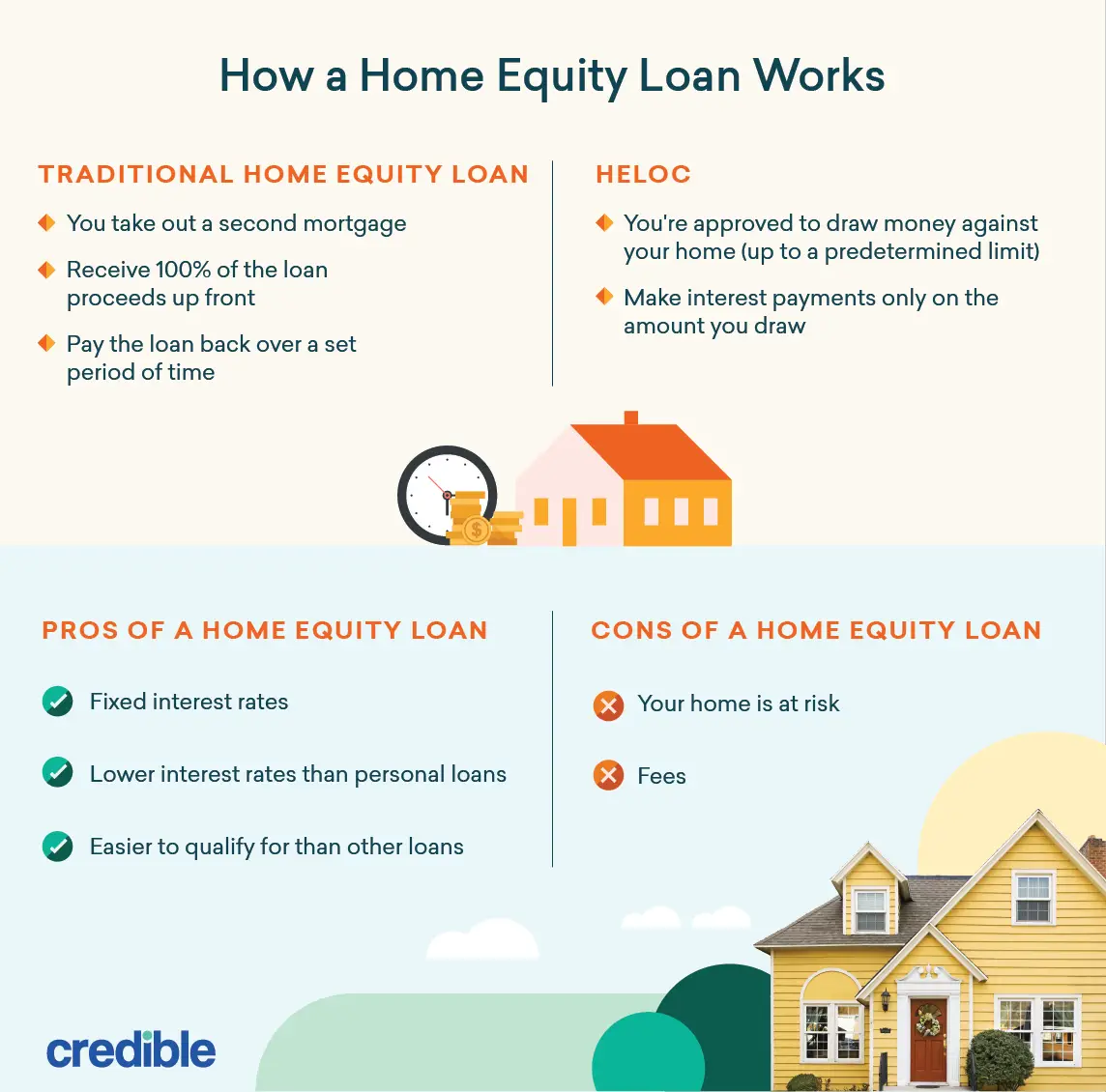

- You need to pay for various fees before you can borrow There are a number of costs that you have to pay for before you are allowed access to it, such as fees for the appraisal, the application, and legal documents.

- Variable rates = variable interest costs You might choose to borrow at a variable rate because initially, the rate might be cheaper than that of the fixed-rate option. However, be aware that if you choose a variable rate your interest rate can change.

- Using your equity for investment purposes comes with its own risks If you decide to use your home equity to make unsheltered investments, not only is it likely that you will have to pay taxes on them, but like any unsheltered investment, theres the possibility that you could lose your money because of how the stock market fluctuates.

- Failure to make your payments can result in your home being taken Defaulting on your payments can lead to your home being foreclosed. So, before taking out a second mortgage, you need to be absolutely certain youll be able to make regular payments.

Also Check: How To Get Approved For Hud Home Loan

Home Appraisals And Equity

A lender must get your home appraised to determine if you are eligible and the amount you can get. The appraisal of your home will inform the lender what your home is worth.

In most cases, the lender will allow you to borrow approximately 20% of the equity you have in your home. To determine how much you can get by an equity loan for your home, youll need to decide on your loan-to-value ratio. To do this, subtract the portion of your principal mortgage from the 80 percent of what is appraised for the home.

For example, if youre home is valued at $400,000, and the remaining portion of your mortgage balance is $100,000 This is how youd estimate the amount of loan you might be eligible for:

$320,000 x .8 = $320,000

That means that you could get $220,000 with an equity loan for your home.

Home Equity Loans Vs Refinancing

Second mortgages arent the only way to tap the equity in your home and get some extra cash. You can also do whats known as a cash-out refinance, in which you take out a new loan to replace the original mortgage. When your new loan is bigger than the balance on your previous one, you pocket the extra money. As with a home equity loan or HELOC, homeowners can use those funds to make improvements to their property or consolidate credit card debt.

Refinancing does have certain advantages over a second mortgage. The interest rate is generally a bit lower than that of home equity loans, and if rates have dropped overall, youll want your primary mortgage to reflect that.

Also Check: Can I Get Another Loan From Upstart

Check Out These Helpful Articles

footnote *Annual interest is calculated semi-annually, not in advance. All mortgage and Home Equity Line of Credit applications are subject to meeting Tangerine Banks standard credit criteria, residential mortgage standards and maximum permitted loan amounts. Conditions may apply. Interest rates are provided for information purposes only and are subject to change at any time without notice. The interest rate on your Tangerine Home Equity Line of Credit is set out in your Home Equity Line of Credit Agreement and is expressed as a variable interest rate per year equal to the Tangerine Prime Rate plus or minus an adjustment factor and will vary automatically when Tangerines Prime Rate changes. As of Mar 30, 2020, the Tangerine Prime Rate is . Prime Rate is the prime lending rate published from time to time by Tangerine and is subject to change without notice. You can find Tangerine’s current Prime Rate at tangerine.ca/en/rates .

What Can A Home Equity Loan Be Used For

As a homeowner, you can use home equity loans or second mortgages for almost anything you want. Since the money comes as a lump sum , many homeowners use them for large, one-time expenses, such as:

- Home repairs, upgrades, or large remodel projects

- Paying for kids college tuition

- Paying off high-interest credit card debt

Often, the interest rates on home equity loans or second mortgages are much lower than rates on credit cards, so this can make financial sense as an alternative to using a credit card if youre careful.

Also Check: Will Refinancing My Auto Loan Help My Credit

Home Equity Loans For Non Residence Of Canada

If you are not a Canadian Citizen or you are a Canadian Citizen or Permanent Resident PR but have lived outside of Canada for a period of time, home equity lenders will deem you a non resident. We have home equity financing available to you up to 65% loan to value. Meaning you can buy in major centers in BC with as little as 35% down. We have options on a case by case basis for home equity loans up to 80% loan to value. Conditions apply.

What Is A Second Mortgage

A home equity loan can be considered a second mortgage if the home equity loan is in second position. That means that you have a primary mortgage that would be paid out first in the event of a sale or foreclosure and an additional mortgage that would be paid out in second priority. The amount you can borrow will depend on the amount of your homes equity. Some second mortgages require the loan to be paid off over a set period of time, with payments that include both principal and interest. Others only charge interest during the term, with the principal remaining the same. Home equity loan requirements for a second mortgage can be lenient in certain circumstances and people with bruised credit and low or no income may be able to qualify.

In short, is a home equity loan considered a second mortgage? Answer: it depends. Now lets take a look at another type of home equity loan in Canada: the HELOC.

Recommended Reading: When To Apply For An Auto Loan

Why Choose A Heloc

Perhaps the biggest benefit of a HELOC is its flexibility. Thats what makes them so popular.

HELOCs offer attractive borrowing rates for large sums of moneyup to 65% of your homes value. If you use a credit union or lock part of the HELOC into a regular mortgage, you can borrow up to 80% of the homes value.

Rolling other debt into a secured credit line is an effective way to reduce interest costs on higher-interest borrowing, particularly credit cards. And it can also serve as:

- a handy rainy day or emergency fund

- investment capital

- business capital

- a source of funds to cover anything from medical expenses to renovations to a family members post-secondary education

- a full-fledged bank account

How To Apply For A Home Equity Loan After Your Home Is Paid Off

You can apply for a home equity loan or HELOC by visiting a local lenders branch office or filling out an online application. Youll need to provide the same types of documentation that you do when you apply for a mortgage.

Along with the information on your application and your credit report, the lender will want to see your pay stubs, W-2 forms, documentation of other sources of income, and the most recent monthly statements on all outstanding debts. The lender will also want to obtain an appraisal report in order to determine the current market value of the property, as well as at least 2 years of tax returns.

The lender will evaluate your credit history and total outstanding debt payments as part of the underwriting process to see if you meet the requirements. This is where it will help you to have paid off your home.

You established good borrowing behavior by paying off the debt, you no longer have that debt adding to your overall debt calculation, and you will be able to access the maximum amount of money that could be available based on the current market value of your property.

You May Like: How To Get 150k Business Loan

Best Home Equity Loans

If you’re looking for money to cover your home improvement project, consolidate debt or cover an emergency expense, a home equity loan might be the right answer for you.

See Mortgage Rate Quotes for Your Home

To help you find the best home equity loan for your needs, we’ve compared terms from over a dozen home equity lenders and compiled a list of the best ones.

Home Equity Loans: Dos And Don’ts

Home equity loans are an attractive borrowing choice because you get the best of both worlds: the freedom to use the funds for anything you want, just like you would with a personal loan or a credit card, but without the high interest rates and fluctuating payments.

Some of the best uses for home equity loans, include:

According to the Federal Reserves Consumer Credit report, the average credit card APR in the US is of 16.97% as per the latest information collected on August 2019, while personal loans have an average APR of 10.07%. Home equity loans can help you consolidate your payments and save money by offering considerably lower rates as low as 3.99%.

HomeAdvisors latest data revealed that the national average spent per home renovation project in the US was of $46,134 in 2019. Taking out a home equity loan for home renovations like a kitchen remodel, a new garage door, or to replace old plumbing can boost your homes value and even increase your equity. Additionally, the IRS allows you to partially deduct the interest paid on a home equity loan as long as the money was used to build or substantially improve your home.

This is one of the least talked about uses of home equity loans, but one of the most beneficial ones. If youve taken out a variable interest rate loan, you can use your equity to pay it off and turn it into a predictable, fixed-rate loan.

Recommended Reading: Is Homeowners Insurance Included In Fha Loan

Mortgages For Home Equity: A Comprehensive Guide

Home equity loans can be an excellent method of tapping into the equity in your home and getting funds if your assets are tied to your home. They are generally offered at lower interest rates than other consumer loans since theyre secured with your house, the same way as the mortgage you have in place.

Find out information on home equity loans along with other ways to benefit from your equity to determine whether theyre the right choice for you.

Home Equity Loan Vs Heloc

Home equity loans and home equity lines of credit are both loans backed by the equity in your home. However, while a home equity loan has a fixed interest rate and disburses funds in a lump sum, a HELOC lets you make draws with variable interest rates, like a credit card.

Generally speaking, if you’re planning on making multiple home improvement projects over an extended period of time, a HELOC may be the better option for you. If you’re thinking about consolidating high-interest credit card debt or doing a larger home improvement project that would require all of the funds up front, a home equity loan may be the best option.

You May Like: How Much Do You Need Down For Fha Loan

Home Equity Loans: What To Expect

Equity is the amount you get after subtracting your mortgage balance from your homes current fair market value. In other words, home equity is the figure that represents how much of that property you actually own. There are a few ways of accessing your home equity, but one of the most common and less risky ones is through a home equity loan.

Just like its name suggests, a home equity loan is a type of installment debt that allows you to borrow against your equity. With this type of loan, you borrow a certain amount at a fixed rate, which is then disbursed on a single-lump sum and is repaid through a series of regular monthly payments for a set period of time, also known as the term.

One of the main benefits of taking out a home equity loan is that you can use the funds however you want. Also, since youre using your home as collateral, interest rates tend to be much lower than those of unsecured debt, like personal loans and credit cards.

Other Equity Lending Options

Oftentimes, people confuse home equity loans with home equity lines of credit or cash-out refinance loans. Although all three loan products allow you to borrow against your home equity, have similar requirements, closing costs, terms and can be used for any purpose, theyre structured differently, particularly when it comes to how the funds are disbursed, how theyre repaid, and the type of interest they offer.

Comparing All Three

| YES |

Alternatives To A Home Equity Loan

A home equity loan is not the right choice for every borrower. Depending on what you need the money for, one of these options may be a better fit:

- Home equity line of credit : Like a home equity loan, a HELOC lets you borrow from your home’s equity. However, you’ll borrow from a credit line. Additionally, HELOCs have variable rates.

- Cash-out refinance: If you can qualify for a lower interest rate than what you’re currently paying on your mortgage, you may want to refinance your mortgage. If you refinance for an amount that’s more than your current mortgage balance, you can pocket the difference in cash.

- Reverse mortgage: With a reverse mortgage, you receive an advance on your home equity that you don’t have to repay until you leave the home. However, these often come with many fees, and variable interest accrues continuously on the money you receive.

- Personal loan:Personal loans may have higher interest rates than home equity loans, but they don’t use your home as collateral. Like home equity loans, they have fixed interest rates and disburse money in a lump sum.

Don’t Miss: What The Highest Apr For Car Loan

Loan Collateral And Terms

The equity in your home is used as collateral, which is why it’s called a second mortgage and works similarly to a conventional fixed-rate mortgage. However, there needs to be enough equity in the home, meaning the first mortgage needs to be paid down by enough to be qualified to borrow via a home equity loan.

The loan amount is based on several factors, including the combined loan-to-value ratio, or ratio. Typically, the loan amount can be 80% to 90% of the property’s appraised value. Other factors that go into the lender’s credit decision include whether the borrower has a good , meaning they haven’t been past due on their payments for other credit products, including the first mortgage loan. Lenders may check a borrower’s , which is a numerical representation of a borrower’s .

Best No Closing Cost Home Equity Loan

We picked Discover as our best no-closing cost home equity lender, thanks to its competitive rates, straightforward product and national focus. Discover’s home equity loans feature no origination fee, no application fee and, of course, no costs due at closing. It’s also one of a select few lenders who operate out of almost every state in the nation, with the exception of Iowa, Maryland and Texas, making them one of the most accessible options around.

Highlights: While Discover’s terms aren’t fancy, they’re easy to understand and competitive when compared to other national lenders. Discover offers a healthy range of loan terms, including 10, 12, 15, 20 and even 30-year home equity loans, distinguishing itself from the majority of competitors which tend to cap their terms at 15 years. As an online-only lender, Discover is also able to keep costs lower than many of its brick-and-mortar competitors its home equity rates start at an aggressive 4.99% for well-qualified customers, which is significantly lower than the national average of 5.79%.

- Terms: 10, 12, 15, 20 or 30-yr

- Max Loan Size: $150,000

- Maximum LTV: 4.99% – 11.99%

How to Get a Discover Home Equity Loan: Discover offers home equity loans in 47 states, but does not offer them in Iowa, Maryland or Texas. If you’re looking for an easy, no-fee home equity loan from Discover, click on the link above to get a quick quote today.

Recommended Reading: What Are Assets For Home Loan