How Credit Affects Your Home Buying Options

Your credit history directly impacts whether youre approved for an FHA mortgage. It also determines your mortgage interest rate. Borrowers with low credit scores and more recent credit problems have a higher risk of default. So they typically pay higher mortgage rates, which increases the cost of their loan. A higher rate means paying more in interest over the life of the loan, as well as a higher monthly payment.

How Do I Get Pre

Pre-approval for a bad credit mortgage requires careful consideration of your debt-to-income ratio, equity , the reasons for your bad credit history, etc. The most important thing you can do to prepare yourself for success is to partner with a lender that has a lot of experience with these types of loans.

What Are Todays Mortgage Rates

For todays U.S. home buyers, the Federal Housing Administration mortgage is among the most lenient and forgiving mortgage programs available. Find out whether youre FHAeligible.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Read Also: Usaa Pre Approval Car Loan

Hud Wants To Increase Lending To ‘underserved’ Borrowers

A few years ago, HUD launched an initiative to get lenders to relax and lower some of their overlays, particularly where credit scores are concerned. It’s all part of their “Blueprint for Access” program. According to the program announcement:

“… the average credit score for loans sold to is 752. Currently, there are 13 million people with credit scores ranging from 580 to 680. Shutting these consumers out of the market hurts American families … FHA is committed to finding ways to responsibly increase access for underserved borrowers.”

The Department of Housing and Urban Development is currently revising their policies and procedures to reduce lender overlays. According to HUD, lenders often impose these overlays because they are fearful of “back-end enforcement actions” resulting from improper underwriting and loan origination. In other words, they are afraid of being penalized for making bad loans, and later having to repurchase those loans. So HUD and FHA officials are currently working with lenders to ease these fears and, by extension, reduce the overlays on FHA credit score requirements.

“We want to work with lenders to provide clarity and transparency in FHA’s policies

to encourage lending to qualified borrowers across the credit spectrum,” HUD officials stated. “Our initial efforts are paying off as some lenders are already beginning to reduce overlays.”

Whats On Your Credit Is More Important Than Your Score

A borrower with a 580 credit score may actually be able to qualify, while a borrower with a 620 credit score is denied. Why your credit score is low is actually more important than your score. Consumers credit scores can be low for different reasons. Lets look at a couple of scenarios.

- Applicant 1 has a 600 credit score. They pay their bills on time, but their score is low because their credit cards are almost maxed out, and they havent had their account open for very long.

- Applicant 2 has a 620 credit score. All their credit cards have low balances, but they have several recent late payments bringing their score down.

Even though applicant 1 has a lower credit score, they are more likely to get approved for an FHA loan. Applicant 2 should qualify based on their credit score but likely will not because of recent late payments.

Also Check: Can I Transfer Car Loan To Another Person

What Credit Score Is Needed To Buy A House In Georgia

This is a good idea of the credit worthiness needed to buy a home in Georgia. The good news and the bad news is that there is no fixed or minimum credit rating that you should get when buying a home as it depends on many factors. Different loans have different requirements. Loans guaranteed by Freddie Mac and Fannie Mac have a minimum credit rating of 620 and FHA loans have the lowest credit rating of 580.

Can I Get A Home Loan With No Credit Score

Like FHA loans, USDA allows borrowers to get a loan without a credit rating. In most cases, they prefer a non-traditional credit report, but a rental history and three additional business references may be acceptable as long as they have a 12-month payment history and the credit source can be independently verified.

Recommended Reading: Www.upstart.com/myoffer

What Are Fha Loans

FHA mortgage loans are government-backed home loans guaranteed by the Federal Housing Administration and offered by private lenders. They require a mortgage insurance premium of 0.80% 1.05% and an upfront MIP fee of 1.75% of the loan amount.

- 500 credit score with a 10% down payment

- 580 credit score with 3.5% down

- 50% maximum debt-to-income ratio

- 1.75% upfront MIP fee

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Don’t Miss: Manufactured Home Va Loan

Borrowers With No Credit

It is possible to get an FHA-insured mortgage with no credit score or history. While traditional lenders require at least two lines of credit. Borrowers with no credit score can qualify using non-traditional credit lines. This includes utility and cell phone bills, insurance payments, and proof of rent payment.

What Is The Minimum Credit Score For An Fha Loan

An FHA loan requires a deposit of at least 3.5% with a credit rating of 580 and above. If you can pay a 10% deposit, your credit score can be between 500 and 579. Rocket Mortgage® requires a minimum credit score of 580 for FHA loans.

Recommended Reading: Does Va Loan Cover Manufactured Homes

What Is The Loan Approval Criteria For An Fha Loan

FHA loans are federally insured loans issued by private lenders. The FHA mortgage insurance premium is paid for by the homeowner at the time of the loan closing. Loans are only available to buyers with a credit score of 500 or higher, but credit scores can go up to 580. Buyers with a credit score of 500-579 are allowed to buy if they pay for the mortgage insurance upfront. There are also special programs for people with lower credit scores. The maximum amount that you will be able to borrow based on your total household income is 84 percent of what it would cost to rent the same home in the area.

Can You Apply For An Fha Loan More Than Once

There’s good news and there’s bad news here: FHA loans aren’t limited to first-time home buyers, and there’s no restriction on how many times you can take out an FHA loan in your lifetime.

However, because these loans are for primary residences only, you generally can’t have more than one at a time. There are some exceptions, however, such as if you’re relocating for an employment-related reason or if you’re permanently vacating a jointly owned property .

Read Also: Usaa Used Car Loans

History Of The Fha Loan

Congress created the Federal Housing Administration in 1934 during the Great Depression. At that time, the housing industry was in trouble: Default and foreclosure rates had skyrocketed, loans were limited to 50% of a property’s market value, and mortgage termsincluding short repayment schedules coupled with balloon paymentswere difficult for many homebuyers to meet. As a result, the U.S. was primarily a nation of renters, and only one in 10 households owned their homes.

In order to stimulate the housing market, the government created the FHA. Federally insured loan programs that reduced lender risk made it easier for borrowers to qualify for home loans. The homeownership rate in the U.S. steadily climbed, reaching an all-time high of 69.2% in 2004, according to research from the Federal Reserve Bank of St. Louis. As of the second quarter of 2021, it was 65.4%.

What You Need To Know About Fha Loans

While VA loans are restricted only to the military, FHA loans have different requirements. They’re sometimes referred to as first-time home buyer loans, since they can be a good “foot-in-the-door” to homeownership for many people

The U.S. Department of Housing and Urban Development insures Federal Housing Administration mortgage loans. As a result, the loans are less risky for lenders. Because of the decreased risk, borrowers only need a down payment of 3.5% . Plus, borrowers can have lower credit scores. and if you have a down payment of 10%, the credit score requirement drops to 500.

This means that FHA loans might be a good option for first time borrowers with lower credit scores and lower down payments. So, as long as you meet the FHA minimum credit score and other requirements, this loan option may be the best one for you. However, there are notable expenses that come along with this loan type.

For example, buyers have to pay a one-time fee of 1.75% of the home cost at closing. This can often be added to the loan financing. Similarly, buyers who had less than a 5% downpayment have to pay 0.85% of loan total every year throughout the term of the loan. Once again, this can be added to your monthly payments.

FHA loan amounts and requirements vary by state. To learn more about your options, check the HUD.gov state directory.

Read Also: Does Usaa Do Auto Loans

Dont Close Your Credit Cards

If you dont use a credit card anymore or have just paid off the entire balance, your first instinct may be to close it and never look back. The credit bureaus think otherwise. The longer you hold onto a credit card and use it responsibly, the better you look on your credit report. For any card you dont intend to use as a primary credit card, charge a monthly bill to it and set the cards balance to be paid automatically each month. That way youre reaping the benefits of an old credit card without the hassle.

Qualifying For An Fha Loan

Your lender will evaluate your qualifications for an FHA loan as it would any mortgage applicant. However, instead of using your , a lender may look at your work history for the past two years . As long as you’ve re-established good credit, you can still qualify for an FHA loan if you’ve gone through bankruptcy or foreclosure. It’s important to keep in mind that, as a general rule, the lower your credit score and down payment, the higher the interest rate you’ll pay on your mortgage.

Along with the credit score and down payment criteria, there are specific FHA mortgage lending requirements outlined by the FHA for these loans. Your lender must be an FHA-approved lender, and you must have a steady employment history or have worked for the same employer for the past two years.

If you’re self-employed, you need two years of successful self-employment history this can be documented by tax returns and a current year-to-date balance sheet and profit-and-loss statement. If you’ve been self-employed for less than two years but more than one year, you may still be eligible if you have a solid work and income history for the two years preceding self-employment . You must have a valid Social Security number, reside lawfully in the U.S., and be of legal age in order to sign a mortgage.

Your front-end ratio needs to be less than 31% of your gross income. In some cases, you may be approved with a 40% ratio.

The chart below lists the 2021 loan limits:

| 2021 FHA Loan Limits |

|---|

| $2,372,625 |

Read Also: Can I Refinance My Sallie Mae Loan

Add Utility Bills And Rent Payment History

The most common items on your credit report are students loans, credit cards, mortgages, and personal loans. But you can also self-report other regular payments to credit bureaus. Meyer says some utility companies and landlords allow you to opt in to the credit bureaus, so each payment is recorded on your credit report. If you make your electric bill and rent on time each month, this is an easy way to potentially boost your credit score by a few points.

Downsides Of Fha Loans

- Mortgage insurance can be costly. You may pay a price for making a small down payment. Youll have to pay a one-time upfront mortgage insurance premium, as well as an annual premium thats collected in monthly installments. The one-time premium is generally equal to 1.75% of the home purchase price and can be financed in the mortgage or paid for in cash but not a combination. The annual premium depends on your loan amount and loan-to-value ratio.

- Theres a limit to how much you can borrow. The FHA establishes loan limits based on median home prices in metro areas and counties. As of July 2020, the FHA maximum for a single-family home in a low-cost area is $331,760 while its $765,600 in a high-cost area. Alaska, Hawaii, Guam and the Virgin Islands are exceptions with a maximum of $1,148,400 for a single-family unit. These loan limits change periodically, so be sure to check for updated information. The Department of Housing and Urban Development has a search tool on its website to identify mortgage limits by county and state, so you can find out how much youre able to borrow where you live.

- Good credit? Consider other options. If you have strong credit and dont have enough money for a large down payment, you still might want to consider other options because of FHA loans mortgage premiums. Just keep in mind that if you dont put at least 20% down, youll likely have to pay private mortgage insurance, or PMI.

Don’t Miss: Usaa Used Auto Rates

Fha Dti Ratio Standards

You must show lenders you have the means to make your monthly loan payments consistently.

Lenders use several tools to assess your ability to repay a loan. One of the most important is a number called the debt-to-income ratio . Your DTI ratio is the total of all of your debt divided by your gross monthly income. The lower the ratio, the less of a debt load you carry.

Whats Next: Is An Fha Loan Right For You

If youre considering an FHA loan, here are a few more things to think about before you apply.

- Whats my budget for a home?

- How much money can I put toward a down payment?

- Whats my credit like?

- Do I want to buy a fixer-upper? A new build?

- Am I OK paying more each month for mortgage insurance?

- Do I have a preferred lender?

You should shop carefully among lenders to find the loan thats best for your situation and consider all of your options before making a long-term commitment.

About the author:

Read More

You May Like: Texas Fha Loan Limits

What Are Some Fha Loan Alternatives

If youre not sure if an FHA loan is right for you, there are a few other options to consider.

- Conventional loan A conventional loan means your mortgage isnt part of a government program. There are two main types of conventional loans: conforming and non-conforming. A conforming loan follows guidelines set by Fannie Mae and Freddie Mac such as maximum loan amounts. A non-conforming loan can have more variability on eligibility and other factors.

- USDA loan A USDA loan, also called a rural development loan, may be an option for people with low-to-moderate incomes who live in rural areas. They can be attractive because they offer zero down payments, but youll have to pay an upfront fee and mortgage insurance premiums.

- VA loanVA loans are made to eligible borrowers by private lenders but insured by the Department of Veteran Affairs. You may be able to make a low down payment . Youll probably have to pay an upfront fee at closing, but monthly mortgage insurance premiums arent required.

Gifts As Down Payments

You must show proof of the gifted down payment by asking the donor to provide a letter with a statement that the money is a gift without expected repayment. The donor will also need to provide proof of the account from which he withdrew the funds. You cannot receive the gift in cash. Cashier’s check and money order are the preferred method, with a copy of both sides of the check and the bank statements showing where the money was taken from and deposited to.

You must document the source of any large sums of money deposited to your account recently, other than your regular paycheck. What the lender considers a large sum might be as little as $500.

Also Check: Va Second-tier Entitlement Calculator

Lenders Can Set Higher Minimums

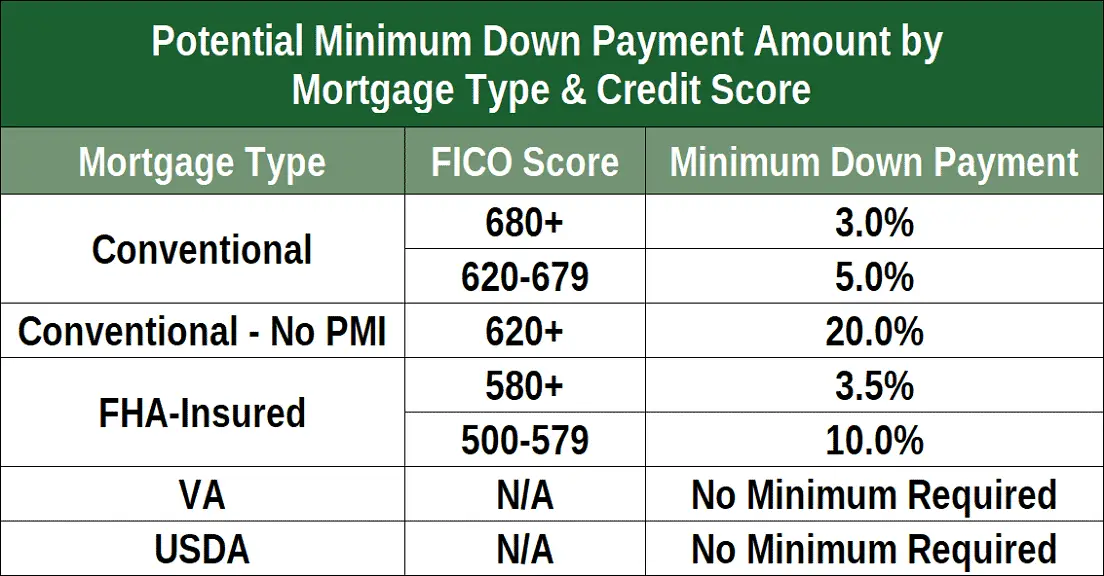

To recap, the minimum credit score needed for an FHA in 2020 is 500. But there’s a catch. Most mortgage lenders today will not offer financing to a borrower with a score that low.

Remember, you’re not borrowing money from the Federal Housing Administration. You’re borrowing it from a lender in the private sector. The loan is only insured by the FHA. So you have to meet the lender’s minimum credit-score requirements in addition to HUD’s guidelines.

Most lenders set their standards higher than the official program minimums shown in the table above. This is known as an “overlay,” because the mortgage company is laying its own requirements over HUD’s. Because of these overlays, a borrower who meets FHA’s minimum score requirement could still be turned down by the lender.

It raises the question: What credit score requirements are mortgage companies using in 2020, for borrowers seeking an FHA loan? This is a harder question to answer because it varies from one lender to the next. There is no industry-wide rule. Based on our research, it seems most are drawing the line somewhere between 600 and 620 these days. They might require even higher scores for conventional home loans. But for FHA, the current minimum seems to lie between 600 and 620.

Just note that these numbers are not set in stone. Lenders often make exceptions for borrowers who have strengths in other areas, such as a long history of paying bills on time.