Do Uber Drivers Qualify For Loans

Yes, Uber drivers qualify for loans.

The only puzzle that needs solving is whether a loan is the right move.

Unfortunately, its a puzzle youll have to solve yourself.

If you plan to supplement a stable income by driving with Uber, a loan is ideal.

It means youll always have your income for support with bank payments.

Its unlikely youll have any problem keeping up with bank payments and still making ends meet.

If Uber is your primary source of income, youll need to consider your options.

Start by researching the income potential for Uber drivers in your area.

Your research will help you answer the question of whether youll be able to meet loan payments and still have enough to live decently.

Its a decision that needs careful contemplation.

Loans for Uber drivers are fixed borrowing schemes.

And, the ridesharing business is fluid.

Car payments come with zero consideration for slow months.

Can I Get A Loan Working For Doordash

Drivers for DoorDash, referred to as Dashers, are not employees of the company and should not expect to borrow from it. Just as with the independent drivers who work for Uber, drivers at DoorDash can avail themselves of outside loan providers, bolstered by their earnings and bank records.

During the application process for an online personal loan or some other type of borrowing, DoorDash drivers must identify themselves as a small business owner or sole proprietor, not an employee.

You must apply as a small business owner or sole proprietor to get a loan as a DoorDash driver.

This article reviews online personal loan companies that cater to borrowers with bad credit. You may qualify for an unsecured personal loan from one of these services if you meet the income and other requirements.

Can I Use My Car As Collateral

Yes, Uber and Lyft drivers who will opt for a business term loan may use their cars as collateral. Any tangible hard assetsuch as real estate, equipment, invoices, and inventorymay be used to collateralize your loan. However, you may need to hire an appraiser to verify the true value of your asset before the lender makes a decision.

In a typical setup, the borrower should provide collateral thats as valuable as the loan amount they are seeking. Some stricter lenders may even require the borrowers collateral to cost higher than the amount theyre applying for to reduce their risk.

Also Check: How To Refinance An Avant Loan

How Long Does It Take To Get Approved For An Sba Loan

SBA loans arent known for quick-turnaround times. If youre seeking to get approved within daysand receive your cash within a week or lessthese loans might not be for you. An alternative lender might be a better choice for quick financing. Expect to spend time preparing your documents, applying, and hearing back about the status of your SBA loan. Some SBA lenders may give you a reply within 3-10 business days, but getting the funds will take longer. SBA Express loans can sometimes get approval within 24-48 hours from the SBA, but the loan wont close that quickly. If you need money faster, again, alternative loans might be a better option.

Additional Sba Loan Requirements

In addition to the specifications above, SBA lenders may have other criteria to help them determine whether youre a good credit risk.

- Capital Requirements How much money do you seek? Having a number in mind, along with your intended use for the cash, will help the bank see your vision for the future and their funding. It also demonstrates that you understand the requirements set by the SBA on how loan proceeds can be used. A cash flow report can help here.

- Financial future Do you have your business forecasts for the next few months? How about the next year? Be ready to show the bank that youve budgeted for the future, including how youll pay back the loan.

- Collateral If you dont have business assets to secure a loan, many SBA business loans require you to put up your home, vehicle, property, or other personal assets as a loan guarantee against non-payment. Make a list of real or fixed assets. The lender may not require you to completely collateralize a loan, but they will require all the collateral that you have.

Recommended Reading: How To Remove Pmi From Fha Loan

Can Uber Drivers Apply For A Ppp Loan

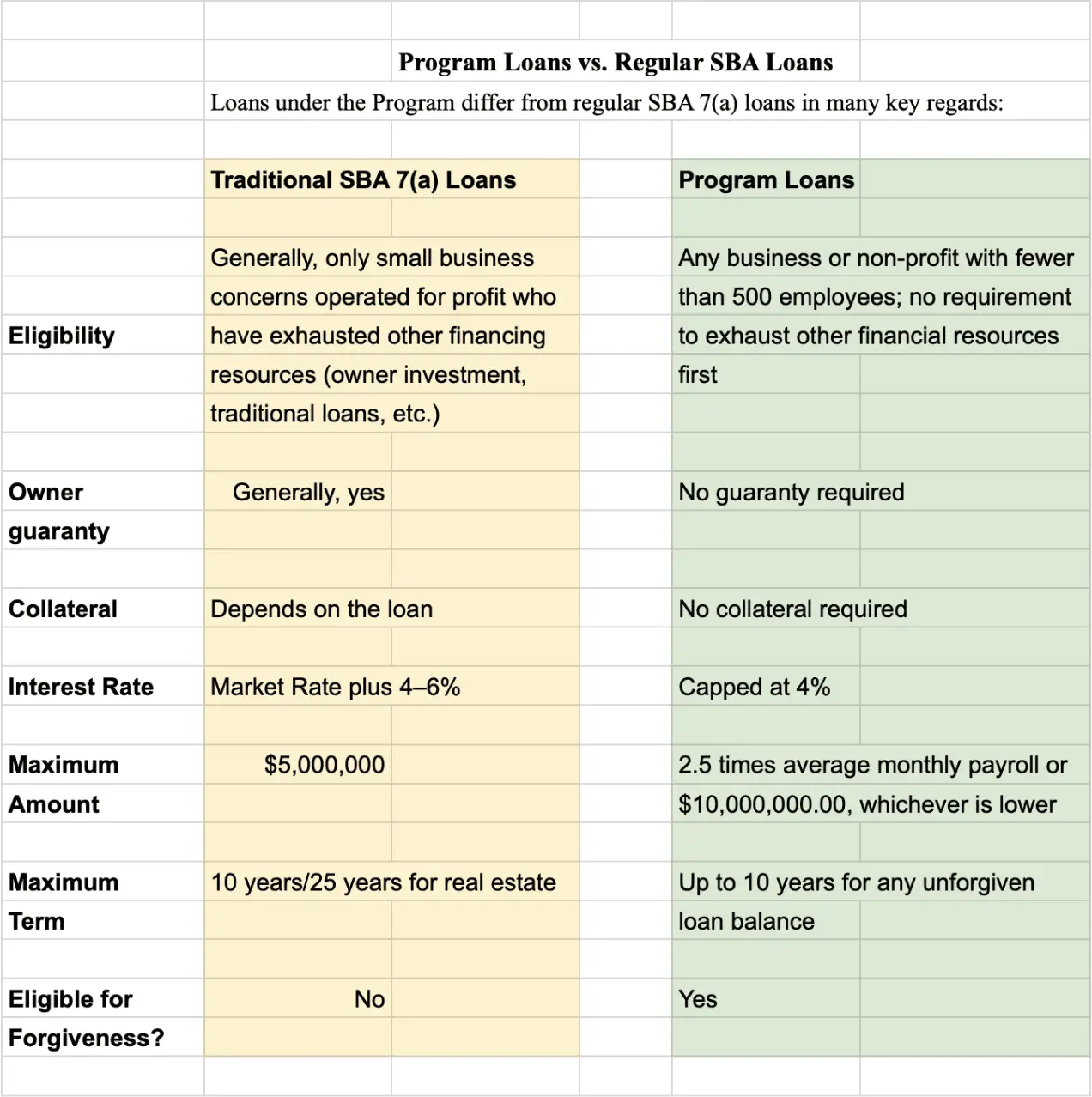

The Paycheck Protection Program first appeared in the 2020 CARES Act. PPP provides loans to many types of businesses, including to self-employed individual contractors like drivers at Uber and the other rideshare and food delivery companies. The purpose of the PPP is to help small businesses keep workers on payrolls and potentially make them eligible for loan forgiveness.

A second draw of PPP loans continued availability through May 31, 2021 thanks to the American Rescue Plan signed by President Biden in March 2021. You can follow the application process for a PPP loan if you are a self-employed individual who files Schedule C with Form 1049.

PPP isnt affected if you are collecting unemployment benefits, but be aware that if you are still partially working, your unemployment benefits may be reduced.

PPP loans can be forgiven if the proceeds are used to pay for certain expenses:

- Up to 24 weeks of payroll costs in which compensation level is maintained. At least 60% of loan proceeds must be spent on payroll, without deductions.

- Up to 40% of the loan amount used for other forgivable expenses. These include business payments for mortgage interest, rent, and utilities. Youll have to submit the appropriate documentation to prove these business expenses.

You can apply for loan forgiveness at any time up to the loan due date. Borrowers can defer loan payments up to 10 months. SBA Form 3508 or one of its variants can be used to request PPP loan forgiveness.

Below You Will Also Find Information About Medallion Debt Forgiveness Food & Meals Help For Parents And Students And More

ALL DRIVERSwho are unemployed or are partially employment may apply for unemployment. We have created step-by-step resource guides to help you.

App drivers are considered employees and are eligible for State Unemployment. Use this step-by-step guide to apply.

Yellow & Green Drivers are eligible for the federal Pandemic Unemployment Assistance program. Use this step-by-step guide to apply.

Read Also: Who Has The Best Student Loan Refinance Rates

Navs Final Word: Sba Loan Requirements

As a small business owner, you need to stay apprised of financing options so that, should the day come that you want to grow your business, you know the best financing solution for your needs.

Even if right now you dont plan to apply for an SBA loan program, its still a wise idea to work on building your credit and organizing your finances so that, down the road, if you decide to apply, you are likely to qualify for one of these loans.

Find Funding Fast

Have at it! We’d love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Leave a Reply

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

You May Like: How To Get The Best Used Car Loan

How Much Money You Might Get

The PPP loan is intended for one purpose and one purpose only: to provide you with income while youre unable to work. The loan program was designed so you can use the proceeds to pay your basic business expenses in order to keep yourself afloat.

In order to qualify for a PPP loan, the maximum amount of annual net income for sole proprietors is $100,000. That would be a massive load of rideshare trips and delivery runs, so lets use a more realistic number.

Say your Schedule C shows that your net profit in 2019 was $50,000.

Divide that by 12 $50,000 ÷ 12 = $4,167

Now multiply that by 2.5 $4,167 x 2.5 = $10,418.

This represents approximately 10 weeks of income for you. Plug in your own numbers, and see what you come up with.

What The Ppp Loan Program Is

When COVID-19 was declared a pandemic in March 2020, U.S. government officials were faced with a crisis of catastrophic proportions. A national emergency was declared, and ensuing stay-at-home orders were issued by governors in most states.

This was necessary to keep COVID-19 containedbut it devastated small businesses. Many were forced to close down temporarily, and in some cases permanently. Millions of small business owners, including independent contractors and gig workers, were in desperate need of help.

In response to the needs of workers throughout the nation, Congress enacted the Coronavirus Aid, Relief, and Economic Security Act.

Among other provisions, the legislation included first-time opportunities for independent contractors to collect unemployment benefits. It also offered loans that allowed small businesses to keep their workers paid, even though the businesses werent allowed to be open so employees could do their jobs.

If youre wondering what a PPP loan entails, here are some points to remember:

If youre wondering how youd qualify for a PPP loan when you dont have employees, dont sweat it. Because of a concept developed by the Small Business Administration called owner compensation replacement, self-employed individuals such as independent contractors and gig workers are allowed to claim a portion of their loan to make up for lost income due to COVID-19.

Heres how it works:

You May Like: How To Calculate Interest Over Life Of Loan

Secured Car Loans & Secured Personal Loans

Secured car loans and secured personal loans are options suitable for individuals without the best credit or income that may not be approved for unsecured loans.

Secured loans allow you to qualify for relatively low interest rates by using your car or something else as collateral for the loan.

If you add a cosigner to your application, you may also be able to qualify for a substantially lower interest rate. However, if you miss payments, you may lose the car, which, if youre an Uber driver, would result in loss of income.

Personal Loans For Delivery & Rideshare Drivers

These networks will match you to a lender that specializes in personal loans for customers with bad credit. Drivers are welcome to apply, whether you work for big names like Uber, Lyft, DoorDash, Postmates, and GrubHub, or for lesser-known companies like Amazon Flex, GoPuff, and Ridejoy, to name a few.

All of these online lender-matching services can give you immediate decisions and next-day funding with a minimum of hassle.

| 3 to 72 Months |

See representative example |

The direct lenders on the CashUSA.com network regularly approve personal loans to bad-credit consumers seeking a wide range of loan amounts and repayment term options. The company prequalifies applicants living in the United States who are 18 or older, earn at least $1,000/month after taxes and can provide a valid phone number, email address, and bank account number.

Prequalified applicants are immediately transferred to an online lender that will quickly render a decision and fund successful applicants as soon as the next business day. These services are free the lending companies earn revenues when a network lender closes a loan. You are never under obligation to apply for a loan or to accept a loan offer.

| 3 to 72 Months |

See representative example |

Also Check: What Are Typical Loan Origination Fees

Do Business Loans For Uber Drivers Exist

There are a few options available. First, you could take out a personal loan or business loan that can be used for a variety of purposes, including car repairs, maintenance, and more.

Second, there are online lenders that specialize in providing financing to gig economy workers.

Finally, Uber itself offers a program called Uber Pro that provides discounts and other perks to high-performing drivers. While the options are somewhat limited, business loans for Uber drivers do exist.

Sba Loan Rates And Credit Scores

With most types of small business loans, your credit scores not only determine whether you qualify but may also affect the interest rate you pay. Most SBA loan rates are quite affordable to begin with, and maximum rates are set by the SBA. However, some SBA loan rates may be determined in part by credit. For example, a portion of CDC 504 loans are made by a bank or financial institution which can set the rate for that portion of the loan.

Read Also: How Do I Get My Student Loan

How Can I Prove My Income As A Delivery Or Rideshare Driver

Most drivers working today are most likely to be self-employed individuals rather than employees. Indeed, the controversy came to a head in California after the state legislature in 2019 passed Assembly Bill 5, reclassifying many workers in the gig economy, including delivery and rideshare drivers, as employees. In 2020, voters approved Proposition 22, and the legislature passed AB 2257, which restored independent contractor status to drivers.

As independent contractors, drivers do not receive pay stubs, but there are several alternative ways to prove income:

- Form 1099: Independent contractors and the IRS receive a copy of Form 1099 each year no later than January 31. The form reports non-employee compensation of $600 or more for the previous calendar year.

- Monthly earnings summaries: Many of the rideshare and delivery companies issue monthly earnings summaries that drivers can print out or receive in the mail.

- Weekly earnings screens: Your company may have an online screen or dashboard showing your earnings for the week. You can take screenshots of these to build up a record of your earnings over time.

- Bank statements: Your monthly bank statements should show deposits from your company that demonstrate your earnings.

Create A Business Plan

You may not need a business plan to get an SBA loan. Not all loans or lenders require them. However, some will. And even if they dont, the information in your business plan can provide you and the lender with the information you need to demonstrate your ability to repay the loan. If you dont have one, get free business plan help at your local SBDC or from a SCORE mentor.

Also Check: How Much Home Loan Can I Get On 90000 Salary

What Is The Best Company To Refinance Auto Loan With

Category: Loans 1. Best Auto Refinance Loans of 2021 Investopedia PenFed Credit Union is our top choice for auto loan refinancing from a credit union. The lender features widespread availability and competitive rates. Pros & Final Verdict · Compare Providers 3 days ago Our Top Picks for Best Auto

Additions Ways To Use An Sba Loan

If your vehicle meets the qualifications of being accepted into the Uber family, and needs an upgrade, you can do that with a loan. Uber has strict requirements about which vehicles are allowed to be under their banner. First of all, if your vehicle is more than 15 years old, you will need to replace it.

Cars 10 years old or younger stand a better chance of being accepted. In this case, you can upgrade your vehicle. If there is any visible cosmetic damage or missing pieces, you can take your vehicle to a qualified body shop to do the work.

It may sound easy to qualify for an SBA loan, but it is not as simple as it sounds. To apply is simple, as far as answering the questions on the application. However, when it comes to actually getting the money, steps must be taken to enhance your chances of meeting the eligibility status.

However you decide to spend the loan, it is up to you. Uber drivers can apply for a line of credit, if they own their own Uber or a business loan based on a decent credit score.

Recommended Reading: How Much Construction Loan Can I Get

A Small Business Loan Can Be A Great Solution For Funding With Low Rates Allowing You To Protect Your Cash Flow

What It Is?

An SBA loan is a long-term, low-interest loan that is funded in part and gauranteed to the bank by the government.

Easily Reliable

General Overview

Much like the other products we provide, the money can be used for just about any business purpose adding to working capital, refinancing and other debts, or even equipment purchasing.

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Read Also: When Does Jackson Hewitt Start The Holiday Loan 2021