Details: Best Home Equity Loan Rates In 2022

A variety of lenders offer home equity loans that let you borrow against your homes value. Most are fixed-rate loans, which protect you against payment hikes because the interest rate and monthly payment remain the same over the life of the loan. However, some lenders offer better loan terms, lower rates or fewer fees.

Current home equity loan rates range between 3 percent and 12 percent, depending on the lender, loan amount and creditworthiness of the borrower. Our list of the best home equity loans for 2022 can help you decide which loan might work best for your needs.

- Best home equity loans for low rates: Discover

- Best home equity loans for different loan options: BMO Harris Bank

- Best home equity loans for homeowners with limited equity: KeyBank

- Best home equity loans for fast funding: Spring EQ

- Best home equity loans for flexible loan terms: Flagstar Bank

- Best home equity loans for low fees at a national bank: U.S. Bank

- Best home equity loans for customer support: Third Federal

- Best home equity loans for low fees at a regional bank: Frost

- Best home equity loans for branch network: Connexus Credit Union

- Best home equity loans for customer experience: Regions Bank

How To Calculate Your Home Equity

To calculate your home equity, estimate the current value of your property by looking at a recent appraisal, comparing your home to recent similar home sales in your neighborhood, or using the estimated value tool on a website like Zillow, Redfin, or Trulia. Be aware that these estimates may not be 100% accurate. When you have your estimate, combine the total balance of all mortgages, HELOCs, home equity loans, and liens on your property. Subtract the total balance of what you owe from what you think you can sell it for to get your equity.

Why Is Home Equity Important

Homeownership and home equity has long been an avenue to build wealth. As you reduce your mortgage debt, your home gains value over time and becomes an asset. Other major purchases dont tend to appreciate the way a home does over time. Vehicles, for example, lose value the minute you drive them off the lot and continue depreciating rather than increasing in value.

Home equity and the personal wealth it can build isnt meant to be treated like a cash jar. Buying a home provides a basic need, but its also meant to be a long-term investment for most people. Your home equity can be a resource when you need to use it, but it should be used with careful consideration and planning.

You May Like: What Is Home Loan Insurance

Get Money From Your Home Equity Line Of Credit

Your lender may give you a card to access the money in your home equity line of credit. You can use this access card to make purchases, get cash from ATMs and do online banking. You may also be given cheques.

These access cards don’t work like a credit card. Interest is calculated daily on your home equity line of credit withdrawals and purchases.

Your lender may issue you a credit card as a sub-account of your home equity line of credit combined with a mortgage. These credit cards may have a higher interest rate than your home equity line of credit but a lower interest rate than most credit cards.

Ask your lender for more details about how you can access your home equity line of credit.

Pros Of Getting A Fixed

For risk-averse borrowers exploring HELOC options, there are benefits to selecting a fixed rate that are worth considering.

-

Fixed-rate HELOCs safeguard your loan from rising interest rates. This can save you money in the long run if interest rates go up.

-

You know exactly what youll be paying, making long-term financial planning easier.

-

Some lenders allow you to revert to a variable rate if rates go down, so locking your APR doesnt necessarily mean gambling on a rate increase.

Also Check: Is Freddie Mac An Fha Loan

What Are The Minimum Requirements

Many lenders have fixed LTV ratio requirements for their home equity loans, meaning you’ll need to have a certain amount of equity in your home to qualify. Lenders will also factor in your credit score and income when determining your rate and eligibility.

Minimum requirements generally include a credit score of 620 or higher, a maximum loan-to-value ratio of 80 percent or 85 percent and a documented source of income.

Real Estate Equity Loan

- Fixed amount of funds in one lump sum

- Fixed rate for the entire term of the loan

- Predictable monthly payments

- 5 and 10 year repayment terms

| Annual Percentage Rate | |||

|---|---|---|---|

| 5 Year Equity Loan-to-Value up to 80% 4.115% | 5 Year Equity Loan-to-Value greater than 80% to 90.00% 4.615% | 10 Year Equity Loan-to-Value up to 80% 4.365% | 10 Year Equity Loan-to-Value greater than 80% to 90.00% 4.865% |

Don’t Miss: How To Loan Money To Family Legally

Is A Heloc Right For You

As with any other major financial decision, before you take out a HELOC, think about your financial needs and your current situation. A HELOC is a great option if you want flexibility and think you may be able to pay it off early. For example, if you’re obtaining a HELOC to perform renovations on your home prior to selling it, the value added to your home outweighs the amount you will have to pay in interest on the HELOC.

Because of its flexibility and low monthly payments, a HELOC may be a better choice than a conventional loan in some situations. For example, for many parents in Canada, obtaining a HELOC is a useful vehicle to assist their children in making a down payment on a first home.

If you’re unsure as to whether getting a HELOC is the right choice for you, it helps to speak with a mortgage broker, who can give you expert, personalized advice for free.

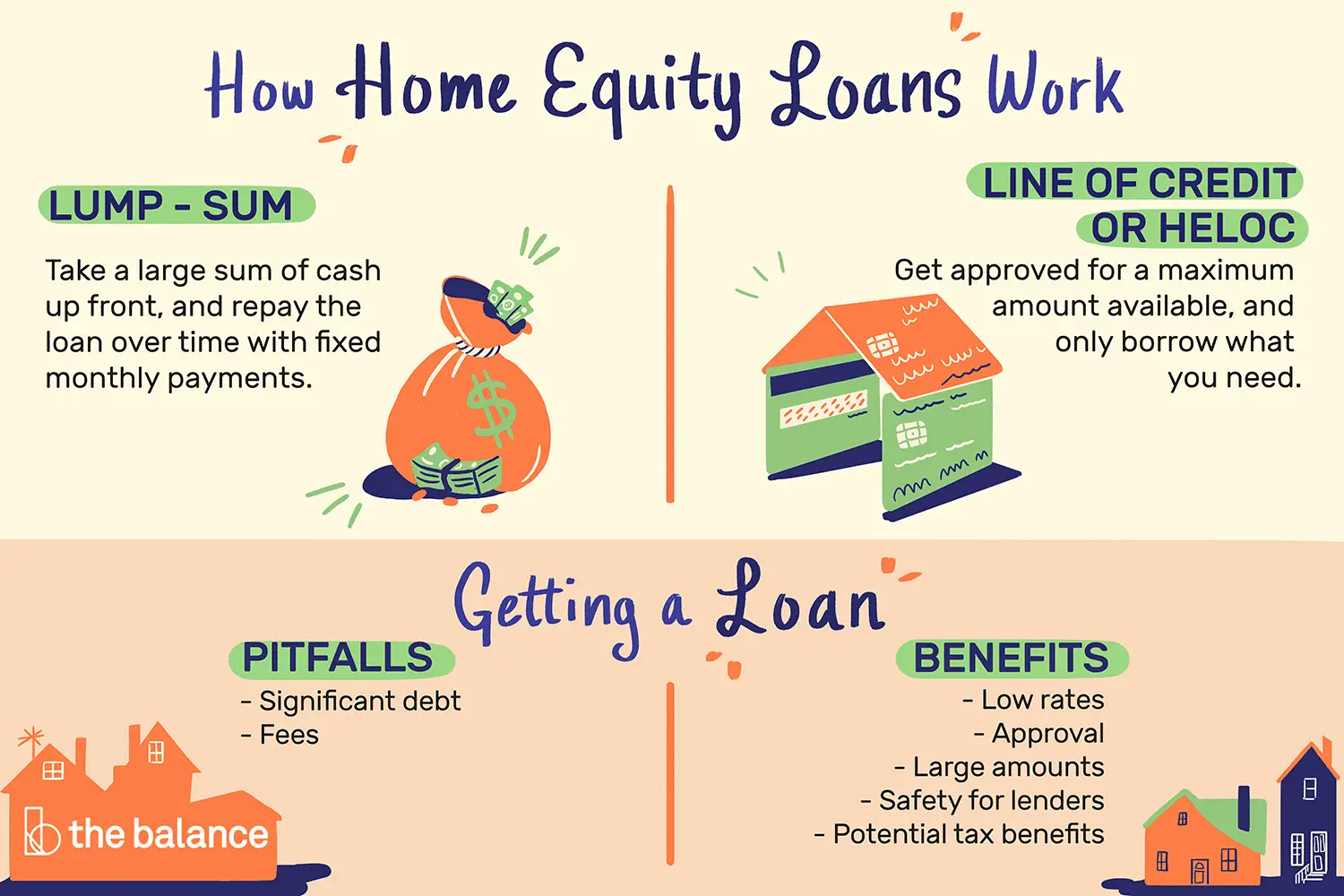

Home Equity Loan Pros And Cons

-

Cant take out more for an emergency without another loan

-

Have to refinance to get a lower interest rate

-

May lose your home if you cant make payments

A home equity loan provides you with a one-time lump sum payment that allows you to borrow a large amount of cash and pay a low, fixed interest rate with fixed monthly payments. This option is potentially better for people who are prone to overspending, like a set monthly payment for which they can budget, or have a single large expense for which they need a set amount of cash, like a down payment on another property, college tuition, or a major home repair project.

Its fixed interest rate means borrowers can take advantage of the current low interest rate environment. However, if a borrower has bad credit and wants a lower rate in the future, or market rates drop significantly lower, they will have to refinance to get a better rate.

Don’t Miss: Can I Refinance My Car Loan With The Same Bank

Calculating A Home Equity Line Of Credit

As per the Office of the Superintendent of Financial Institutions , a HELOC can give you access to no more than 65% of the value of your home. It’s also important to remember that your mortgage loan balance + your HELOC cannot equal more than 80% of your home’s value.

To see how this works, let’s look at an example:

The maximum amount of equity you could pull from your home through a HELOC is $105,000.

Now, you still need to make sure that $105,000 doesn’t exceed 65% of your home’s value. To be sure, simply divide the HELOC amount by the value of your home:

In this example, you could access $105,000 through a HELOC, as it only amounts to 30% of your home’s value.

How To Evaluate Your Homes Equity

You can figure out your homes equity by subtracting the amount you owe on your mortgage from your homes appraised value. That formula looks like this:

Current home appraisal value mortgage balance = home equity

For example, lets say you want to get a $50,000 home equity loan and the current market value of your home is $300,000. You have a 30-year mortgage with a remaining balance of $180,000. $300,000 minus $180,000 equals $120,000. You currently have $120,000 in home equity, 40% of your homes total appraised value.

Lenders also review your loan-to-value ratio and CLTV ratio. When you already have an existing mortgage, your LTV compares your mortgage balance to the appraised home value. In our example, your LTV ratio would be 60%. That equation looks like this:

x 100 = LTV ratio percentage

Determining your CLTV ratio can help you see if you meet the 85% maximum required by most lenders. To determine CLTV, add the desired loan amount to your current mortgage balance, then divide that number by the current appraised value. Finally, multiply by 100 to turn that number into a percentage:

/ home appraisal value x 100= CLTV ratio

In our example, you would add $50,000 to $180,000, then divide that number by $300,000. Multiply by 100 to get a 77% CLTV ratio, which most lenders would approve.

Recommended Reading: Is An Fha Loan Assumable

What Is A Home Equity Loan And How Does It Work

A home equity loan is a lump sum that you borrow against the equity youve built in your home. Most lenders will let you borrow up to 80 percent to 85 percent of your homes equity, that is, the value of your home minus the amount you still owe on the mortgage.

These loans have fixed interest rates and typical repayment periods between five and 30 years. Because your home serves as the collateral for a home equity loan, a lender can foreclose on it if you fail to make the payments.

Home equity loans are available at many banks, credit unions and online lenders. You may use these funds for a range of purposes, including debt consolidation, home improvement projects or higher education costs. The amount you can borrow depends on how much equity you have, your financial situation and other factors.

After reviewing your application and checking your credit, the lender will tell you how much you can borrow, your interest rate, your monthly payment, your loan term and any fees involved. Once you agree to the loan terms, the financial institution will disburse funds as one lump sum. You then repay the loan over time in fixed monthly payments.

The Line Of Credit Based On The Equity You Have In Your Home

Community Resource Home Equity loan options include fixed and variable rates with flexible terms. In some cases, you can borrow up to 85% of the available equity in your home for home improvements, debt consolidation, education, or other major purchases. Apply now or call to speak to a Financial Services Representative.

Don’t Miss: How Do I Get Out Of Car Loan

Best Uses For A Home Equity Loan

While home equity loans can be used for almost anything, taking out a loan for something you can pay for another way or don’t need can be expensive in the long run. For that reason, financial experts generally advise being careful with what you use loan money for.

Some of the best uses to make the most of your loan include:

- Home improvements: Because these can often add value over time, using your home’s value to increase the value can be helpful.

- Education: Home equity loans generally have a lower interest rate than student loans.

- Debt consolidation: Using home equity to help with debt consolidation may give you better interest rates so you can get your finances on track.

- Emergency expenses: If you don’t have the funds for an immediate need, home equity loans can give you money with much more favorable interest rates than something like a payday loan.

- Investments: Although risky, using home equity on investments may increase your financial portfolio over time.

Fully Amortizing Or Partly Amortizing Term

A fully amortizing term means youll pay off the whole fixed-rate balance during the fixed-rate term. A partly amortizing term means youll still have an outstanding balance at the end of the fixed-rate term, which will then revert to a variable rate.

Taking longer to pay off your balance means paying more interest, especially if the variable rate it reverts to is higher than the fixed rate you were paying.

Also Check: How To Cancel My Student Loan Debt

When Is A Heloc Better Than A Home Equity Loan

A HELOC is a better option than a home equity loan if:

- You need a revolving credit line to borrow from and pay down variable expenses.

- You want a credit line available for future emergencies but dont need cash now.

- You are deliberate in your spending and can control impulse spending and a variable budget.

Home Equity Borrowing Limits

Most banks and lenders do not allow you to borrow 100% of the value of your home. Your combined loans against your home, including mortgages and home equity loans, typically cant exceed 80% to 90% of the value of your home. This is known as your Loan-to-Value ratio .

To determine your current home value, banks will want a recent appraisal. You can then borrow a percentage of that market value. If your home appraises for $200,000 and you owe $140,000, the equity in your home is currently worth $60,000.

You cant borrow the full $60,000, though. If youre allowed to borrow up to 90% of your homes value, your total combined loan balances cant exceed $180,000 . Since you already owe $140,000, you could only borrow another $40,000.

Lenders may also have maximum or minimum loan balances for their home equity loans, which could limit the amount youre allowed to borrow as well.

You May Like: How Long Does Student Loan Approval Take

Whats The Difference Between A Fixed And Variable Rate

When you take out a loan, its common to pay the lender something extra on top of the amount borrowed to make it worth their while. This charge is what refer to as interest, and it can be either fixed or variable.

A fixed-rate loan applies the same interest rate for the duration of the borrowing period. The cost to borrow the money is set before you agree to take on the loan and remains the same until the debt is repaid unless otherwise specified.Variable-rate loans work in the opposite way. When taking this path, borrowing costs periodically fluctuate, moving up and down.

Variable rates are tied to the movements of a specific financial index tasked with reflecting how much the wider economy is paying for credit. The index on which your loan is based will be listed in your loan documents. Common benchmarks include:

- The Wall Street Journalprime rate

Interest rates on home equity loans are determined by inflation prospects, general borrowing costs, and the applicants individual circumstances, such as their , debt-to-income ratio, and combined loan-to-value ratio.

How We Chose The Best Home Equity Loans

To narrow down our list of best home equity loans, we vetted each mortgage lender by evaluating them on the following criteria:

- Loan features: We evaluated the types of loans offered, minimum and maximum loan amount, interest rates, loan terms and credit score requirements for each lender.

- Price transparency: We preferred lenders that openly disclose loan costs, discounts, fees and other charges on their website.

- Application process: We checked eligibility requirements and approval times. In addition, we compared application and evaluation fees, and whether application services were available online, by phone and/or in person.

- Reputation and customer satisfaction: We looked into two main data sources: J.D. Power’s 2021 U.S. Primary Mortgage Servicer Satisfaction Study and complaint data as reported by the Consumer Financial Protection Bureau .

Don’t Miss: Do You Get Student Loan All At Once

Tax Benefits Of Homeownership

Before the 2018 tax bill passed homeowners could deduct the interest expenses on up to $100,000 of debt from home equity loans & HELOCs, but interest on these loans is no longer tax deductible unless it is obtained to build or substantially improve the homeowner’s dwelling.

If you are planning on taking a large amount of equity out of your home it may make more sense to refinance your first mortgage, as first mortgages & mortgage refinance loans still qualify for the interest deduction on up to $750,000 of mortgage debt.

Homeowners who had up to $1 million in mortgage debt before the new tax law was passed will still retain the old limit even if they refinance their homes.

How Much Money Could You Save By Refinancing at Today’s Low Rates?

Our home refinance calculator shows how much you can save locking in lower rates.

How Does A Heloc Work

A HELOC gives you a set credit limit that is based on your appraised home value, which will require ahome appraisal. Your HELOC limit can also be determined by your existing debt and credit history. Youâre able to borrow funds from your HELOC or repay your HELOC at any time. With most HELOC lenders, you can access your HELOC funds at any time through online banking, at a branch, an ATM, or by using a cheque. Some HELOC lenders can also let you use your HELOC through a debit card or Visa access card.

You will only pay interest on the amount that you borrow. This will be through an interest-only minimumpayment for your HELOC.However, your HELOC won’t be interest-only forever. After a certain period of time has passed, known as your HELOC’s draw period in your agreement, you’ll have to start repaying the money that you have borrowed.

Don’t Miss: What Is Fast Cash Loan