Will Home Loan Interest Rates Go Down In 2021

Interest rates are at historically low levels but are gradually increasing over the course of 2021. While we cant say whether this will remain a trend, you should monitor rates closely and be prudent with your property purchases.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyGuru will endeavour to update the website as needed. However, information can change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time.Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs.PropertyGuru does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyGuru, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.

What Is A Lock

The lock-in period restricts you from partial/full prepayment of your home loan. Refinancing is considered a full prepayment of your existing home loan. If you choose to refinance before the lock-in period ends, you may have to pay a hefty partial/full prepayment penalty, which is typically 1.5% of your outstanding principal.

If you’ve received legal subsidies taking the home loan, the bank will also likely require you to refund the amount if you refinance during the lock-in period.

Can I Take 2 Home Loans At A Time

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Recommended Reading: How Long For Sba Loan Approval

What Is A Fixed Home Rate Loan

Contrary to what its name may suggest, the interest rates of a fixed home rate loan in Singapore typically only remain fixed for two or three years.

After the fixed interest rate period is over, the interest rates for the FHR loan will be pegged to SIBOR, FDR or other reference rate determined by the bank, which may have an equal or higher interest rate than a floating rate home loan, depending on bank spread.

The bank spread is the additional percentage that the bank earns from you in addition to the cost of lending you the principal.

The typical lock-in period of an FHR loan matches the period of fixed interest rate.

How To Get Rid Of Student Loans Debt Without Paying

Category: Loans 1. Debt Forgiveness: Escape Your Student Loans Investopedia Forgiveness eliminates your debt forbearance postpones your payments. If youre having trouble making student loan payments, you can ask your lender for Teacher Loan Forgiveness Program · Public Service Loan Forgiveness May 28, 2021 Instead of ignoring your debt,

Recommended Reading: Becu Auto Loan Payoff

Floating Rate Loan Explained

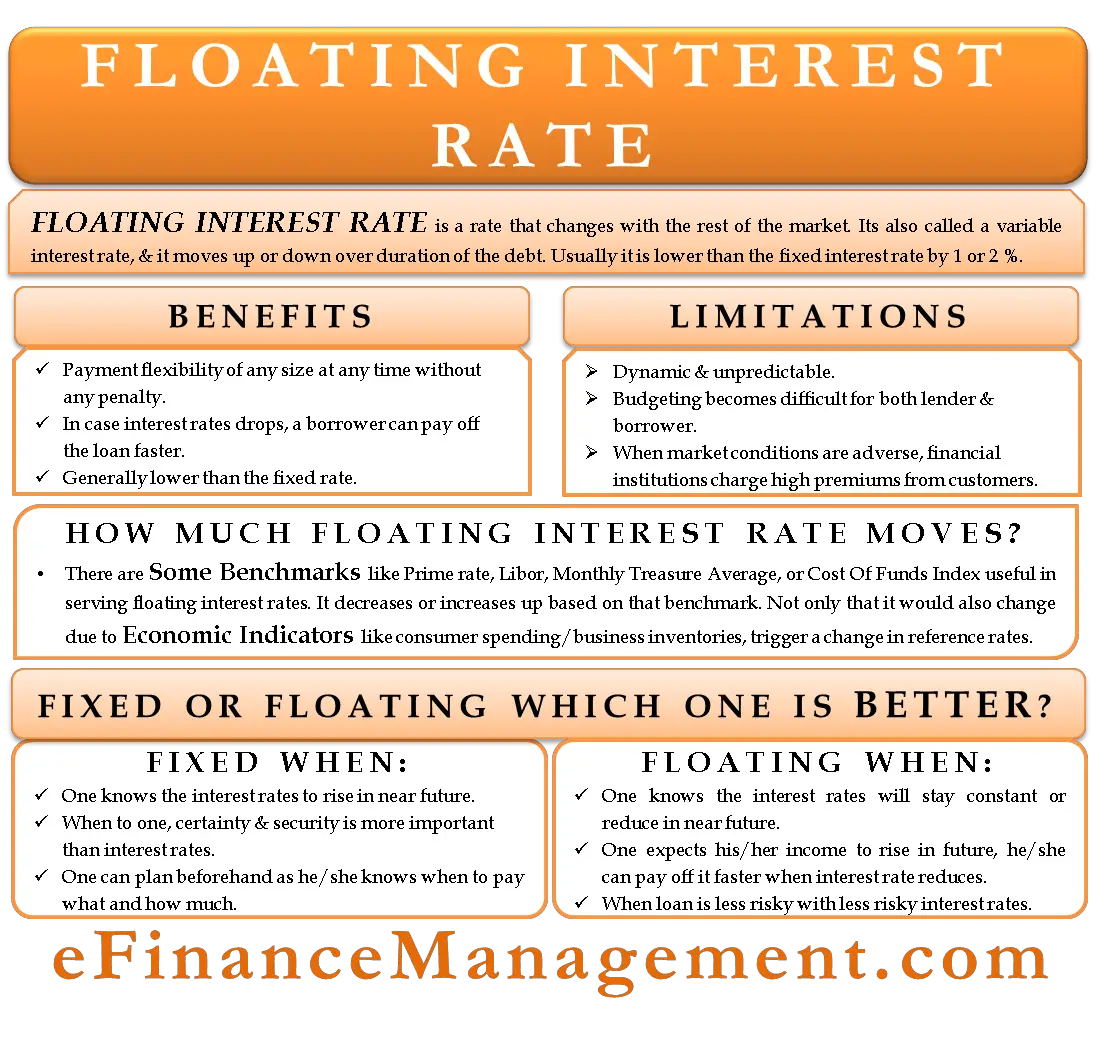

A floating interest rate is also known as an adjustable or variable interest rate. The name comes from the fluidity of the interest rate that borrowers must contend with, as the interest percentage fluctuates throughout the life of the loan . The interest rate is affected by the markets margins or mortgage index.

Floating interest rates may sound like a rip-off, but in general, they can be much lower than that of a fixed rate due to the risk the borrower is taking in that the rate can increase and result in an increased monthly payment. Typically with a floating rate loan, the initial interest rate is set lower than what a borrower could get from a fixed-rate mortgage loan.

A Mortgage Rate Float

- A float-down may also be an option with some banks and mortgage lenders

- It allows you to lower your already locked-in interest rate for a small fee

- The option goes into effect if rates fall significantly after you lock in your rate

- At that time you may be given the option to re-lock at the lower rate despite previously locking your loan

Aside from floating and locking, you might also be given the option to float down your rate. Be sure to ask your broker or loan officer about their float-down policy when inquiring about pricing.

A float-down is an option that becomes available once you lock your rate to take advantage of potential interest rate improvements after the fact.

For example, say mortgage rates fall dramatically after you lock. Go figure!

If they do, you could have the one-time option to float the rate down to current levels for a cost.

This allows you to take advantage of interest rate decreases if you want an even lower rate, despite already being locked in on an earlier date.

However, as noted, there is a cost to the float-down, and it could be quite significant. Theres also no guarantee rates will improve once you lock.

The cost of a float-down will range from bank to lender, and could run anywhere from .125% to .375% of the loan amount to take advantage of current pricing.

So for higher loan amounts, say on a jumbo home loan, it could be a pricey option.

Just make sure you stay in the home long enough to recoup the fee.

Also Check: How To Transfer Car Loan To Another Person

Using The Manual Emi Calculation Formula

No matter the home loan interest rate in India, you can compute EMIs the traditional way using a formula. However, this can be time-consuming and increases the possibility of making errors. Here is the formula.

EMI = /

Here, âPâ is the principal or loan amount, ârâ is the rate of interest and ânâ is the tenor in months.

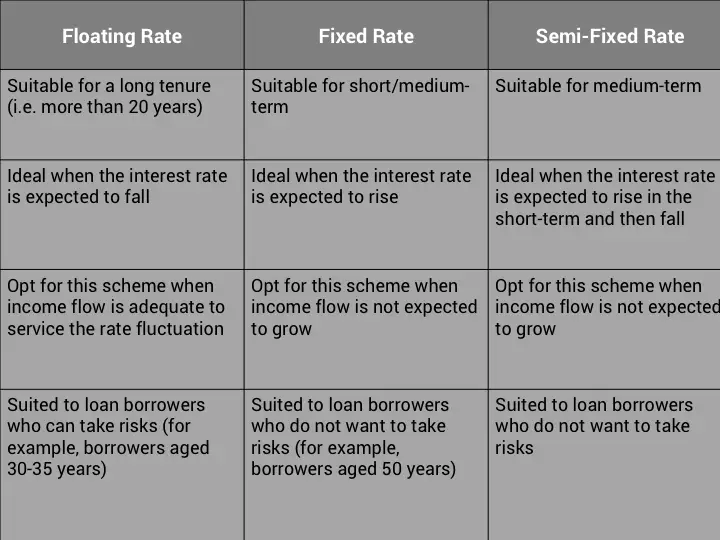

If You Still Cannot Decide

If you are still unsure about which kind of housing loan is suitable for you, opt for a combination loan which is part fixed and part floating. This is especially suitable for you if you have other loan repayments presently and your cash flows have been planned to meet your loan obligations for the first 3-5 years during this term, you can opt for a fixed rate. After this phase, you can opt for the floating option for the balance term of the housing loan.

It is normally difficult to predict future home loan rates. It may so happen that the housing loan interest rates move contrary to your expectation, which may leave you with an unfavorable interest rate option on hand. But you need not worry too much about making a wrong decision regarding your housing loan. Remember, you also have the option to switch between a fixed rate and floating rate housing loan at any point in time lenders would usually levy a nominal fee for this facility.

To conclude, one cannot say that one kind of loan is better than the other selecting the fixed option or floating home loan interest rate option will depend on your needs, preferences and financial profile. You need to consider the factors discussed above to select the option that suits you best. Though your choice of loan has a material impact on the eventual cost of home, you have the flexibility to change how interest is levied on your home loan depending on the circumstances.

Don’t Miss: Genisys Loan Calculator

The Latest Home Loan Interest Rates: Sep 24 2021

What are the various fixed and floating interest rates on offer for home loans today? Lets take a comprehensive look at interest rates across banks and housing finance companies.

| Interest rates on home loans |

| Institution |

| HOUSING FINANCE COMPANIES |

| Floating Rates: |

| HOUSING FINANCE COMPANIES |

| HDFC Ltd |

| 10.15 |

Compiled by BankBazaar.com from respective banks website as on the date mentioned above. Note that fixed interest rates may be subject to a revision after a specified tenure depending on the banks T& Cs.

Some banks/FIs allow fixed rate only for a definite period and thereafter prevailing floating rates are made applicable. *Including balance transfer rate

Advantages And Disadvantages Of Floating Rates

ARMs tend to have lower introductory interest rates than fixed-rate mortgages, and that can make them more appealing to some borrowers. Those who plan to sell the property and repay the loan before the rate adjusts or borrowers who expect their equity to increase quickly as home values increase may choose an ARM.

The other advantage is that floating interest rates may float down, thus lowering the borrower’s monthly payments. The key disadvantage is that the rate may float upward and increase the borrower’s monthly payments.

Most credit cards have floating interest rates.

You May Like: How To Get An Aer Loan

How Mortgage Interest Works

Category: Loans 1. How Does Mortgage Interest Work? | Policygenius Interest is calculated as a percentage of the mortgage amount. If you have a fixed-rate mortgage, your interest rate will stay the same throughout the lifetime Knowing your mortgage interest rate · Compounding interest Sep 2, 2020 With a fixed-rate

Difference Between Fixed And Floating Rate Loan

Read also: What is KDM Gold which has been banned by the government, how much is different from 916 Gold

You May Like: Loan Originator License California

What Is A Fixed Interest Rate

As the name indicates, it is an interest rate that is fixed at the time of taking the loan for a specific duration. Different lenders have various options for the period for which the interest rate is fixed, and it can range anywhere between 8.5% to as much as 12.5% differing between banks and NBFCs. The rate depends on your choice of a specified tenure of 5-10 years or the full duration of the loan.

Is A Home Loan Tax Deductible

If the yearly repayment of the home loan is more than INR 1.5 lakhs, then as per the Income Tax Act 1961, the borrower will be able to deduct a certain amount from his total due annual income tax. So, yes, home loan is tax deductible and it will taking the loan will also reduce your total due tax amount.

Recommended Reading: Genisys Credit Union Auto Loan Calculator

Floating Rate Loan Means That Which Is Affected By The Repo Rate Or The Market Interest Rate If The Reserve Bank Changes The Repo Rate The Floating Interest Rate Also Changes If Mukesh Takes This Loan Then Due To The Increase In The Repo Rate His Interest Rate Will Also Increase

A person named Mukesh is planning to get a house in Nagpur. He has submitted all the documents in the bank and according to his income and financial condition, a loan of 50 lakhs has been passed. Now Mukesh is stuck on a decision before taking the loan. Mukesh is wondering what kind of interest he should choose. What should be the mode of payment of interest? Since the interest is to be paid for a long period of time on a home loan, the interest factor is the most important. Let us know here who are the two types of loans and what will be right for Mukesh.

Uses Of Floating Interest Rate

There are many uses for a variable interest rate. Some of the most common examples are:

- Floating interest rates are used most commonly in mortgage loans. A reference rateEffective Annual Interest RateThe Effective Annual Interest Rate is the interest rate that is adjusted for compounding over a given period. Simply put, the effective or index is followed, with the floating rate calculated as, for example, the prime rate plus 1%.

- Floating rate loans are common in the banking industry for large corporate customers. The total rate paid by the customer is decided by adding a spread or margin to a specified base rate.

Recommended Reading: Aer Loan Balance

How To Get Low Home Loan Interest In India

Every smart borrower wonders how to get low interest home loan as this decreases the cost of borrowing and makes repayment stress-free. Getting a low home loan interest in India

is simply a matter of improving your eligibility for the loan and maintaining a disciplined credit behaviour. Read on for some tips.

Benefits Of Fixed Interest Rate

These are the benefits of a fixed interest rate based on various parameters:

- Interest rate: The interest rate remains constant throughout the entire loan tenure and is not affected by market conditions.

- EMI: Since this interest rate doesnt fluctuate over time, your EMI remains fixed, making it easier to more accurately plan your monthly budget and long-term financial savings or investments.

Don’t Miss: How To Get An Aer Loan

Which Home Loan Is Best: Fixed Or Floating

Unsurprisingly, plenty of people who lived through the Great Recession prefer the dependability of a fixed-rate loan. Only 6% of todays loans are floating, but they made up 20% of loans in the decade before the recession. Most of the homebuyers I work with gravitate toward fixed options more often than not, as these have been lower in recent years.

However, floating loans do have their benefits. In fact, they afford unique opportunities for certain homeowners to save money. Consider a young professional who has to move every two or three years for her career. In one location, she decides to buy a house knowing shell sell it in about 36 months.

She asks plenty of questions about applying for a mortgage, including the difference between fixed and floating interest rates for her home loan. After carefully weighing her choices and working with a trustworthy lender, she takes advantage of the low introductory interest rates on a 20-, 25-, or 30-year floating loan. By the time she relocates again, this savvy homeowner will have saved some money.

Admittedly, the above situation is uncommon. A fixed-rate loan is usually the best fit for my clients. As a mortgage professional, though, Im happy to walk people through both options to find the best fit for their needs.

Drawbacks Of Fixed Interest Rate

Some of the drawbacks of a fixed interest rate are as follows:

- The fixed interest rate is usually 1% to 2.5% higher than the floating interest rate offered by a bank or non-banking financing company .

- Even if the fixed interest rate reduces after an announcement from the Government or Reserve Bank of India , it doesnt affect the loans already borrowed using the previous interest rate. The borrower will have to continue repayment at the higher interest rate even after a rate cut.

- Many a times, the fixed rate of interest is only valid for a couple of years after which the interest rate gets revised according to the ongoing rate.

Recommended Reading: How To Transfer Car Loan To Another Person

What Is Floating Interest Rates

A floating interest rate implies that the rate of interest is subject to revision every quarter. The interest charged on your loan will be pegged to the base rate, which is determined by the RBI based on various economic factors. With changes in the base rate, the interest charged on your loan will also vary.Changes, if any, in the interest rate during the tenor of the loan will not affect the EMI instead, the tenor of the floating interest loan will vary. On loans with floating interest rates, lenders cannot apply any prepayment penalty as per the rules of the RBI.

Home Loan Interest Rates Options

The following information is provided to help you decide which rate option will suit you best. It explains the benefits of, and differences between, the two types of interest rate options available with your GO Home Loan.

Interest rate options

Floating rate

- The GO Floating Rate Loan is very popular with our customers, allowing them to pay their salary directly into the account, helping to minimise interest charges.

- A floating interest rate can move up or down according to what’s happening in the market. This means that your repayments may increase or decrease.

- The advantage of having your home loan at our standard floating rate is that you have maximum flexibility, enabling you to increase your repayments or make lump-sum repayments at any time without penalty.

Fixed rate

Interest repayment options

- Principal and interest: Your regular loan instalment pays all of the monthly interest plus a portion of the principal amount of the loan. Over time, as the amount borrowed reduces, the interest charged reduces as well, so more of your regular monthly payment reduces the outstanding loan amount.

- Interest only: You may apply for an interest-only period of up to 60 months. During the interest-only period, your regular loan instalment covers only the interest, calculated on the outstanding daily actual loan balance. At the end of the interest-only period, principal and interest payments will commence to ensure your loan is repaid in full within the loan term.

Lump-sum repayments

Don’t Miss: How To Get An Aer Loan