Start Repaying 6 Months After Leaving School

After finishing school, there is a 6-month non-repayment period. No interest accrues on your loan during this time. When this period is over you have to start making payments on your Canada Student Loan. Temporary COVID-19 relief

Contact your province for information on interest charges to your provincial loan.

The 6-month non-repayment period starts after you:

- finish your final school term

- reduce from full-time to part-time studies

- leave school or take time off school

If you need to take leave from your studies, you might qualify for Medical or Parental Leave.

You Have Nongovernment Owned Ffel Or Perkins Loans

Student loan borrowers with the Federal Family Education Loan Program or Federal Perkins loans not owned by the Education Department dont have access to the automatic forbearance.

To take advantage of the forbearance, youll need to combine your loans into a federal direct consolidation loan. Consolidating loans will cause any unpaid interest to capitalize, or be added to the principal balance. Contact your loan servicer to determine how consolidation will affect the total repayment amount, interest rate and loan balance.

About the author:Anna Helhoski is a writer and NerdWallet’s authority on student loans. Her work has appeared in The Associated Press, The New York Times, The Washington Post and USA Today. Read more

Delay Student Loan Payments

Sen. Mitt Romney has proposed new legislation to delay federal student loan payments for new college graduates for up to three years. The COVID-19 Graduate Relief Act would apply to anyone who graduates college from January 1, 2020 to December 31, 2020. Interestingly, the proposed legislation would empower the Secretary of Education – not Congress – to extend eligibility to anyone who graduates in 2021 or 2022, if the Secretary determines that the negative economic impact of COVID-19 warrants such an extension. Romneys proposed bill would amend the Higher Education Act of 1965.

Students graduating from college this year are suddenly facing significant hurdles entering the workforce, Romney said. …We must further ease the burden on students by allowing them to defer their payments until the economy regains normalcy.

Read Also: How Much Do Mortgage Officers Make

Pause On Student Loan Payments Extended Through January

The Biden administration has announced that federal student loan payments will remain suspended through January 2022, extending a pause that was scheduled to expire next month

The Biden administration on Friday issued what it says will be the final extension to a student loan moratorium that has allowed millions of Americans to put off debt payments during the pandemic.

Under the action, payments on federal student loans will remain paused through Jan. 31, 2022. Interest rates will remain at 0% during that period, and debt collection efforts will be suspended. Those measures have been in place since early in the pandemic but were set to expire Sept. 30.

In announcing the decision, President Joe Biden said the economy is recovering at a record rate.” But he said the road to recovery will be longer for some Americans, especially those with student loans.

This will give the Department of Education and borrowers more time and more certainty as they prepare to restart student loan payments, Biden said in a statement. It will also ensure a smoother transition that minimizes loan defaults and delinquencies that hurt families and undermine our economic recovery.

The policy applies to more than 36 million Americans who have student loans that are held by the federal government. Their collective debt totals more than $1.3 trillion, according to the latest Education Department data.

The Basics Of Deferring Student Loans While In Grad School

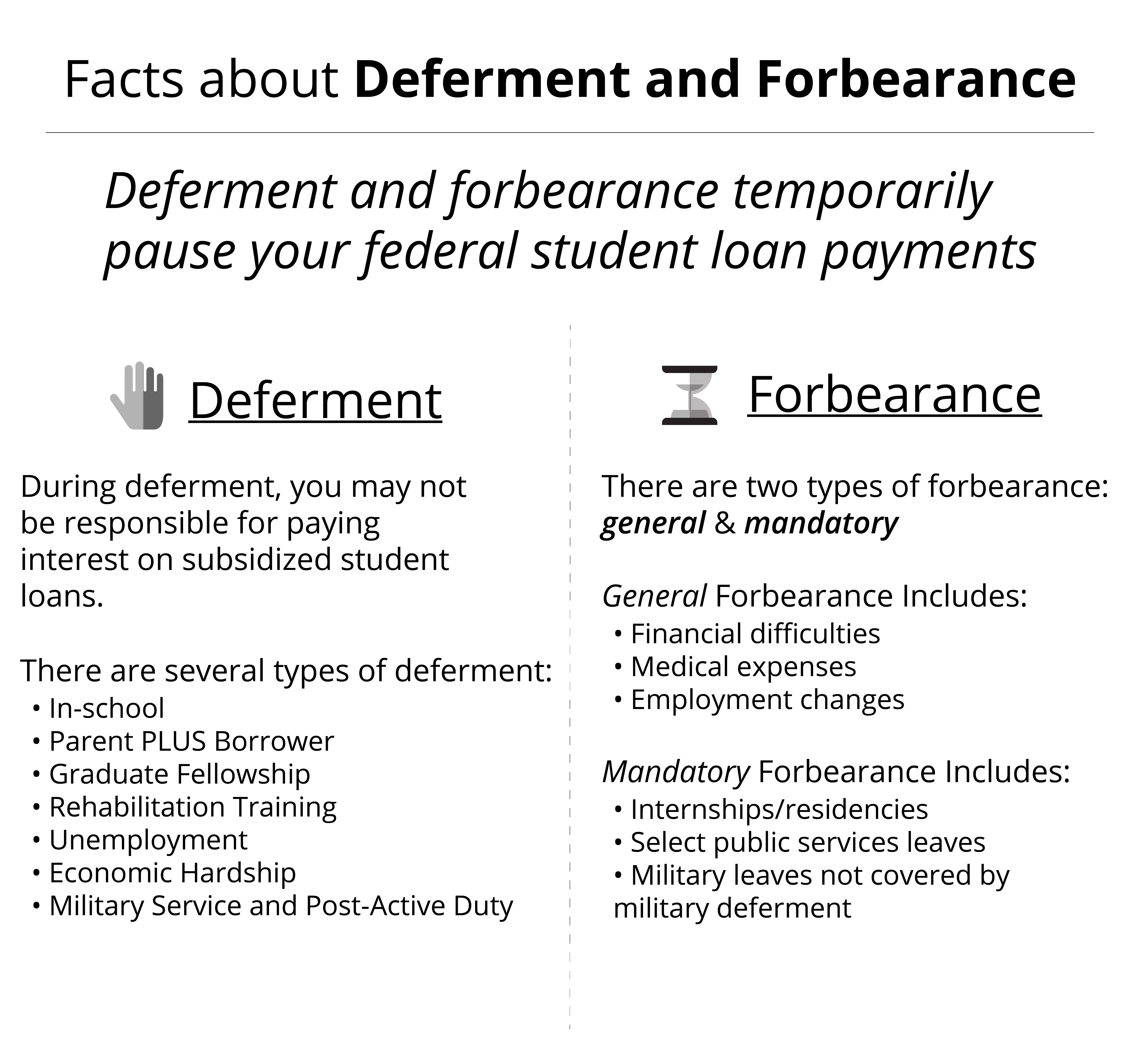

When you put your student loans into deferment, you postpone making payments for a certain period of time. Normally, if you walked away from your student loan bills, your loans would go into default. But if you defer loans, you can stop paying without penalty.

The Federal Student Aid office offers deferment on federal student loans, such as federal direct loans and PLUS loans. You can request deferment through your loan servicer. Youre eligible if youre a graduate or professional student, or if youre taking part in an approved graduate fellowship program.

Besides going back to school, there are other ways to qualify for student loan deferment. But one constant requirement, at least for federal loans, is that you have direct loans, PLUS loans, Federal Family Education Loan loans or Perkins loans.

As for private student loans, your options will vary from lender to lender. Some private lenders do offer deferment, but not all of them do. If you have private debt, speak with your lender or servicer about what possibilities are open to you.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Student Loan Cancellation Wont Happen Now

Its possible that todays announcement to defer student loan payments for eight months signals that Congress or Biden wont cancel student loans in the near-term. Now, Congress and Biden has an eight-month window to consider student loan forgiveness. Congress may focus first on a new stimulus package and other priority policies. Then, later this year, Congress could consider student loan cancellation. In the interim, Biden has granted student loan relief to millions of borrowers. While its not the same as student loan cancellation, the longer window provides time for the Biden administration to distribute more Covid-19 vaccines and to stimulate the economy. After this eight-month period, the economy could recover and Congress may determine that student loan cancellation is not needed as urgently, especially if the Covid-19 pandemic is dwindling. Alternatively, at the end of eight months, the economy may not recover, Biden again may extend student loan relief, and Congress may decide to cancel student loans then.

Why Was The Payment Pause Extended Again

There are likely a few reasons the Biden administration decided to give borrowers more time. For one, it was under pressure from Democrats to do so.

“Since the beginning of the Covid-19 pandemic, millions of Americans have struggled to keep a roof over their heads, pay bills and put food on the table,” the heads of the Senate and House Education Committees, Sen. Patty Murray, D-Wash., and Rep. Robert C. Scott, D-Va., respectively, wrote to the White House in June.

“While the economy has begun to show promising signs of recovery, more than 9 million Americans remain out of work, and the economic and health disparities created by the pandemic are severe.”

Indeed, unemployment levels among young workers are still higher than they were before the public health crisis. And in a recent survey conducted for The Pew Charitable Trusts, more than 66% of student loan borrowers said they’re not ready to start their payments again.

Lastly, a recent change in student loan servicing may have worked in borrowers’ favor.

The Pennsylvania Higher Education Assistance Agency which oversees the loans of 8.5 million student borrowers announced last month that it would not renew its contract with the federal government when it ends in December. As a result, those borrowers will need to be matched with a new lender.

The U.S. Department of Education likely didn’t want to force these borrowers to begin repayment and then have to change their servicer two months later.

Read Also: Cornerstone Loan 1098-e

Could The Payment Pause Be Extended Again

The Education Department said this would be the “final extension” of the respite, which has now been in effect since March of last year.

Still, experts say a lot depends on the state of the pandemic and economy come February.

If you’re still unemployed or dealing with another financial hardship because of Covid, you’ll have options whenever payments resume.

Applying for an economic hardship or unemployment deferment will allow you to postpone your payments without interest accruing. If you don’t qualify for either of those, you can still use a forbearance to continue suspending your bills.

For those who expect their struggles to last a while, it may make sense to enroll in an income-driven repayment plan. These programs aim to make borrowers’ payments more affordable by capping their monthly bills at a percentage of their discretionary income and forgiving any of their remaining debt after 20 years or 25 years.

What If I Want To Continue Making Payments

Any payments you make during the forbearance period will be applied to principal once all the interest that accrued before March 13, 2020 and any fees are paid.

Making any voluntary payments right now will help you pay down your loan balance faster, but Farnoosh Torabi, editor-at-large of personal finance at CNET and host of the podcast So Money, says you shouldnt worry about paying down your student loans too aggressively this year. You should instead focus on building an emergency fund or paying off high-interest debt.

Even if were to believe that the loans will come due again in early 2021, I dont recommend working extra hard to erase your government loans this year. Pay the minimums, as needed, but not a penny more, Torabi writes.

If youre determined to pay down your student loans right now, these strategies can help you.

Read Also: Does Va Loan Work For Manufactured Homes

Extend Your Grace Period By Another Six Months If You:

You make loan payments to the National Student Loans Service Centre, not to OSAP.

Your payments are based on a 9 ½ year pay-back schedule. This pay-back schedule is the average amount of time it takes to pay back an OSAP loan.

You can make payments on your loan at any time to repay it faster.

Get repayment assistance:

If youre having trouble repaying your loan, you might be able to get repayment assistance.

If you have a severe permanent disability and you cant attend work or school, you can apply for the Severe Permanent Disability Benefit. Contact the National Student Loans Service Centre.

Extend your repayment period:

You can lower your monthly payments by extending your repayment period from 9 ½ up to 14 ½ years. Log in to your National Student Loans Service Centre account.

What To Do Before Applying For Deferment Or Forbearance

When you apply for deferment or forbearance, remember that you must keep making your regular monthly student loan payments until your loan servicer notifies you that theyve accepted your request. Otherwise, you could become delinquent on your loans.

Even though deferment or forbearance can extend your repayment term and cause interest charges to build up, either option is preferable to avoiding loan payments altogether. These two programs can provide much-needed relief if youre facing a financial emergency. If you dont foresee a way to afford your loans long-term, however, look into lowering your federal student loan payments for a longer period using income-driven repayment plans instead.

Rebecca Safier and Jacqueline DeMarco contributed to this report.

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Read Also: Usaa Rv Rates

How Long Can I Defer Student Loans

Fundamentally, there are two different types of loan categories, federal loans and private loans. Each one of these has slightly different rules when it comes to repayment options. For federal loans, as long as you are degree-seeking and enrolled at least half-time in your program, your federal loans will automatically be deferred.

At the graduate level, half-time status can mean different things based on how your program is designed. However, as a general rule of thumb, as long as you are taking two courses each term you are most often considered at least half-time and therefore able to delay your student loan payments. While you are in graduate school you can of course choose to continue to make payments on your undergraduate federal loans as well, but you wont be required to.

Other Ways To Reduce Payments On Your Student Loans

Instead of pausing payments on your federal student loans through deferment, you might instead reduce payments with an income-driven repayment, graduated repayment or extended repayment plan.

All of these plans adjust your monthly payment, so you have the opportunity to pay significantly less than what you would on the standard 10-year plan. If youre working a part-time job during grad school, you might be able to swing these lower payments.

Alternatively, you could defer your student loans but continue to make interest-only payments. That way, your unsubsidized or PLUS loans wont accumulate a ton of interest during your student years.

Whatever payments you can make while in grad school could mean a more manageable balance after you graduate.

Also Check: How To Transfer Car Loan To Another Person

How Do I Find Out If I Owe Student Loans

Ask your school for help: If youre having trouble tracking down your loans, talk to your universitys financial aid office. They can help you identify who currently manages your debt. Check your credit report: Credit reports list all of your current and past credit obligations, including student loans.

Finally What About Those Who Currently Have Private Student Loans

Unfortunately, the CARES Act extension until Jan. 31, 2022, only applies to federal student loans, such as Federal Student Subsidized Loans, Federal Student Unsubsidized Loans, Federal Parent PLUS Loans and Graduate PLUS Loans. However, many private lenders are offering relief similar to the temporary forbearance, but interest will likely still accrue. Borrowers with private loans can start by checking their servicers website for information on COVID-19 relief or contact them to inquire about forbearance or rate reduction programs.

You May Like: What Is The Maximum Fha Loan Amount In Texas

How To Defer Student Loans While In Grad School

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

Start A Mini Business

What better way to secure yourself some instant emergency cash than starting your own mini business at uni?

This can involve anything from selling stuff on eBay to offering a delivery service to other students in your halls for a small fee.

In fact, we’ve got dozens of small enterprise ideas to get your entrepreneurial juices flowing.

If you need some extra tools and tips, these money-saving resources will help you cut down your costs and give your bank balance a boost!

Hottest Deals

Also Check: Usaa Auto Loan Calculator

How Is This Even Possible

Several professions are supervised and overseen by the states local government, such as Doctors, Nurses, Cosmetologists, Lawyers, etc. To be able to work in these professions, you have to be licensed by your state in your area of work.

In a lot of states, the borrowers who have fallen behind on their monthly student loan repayments might find their license to practice being suspended which would lead to them being unable to continue working.

And as anyone reading this right now would be thinking, it really is counterintuitive to take away the jobs of those who are already running behind on their monthly student loan repayments, but that is exactly what is happening in not just one but 22 states.

It would instead be much better for everyone if the state could identify those who are falling behind or are likely to fall behind on their monthly payments and offer them a repayment plan that could help them get back on their feet and resume making reasonable monthly payments again. The most common victims who have lost their livelihood so far due to non-repayment are cosmetology professionals, followed closely by the registered nurses and the nurse aids.

Need a Student Loan for your Education? Check out the Best Student Loan today!

How To Apply For Forbearance

If youre applying for a discretionary forbearance, you must complete the General Forbearance Request and submit it to your student loan servicer.

For mandatory forbearance applications, complete the form that matches your situation, such as the Student Loan Debt Burden Forbearance Request, Medical/Dental Residency Forbearance Request or AmeriCorps Service Form.

All forms are available on the Federal Student Aid website. Send the form to your loan servicer, along with documentation to back up your claim.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Qualifying For A Student Loan Deferment

You canât simply stop making payments on your student loans and declare yourself in deferment. You must qualify, which involves working with your loan servicer or lender and, in most cases, making an application. Your loan servicer or lender will process your application, let you know if more information is needed, and tell you whether you qualify. Itâs important to continue to make timely payments on your loans while you await a decision. Failure to do so could ultimately result in loan default and a serious blow to your credit score.