Start Your Fha Loan Application

Applying for an FHA loan is pretty straightforward. Once youve chosen the lenders you want to apply with, their online systems and loan officers will walk you through the process step by step.

Make sure you have all your financial documents on hand to make the application process go as smoothly as possible.

Most importantly, apply with more than one FHA lender. This is the only way to be sure youre getting the lowest-rate loan. Remember, even a seemingly tiny rate difference can cost you thousands of dollars over the life of the loan.

Luckily, many lenders offer online preapproval these days. So getting mortgage quotes and comparing rates can be relatively quick and painless.

What Is An Fha Streamline Refinance

The FHA Streamline Program may enable those with existing FHA loans to refinance in order to lower their monthly payment or change the term of their loan. As the title suggests, the program is meant to streamline the process of refinancing for those with FHA loans so they can save money faster and easier than they might otherwise.

An FHA streamline refinance has a few key benefits over traditional mortgage refinancing options:

- An appraisal usually is not required

- The FHA will let you use this program regardless of the amount of equity youve built

- You can get a partial refund of the upfront mortgage insurance premium you paid

- There is likely reduced documentation needed since you already have the loan, so the refinance process will be faster

In order to qualify for an FHA Streamline refinance with Quicken Loans®, you must have an FHA loan for a one- or two-unit primary residence. You have to be current on your loan, and the FHA requires that youve made at least 6 months worth of payments before applying.

Will Loan Limits Increase In 2022

Do FHA limits increase every year?

FHA has a maximum loan amount to be insured, which is known as the FHA loan limit. This loan limit is calculated and updated annually, and is influenced by the conventional loan limit set by Fannie Mae and Freddie Mac.

Will FHA raise loan limits?

For most of the US, the lending limit for FHA mortgages will increase by 2022 to $420,680 for most states, particularly in areas where 115% of the median home price is less than this limit. This equates to 65% of the newly announced $647,200 compliant lending limit for conventional loans.

You May Like: Pre Approved Capital One Auto Loan

Adjustable Rate Fha Mortgages

An adjustable rate mortgage has an interest rate that periodically changes over the term of the loan. The initial interest rate of an ARM is usually lower than a fixed rate mortgage, making an adjustable rate FHA mortgage a potentially good option for borrowers who plan on holding the home for a short period of time before selling or refinancing.

Adjustable rate FHA mortgage options include:

- 1- and 3-year ARMs that may increase by 1% after the beginning fixed interest rate period and by 5% over the life of the loan.

- 5-year ARM with an interest rate that may increase by 1% annually and 5% over the life of the loan, or by 2% annually and 6% over the life of the loan.

- 7- and 10-year ARMs may only increase by 2% annually after the beginning fixed interest rate period and by 6% over the life of the loan.

What Are The Requirements For A Loan

Personal information required to apply for a loan includes current and former addresses, current and former employment for the past five years, date of birth, social security number, and names and information of guarantors or co-owners. Some loan applications may also require at least three or more references.

You May Like: What Car Can I Afford Based On Salary

What Is An Fha Home Loan

An FHA home loan is a specific type of residential mortgage that a borrower can use to either purchase a home or refinance a mortgage attached to a home they already own. FHA home loans in California are backed by the federal government and FHA mortgage rates differ from other programs including Conventional and Jumbo loans.

The Federal Housing Administration is the agency that oversees the FHA home loan program in California. The government agency is also responsible for gauranteeing FHA home loans which is the distinct feature that separates it from other home lending programs available in California.

If the borrower defaults on an FHA loan the Federal Housing Administration will reimburse the mortgage lender for the losses associated with the default.

The FHA does not lend money directly to consumers only banks and lenders provide funding under the FHA loan program. Banks and lenders that provide FHA loans avoid taking on the higher risk due to the FHA insuring the loan against default.

This allows banks in California and nationwide to take more of a chance on borrowers who otherwise might not be able to get a home loan. The FHA loan program has been a big part of the California housing market for decades.

Remedies For Properties Below Minimum Standards

There are options for homebuyers who have fallen in love with a property that has one of these potentially deal-killing problems.

The first step should be to ask the seller to make the needed repairs. If the seller can’t afford to make any repairs, perhaps the purchase price can be increased so that the sellers will get their money back at closing. Usually, the situation works the other way aroundif a property has significant problems, the buyer will request a lower price to compensate. However, if the property is already priced below the market or if the buyer wants it badly enough, raising the price to ensure the repairs are completed could be an option.

If the seller is a bank, it may not be willing to make any repairs. In this case, the deal is dead. The property will have to go to a cash buyer or a non-FHA buyer whose lender will allow them to buy the property in the present condition.

Many homebuyers will simply have to keep looking until they find a better property that will meet FHA standards. This reality can be frustrating, especially for buyers with limited funds and limited properties in their price range.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with HUD.

Read Also: Usaa Certified Dealers List

Fha Property Requirements: Which Homes Qualify For A 35% Down Loan

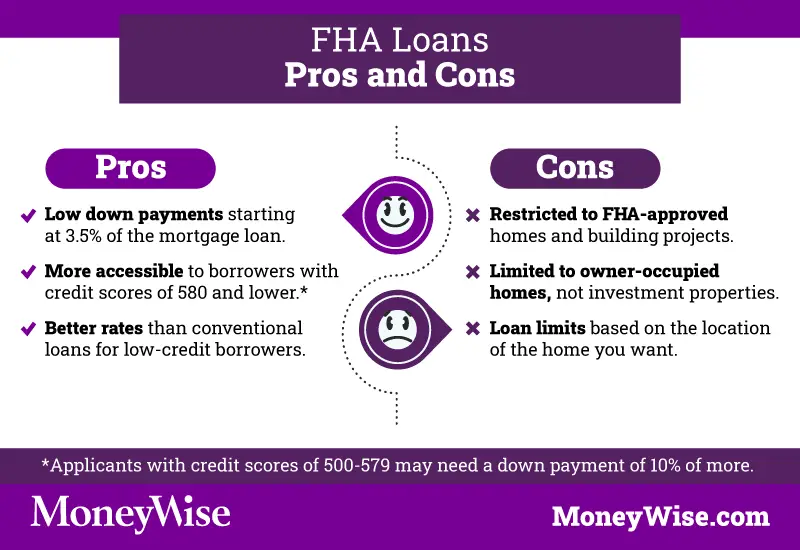

FHA loans are among the most solid mortgages in the market. Low down payment, low credit score requirement, and relatively low interest rates. Plus, unlike some home loan programs, theres no upper income limit on who can qualify and FHA loans can be used anywhere in the country.

But if youre considering an FHA loan for your home purchase, you need to know all of the criteria particularly the FHA property requirements.

To qualify for this low down payment loan, the house you buy must pass an FHA appraisal. And FHA property standards are a bit stricter than, say, conventional loan programs.

That doesnt mean theyre impossible to meet. In fact, most homes will pass the FHA appraisal just fine. But it helps to understand the FHA property requirements before you start your house search so you can focus on seeing properties that are likely to qualify.

Fha Loan Requirements Faq

What is an FHA loan?

An FHA loan is a home purchase and refinance loan just like a conventional mortgage. The main difference? FHA loans feature mortgage insurance from the Federal Housing Administration. This insurance shields lenders from losses in case the borrower defaults. With help from this insurance, borrowers with lower credit scores and higher existing debt payments can still qualify for lower interest rates.

Is FHA only for first-time home buyers?

No. Firsttime homebuyers as well as repeat homebuyers can get FHA loans. However, FHA loans are for first homes and not vacation homes or investment properties.

What are the qualifications for an FHA loan?

Qualifying for an FHA loan usually requires a credit score of at least 580, a 3.5 percent down payment, and a debttoincome ratio of 43 percent or less. Individual lenders have some leeway with these requirements. So if you get turned down with one lender, you may be approved by another.

What will disqualify you from an FHA loan?

A home purchase price above the FHAs loan limits for your area will disqualify your application. Buying an investment property or a vacation home will also exclude your loan. As for personal underwriting, a debttoincome ratio above 50 percent or a credit score below 500 would make getting approved almost impossible unless you added a coborrower who has better borrowing credentials.

How hard is it to get an FHA loan?Can I get an FHA loan without 2 years of employment?

Also Check: 1-800-689-1789

What Are Fha Guidelines For Employment History And Loan Income Requirements

A two-year employment and income history is required for both employees and self-employed borrowers by way of pay stubs, tax returns and W2s or 1099s.

Borrowers with court ordered alimony and child support must document receipt of the income for a minimum of three months and proof that it will continue for at least three years.

What Is It Like To Get An Fha Loan Right Now

Although HUD’s minimum requirements for FHA loans havent changed, FHA-approved lenders seem to favor applicants with higher credit scores. Over 71% of FHA borrowers had FICO scores of 650 or above in September 2021, with an average score of 676 for FHA purchase loans, according to data from ICE Mortgage Technology.

On average, it took longer to close an FHA purchase loan in September 2021 than in September 2020 52 days compared with 49 days a year earlier. Conventional purchase loans, meanwhile, closed in an average of 49 days in September 2021, according to ICE data.

The most recent HUD data shows that over 33% of FHA loans were for amounts between $250,000 and $399,000 by far the most common range. Over 68% of FHA loans issued during this period covered at least 96% of the homes estimated value, implying that most FHA buyers are making the minimum FHA down payment of 3.5%.

Don’t Miss: Usaa Refinance Student Loans

Things To Consider Before Using An Fha Loan For An Investment Property

One of the biggest advantages to using an FHA loan for an investment property is a low down payment of 3.5%. However, the tradeoff for making a small down payment is having to pay an upfront mortgage insurance premium plus monthly mortgage insurance over the life of the loan.

The FHA upfront mortgage insurance premium costs 1.75% of the loan amount, which means the MIP on a $150,000 single-family home is $2,625. The MIP may be paid at closing, or financed over the life of the loan.

The annual insurance premium ranges from 0.45% to 1.05% of the mortgage amount and is paid monthly. So, the monthly MIP on a $150,000 home would range between $56.25 and $131.25 per month, in addition to the monthly mortgage payment of principal, interest, property taxes, and homeowners insurance.

The MIP annual insurance premium percentage may vary based on the down payment amount and loan repayment term. Unlike the private mortgage insurance on a conventional loan that is removed when a borrower has 20% equity in a home, MIP remains for the life of the loan.

Some borrowers acquire a home as an owner-occupant with a low down payment FHA loan, find a tenant and turn it into a rental property, then refinance the loan at a later date to eliminate the mortgage insurance. Once the equity in a home exceeds 20%, a borrower may be able to eventually refinance to a conventional loan and use any accrued equity to make a down payment of 20% or more.

What Are The Qualifications For A Construction Loan Forgiveness

When the PPP was first introduced, all borrowers had to use 75% of the loan to pay salaries. If your construction company meets this limit, it is eligible for a waiver of a PPP loan. In many places, crews were not allowed to work, making it difficult to spend that much money on wages.

What is debt serviceWhat is debt service coverageCalculate your total monthly debt service payments. Start by calculating the monthly payment for each of your loans. Add up the monthly payments of all your loans. adding all of the monthly payments together … Once you know the total amount of your debt service payments, you can calculate your debt service ratio. What are debt service requirements?Determination of Debt Service Requirements. What is maximum an

Read Also: Usaa Car Loan Interest Rates

Safety And Livability Of The Property

The safety and livability standards include:

- Structural integrity, such as foundations, roofs, attics, and basements

- Availability of services such as heat, water, electricity, and sewage

- Adequate living space for cooking, eating, and sleeping, and daily activities

The appraiser will also be on the lookout for physical and structural hazards, such as:

- Inadequate or damaged foundations

- Prevent moisture from entering the home

- Be reasonably durable and functional

Crawl spaces must be:

- Free of moisture and debris

- Show no sign of termites or other infestations

- Adequately ventilated to prevent heat and moisture

- Have adequate access to the crawl space

Most homes will pass the FHA appraisal just fine. But it helps to understand the FHA property requirements before you start your house search.

Fha Loan Down Payments For Investment Properties

The down payment requirements for buying a property with rental units are the same as the requirements for single-family homes. You can usually make a down payment as low as 3.5% of the purchase price when you have a of at least 580 and higher. You typically have to make a 10% down payment when your credit score is below 580.

For example, pretend you want to buy a duplex that costs $375,000. With a credit score of 580, you might be able to make a $13,125 down payment. With a credit score lower than 580, your down payment might be $37,500.

Don’t Miss: Upstart Vs Avant

Who Can Apply For An Fha Loan

People who do not have perfect credit, have filed for bankruptcy in the past, or new homebuyers who are still working on their finances should consider an FHA loan. In cases where you may not qualify for a traditional loan, FHA financing may be right for you.

First-Time Homebuyers

FHA loans may be a good match for new homebuyers who may still be working on their financial picture. Those who have been renting and dreaming of buying a home sometimes hesitate because their credit is not perfect or because itâs hard to save up 20% of the down payment of a home.

Fortunately, the more relaxed requirements of an FHA loan mean that more people can enjoy the American dream of buying their own property. FHA loans are available for properties with one to four units.

If youâre not sure whether this type of home loan is a match for your plans, speak to FHA loan lenders at Assurance Financial. We can explore your options together.

Fha Appraisal Requirements: Checklist And Guidelines

See Mortgage Rate Quotes for Your Home

All properties bought with an FHA loan must go through an FHA appraisal, which accomplishes two things: It establishes the market value of the property and determines if the home meets the General Acceptability Criteria established by the U.S. Department of Housing and Urban Development .

FHA loans are government-backed mortgage designed to help people with lower incomes or credit scores buy homes. When applying for an FHA loan, your lender uses the results of the appraisal to determine if the property is eligible for financing. We cover the requirements mandated by the Federal Housing Administration for appraising properties.

You May Like: How Much To Spend On Car Based On Income

What Are The Fha’s Appraisal Requirements

With conventional financing, the lender orders an appraisal to determine the market value of the home. However, with an FHA loan, the appraisal serves two purposes. In addition to establishing the value of the property, an FHA appraisal determines whether the home meets the agencys minimum property requirements.

An appraisal is a written assessment of a property performed during the mortgage approval process. To determine if the property is eligible for financing, the appraisal accomplishes the following:

- Estimates the market value of the property. FHA uses the estimate to confirm the home is worth the amount it is guaranteeing.

- Evaluates the physical condition of the property. The appraiser will complete a Valuation Conditions form, documenting any necessary repairs.

- Assesses whether the property is free of hazards, odors, physical defects noise.

- Assesses the longevity of the property. The expected life of the property must warrant having a long-term mortgage,

- Analyzes the site of the property. The appraiser will provide an analysis of the site, which includes the topography of the location, suitability of soil, easements, encroachments and the areas adjacent to the property.

- Assesses the livability of the home. The appraiser will analyze the above-ground and basement living areas, the overall structure and functionality of the property.

Generally, the appraiser will look for things that may have the following effects:

What Are The Fannie Mae Loan Limits For 2022

Starting January 1, 2022, the new compliant lending limit will be up to $647,200 in most of the US and $970,800 in high-cost areas.

What is the jumbo loan limit for 2022?

Will the conforming loan limit increase in 2022?

In most housing markets, the corresponding new lending limit will be $647,200 in 2022, an increase of $98,950 compared to the 2021 limit of $548,250.

You May Like: How To Calculate Va Loan Amount