How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Capital One Quicksilver Student Cash Rewards Credit Card

Best overall for students

- This card is best for: Students who want to earn substantial cash back rewards right away without too much hassle.

- This card is not a great choice for: Students looking to take advantage of even higher cash back rewards in certain spending categories.

- What makes this card unique? The Capital One Quicksilver Student Cash Rewards card has one of the highest flat-rate cash back rewards rates for students. Students can earn unlimited 1.5 percent cash back on all purchases

- Is the Capital One Quicksilver Student Cash Rewards Credit Card worth it? Students who want to earn considerable cash rewards quickly will fare well with the Capital One Quicksilver Student Rewards card. Theres no annual fee or foreign transaction fees, so you dont have to worry too much about onerous charges.

Jump back to offer details.

Capital One Auto Finance

Pay Your Bills Securely with doxo

- State-of-the-art security

- Free mobile app available on Google Play & Apple App Store

- Never miss a due date with reminders and scheduled payments

- Real-time tracking and bill history

- Pay thousands of billers directly from your phone

doxo is a secure all-in-one service to organize all your provider accounts in a single app, enabling reliable payment delivery to thousands of billers. doxo is not an affiliate of Capital One Auto Finance. Logos and other trademarks within this site are the property of their respective owners. No endorsement has been given nor is implied. Payments are free with a linked bank account. Other payments may have a fee, which will be clearly displayed before checkout. Learn about doxo and how we protect users’ payments.

Don’t Miss: How Do I Find Out My Auto Loan Account Number

Capital One Review Details

Capital One is a well-known lender that works with an established network of car dealerships. You can pre-qualify to refinance with Capital One, which has no effect on your credit score.

Pre-qualification decisions are typically returned within 24 hours your loan offer will show a new rate, term and monthly payment. If you select the offer, youâll submit a complete credit application. At that point, a hard credit inquiry is required and your final terms could change.

Capital One does not offer cash-out refinancing or lease buyouts.

- Not available in every state.

- Only available at participating dealerships.

Best for borrowers who plan to buy from a dealership in Capital One’s network.

Re: Anyone Ever Had A $0 Down Payment With Capital One Auto Navigator

I purchased a brand new 2018 on the 4th with no money down through Auto Navigator. Below is the link to my orginal post.

Auto Navigator had the loan at 60 months, I had to settle for 66 months and the dealer did have to lower the price of the vehicle even more than I asked to make it work without any money down but they did it without a problem because they knew I would walk.

You May Like: Avant Refinance

How To Contact Capital One Customer Service

You can speak to a Capital One representative over the phone or by mail . The best contact number depends on the type of support you need. See below for how to contact credit card support over the phone.

Personal credit cards

- Outside the U.S., call collect: 1-804-934-2001

- Online banking support: 1-866-750-0873

- Fraud protection: 1-800-427-9428 or 1-800-239-7054

- International collect calls to report a lost or stolen card: 1-804-934-2001

Small business credit cards

- Small business credit card customer service: 1-800-867-0904

- Online banking customer service for small business credit card customers: 1-866-750-0873

- Report a lost or stolen card: 1-804-934-2001

Make sure you have your credit card handy, as well as any security words that may be requested. And be prepared to experience longer than usual wait times.

When you get through to a representative, discuss any financial hardships you’re facing, such as a recent layoff or reduction in working hours that reduces your income and ability to make payments. This allows the representative to understand your situation and discuss available options to assist you during this time.

Coronavirus latest:

Alex Wise Wallethub Credit Cards Analyst

There are multiple ways to pay your Capital One auto loan bill:

- to make online or mobile payments using your account information. . These can be scheduled as one-time or recurring payments.

- Mail a cashier%s check, money order or personal check, along with the payment coupon in your monthly statement to: Capital One Auto Finance, P.O. Box 60511, City of Industry, CA 91716.

Ad Disclosure:

You May Like: Can I Refinance My Sofi Personal Loan

Best Bank For Refinancing Your Capitalone Loan

Best Auto Loan Refinance Companies of 2021

- Best for Great Credit: Credit Unions

- Best for Checking Rates Without Impacting Your Credit: Capital One.

- Best Trusted Name: Bank of America, Chase or WellsFargo.

- Best for The Most Options: WithClutch.

- Best for Members of the Military: USAA or Navy Federal CU.

- Best for Peer-to-Peer Loans: LendingClub although not recommendable.

- Digital Credit Union and PenFed.

What Is The Maximum Auto Loan Term You Can Get With Capital One Auto

Capital One Auto has car loans with terms ranging from 36 to 72 months. Having the option of longer terms — terms can range up to 144 months — allows borrowers to take on larger auto loan amounts while keeping monthly payments more affordable. However, the longer the term of your auto loan, the more interest you will pay.

Also Check: What Is An Rv Loan

Here Are Some Other Payment Options:

- ATM:Capital One has over 70,000 fee-free ATM locations. You can find them at select Target, Walgreens, and CVS Pharmacy locations. Check online or call customer service to find additional locations. You can use the ATM to deposit cash or checks to your Capital One checking account. Then, you can use that money to pay your Capital One credit card bill online, by phone, or mobile app.

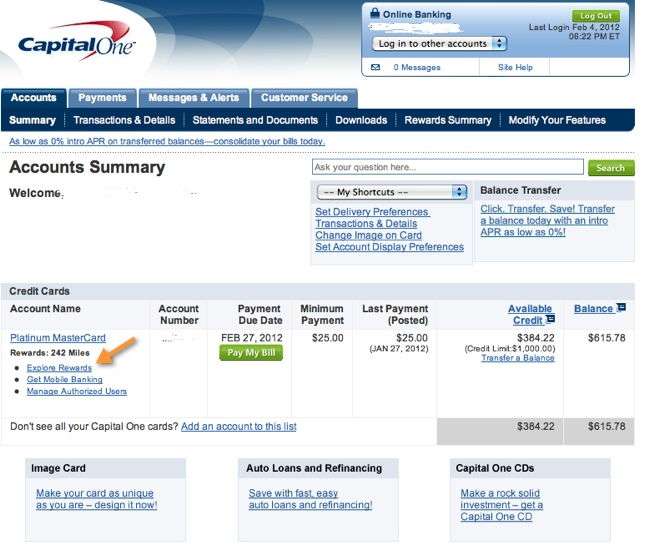

- Online: You can also make an online credit card payment by signing in to your Capital One account.

- Mobile App:You can instantly deposit checks to your Capital One checking account using your mobile phone. You can also transfer money between banks with Capital Ones online banking but this takes a little longer. However, this can be a convenient option in the future once you link your bank accounts.

- Mail: Lastly, you can pay your Capital One credit card bill via mail. The address is:

Capital One

PO Box 71083

Charlotte, NC 28272-1083

Where you decide to pay your Capital One credit card bill in person, if anywhere, depends on how strapped you are for time. You might have to pay a fee if you arent close to a Capital One bank, or one isnt open. But that will certainly beat triggering a late payment fee. Make sure to bring the proper information, identification and form of payment needed.

Just trying to pay it forward, information-wise, and hope that others wont have to go through all the same things I have!

Questions About Your Billing Statement Or Account

Capital One Auto Finance lists all current APRs and rates on the Current Rates for Auto Loans page. If you need more information on service charges, late payment fees and other fees appearing on your bill, the best contact number is 1-800-946-0332 if you already have an auto loan and 1-800-689-1789 if you are not currently a customer.

You May Like: How To Get An Aer Loan

Capital One Auto Finance: 2021 Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Auto loan reviews

-

Auto loan refinancing

-

Auto purchase loan

The bottom line:Capital One Auto Finance is a good fit if you want to check rates without affecting your credit score and plan to shop within its large dealership network. It also refinances existing loans.

Capital One Spark Cash Plus

Best for small businesses

- This card is best for: Small business owners looking to earn high cash back rewards without keeping track of spending categories.

- This card is not a great choice for: People who may not have the cash flow in their business to cover the annual fee.

- What makes this card unique? Small business owners can earn unlimited 2 percent cash back on all purchases, making it a bit easier to earn consistent rewards on business expenses. Theres also the opportunity to earn cash bonuses with certain terms and conditions.

- Is the Capital One Spark Cash Plus worth it? For small businesses with the cash flow to handle an $150 annual fee, the Capital One Spark Cash Plus is a great way to earn consistent and high cash back rewards on purchases. If youre looking to earn some of the cash bonuses but youre worried about the spending requirements, there may be other cards on the market that offer a different set of rewards that better fit your needs.

Jump back to offer details.

Read Also: Usaa Credit Score

Capital One Auto Loans Vs Bank Of America Auto Loans

Bank of America auto loans are a good option for current customers, as interest rate discounts are based on customer relationships with the bank and categorized by status. Customers with gold, platinum, or platinum honors status will receive up to .5% off their auto loan’s APR. But, status requirements mean that discounts are only available to customers with three-month average balances of $20,000 or more.

Capital One has an advantage over Bank of America for borrowers looking for affordable used cars. While Bank of America has a minimum loan amount of $7,500, Capital One only requires minimum loans of $4,000. While Bank of America will finance cars valued as low as $6,000, the $7,500 minimum loan amount means that borrowers could be underwater, or have a loan worth more than the car’s value.

Capital Ones Late Fees

In addition to income from credit card account interest, Capital One makes a tidy sum from late fees. They can and will charge you up to $27 the first time you pay late, and if you’re late again within the next six months, they’ll charge you up to $39. This is per late payment.

Video of the Day

Gone are the days that a bill payment was considered late after 30 days. Like many other credit card companies, Capital One’s late fees kick the moment your payment is made after 8 p.m. Eastern Standard Time on the day it’s due. No exceptions.

Even if you’re uncomfortable with the idea of automatic payments, if you’ve ever forgotten a payment and were charged a hefty late fee, you might want to reconsider. Setting up automatic payments is the best way to ensure that you’ll never be late again.

Don’t Miss: How Much Do Mortgage Officers Make

Auto Approve Vs Capital One Auto Loans

Auto Approve is an auto loan refinancing company that offers rates as low as 1.9% ranging from $7,500 to $150,000.

Customers who want to refinance a large auto loan will enjoy the high limits and low rates.

However, Capital One offers lower refinancing limits starting at $4,000 up to $50,000, which may make it a better choice for lower refinancing amounts.

Capital One Quicksilverone Cash Rewards Credit Card

Best for fair credit

- This card is best for: Anyone with fair credit who wants to improve their score through responsible use and earn a respectable amount in cash back rewards.

- This card is not a great choice for: Those who want to receive a sign-up bonus or carry a large balance .

- What makes this card unique? The Capital One QuicksilverOne Cash Rewards Credit Card provides cash back rewards on every purchase and is one of the few cards that is available to those with fair credit. Plus, cardholders are automatically considered for a higher line of credit in as few as six months with on-time payments.

- Is the Capital One QuicksilverOne Cash Rewards Credit Card worth it? If you have fair credit, this card is very much worth it. There arent many rewards credit cards available for those with fair credit, so you can use this to both build your credit and get cash back on all your purchases, but keep the $39 annual fee in mind.

Jump back to offer details.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

How To Pay The Bill

Pay online: Customer can pay your Capital One Auto Finance bill online by visiting . The service requires the customer enter your user identification number and password. Common forms of payment include money transfers from a checking or savings account. The online bill pay does not incur convenience fees.

Payment stations: Customers can pay your Capital One Auto Finance bill at any convenient pay station across the world.

- Western Union Customers provide account information and payment details. A convenience fee applies with every transaction. Western Union only accepts cash.

- Money Gram Customers provide account information and payment details. A convenience fee applies with every transaction. Money Gram only accepts cash.

Pay by phone: Customers can pay your Capital One Auto Finance bill by phone by calling 1-800-946-0332. The automated system will assist you in paying your Capital One Auto Finance bill. Credit cards and debit cards are not accepted, so the customer must provide checking or savings account information.

Automatic payment: Customers wanting your Capital One Auto Finance bill deducted on a monthly basis can sign up for recurring payments. The service automatically deducts funds from your checking or savings account. The customer must provide the routing number associated with your account as well as your Capital One Auto Finance account information.

Pay by mail: Customers can pay your Capital One Auto Finance bill by mailing it to:

Capital One Venture Rewards Credit Card

Best for travel rewards

- This card is best for: Anyone who wants a flat-rate travel rewards card that allows you to redeem miles to offset travel purchases and everyday expenses.

- This card is not a great choice for: Those who will not spend enough to receive the sign-up bonus or offset the $95 annual fee.

- What makes this card unique? The Capital One Venture Rewards Credit Card offers unlimited 2X miles on all eligible purchases, up to $100 credit for Global Entry or TSA PreCheck application fee and cardholders will not be subject to foreign transaction fees.

- Is the Capital One Venture Rewards Credit Card worth it? The Capital One Venture Rewards Credit Card is a worthwhile option if you prefer simple flat-rate rewards or if you dont spend enough on travel to justify a bonus category card.

Jump back to offer details.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Tips For Paying A Car Loan With A Credit Card

- Before you actually begin the card application process, take stock of your monthly budget looking at income and expenses. Most 0% APR credit cards will have six- to 18-month balance transfer options. Determine whether you can feasibly pay off your loan within the given time and make sure you get one of the best balance transfer credit cards to help you.

- If you do end up getting a 0% APR credit card, be sure to read over the cards agreement papers. In the event that you dont repay the whole loan before the introductory period ends, many credit card issuers can charge you interest on the whole balance, not just whats left. Also pay attention to the balance transfer APR after the intro period. That will give you an idea of how expensive things could get if you have to start paying interest.

Which Card Do You Have

Different Capital One cards have different phone numbers on the back. That means getting a generic customer service number from an online search might not get you to the account you want.

For example, as of August 2021, Capital One’s GM Flexible Earnings Mastercard shows a customer service phone number of 800-947-1000. Capital One’s Platinum Mastercard shows 800-227-4825.

When you call those numbers, you might be prompted for your zip code, the last four numbers of your card or the last four digits of your Social Security number. Using the number associated with your particular card should get you where you want to go in the quickest manner possible.

As of August 2020, the Capital One website offers 888-464-7868 as the number to access its automated system 24/7. To speak with a live representative, call 800-289-1992 from 8:00 a.m. to 8:00 p.m. seven days a week.

Whatever number you use, an automated phone system or customer service rep should be able to help you. You might need to provide your entire card number and other information if you call another of Capital One’s numbers. If you have Capital One checking or savings accounts, the process is similar.

Read More: How to Set Up Automatic Payment for Capital One Credit Card

Don’t Miss: Can You Buy A Manufactured Home With A Va Loan