Tax Consequences For Non

The Swiss tax authorities regularly check whether the interest rates applied by a Swiss company meet third-party comparisons. If the tax authorities determine that this is not the case, there are usually a number of relevant administrative, tax and sometimes criminal consequences.

Excessive interest payments, for example to a foreign parent company, qualify as so-called hidden profit distributions , which are subject to Swiss withholding tax of 35%.

The Swiss withholding tax requires that the tax is borne by the recipient. More specifically, in practice, when interest is being adjusted, 35% of the taxable amount must be paid back by the dividend recipient to the dividend payer , so that the latter can remit the withholding tax in the amount of 35% to the FTA. If this does not happen for example, due to liquidity reasons or a gross-up clause in the loan agreement then according to the FTA, the dividend received is already reduced from the perspective of the dividend recipient, i.e. 65%, which means that the withholding tax to be remitted must be grossed up on this basis and in fact amounts to 53.8%.

Fortunately, Switzerland has concluded double taxation agreements with many jurisdictions, which means that in some cases the remittance of withholding tax can be reported and does not have to be remitted if all formalities and requirements are met .

© 2021 Euromoney Institutional Investor PLC. For help please see our FAQ.

What Are The Warning Signs Of A Dishonest Lender

Dishonest lenders may contact you with a supposed deal on financing. They may say your credit history doesnt matter. They will try to push you into more expensive agreements with less favorable terms and pressure you to commit before youve had a chance to research and consider other options. Know that legitimate lenders will give you time to review the terms of the offer in writing and want you to understand them. They will never ask you to sign blank documents or hide disclosures and key terms.

Here are some rules of thumb to spot and avoid dishonest lenders:

- Avoid a lender who wants you to apply to borrow more than the amount you need.

- Dont deal with a lender who wants you to get financing with monthly payments bigger than you can comfortably make.

- Never work with a lender who wants you to lie on a financing application like saying your income is higher than it really is.

- Avoid lenders who say to sign blank forms. If they fill in the blanks later, you dont know what theyll say.

- Never work with a lender who says you cant have copies of the documents you signed. Of course you can.

- Dont deal with any lender who tells you not to read the financing disclosures. The law says you must get them, so make sure you do and be sure to read and understand them before you sign for the financing.

- And be sure to avoid any lender who promises one deal when you apply, but gives you a different set of terms to sign, with no good explanation of the change.

Whats A Home Equity Line Of Credit

This type of financing, also known as a HELOC, is a revolving line of credit, much like a credit card except it is secured by your home. The lender approves you for a certain amount of credit. Generally, as long as you stay under that credit limit, you can borrow as much as you need, any time you need it, by writing a check or using a credit card connected to the account. Many HELOCs have an initial period of time a draw period when you can borrow from the account. After that, you might be able to renew the credit line but if not, you will probably have to start repaying the amount due either the entire outstanding balance or through payments over time. HELOCs generally have variable interest rates and payments so the rates and payments can go up or down over time.

Like home equity loans, you use your home as collateral for a HELOC. This can put your home at risk if you cant make your payments or theyre late. And, if you sell your home, most HELOCs make you pay off your credit line at the same time.

Also Check: Stilt Loan Calculator

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Lending And Mortgage Servicing Practices That Can Hurt You

You could lose your home and your money if you borrow from dishonest lenders. Certain lenders target homeowners who are older or who have moderate means or credit problems and then try to take advantage of them by using deceptive, unfair, or other unlawful practices like these:

- Loan flipping happens when the lender encourages you to repeatedly refinance the loan, which often leads you to borrow more money. Each time you refinance, you pay additional fees and interest points. That increases your debt.

- Insurance packing happens when the lender adds to your financing credit insurance or other insurance products that you may not need.

- Bait–and-switch happens when the lender offers one set of terms when you apply, then pressures you to accept higher charges when you sign to complete the deal.

- Equity stripping which involves practices that reduce the value in your home, can happen when the lender offers financing based on the equity in your home, not on your ability to repay. If you cant make the payments, you could end up losing your home.

- Non-traditional products include home equity loans that

- have monthly payments that increase either because they have variable interest rates, or because the minimum payment doesnt cover the principal and interest due

- have low monthly payments, but a large lump-sum balloon payment due at the end of the loan term. If you cant make the balloon payment or refinance, you face foreclosure and the loss of your home.

Read Also: How To Transfer Car Loan To Another Bank

Other Home Equity Tips

- A home equity line of credit, or HELOC, has an adjustable rate of interest attached to paying it off, which means that your payments can fluctuate based on the federal funds rate. Think about a home loan if the idea of an adjustable rate unnerves you.

- Know your loan-to-value, or LTV, ratio. This is how much you owe vrsus how much the home is worth. Many people are in trouble now because their homes dropped in value. You don’t want to be stuck owing more than your house is worth.

- Figure out what the loan is for and how long you’ll need the money to help decide which kind of loan you need. Home equity loans are better for single lump sum expenses while home equity lines of credit, or HELOCs, are best for prolonged expenses, like college tuition.

Which Is Better A Heloc Or A Reverse Mortgage

For seniors in need of funds and contemplating whether to get a reverse mortgage or a credit line, here are a few best practices for those who opt for the HELOC:

- Keep your HELOC limit at about 75-80% of what youd get with a reverse mortgage. By doing this, you ensure you can always refinance into a reverse mortgage in case you become unable to keep up with the HELOC payments, or if your lender freezes your HELOC for some reason.

- Apply for a HELOC before you retire and while your income is higher. This will likely maximize your odds of being approved compared to applying once in retirement.

- In certain cases, and if permitted by the lender, you can make the required interest-only payments directly from the HELOC itself, so you’re not out-of-pocket each month.

- Of course, your best bet is to contact an experienced broker to verify the right strategy for your personal scenario.

Also Check: Bayview Loan Servicing Class Action Lawsuit

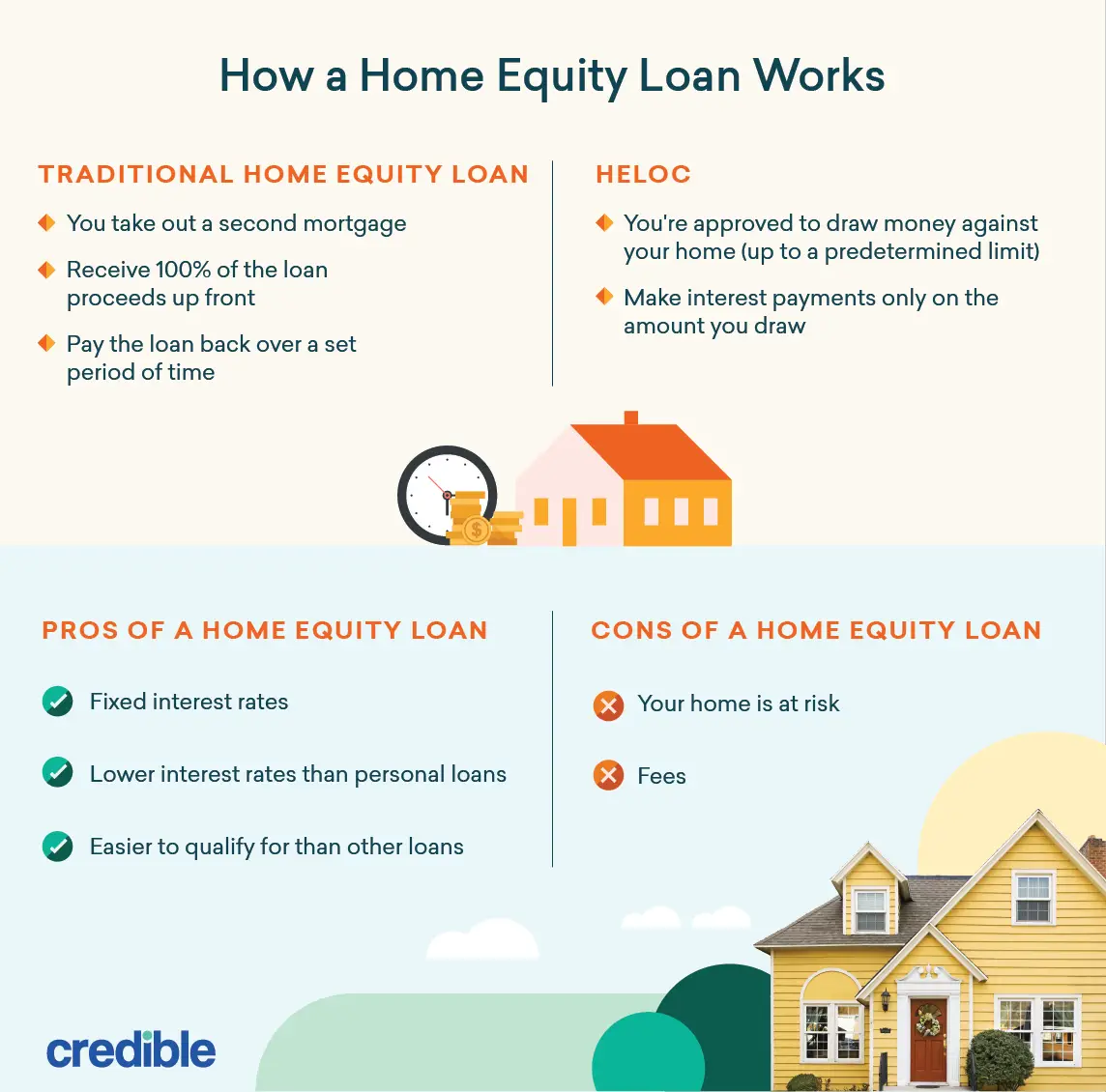

What Is The Difference Between Mortgages And Home Equity Loans

Mortgages and home equity loans are both borrowing methods that require pledging a home as collateral, or backing, for the debt. This means the lender can seize the home eventually if you don’t keep up with your repayments. While the two loan types share this important similarity, there are also key differences between the two.

Getting A Second Mortgage

A second mortgage is a second loan that you take on your home. You can borrow up to 80% of the appraised value of your home, minus the balance on your first mortgage.

The loan is secured against your home equity. While you pay off your second mortgage, you also need continue to pay off your first mortgage.

If you cant make your payments and your loan goes into default, you may lose your home. If thats the case, your home will be sold to pay off both your first and second mortgages. Your first mortgage lender would be paid first.

Recommended Reading: Fha Refinance Rate

What Is The Difference Between Apr And Interest Rate

- Main

-

Your interest rate is the direct charge for borrowing money.The APR, however, reflects the entire cost of your mortgage as a yearly rate and includes the interest rate, origination charge, discount points, and other costs such as lender fees, processing costs, documentation fees, prepaid mortgage interest and upfront and monthly mortgage insurance premium. When comparing loans across different lenders, it is best to use the quoted APRs for the same type and term of loan.

Figure: Best Home Equity Line Of Credit For Fast Funding

Overview: Figure is an online lender that offers HELOCs in 41 states and Washington, D.C. Its rates are as low as 3 percent APR, which includes an origination fee of up to 4.99 percent and discounts for enrolling in autopay and joining one of its partner credit unions. Its HELOC works a bit like a home equity loan in the beginning: You get the full loan amount with a fixed rate. As you pay off the line of credit, you can borrow funds again up to the limit. These draws will get a different interest rate.

Why Figure is the best home equity line of credit for fast funding: Figure promises an easy online application process with approval in five minutes and funding in as few as five business days. Figure could be a good option for borrowers who need fast cash.

Perks: Theres a fixed interest rate, which means the payments wont change over the life of the loan unless you make additional draws.

What to watch out for: While some lenders offer a wide range of loan amounts, Figure caps its loans at $250,000 though you may qualify for less, depending on your loan-to-value ratio and credit score. That might not be enough for some borrowers. Theres also an origination fee of as much as 4.99 percent.

| Lender | |

|---|---|

| Fees | Pay an origination fee of up to 4.99% of your initial draw |

Terms and conditions apply. Visit Figure.com for more details. Figure Lending LLC is an equal opportunity lender. NMLS #1717824

Also Check: Usaa Car Payment Calculator

Bmo Harris Bank: Best Home Equity Line Of Credit For Different Loan Options

Overview: BMO Harris Bank has more than 500 branches spread across eight states. However, customers nationwide can bank with BMO online. Its HELOCs start at $25,000, come with flexible repayment terms and have no setup fees.

Why BMO Harris Bank is the best home equity line of credit for different loan options: BMO Harris has a standard variable-rate HELOC, but you can also lock in all or part of your line at a fixed rate for a five- to 20-year term.

Perks: There are no application fees or closing costs, and you get a 0.5 percent discount when you set up autopay with a BMO Harris checking account.

What to watch out for: Borrowers may have to repay setup costs if the line of credit is closed within 36 months. Depending on the state in which you live, you may also have to pay mortgage taxes and an annual fee.

| Lender | |

|---|---|

| $25,000 to $150,000 | |

| Fees | BMO Harris covers the setup costs, but the borrower may have to repay those costs if the line of credit is closed within 36 months. Depending on the state, borrowers may also have to pay mortgage taxes. In some states, there is a $75 annual fee during the draw period. |

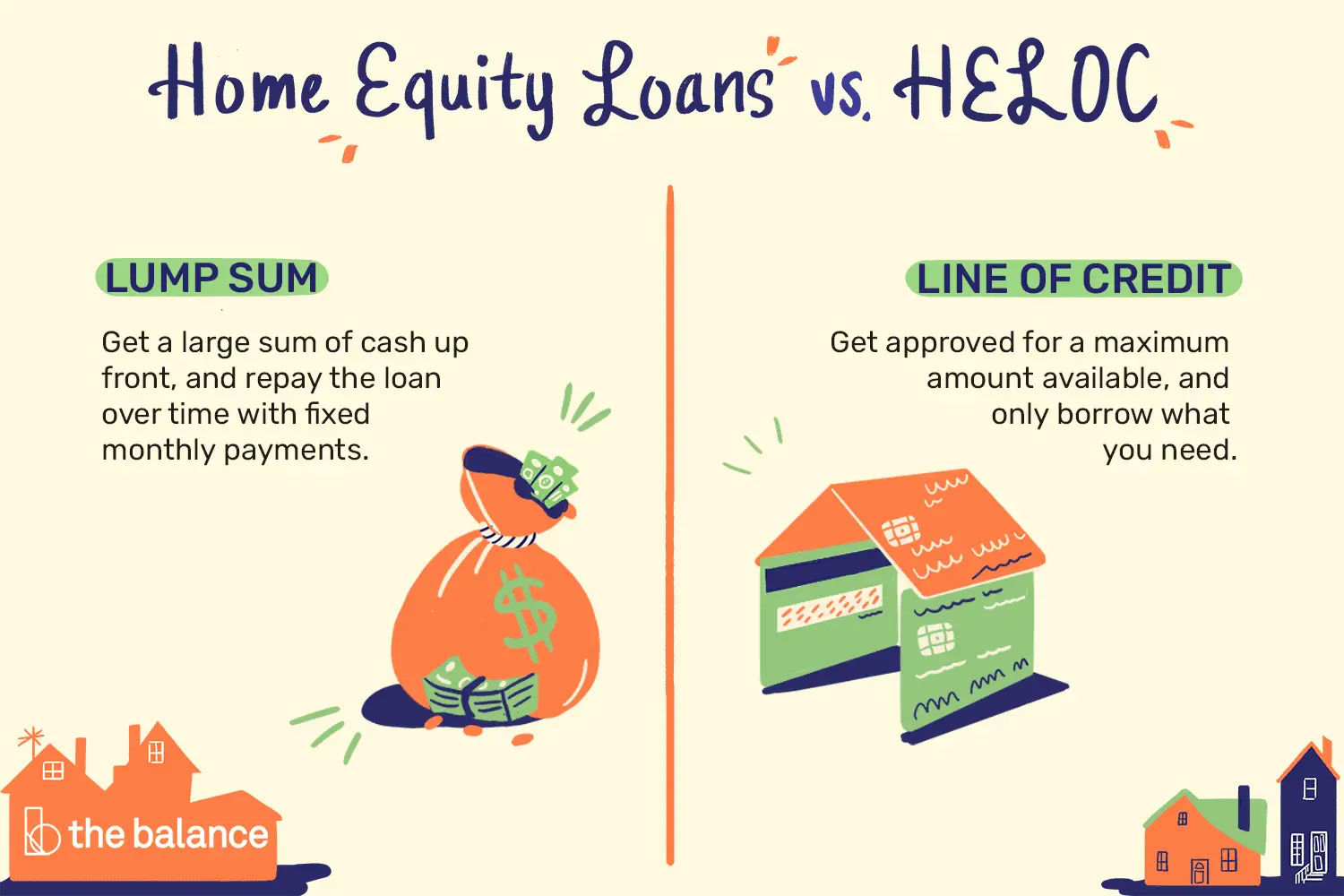

Home Equity Loan Vs Heloc

Home equity loans and home equity lines of credit are both loans backed by the equity in your home. However, while a home equity loan has a fixed interest rate and disburses funds in a lump sum, a HELOC lets you make draws with variable interest rates, like a credit card.

Generally speaking, if you’re planning on making multiple home improvement projects over an extended period of time, a HELOC may be the better option for you. If you’re thinking about consolidating high-interest credit card debt or doing a larger home improvement project that would require all of the funds upfront, a home equity loan may be the best option.

Read Also: Capital One Car Loan Apr

Best Heloc Lenders In December 2021

The best HELOC lenders offer competitive interest rates, low fees and an easy online application process. We analyzed HELOC offers from a wide range of banks, credit unions and online lenders to come up with this list of top lenders in this space:

- Third Federal Savings and Loan: Best home equity line of credit with a long repayment term

- Bethpage Federal Credit Union: Best home equity line of credit with a fixed-rate option

- Bank of America: Best home equity line of credit for low fees

- Flagstar Bank: Best home equity line of credit for good credit

- Figure: Best home equity line of credit for fast funding

- Citizens: Best home equity line of credit for low loan amounts

- BMO Harris Bank: Best home equity line of credit for different loan options

- Lower: Best home equity line of credit for quick approval

- PenFed Credit Union: Best home equity line of credit with flexible membership requirements

- PNC: Best home equity line of credit for flexible borrowing options

- TD Bank Best home equity line of credit for in-person service

Payments And Interest Rate

A home equity loan’s interest rate is fixed, meaning the rate doesn’t change over the years. Also, the payments are fixed, equal amounts over the life of the loan. A portion of each payment goes to interest and the principal amount of the loan. Typically, the term of an equity loan term can be anywhere from five to 30 years, but the length of the term must be approved by the lender. Whatever the period, borrowers will have stable, predictable monthly payments to make for the life of the equity loan.

Don’t Miss: Car Loan Interest Rates Credit Score 650

How Borrowing On Home Equity Works

You may be able to borrow money secured against your home equity. Typically, interest rates on loans secured against home equity can be much lower than other types of loans.

Not all financial institutions offer home equity financing options. Ask your financial institution which financing options they offer.

You must go through an approval process before you can borrow against your home equity. If youre approved, your lender may deposit the full amount you borrow in your bank account at once.

You can borrow up to 80% of the appraised value of your home.

From that amount, you must deduct the following:

- the balance on your mortgage

- your total HELOC amount, if you have one

- any other loans secured against your home

Your lender may agree to refinance your home with the following options:

- a second mortgage

- a loan or line of credit secured with your home

How Soon Can I Tap The Equity I’ve Built

Generally, lenders require that homeowners have at least 20 percent equity in their homes before they can withdraw money through a home equity loan product. This means you need a loan-to-value ratio, or LTV, of 80 percent. A professional property appraisal is done to verify your homes current market value. A lender then divides your outstanding mortgage balance by the appraised value to get a percentage for your LTV ratio.

Home values and the term of your loan play a role in how quickly you gain equity. When home values rise, as they have in recent years, you can build equity much faster. But if the market takes a dive as it did during the Great Recession, you could lose equity and become underwater in your mortgage owing more than your home is worth.

Recommended Reading: Usaa Bad Credit Auto Loans

How Can You Use Home Equity

Your home may be your most valuable asset, and borrowing against your equity in it could free up cash for any of several purposes. You might use the money to:

- Finance a home-improvement project. Under the recent tax law, interest on a HELOC or HELOAN used to buy, build or substantially improve a home may be tax deductible. Consult your tax advisor.

- Consolidate what you owe on credit cards or other higher-rate debts into a single loan. Since your home is used as collateral for HELOCs and HELOANs, these loans may have lower interest rates than other kinds of loans.

- Cover emergency expenses. If youve used up the cash in your emergency fund, you could draw on a HELOC to pay for house repairs, medical bills or other unexpected costs.

- Help pay for education tuition and fees. Home equity line or home equity loan interest rates may be lower than rates on college loans.