Refinancing Parent Plus Loans

If you have Parent PLUS Loans and want to eliminate your debt as quickly as possible, consider student loan refinancing. When you refinance Parent PLUS Loans, you may qualify for a lower interest rate, smaller monthly payment, or you may even transfer your debt to your child.

Student loan refinancing is a process that involves borrowing money from a private lender to pay off all or some of your existing student loans. Since refinancing loans are offered by private lenders rather than the government, you can qualify for different terms.

Comparing Federal And Private Student Loans

Federal student loans, such as the Federal Direct Loan and the Parent PLUS Loan, generally have more favorable terms and conditions than private loans. We recommend using all federal loan eligibility before turning to private loans.

We will hold the processing of a private alternative loan until you:

Which Type Of Student Loan Is Best For My Family

Parents and students should sit down together and discuss how they plan to finance the child’s higher education. Figure out how much you need to borrow and decide who is going to foot the bill. In most cases, it’s best for the child to take out the loan in his or her own name, both because loan terms for students are usually more flexible and because if the parent cannot keep up with the loan payments, it could make it difficult or impossible for them to save for their other financial goals.

Parents of college-age children usually have their eyes on retirement and it’s important that they prioritize saving for this first because if they run out of money in their old age, their child will have to support them, and this may cost the child more than a student loan would. So if the parent is behind on retirement savings or is unsure of his or her ability to pay back the loan on time, it’s better to let the student take responsibility for the debt.

If the parent isn’t comfortable placing such a heavy burden on the child, the two may decide to split the loans. The child may take out what he or she can in federal student loans and then if that’s not enough, the parent may make up the rest with a Direct PLUS loan.

You May Like: Does Va Loan Work For Manufactured Homes

What Interest Rate Can I Qualify For

If you have good credit and a steady income, parent private student loans may offer more competitive rates.

- Parent PLUS Loans: All borrowers who take out a PLUS Loan on or after July 1, 2021, and before July 1, 2022, will have a 6.28% regardless of their credit. However, keep in mind that the upfront fee on PLUS Loans can increase your APR by about a full percentage point.

- Private student loans: Private loan borrowers with good to excellent credit and steady income might be able to qualify for a lower rate. Over the length of your loan repayment, that lower interest rate could help you save a significant amount of money.

Use Other Federal Student Loans First

Before we get started with this comparison, it’s important to point out that it’s generally not a smart idea to use either Graduate PLUS Loans or private student loans made to grad students unless you’ve exhausted your other federal loan borrowing ability first.

Specifically, graduate and professional students can obtain Direct Unsubsidized Loans that are, in virtually all ways, far superior to PLUS Loans or anything available in the private market.

I won’t get too deep into a discussion of the advantages, but here are a couple of reasons:

- Direct Unsubsidized Loans have lower fees and interest rates than PLUS Loans. In fact, the origination fee, or loan fee on a Direct Unsubsidized Loan is one-fourth of the fee you’ll pay for a PLUS Loan.

- Direct Unsubsidized Loans aren’t credit-based, unlike private student loans. Even with Grad PLUS Loans, while there’s no credit score requirement, you can’t have an adverse credit history.

However, the biggest downside to Direct Unsubsidized Loans is the borrowing limit. Under the current program rules, the maximum amount of Direct Unsubsidized Loans you can borrow is $20,500 per school year. While this is certainly higher than undergraduate borrowing limits, it isn’t enough to cover the entire cost of attendance at many graduate and professional programs.

Meanwhile, Grad PLUS Loans and private graduate student loans can generally be made for a student’s entire cost of attendance, minus any other financial aid received.

Recommended Reading: Va Loan Manufactured Home With Land

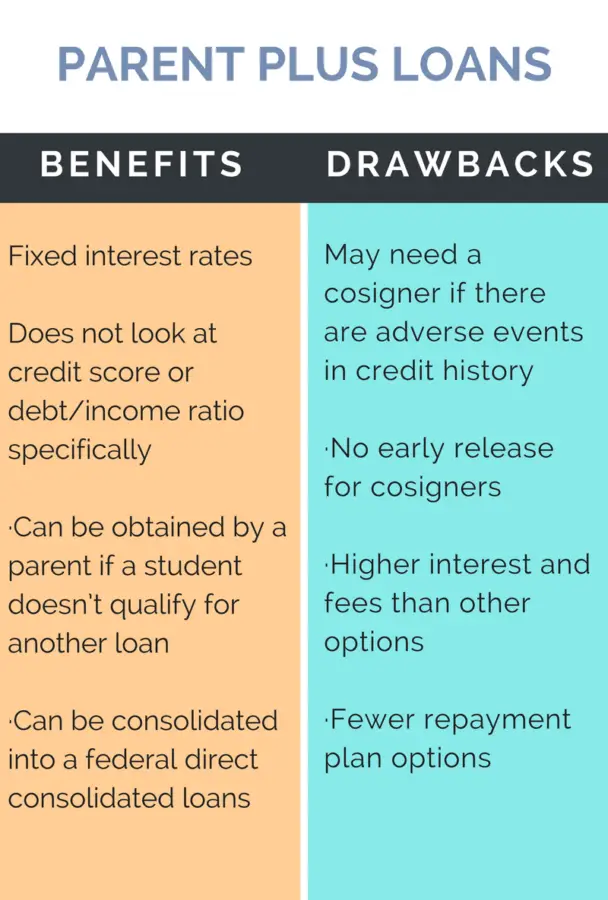

Are There Any Benefits To Parent Plus Loans

The one benefit that Parent PLUS loans do have in common with other student loans is that they are eligible for one of the governments income-based repayment programs. However, even that benefit is limited for parents. Qualified Parent PLUS loans are only eligible for the income-contingent repayment, which caps payments at 20% of income with forgiveness after 25 years.

While these PLUS loans might be bundled up into an award letter from a schools financial aid offer, parents should consider all their options first. As always, it pays to shop around and find the best fit for each family.

Finding A Plus Loan Lender

All new federal education loans, including the PLUS loan, are made through the Direct Loan program. To obtain a Parent PLUS loan, contact the colleges financial aid office.

The PLUS loan borrower will need to sign a Master Promissory Note , which covers a period of continuous enrollment. Annual borrowing is capped at the cost of attendance minus other aid. The college will draw down the funds from the Common Origination and Disbursement system and deposit them into the students account. After the funds are applied to tuition and fees , any remaining funds will be disbursed to the student to pay for textbooks and other college-related costs.

Parents who are considering a PLUS loan also often consider a home equity loan or an alternative loan. Have questions? Learn more about qualifying for a Parent PLUS Loan: Questions about Qualifying for the Parent PLUS Loan

Don’t Miss: Www Chfainfo Com Homebuyer

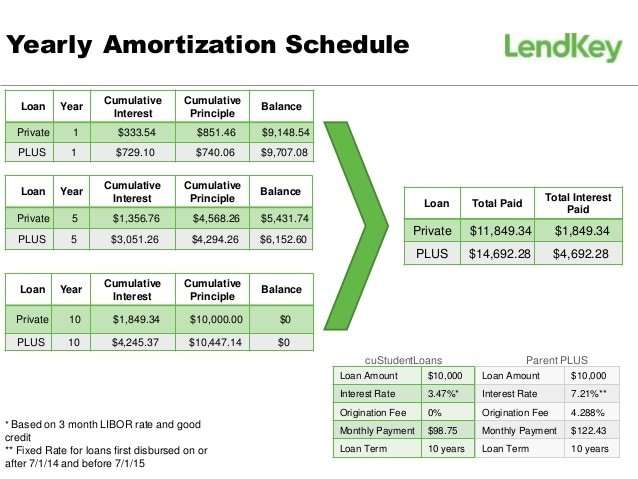

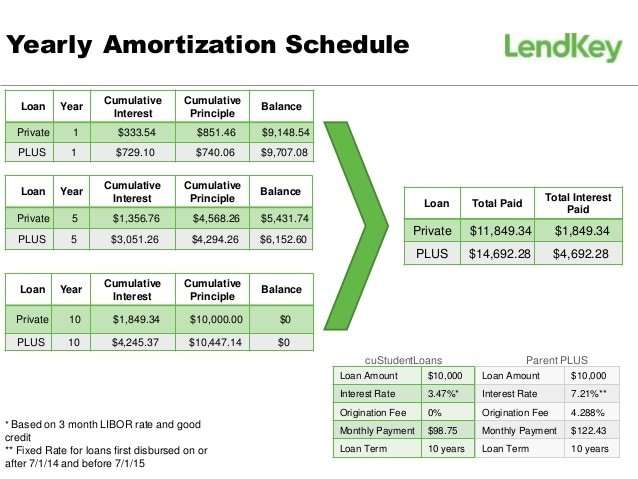

Comparing Parent Plus Loans And Private Student Loans

Despite college costs skyrocketing in recent years, borrowing limits on most federal loans like Direct Subsidized and Unsubsidized Loans havent increased in over a decade. As a result, more parents and graduate students are turning to PLUS loans because they can borrow up to the total cost of attendance, filling the gap left by the strict borrowing limits.

However, Parent PLUS Loans have significant downsides which can make private student loans a viable alternative:

Check Out:

Cons Of A Parent Plus Loan

Fees on PLUS Loans are also higher than on the other Direct Loans. Most income-driven repayment plans are unavailable to parent PLUS loan borrowers, although they may be eligible for an Income-Contingent Repayment Plan under certain circumstances.

And youll have to start making payments on the loan as soon as it is disbursed though you can request a deferment while your student is in school, but the interest on the loan will still accrue and add up. Of course, the loan is taken out in the parents name, so responsibility for paying the loan back is on you, not on your kid.

You May Like: What Do Mortgage Loan Officers Do

Where Should You Look For An Alternative To Parent Plus Loans

The private student loan market might provide better options if youre not feeling sold on Parent PLUS loans. Students who have already hit the federal lending limit for Direct loans should take a look at Juno. Instead of being lenders themselves, they take bids from a massive pool of private lenders and then offer the best deal to their members.

While youll likely still need a co-signer for this , it can lead to much more competitive terms than Parent PLUS loans. With this program, youre not going to get charged anything at allno origination fees or anything like that. They also guarantee youll get the best possible deal on a private loan, or theyll match it. Thats something the federal government wont offer you.

Theres currently about $1.7 trillion in outstanding student loan obligations among U.S. borrowers. Finding the right loans will help you pay down your debt faster, and allow you to excel during and after school.

Grad Plus Loans: The Quick Version

The Grad PLUS Loan is the type of Direct PLUS Loan that’s available to students enrolled in graduate or professional programs at eligible colleges and universities.

In order to be eligible for a Grad PLUS Loan, a student needs to be enrolled in an eligible graduate degree or certificate program on at least a half-time basis, and they cannot have an adverse credit history. While this isn’t as comprehensive or restrictive as the credit checks used by private lenders, it does mean that things like active collection accounts or recent foreclosures can prevent you from getting a Grad PLUS Loan or could create the need to find a creditworthy cosigner. And while they don’t need to have a demonstrated financial need, borrowers do need to file the FAFSA.

Grad PLUS Loans have two costs to consider — the interest rate and the loan fee. Both costs are determined for each school year, so they do fluctuate over time. For the 201819 school year, the Grad PLUS Loan has a fixed interest rate of 7.6%. And the loan fee is 4.248% of the loan amount, which is deducted before the funds are distributed to the school.

Read Also: How Can I Get An Rv Loan With Bad Credit

Can You Get A Better Interest Rate With Private Lenders

The current interest rate for Direct PLUS Loans is a fixed rate of 6.28 percent . If you have a good credit score, you may be able to qualify for a better interest rate with a private lender. Look into private loan options and determine where you can get the best rates before deciding to apply for a parent PLUS loan.

How Do Private Parent Student Loans Work

Private student loans originate from private financial institutions such as banks, credit unions and online lenders. Parents may take out the loan as the primary borrower or co-sign a loan with their child. Heres how to get a private college loan for parents:

As with federal college loans for parents, youll likely need to reapply each year.

Don’t Miss: How Much To Loan Officers Make

Best Parent Student Loans: Private Vs Plus

Picking a Parent PLUS loan or a private student loan can depend on your credit score and student status.

Determining the most cost-effective way to borrow for school is essential as college graduates worry about repaying the collective $1.6 trillion in outstanding student debt they owe.

Maxing out direct subsidized and unsubsidized loans first is advisable as these come with the best student loan interest rate, repayment plans, and borrower protections. But those loans have limits. Once they’re met, there are only two primary options for undergrads: private loans and Parent PLUS loans.

If you’re a parent, then you’re going to want to do your research on parent loans for college like a plus or private parent student loan and determine which best meets your long-term financial goals. Fortunately, an online marketplace like Credible can walk you through the various loan products currently available and snag you a good deal. Compare student loan lenders and rates today by clicking here.

For those looking to learn more about school loans, specifically parent student loans, read on.

Parent Plus V Private Student Loans: Which Should You Choose

If you’re figuring out your funding plan for the 2020-21 school year, we have some good news: Record-low interest rates mean there are plenty of great options for both student and parent education loans.

However, it’s important to know that rates and terms vary widely between student and parent options. In general, cosigning a private student loan for your child is going to provide the best opportunity for the lowest-possible interest rates and most generous loan terms.

Plus, having the loan in your child’s name means that you may be able to be released as a cosigner after a certain number of years. Removing the loan from your credit report may be an increasingly important factor as you get closer to retirement.

Don’t Miss: Va Loan Requirements For Mobile Homes

Your Child Can Afford The Payments And Is Willing To Take Over The Loans

After graduating from college, your child secures a great job and starts earning a healthy income. As they climb the corporate ladder, their financial situation gets even better, and they offer to take over the loans you borrowed to help them pay for their degree.

If thats the situation for you and your child, refinancing your loans and transferring them into the childs name is an excellent idea. It frees you from the obligation and stress of repaying the debt.

Sofi Parent Loans Could Have Lower Interest Rates

There are lots of factors that go into choosing a loan, including eligibility criteria and repayment options. But if your priority is saving money, take a close look at interest rates.

All parent PLUS loans come with a fixed rate of 5.3% in the 2020-21 year. This rate is significantly lower than past years rates, which were set around 7%. But it might still be higher than what youd get on a SoFi parent loan, which has fixed APRs starting from 2.74% and variable APRs starting at 2.25%.

Depending on your credit, income and other factors, you could snag a rate on a SoFi parent loan thats lower than what youd get with a parent PLUS loan. Reducing your interest could save you a good deal of money over the long run. That said, a variable rate, unlike a fixed rate, could potentially rise over time.

Since SoFi offers an easy pre-application online, its worth it to check your rates. This preliminary rate quote wont affect your credit score, and youll see what rate you could be eligible for.

If its lower than the one youd have on a parent PLUS loan, it could be worth going with SoFi.

Recommended Reading: Is Bayview Loan Servicing Legitimate

Parent Plus Loans Have Fewer Repayment Options

Federal student loans generally are eligible for a wide menu of repayment options, including Extended plans, Graduated plans, and multiple income driven repayment plans such as Income Based Repayment and Pay As You Earn , where the borrowers income can help determine the payment amount.

As a general rule, Parent PLUS loans have fewer repayment options. While they can sometimes be repaid under Extended or Graduated plans, they cannot be repaid under IBR, PAYE, or Revised Pay As You Earn . Parent PLUS loans can be repaid under another income-driven plan called Income-Contingent Repayment if the loans are first consolidated via a Direct consolidation loan. However, Direct consolidation is not the right decision for everyone, and ICR is almost always going to be more expensive than IBR, PAYE, or REPAYE.

Parent Plus Loans Application Process

You can apply for the Parent PLUS loan online through the Federal Student Aid website in about 20 minutes. You can also download and print a copy of the application and submit it by mail.

To apply youll need:

- Your own verified Federal Student Aid ID , which youll set up on the Federal Student Aid website

- Name of the school your child will attend

- Your personal information, such as your name and address

- Information about the student, including Social Security number and date of birth

- Your employment information

Don’t Miss: What Car Loan Can I Afford Calculator

Pros Of The Parent Plus Loan

- Parent PLUS Loans arent income-dependent, nor do they require good credit.

- PLUS loans offer fixed interest rates, which may be lower than rates offered by some private lenders.

- Parents can pause payments by putting loans in forbearance for up to five years in times of financial need.

- Theres no maximum loan amount.

Qualifying For A Parent Plus Loan

The first step to qualifying for any type of federal loan is to fill out the Free Application for Federal Student Aid . Its a required step to document your childs financial need. Colleges use the FAFSA information to determine a financial aid packagewhich could include grants, work-study, subsidized loans, and/or unsubsidized loans.

If your child is offered a financial aid package, you can then figure out how much of their tuition will be covered by financial aid vs how much you might need to take out additional loans to cover any remainder. At that point, you can start to weigh the benefits of private student loans vs. parent PLUS loans.

Read Also: How To Get An Aer Loan