Conventional Loan Vs Usda Loan

Depending on where in the country you want to buy a home, a USDA loan may be an option. You can get a USDA loan with little or no money down. The main criterion is that you need to purchase a home in a rural area that qualifies for the USDA loan program. If you want to buy in a city or a well-developed suburban area, a conventional loan is likely your better option.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Conventional Loan Vs Construction Loan

If youre hoping to build a house from the ground up and need to finance the cost of construction, you will likely need to consider a construction loan. Construction loans cover the cost of building the home. Once construction is complete, the loan becomes due. You can convert it to a conventional mortgage at that stage.

Two types of construction loans exist. The first is a single-closing loan that automatically converts to a permanent, conventional mortgage after construction is finished. A two-closing loan has a separate closing process in the middle before the construction loan becomes a conventional mortgage.

Since conventional mortgages use the property you buy as collateral, and because theres no property at the start of the construction process, you need a construction loan if you want to finance your new home purchase from the start.

Don’t Miss: Can I Transfer My Car Loan To My Business

Down Payment Options Fewer In Some Parts Of The Country

Some areas of the country feature a smaller number of condos approved by either Fannie Mae and Freddie Mac or the Department of Veterans Affairs or Federal Housing Administration. So depending on where you are looking to buy your condo, your down payment options might be even more limited.

You can search for FHA-approved condos by state and county on the link shown. You may find limited options in some states. In Florida, for example, only 130 condo buildings were approved for FHA insurance as of June 16 of this year. In Nevada, only 29 condo developments were approved for FHA financing. In Arizona, only 145 condo buildings had earned this approval, and in New Jersey just 298. Looking for an FHA-approved condo in New York? Your options were limited to just 84 as of June 16.

But in California, 2,056 condo developments have been approved for FHA financing as of June 16. In Illinois, buyers can find 632 FHA-approved condo developments.

Michael Kelczewski, a real estate agent with Brandywine Fine Properties in Centreville, Delaware, said that buyers might struggle to find condos in their states that are approved for FHA or VA loans, so they’ll typically have to go with conventional mortgages, those not insured by a government agency. Often, lenders will request higher down payments for these loans.

Conventional Loans Vs Va Loans

While conventional loans are available to anyone who can meet the requirements, VA loans are only available to veterans, active-duty military members and their surviving spouses.

The requirements for VA loans are similar to that of conventional loans. VA loans, however, come with a few extra benefits.

First, VA loans dont require a down payment. Second, VA loans dont require you to pay mortgage insurance, regardless of how much money you put down.

If youre thinking about getting a VA loan instead of a conventional loan, here are a few things to consider:

- You cant use a VA loan to buy a second home. The Department of Veterans Affairs only guarantees a certain dollar amount for each borrower, so you typically cant have more than one VA loan at a time.

- Youll have to pay a funding fee. The funding fee offsets the cost to taxpayers of getting the VA loan. Certain groups are exempt from paying the funding fee, but most are required to pay it. The funding fee ranges from 1.25% to 3.3% of the loan amount and varies based on how much your down payment is, whether youre buying a home or refinancing, and which branch you served in.

Don’t Miss: How To Qualify For Loan Modification

Conventional Loan Down Payment Translates Into Equity

The money you put down, the more of your home you own outright. When you put down, say, 5% on a home valued at $300,000, you own $15,000 worth of home from the minute you close.

This $15,000 is your equity in the home. Over time, as you make payments and the home appreciates in value, your equity will grow. Later, once your equity grows large enough, you could borrow against it and use the cash to renovate or expand the home or to make a down payment on a second home.

A larger down payment gives you a nice head start on the road to building wealth through home equity.

How Much Investment Property Can You Afford

Qualifying for an investment property mortgage involves proving your ability to comfortably manage the monthly payments. Before you make purchase offers, its wise to apply for a mortgage preapproval. This is the most straightforward way to determine how much investment property you can afford to buy.

Once you have a price range, take some time to research the local rental market online. Your lender will most likely consider 75% of your expected rental income as part of your loan application. This can be done easily if the property was already an investment property and theres a rental history to evaluate. Otherwise, your lender can look at market rents in your area to come up with a reasonable estimation of rental income.

Dont forget to factor in ongoing rental property expenses when figuring out how much you can afford. These may include but arent limited to:

- Landlord insurance

- Utilities

You May Like: How To Stop Loan Payments

Down Payment Requirements On Conforming Loans

The great news is that the two mortgage giants Fannie Mae and Freddie Mac have brought the 3% down payment conventional loan program. The 3% down payment first-time homebuyer conventional mortgage was an extremely popular program. But Fannie Mae and Freddie Mac discontinued it in 2014.Currently, to qualify for a conventional loan, a minimum of a 5% down payment is required.Now home buyers with a 3% down payment can qualify for a conventional loan.Conventional lending guidelines need to be met by the home buyer.

Ways To Save More For A Down Payment

It can be a challenge to save money for a down payment on a home. Here are some quick tips to get you there:

Read Also: How To Eliminate Pmi Insurance On Fha Loan

Commercial Mortgage Down Payment Requirements

The cost of purchasing real estate is often one of the largest expenses any business will ever incur. Getting financing for a commercial property is possible in several ways. Here are some of the typical commercial mortgage programs and the down payment amounts they require:

| Loan Type | |

|---|---|

| Collateral may be required to secure the loan | |

| Construction loan | |

| HUD FHA Healthcare Property Loan | At least 10% for nonprofit, 15% for for-profit |

| Fannie Mae Apartment Loan | At least 3.5% if resident for at least 12 months, 20% if not |

| Freddie Mac Apartment Loan | At least 3.5% if resident for at least 12 months, 20% if not |

| Bridge loan | 10% to 20% |

Due to the size of the purchase, most lenders will require a significant amount of upfront payment. But when it comes to selecting a mortgage for your business, the size of the initial down payment isnt the only factor to consider. Shop around to obtain the best rates and terms for your business, as the conditions offered can vary by lender.

On average, commercial mortgages offered through government-sponsored programs, including the SBA, FHA and USDA, will provide some of the best financing options. If the purchased property serves a good governmental purpose a healthcare facility or public housing, for example your chances of low rates are even better. While the qualifications listed above are based on the typical loan-to-value ratios required for each program, acceptance standards may vary by lender.

How Much Should You Put Down On A House

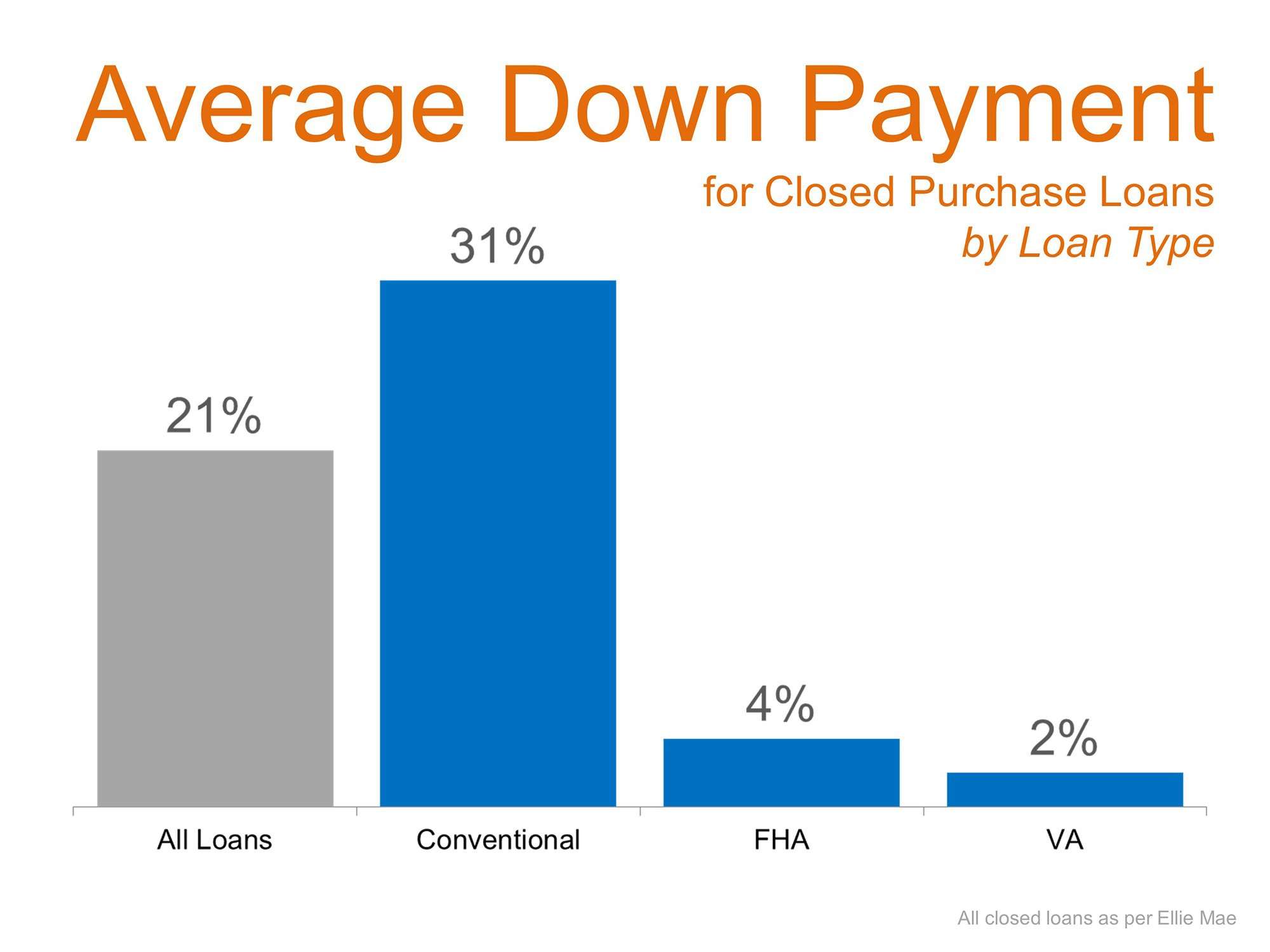

Should you put 20% down on a house, even though its not required? In many cases, the answer is no. In fact, most people put only 6-12% down. But the right amount depends on your situation.

For instance: If you have a lot of money saved up in the bank, but relatively low income, making the biggest down payment possible can be smart. Thats because a large down payment shrinks your loan amount and reduces your monthly mortgage payment.

Or maybe your situation is reversed.

Maybe you may have a good household income but very little saved in the bank. In this instance, it may be best to use a low- or no-down-payment loan, while planning to cancel your mortgage insurance at some point in the future.

At the end of the day, the right downpayment depends on your finances and the home you plan to buy.

You May Like: How To Apply For Student Loan Forgiveness Due To Disability

How To Calculate A Down Payment

Because down payments are expressed as a percentage of the homes sales price, you simply need to multiply the sales price by your target percentage to determine how much youll need to put down. Here are some examples of how much the down payment would be at different price points:

| Home price | |

| $61,200 | $102,000 |

You can use Bankrates mortgage calculator to get a sense of how different down payment amounts impact your monthly mortgage payment, and the interest you can save by putting more money down.

What Is A Conventional Mortgage

A conventional mortgage is one thats not guaranteed or insured by the federal government.

Most conventional mortgages are conforming, which simply means that they meet the requirements to be sold to Fannie Mae or Freddie Mac. Fannie Mae and Freddie Mac are government-sponsored enterprises that purchase mortgages from lenders and sell them to investors. This frees up lenders funds so they can get more qualified buyers into homes.

Conventional mortgages can also be non-conforming, which means that they dont meet Fannie Maes or Freddie Macs guidelines. One type of non-conforming conventional mortgage is a jumbo loan, which is a mortgage that exceeds conforming loan limits.

Because there are several different sets of guidelines that fall under the umbrella of conventional loans, theres no single set of requirements for borrowers. However, in general, conventional loans have stricter credit requirements than government-backed loans like FHA loans. In most cases, youll need a credit score of at least 620 and a debt-to-income ratio of 50% or less.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: How To Check Student Loan Interest

Check Your Conventional Loan Eligibility

The bottom line is that itsvery important for home buyers to shop around for a conventional mortgage withat least three lenders.

Todays rates are very low,and can be even lower with the right shopping practices.

Check your conventional loaneligibility and rates today.

Popular Articles

% Down Payment: Is It Necessary

Young homebuyers, low-wage homebuyers, people with kids, people with high student debt and anyone in an expensive housing market can have trouble saving up 20% of a homes purchase price.

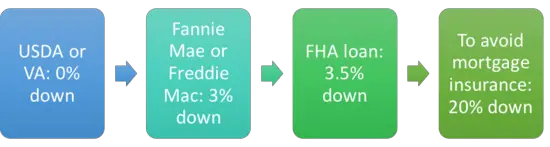

Fortunately, with the wide range of home loans available in todays market, its possible to buy a home with as little as 3% down. You can even put 0% down if you qualify for a down payment assistance program, a VA loan or a USDA loan. The size of your down payment doesnt need to deter you from buying a home.

Recommended Reading: What To Do If Lender Rejects Your Loan Application

How Much Money Should I Put Down On A New Home In Texas

Buying a new home is not an easy decision. FHA loans and incentives available for first-time buyers make it easier, but there are still many considerations to make before you take the plunge.

One of these is how much you should put down on your new house in Texas. What are the rules? How does the down payment affect your mortgage qualification or monthly payments? Today the Texas United Mortgage team answers questions about down payments for first-time home buyers!What is the Down Payment?

You’ve probably heard about “putting money down” on a house, but you might not know what it’s really about. Unless you’re paying cash-in-full for your first home , you’ll need to contribute a portion of the home’s sale price in cash before you can finance the rest of the sale through an FHA loan or conventional loan.

Do you need to put 20% down, no matter the type of loan? With today’s mortgage options and real estate market, many homebuyers can put little to no money down on a home to complete a purchase.

Down Payment Requirements For Conventional Loans

A conventional loan is the most common loan used to buy a home. With a decent credit score and solid minimum down payment, a conventional loan might work for you. But how much money do you need for a minimum down payment for a conventional loan?

Heres how to tell how much you need for a minimum payment for a conventional loan

Read Also: Does Refinancing Car Loan Hurt Credit

What Is A Conventional Home Mortgage Loan

A mortgage is a type of loan that is specifically tied to real property. A conventional mortgage loan a broad term used to describe any loan that is not backed by the government but is instead backed by private mortgage lenders such as Financial Concepts Mortgage.

In comparison, Federal Housing Authority loans and Veterans Administration loans are both backed by the government. FHA loans were created by Congress in the 1930s to make it easier for Americans to get into homeownership, whereas VA loans are designed for veterans, military members, and their spouses.

How Much Down Payment Should I Put Down

Just because a lender allows you to put very little or no money down on a business loan down payment, doesnt mean that you should. The less money down you offer, the higher your interest charges will be over the life of the loan, especially for big-ticket purchases like mortgages and commercial auto loans.

On average, lenders offer lower interest rates on business loans with higher down payments, further incentivizing a borrower to pay more up front. If your business can afford to make a greater contribution to the down payment, it can reduce the overall interest costs of the loan.

You May Like: How Much Loan Can I Afford House