When To Use A Joint Va Loan

A joint VA loan makes sense in several scenarios:

- You dont have the income to qualify on your own. If you apply with other eligible military borrowers, they can help you qualify with their income.

- You have too much debt to qualify on your own right now. Lenders prefer a debt-to-income ratio of 41%, although they sometimes make exceptions. All your debt counts toward this ratio . If you apply with another eligible military borrower with less debt and/or a higher income, that could bring down your DTI ratio.

- Your VA entitlement is used on another home. If your current home has a VA loan and you need to buy a new home before selling it, your entitlement will be reduced or eliminated. If you have a partial entitlement, borrowing with another military borrower who has a full entitlement will ensure more of the home is guaranteed by the VA.

- You want to purchase a multifamily home with more than four units. With military VA loan co-borrowers, you can buy a four-unit property with one family unit for each military participant, and one business unit. For example, two military borrowers could purchase a six-unit property with one business unit.

Can A Non Spouse Be On Title On A Va Loan

VAtitlespouseVAloan

Yes, generally. If the home is not located in a community property state, the non–borrowing spouse can be named on the title to the home without disclosing financial information. But he or she will need to sign title documents as required by state law to establish ownership.

Similarly, can a non borrower be on title? All borrowers on the mortgage application typically must be on title as an owner. However, non–borrowers can be on title as well. This means that both you and your spouse or partner are considered official owners of the residence.

Accordingly, who can be on title on a VA loan?

VA does not allow an individual to take title to a property if that individual is not on either the mortgage or a deed of trust. Accordingly, if a spouse or other owner does not want to sign a mortgage note and be obligated for a VA-guaranteed home loan that individual must sign a deed of trust.

Does a spouse have to be on a VA loan?

The VA guidelines recognize legally married spouses of qualified veterans as co-signers on VA loans, and lenders can include their income. These loans can be fully guaranteed by the VA. While the VA guidelines may allow for a non-veteran to co-sign for a mortgage loan, they will not fully guarantee the loan.

What Happens When Someone Dies With A Va Loan

What happens to the VA loan if the borrower dies before paying off the debt in full? Assuming a VA loan after death means the surviving spouse will be responsible for the debt. If the borrower is single but has a co-borrower, then they will take over the debt. If the deceased borrower has neither, the borrowers estate will handle the debt. The VA loan could also be assumed by an eligible buyer who could be a veteran, non-veteran, or even the children of the deceased owner of the original loan.

Also Check: What Is Bridge Loan Financing

Q: Only A Portion Of My Eligibility Is Available At This Time Because My Prior Loan Has Not Been Paid In Full Even Though I Don’t Own The Property Anymore Can I Still Obtain A Va Guaranteed Home Loan

A: Yes, depending on the circumstances. If a veteran has already used a portion of his or her eligibility and the used portion cannot yet be restored, any partial remaining eligibility would be available for use. The veteran would have to discuss with a lender whether the remaining balance would be sufficient for the loan amount sought and whether any down payment would be required.

Section : Military Spouse Credit Considerations

Every borrower on the loan must meet the lenders minimum credit score for VA loans. Those benchmarks can vary by lender and other factors.

A veteran with outstanding credit cant somehow compensate for a spouse whose score is below the lenders cutoff, and the reverse holds true, too. Both borrowers either meet the requirement or they dont. At Veterans United, prospective buyers who dont meet our current benchmark can work for free with our credit experts on a plan to boost their scores into qualifying range.

Lenders will quote interest rates based on credit scores. When there are multiple borrowers on a loan, lenders will base their rate quote on the lowest score.

Guidelines and policies for these types of derogatory credit can vary by lender.

Getting a good handle on your credit is key before starting the VA loan process. Use a credit monitoring service or get free copies of your reports from AnnualCreditReport.com. Look for errors, credits accounts that arent yours, and other issues that might be hurting your score.

Also Check: Does Refinancing Car Loan Hurt Credit

Can I Keep My Spouses Name Off The Title

If you live in a common-law state, you can keep your spouses name off the title the document that says who owns the property.

The title doesnt have much to do with the mortgage. The names on the mortgage show whos responsible for paying back the loan, while the title shows who owns the property. You can put your spouse on the title without putting them on the mortgage this would mean that they share ownership of the home but arent legally responsible for making mortgage payments.

Apply For A Va Home Loan Today

VA loans are often the most affordable option for active military members, veterans, and surviving spouses to purchase a home. If you decide to take out a VA loan, be sure to specify beneficiaries in your will so your spouse can assume the loan more easily. Its also wise to have life insurance to prevent your loved ones from being burdened with debt after youre gone.

Do you have more questions about qualifying for a VA-backed home loan as a veteran or surviving spouse? Are you ready to get pre-approved for a VA loan? Either way, feel free to contact Financial Concepts Mortgage at 722-5626 for more information, or begin your application online today. We proudly serve military families in Oklahoma, Texas, Kansas, Arkansas, and Alabama by offering some of the lowest rates in the country.

Also Check: How To Lower Car Loan Payments

Q: I Have Already Obtained One Va Loan Can I Get Another One

A: Yes, your eligibility is reusable depending on the circumstances. Normally, if you have paid off your prior VA loan and disposed of the property, you can have your used eligibility restored for additional use. Also, on a one-time only basis, you may have your eligibility restored if your prior VA loan has been paid in full but you still own the property. In either case, to obtain restoration of eligibility, the veteran must send a completed VA Form 26-1880 to our Atlanta Eligibility Center. To prevent delays in processing, it is also advisable to include evidence that the prior loan has been paid in full and, if applicable, the property disposed of. This evidence can be in the form of a paid-in-full statement from the former lender, or a copy of the HUD-1 settlement statement completed in connection with a sale of the property or refinance of the prior loan.

Q: How Do I Get A Certificate Of Eligibility

A: Complete a VA Form 26-1880, Request for a Certificate of Eligibility: You can apply for a Certificate of Eligibility by submitting a completed VA Form 26-1880, Request For A Certificate of Eligibility For Home Loan Benefits, to the Atlanta Eligibility Center, along with proof of military service. In some cases it may be possible for VA to establish eligibility without your proof of service. However, to avoid any possible delays, it’s best to provide such evidence.

Recommended Reading: How To Take Out Equity Loan

Selling Isnt The Only Option

It is possible for your spouse to maintain their benefits through the veteran home loan after getting divorced. To do so, the military member must agree to stay on the mortgage and agrees to make payments on the home until the loan is repaid or the house sells. The military member must guarantee payments even if theyre not living in the house after the divorce. This option isnt always the easiest, but it can provide a sense of stability for parents with young children.

Who Is Liable After A Va Loan Is Assumed

If a veteran home buyer wants to purchase your house and assume a VA loan, it is possible to swap your entitlements. Basically, the veteran homebuyer will use their VA entitlement and in so doing, your VA entitlement will be restored. When this happens, the VA who will assume your mortgage will be liable in the event of a default.

On the other hand, if a civilian wants to purchase your home and assume a VA loan, they dont have a VA entitlement to substitute for yours. This means, your entitlement will remain tied up to the original mortgage. If the non-veteran home buyer who assumed the VA loan defaults on the loan, you can still be held liable. Aside from that, the civilian who assumed your house and mortgage may sell the property to someone else, and you will still be held liable for any losses related to the mortgage.

The buyer must sign a release of liability so the seller will no longer responsible for the mortgage once its been assumed.

Read Also: What Is The Current Va Loan To Value Ltv Rate

Try To Work With The Right Attorney

When youre dealing with veterans benefits and VA loans, its often best to work with an attorney who understands military divorces. Theyll be able to help you negotiate terms with your spouse and can make sure everything gets done correctly so you can maintain your eligibility for VA loans in the future. Theyll also know which documents you need to fill out and what information your spouse needs to submit.

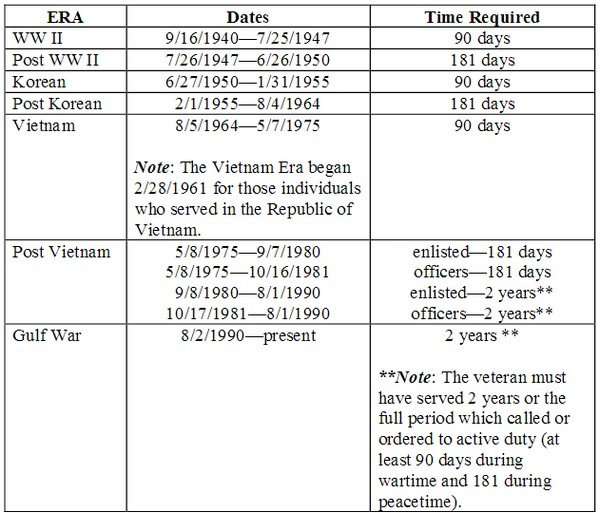

Guide To Va Loan Eligibility

There are many different options when it comes to purchasing a home with a VA-insured mortgage. Some borrowers are confident buying the house by themselves, while others prefer the shared responsibility and lower monthly financial obligation by co-borrowing on their VA loan. And some need a co-signer to make the loan happen.

Read Also: How To Calculate Bank Loan

Getting Under Contract On A Home

Lean on your real estate agent when youre ready to make an offer a home. But also talk with your loan team about your closing costs and how best to address them in your offer. Every market and every transaction is different, but its possible for sellers to cover all of a VA buyers closing costs.

Once you get under contract, the clock starts ticking toward closing day. Most purchase agreements will have deadlines and contingencies to protect both buyers and sellers. VA loans typically close in 30-45 days, just like conventional loans.

The loan process ramps up for lenders once youre under contract, too.

Q: I Sold The Property I Obtained With My Prior Va Loan On An Assumption Can I Get My Eligibility Restored To Use For A New Loan

A: In this case the veteran’s eligibility can be restored only if the qualified assumer is also an eligible veteran who is willing to substitute his or her available eligibility for that of the original veteran. Otherwise, the original veteran cannot have eligibility restored until the assumer has paid off the VA loan.

Don’t Miss: What Is My Monthly Loan Payment

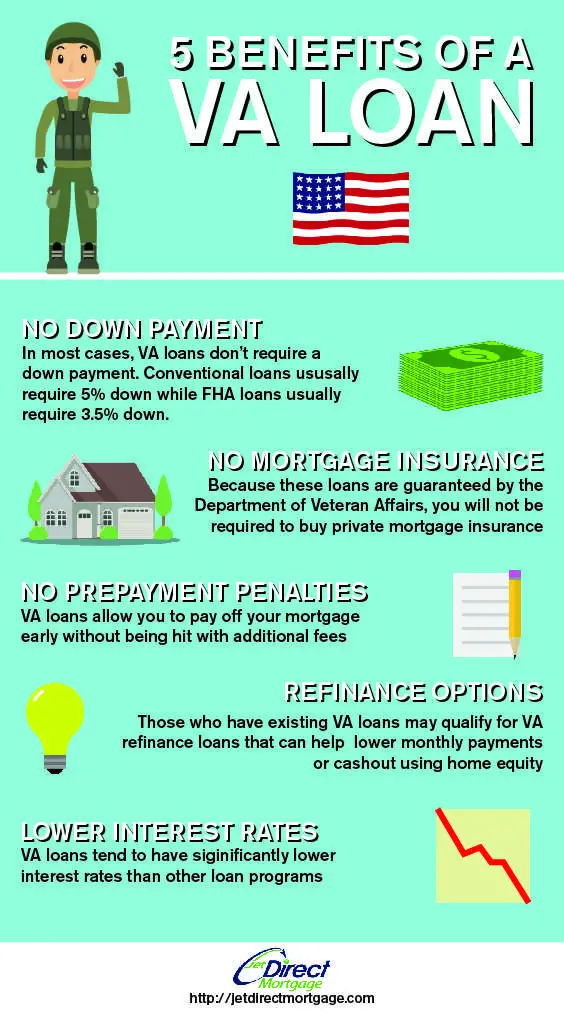

Section : Va Loan Benefits

VA loans are the most powerful home loan option on the market for so many military families. These loans are made by private lenders like Veterans United and backed by the Department of Veterans Affairs.

VA loans have been helping veterans, service members and military families become homeowners for more than 75 years, thanks in large part to some big-time benefits.

Heres a look at four big ones:

- $0 down paymentIts tough to overstate how huge this advantage is for military buyers. FHA loans require 3.5 percent down, while conventional loans often require at least 5 percent. On a $250,000 loan, that translates to an $8,750 down payment for an FHA loan and a $12,500 down payment for a conventional loan. VA buyers dont have to spend years scraping together that kind of upfront cost.

- No mortgage insuranceFHA, conventional and other mortgages often come with expensive monthly mortgage insurance unless you can make a substantial down payment. That extra cost limits your buying power.

- Relaxed credit guidelinesVA loans have more flexible credit requirements than other loan types. You dont need top-tier credit to qualify, and its possible to bounce back faster with a VA loan after a bankruptcy or foreclosure than with other loan types. Having less-than-perfect credit is not a deal-breaker.

A good mortgage lender can help you evaluate your options and get a clear understanding of what all loan types youre eligible for and what might be the best fit for you.

Veteran Working In Another State

Sometimes there are situations where the goal is to move the family. It may even be a long way from the current residence. What if the Veteran needs to stay on the current job and the rest of the family will move into the new home? Even worse, what if the Veterans income is needed to qualify? We have received calls from Veterans who have been denied a VA loan for this situation.

Each situation seems to be different from the next, but often there could be a VA solution. First, a spouse must occupy the home as a primary residence within the 60 days.

Don’t Miss: Is There Any Loan For Buying Land

If Your Spouse Is Not A Veteran

Only one spouse needs to be eligible for a VA loan in order to secure the full guaranty. In fact, its common for couples consisting of a service member or veteran and a person not in the military to use a VA loan to buy their home. According to the Lenders Handbook VA Pamphlet 26-7, the requirements for spouses vary depending on whether or not their names will be on the loan. If a spouse is not participating in the purchasing process, their credit history doesnt need to be considered, but their debts do factor into the calculation as part of the households liabilities. If a spouse will be contractually obligated for the loan, then their income, credit, and debts should be verified and weighed just like the vets. The spouses income will also come into play if the vet is relying on their spouses income to qualify for the loan or counts alimony, child support, or maintenance payments as part of their income.

What if you live in a community property state? As The Mortgage Reports explains, community property states consider assets and liabilities amassed during the marriage to be jointly owned. Therefore, vets applying for a VA loan in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin should expect for their nonmilitary spouses credit, income, and debts to be reviewed whether theyre contractually obligated for the loan or not.

Exceptions For Occupancy More Than 60 Days

The Veterans Administration states more than 60 days may be considered reasonable if both of the following conditions are met:

- The Veteran certifies that he or she will personally occupy the property as his or her home at a specific date after loan closing, and

- There is a particular future event that will make it possible for the Veteran to personally occupy the property as his or her home on a specific future date.

VA further states, Occupancy at a date beyond 12 months after loan closing generally cannot be considered reasonable by VA. The key word here is generally, because there are other exceptions where we have been successful in closing a VA loan for Veterans with outside the box scenarios. Most commonly, the issue is the Veteran or other borrower working outside the reasonable commuting distance from the property.

Recommended Reading: What Size Is Jumbo Loan

Who Is Eligible For A Coe

As a surviving military spouse, you may be able to get a COE if you have not remarried and:

- Your spouse died performing military service or from a service-related disability.

- Your spouse was missing in action or a prisoner of war for at least 90 days.

- Your spouse was totally disabled and eligible for disability benefits at the time of death.

Exceptions and nuances apply to these rules, so contact the VA or a VA mortgage lender for more information.

Section : Will You Be On The Loan

This key question sets the path for military spouses. Many veterans and service members want or need their spouses income in order to maximize their homebuying budget.

When it comes to how much you can borrow, lenders can count income only from people on the loan. But being on the loan also means military spouses must meet lender and VA guidelines for credit, debts, income and more. Well take a closer look at some of those considerations shortly.

The bottom line is spouses with credit or debt issues might have to stay off the loan, which can limit the veteran borrowers purchasing power. Veterans with sufficient income can also opt to be the sole borrower. In either scenario, the military spouse becomes whats known as a non-purchasing spouse.

In most cases, lenders wont consider the credit score or financial information of a non-purchasing spouse. But there are nine states where this isnt always the case — Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. These are the countrys nine community property states, where lenders can consider a non-purchasing spouses credit and debts.

Moving forward, well focus on military spouses planning to be co-borrowers on a VA loan.

Recommended Reading: Which Bank Is Best For Construction Loan