How To Save Hundreds Of Dollars With A Fairwinds Car Loan

FAIRWINDS is helping financial freedom seekers nationwide shop, compare, and save on their next car. Whether youre searching for your first or fifth car, we can help you buy a car and pay off your car loan as fast as possible.

Here are eight common questions and answers to get your car-buying journey started:

We recommend paying for your car in cash, but if you need to finance your next car, use a free budgeting tool to confidently keep track of making your car loan payments on time.Goals and Budgets will help you where your money is going every month and find opportunities to pay off your car loan quicker. Even when youre behind the steering wheel of your new or used car, remember to include additional costs such as insurance, registration fees, gas mileage, and maintenance. For future car repairs, maintain $1,000 in a designated emergency savings account to use for unexpected events instead of taking out another loan or using a credit card.

Once your car is paid off, keep the car and keep making payments to yourself! This will help you achieve other milestones on your financial freedom journey, like paying off other debts, saving 3 to 6 months of expenses, or building your retirement savings. If youre looking to buy another car in the future, open a goals-based savings account and save enough to buy your next car in cash.

What Credit Score Do Credit Unions Require For Auto Loans

There isnt a minimum credit score that all require for auto loans. It depends on the credit union, the type and age of the car, and the borrowers other qualifications such as employment history and income. The higher your credit score, the lower your rate will generally be. Typically, a credit score over 720 will give borrowers the absolute best rates.

Navigate Your Auto Purchase With Ease

Buy your new or used car using our one-stop shop.

Car buying service

$781

FAIRWINDS Credit Union auto loan

FAIRWINDS rates as low as 1.75%APR New Car – 36 Mo

3.72%APR New Car – 36 Mo

$781 is the difference between the amount paid in interest between FAIRWINDS Credit Union’s rate at 1.75% APR compared to 3.72% APR for the National market average over the life of a $25,000 auto loan over 36 months.

*Based upon independent research conducted by Datatrac for 133292 financial institution locations in the National market as of September 19, 2021.APR = Annual Percentage Rate

Don’t Miss: Usaa Auto Refinance Calculator

Features And Benefits Of Car Loan

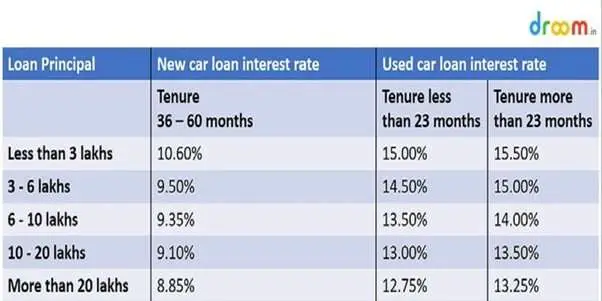

When it comes to car loans in India, in general, the following features and benefits are offered. Note that, the following is a generalized look at the advantages offered by car loans. Individually, car loan lenders may have highly customized and specialized offerings for their customer base.

- It helps you purchase a car even if you dont have all the money for it right now.

- Most car loans will finance the on-road price of the car.

- Some car loans will even finance 100% of the on-road price. This means no down payments.

- With some banks offering financing in the crores, you are not limited in your choice of cars

- Most car loan offerings in India are secured loans. This implies that the car serves as the security/collateral for the loan.

- Procuring a car loan is usually simple when compared to other loan products. Individuals with slightly unsavoury credit scores can also hope to procure one. However, this option differs from bank to bank.

- Car loans in India often offer fixed interest rate options. This means, you are always assured of a fixed amount that needs to be repaid monthly.

- Many lenders will offer interest rates based on your credit score so a high score to get you a cheaper loan.

- Car loans are not meant for just new cars. A used car loan can help you buy a pre-owned car.

Nih Federal Credit Union

Loan amount: Financing up to 125 percent, based on new auto loan-to-value ratioTerms: Up to 84 months

The National Institutes of Health Federal Credit Union, serving the biomedical industry, provides its members with flexible terms and low rates for new, used and refinancing of auto loans. You can join the credit union if youre a member of the healthcare or biomedical industry in Maryland, Washington D.C., North Carolina, Virginia or West Virginia or if youre a family member of someone enrolled. Perhaps one of the best NIHFCU loan features is its online application process, which takes just a few minutes to generate results.

Don’t Miss: What Is The Maximum Fha Loan Amount In Texas

Bank Of America: Best Big Bank Option

Overview: Bank of America offers flexible and convenient auto loans you can apply for directly on its website. Rates are competitive, and you can qualify for additional discounts if youre an eligible Bank of America customer.

Perks: Bank of America will finance a minimum of $7,500 and requires that the car be no more than 10 years old, with no more than 125,000 miles and valued at no less than $6,000. Financing is available in all 50 states and Washington, D.C. Bank of Americas APRs start at 2.89 percent for a new car and 2.99 percent for a used car.

If youre a Bank of America Preferred Rewards customer, you can qualify for a rate discount of up to 0.5 percent off.

What to watch out for: If you’re applying online, the term range you can apply for is limited you can pick only a 48-, 60 or 72-month term.

| Lender |

|---|

| None |

Best For Refinancing: Openroad Lending

OpenRoad Lending

OpenRoad Lending specializes in auto refinancing saving customers an average of more than $100 per month, making it our choice as the best for refinancing.

-

No option to prequalify and check rates with a soft pull

-

Vehicle age and mileage restrictions

While getting a new set of wheels is exciting, theres something to be said for sticking with a reliable ride. However, if your credit improved, you paid off debt, or you got a raise since you first financed your auto loan, you may be paying too much.

OpenRoad Lending allows eligible applicants to refinance existing loans and save an average of $100 per month on their car payments. The application process is simple and entirely online. Within as little as a few minutes of applying, you can receive your decision with complete details about the loan.

If you run into any trouble with your application, OpenRoad Lending’s customer service team can help. Perhaps that’s why 98% of customers say that they are satisfied with their loans. Before applying, you should know that there is only the option to apply with hard credit pull and it is not possible to prequalify or check rates with a soft pull, so this service is only for people who are serious about refinancing. The higher your credit score the lower your rate will be.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

The Bankrate Guide To Choosing The Best Auto Loans

Auto loans let you borrow the money you need to purchase a car. Since car loans are considered secured, they require you to use the automobile youre buying as collateral for the loan.

This is both good news and bad news. The fact that your loan is secured does put your car at risk of repossession if you dont repay the loan, but having collateral typically helps you qualify for lower interest rates and better auto loan terms.

Auto loans typically come with fixed interest rates and loan terms ranging from two to seven years, but its possible to negotiate different terms depending on your lender.

Why trust Bankrate?

At Bankrate, our mission is to empower you to make smarter financial decisions. Weve been comparing and surveying financial institutions for more than 40 years to help you find the right products for your situation. Our award-winning editorial team follows strict guidelines to ensure the content is not influenced by advertisers. Additionally, our content is thoroughly reported and vigorously edited to ensure accuracy.

Whats Considered A Low Interest Rate On A Car Loan

Generally, the lowest interest rates you can find on a car loan are around 2% or 3%. However, any car loan with a rate under 5% is considered low-interest and youll need good or excellent credit to qualify.

However, if you have less-than-stellar credit, the lowest rate you might be eligible could be upwards of 10%. Since car loans are usually secured, they typically come with lower rates than an unsecured personal loan.

Who actually qualifies for the lowest Rate?

Just because you see a low-interest rate advertised for a car loan with one particular lender, dont automatically think thats how much youll end up paying. Those ultra-cheap interest rates may only be available to you if you have excellent credit or if you are buying a certain type of car.

Don’t Miss: When Can I Apply For Grad Plus Loan

How Much Does A Low Interest Rate Car Loan Cost

Low interest car loans come with a few costs, but each individual loan will differ depending on the lender you apply with.

Heres are some fees to watch out for:

- The origination fee. This is the cost to set up your car loan. Lenders usually add this fee into your loan amount to be paid off with the rest of your principal.

- Other monthly fees. Some loans could have maintenance fees to keep your account open.

- Early or additional repayment fees. If you repay your loan early or make additional payments you may be charged a fee to make up for the loss of interest on your loan.

- Late payment fees. Set up autopay to avoid the fee for late or missed payments.

Consider your loan term

How much your car loan costs also depends on how long you take to pay it back that means theres more time for interest to add up

Lets assume you want to borrow $20,000. Over a five-year term you might be quoted an 8% interest rate, but youre offered a 7.5% rate if you accept a seven-year loan term. Lets see how it would work out.

| Low interest loan details | |

|---|---|

| $4,331.80 | $5,768.68 |

If you choose the 7.5% interest rate your payments are almost $100 per month cheaper. This can be appealing because its obviously more budget-friendly. Unfortunately, even with the cheaper interest rate you end up paying more than $1,436 in additional interest charges.

How To Calculate Car Loan Emi

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

Recommended Reading: What Is Chfa Loan Colorado

Car Loan Application Checklist

You can expedite your car loan application by getting your finances in order and by being ready to provide any required documentation.

Proof of Employment: Most lenders want to see that you are employed and earning enough income to cover your car payments. Copies of your bank statements, pay stubs, or notice of assessment should be adequate. Some lenders also accept government assistance or benefits.

: Your 3-digit credit score is a measure of your creditworthiness. If you are not sure what your credit score is, you can check it for free here.

Your credit report also details how you have managed your finances over time. Typically, lenders want to see your debt-to-income ratio, payment history, and account balance. You can improve your credit score by paying bills on time.

Bank Details: You will need to show that you have a bank account in Canada. A void cheque to set up your monthly payment is typical.

Drivers License and Proof of Residence: A government-issued ID such as your drivers license is used to confirm your province of residence and address. Other documents that may be requested include your utility bills.

Vehicle Information: Duh! Of course, you need to know the type, make, and purchase price of the vehicle you want.

Proof of Car Insurance: Before driving off the lot, you may have to show you have purchased car insurance.

How Do You Get A Car Loan

Some consumers can pay cash for a new vehicle, but most use financing from a bank, credit union, nonbank auto lender, or dealer. Here are steps you can take in order to get a car loan:

Read Also: What Credit Bureau Does Usaa Use For Auto Loans

How Do Lenders Come Up With My Rate

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the four main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

Ford Partners With Jiosaavn And Google Search To Promote The Freestyle Flair

Ford India has launched a new campaign of the Ford Freestyle Flair Edition with JioSaavn and Google search. Ford has come out with a fun, quirky, and unique way to promote the Freestyle Flair. The company has used the search behaviour on Google and JioSaavn to bring out the exciting character of the car. Google search continues to be a key feature in car research and purchase. Around 68% of individuals use search without an idea of buying a car and around 98% of the buyers use the feature to purchase a car. Ford wishes to launch the new features of the car during the festive season in the country.

1 September 2020

Recommended Reading: Are Auto Loans Amortized

Who Has The Best Rates For Car Loans

Automakers, credit unions, banks and online lenders could all potentially provide a low rate. Youll never know what you qualify for until you apply. Applying to multiple lenders within a two-week window will not hurt your credit score any more than applying to one lender. Any drop to your credit score will be slight and temporary.

How Does A Car Loan Calculator Work

Simply key in the information essential to compute for your monthly amortization . Input the car cost, down payment and loan period. Also indicate if its a brand new car or second hand. After completing all required details, click calculate and the auto loan comparison table will show the monthly payments, total interest paid over time, and applicable interest rates.

Also Check: Transfer Car Loan To Another Bank

Where Can I Find Competitive Car Loan Rates In Canada

Comparing car loan interest rates offered by different banks, credit unions and online lenders is critical to finding the deal thats best for you.

- Banks or credit unions. Since you have an established relationship with your bank already, it might be easier to get approved for a car loan, even if you dont have the best credit. Banks and credit unions also tend to offer the most competitive rates.

- Online lenders. Some online lenders may be willing to loan money to people with average or poor credit, even if they cant get approval from their bank though they may not get the lowest rate available. Online lenders also tend to be the quickest to approve loans and disburse funds.

- Dealerships. Local car dealers are often willing to work with borrowers of all credit ratings. But because many dealerships offer financing through an external lender, dealers may inflate interest rates in order to make a profit.

Should I Get An Auto Loan From The Dealership Or The Bank

Choosing between a dealership and a bank for an auto loan is complicated. In general, dealerships may offer higher rates than banks but this may not be the case for used cars. Regardless, it’s important to get quotes from a few banks or online lenders first that way you can come to the dealership prepared. Ask for a quote from the dealership as well, comparing rates, terms and any additional fees.

Read Also: How Long For Sba Loan Approval