Check Va Irrrl Rates Today

The VA Streamline Refinance is one of the simplest and fastest mortgage products available for consumers today.

Current rates are low, so its a great time to take advantage of your veteran benefits.

Check with top-rated and VA-approved lenders for your refinance.

Popular Articles

So What Exactly Is A Va Loan

A VA Loan is made available to qualified veterans, active service members and surviving spouses to use for purchasing a home. You do not have to have a down payment or Private Mortgage Insurance with a VA loan. The VA Loan is guaranteed by the U.S. Department of Veterans Affairs .

The VA does not originate loans but sets the rules for who may qualify, issues minimum guidelines and requirements under which mortgages may be offered, and financially guarantees loans that qualify under the program.

A VA Loan is available only as a fixed rate loan, meaning your interest rate will not vary for the life of the loan.

How A Va Loan Works

VA loans help active service members, veterans, and their surviving spouses become homeowners. They provide up to 100% financing on the value of a home. Eligible borrowers can use a VA loan to purchase or build a home, improve and repair a home, or refinance a mortgage.

The VA sets the qualifying standards, dictates the terms of the mortgages offered, and backs the loan, but doesnt actually offer the financing. Instead, VA home loans are provided by private lenders, such as banks and mortgage companies.

When borrowers apply for a loan, they need to provide the lender with a certificate of eligibility from the VA. To get the certificate, youll have to produce service-related documentation, which can vary based on whether you are active duty or a veteran. The certificate can be obtained from the VA website. Although some of the lenders own underwriting requirements still must be met, in most cases, VA loans are easier to qualify for than conventional loans.

VA loans, Federal Housing Administration loans, and other loans insured by departments of the United States government have securitization through;the Government National Mortgage Association;, also known as Ginnie Mae. These securities carry the guarantee of the U.S. government against default.

Borrowers can apply for a VA loan more than once, but the funding fee increases when using a VA loan after your first time if the down payment is less than 5%. Fees range from 1.4% to 3.6% of the loan amount.

Read Also: How To Get Loan Signing Jobs

Va Funding Fee Rate Charts

Effective January 1, 2020, based on Public Law 116-23

Review the VA funding fee rate charts below to determine the amount youll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount.

For example: Let’s say youre using a VA-backed loan for the first time, and youre buying a $200,000 home and paying a down payment of $10,000 . You’ll pay a VA funding fee of $3,135, or 1.65% of the $190,000 loan amount. The funding fee;applies only to;the loan amount, not the purchase price of the home.

The Va Interest Rate Reduction Refinance Loan

The VA Interest Rate Reduction Refinance Loan , is the most common VA refinance loan. This loan program is only for veterans that have a current VA loan. If you do, and you have a timely mortgage payment history on that loan, you may be able to refinance to get a better rate, lower payment, or better term. The IRRRL program doesnt require you to verify your credit score, income, assets, or home value.

The VA does require that you wait until youve made at least 6 payments before you refinance your VA loan with this program. However, they really prefer it if youve made 12 payments on your loan before you refinance. With 12 payments made, the VA can allow one 30-day late payment and still qualify you for the VA IRRRL. If you made less than 12 payments, the VA may allow you to refinance, but you cannot have any late payments within that time.

The seasoning period of 6 to 12 months, gives lenders a chance to see how you pay your mortgage. Do you pay it on time every month? If so, then chances are that youll be able to afford another loan with better terms. The longer the mortgage history that you have, the more evidence the lender can have that you can handle your mortgage.

Also Check: How To Apply For Fha Loan In Illinois

Tips On Securing A Favorable Mortgage Rate

- If you cant make a reasonable down payment now, dont rush into the home buying game. Take some time to build up your funds so you can get a lower interest rate on your loan. Check out our reports on the best savings accounts and best certificate of deposit rates around.

- For help with budgeting and saving, consider working with a financial advisor.; A financial advisor can help you define your goalsand reach them. SmartAssets;financial advisor matching tool;makes it easier to find an advisor who suits your needs. Simply answer a few of questions about your financial situation and preferences, and the program will connect you with up to three financial advisors in your area.

Who Qualifies For A Va Irrrl

To qualify for a VA Streamline Refinance , your current mortgage must be a VA home loan.

Homeowners must also meet underwriting requirements set by the Department of Veterans affairs.

Current guidelines for the IRRRL include:

- You are current on payments with no more than one 30-day late payment within the past year

- Your new rate and monthly payment for the IRRRL must be lower than the previous loans monthly payment. The only time this condition does not apply is if you refinance an ARM to a fixed-rate mortgage

- You must not receive any cash from the IRRRL

- You must certify that you currently or previously occupied the property

- You must have previously used your VA Loan eligibility on the property you intend to refinance. You may see this referred to as a VA-to-VA refinance

You can easily figure out if you meet the VA IRRRL guidelines by checking with your current mortgage lender, or any other lender thats authorized to do VA loans .;

You May Like: How Much Student Loan Interest Can I Deduct

A Brief History Of Va Loans

The G.I. Bill of 1944 is where the VA Loan Guaranty Program originated. This sweeping bill made several provisions for returning veterans of World War II. Its ultimate goal was to thank those individuals for their service to their country, and to help them get on with their lives. Considering that their lives were put on hold in many ways due to their military service, the bill was designed to give them a helping hand. The VA Loan Guaranty Program aimed to make housing affordable for returning GIs.

Through the VA Loan Guaranty Program, veterans and active military personnel were able to qualify for home loans through qualified lenders. The U.S. government backed up a certain portion of those loans, guaranteeing them and, essentially, vouching for those who took them out. One of the most important aspects of how the government achieved that was by insuring the property that was being financed on the GIs’ behalves. For that reason, there was no need for those who qualified for VA loans to take out private mortgage insurance – a benefit that would add up to significant savings down the line.

Can You Refinance A Va Loan

VA loans make buying a home more affordable for veterans, active-duty military personnel, and surviving spouses. You can also refinance your home with a VA loan. Homeowners who qualify for refinancing can enjoy VA loan benefits like competitive interest rates and more generous credit terms.

Freedom Mortgage is the #1 VA lender1 in the United States. We are committed to helping veterans, military personnel, and surviving spouses refinance their homes. Talk to our experienced Loan Advisors about streamline refinancing today by calling or Get Started online.

1.Inside Mortgage Finance,;Jan-Mar 2021

Don’t Miss: Does Refinancing Car Loan Hurt Credit

Why Choose Freedom Mortgage For Your Va Refinance

Freedom Mortgage is the #1 VA lender* in the United States. We are committed to helping veterans, active duty military personnel, and surviving spouses who qualify enjoy the benefits of refinancing their homes with the VA home loan program.

Talk to our experienced Loan Advisors today by calling or Get Started online.

*Inside Mortgage Finance, Jan-Mar 2021

Web Content Viewer

Check out the reviews from some of our customers.

What Are Cltv And Hcltv

When you refinance with a second mortgage secured by the property, the loan to value calculation is a little different. Youll have one or two new ratios to consider:;

- The CLTV measures your first and second mortgage combined against your appraised home value. CLTV applies to both home equity loans and home equity lines of credit;

- The HCLTV measures your highest possible loan to value ratio, including any untouched balance on your second mortgage. HCLTV applies only if you have a home equity line of credit

Heres how each one is calculated.;

Also Check: How To Apply For Loan Consolidation

Close On The Refinance Loan

During the closing process, the lender will validate your ability to repay the loan by reviewing the documentation you provide, if necessary. This is also when the bank will usually require an appraisal to ensure it isnt lending more money than the property is worth. However, with a VA streamline loan, an appraisal may not be required.

How Much Will I Pay

This depends on the amount of your loan and other factors.

For all loans, well base your VA funding fee on:

- The type of loan you get, and

- The total amount of your loan. Well calculate your funding fee as a percentage of your total loan amount.

Depending on your loan type, we may also base your fee on:

- Whether its your first time, or a subsequent time,;using a VA-backed or VA direct home loan, and

- Your down payment amount

Note: Your lender will also charge interest on the loan in addition to closing fees. Please be sure to talk to your lender about any loan costs that may be added to your loan amount.

You May Like: What Is Federal Loan Forgiveness Program

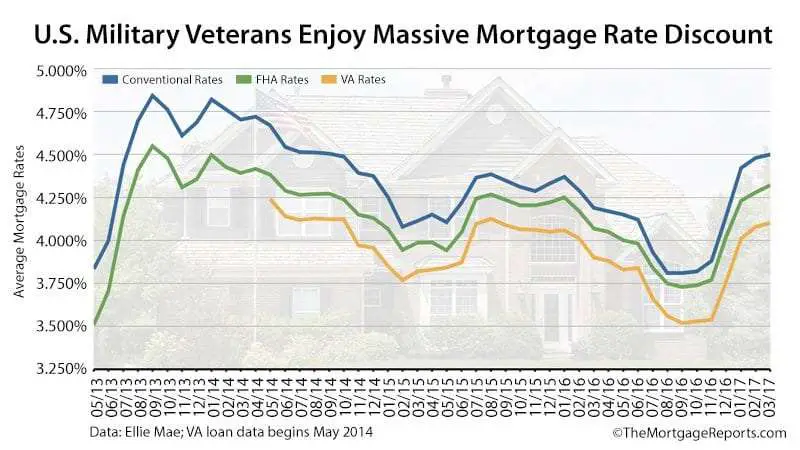

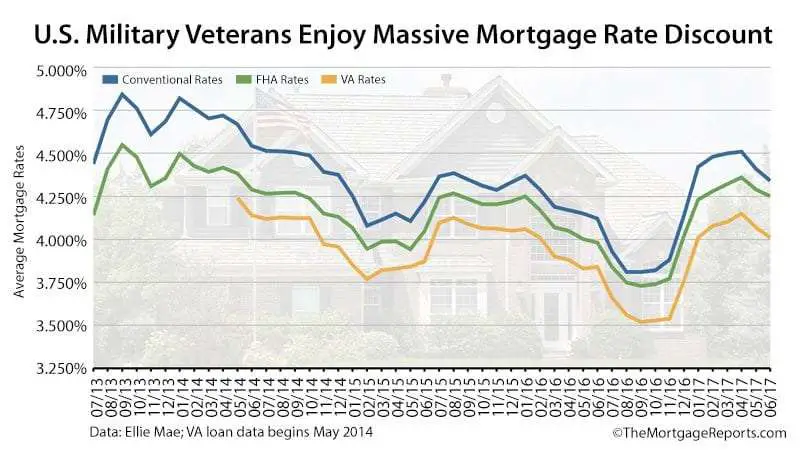

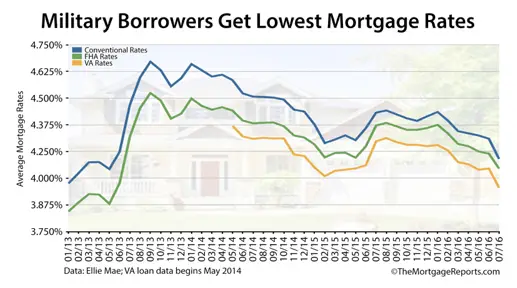

How Are Va Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You cant do anything about that, but its worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk; lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE:Get your credit score for free

Secure A Certificate Of Eligibility

Youll need this to be eligible for your VA loan. Youll need to provide proof of your military service based on your status.

Rocket Mortgage® can help you verify your eligibility and get your certificate. VA-approved lenders, like Rocket Mortgage®, can help you get your certificate quickly with proof of service.

Tell your lender you need your certificate of eligibility early in the process so they can help you get it.

Don’t Miss: Does Fha Loan On Manufactured Homes

Presume Housing Market Shifts

Based on your homes location and how many people are interested in buying a home, your property value could naturally increase over time as demand increases. Of course, the market could experience a downturn. Before you decide to refinance your mortgage, try using the Federal Housing Finance Agencys House Price Calculator to see how homes in your area have appreciated in value.

With a lower LTV, you may qualify for a loan you werent eligible for when you purchased your home. It could be time to refinance your mortgage to improve your interest rate, take cash out or eliminate PMI.

How Does A Va Loan Work

VA home loans are one of the two nonconventional loans available today. They dont work exactly like a regular mortgage you get from a bank because VA loans are specifically guaranteed by the government.

This just means the government will agree to repay a portion of the loan to the bank if you dont make your payments or if you face losing your home .

Since the banks assume less risk compared to a conventional loan, VA loans are relatively easy to get. In 2018, the VA guaranteed 610,513 purchase and refinance loans.2

Recommended Reading: How Much To Loan Officers Make

Am I Eligible For A Va

You may be eligible for this type of loan if you meet all of the requirements listed below.

All of these must be true. You:

- Qualify for a VA-backed home loan Certificate of Eligibility, and

- Meet VAsand your lendersstandards for credit, income, and any other requirements, and

- Will live in the home youre refinancing with the loan

Intended For Primary Residences

If youre looking for a vacation home or want to buy an investment property, you wont be able to use a VA loan. These mortgages are only intended for purchases of primary residences, or to refinance an owner-occupied home.

For second homes or buying rental properties, youll need to seek out a different conventional structure, such as a fixed or adjustable rate mortgage.

You May Like: What The Highest Apr For Car Loan

S To Acquiring A Va Home Loan

Acquiring a VA home loan involves a relatively straightforward, simple process. Before going ahead with it, though, you should familiarize yourself with what you’re going to be expected to do. Below, the basic steps for acquiring a VA home loan are outlined for your convenience. Although everyone’s experience is going to vary slightly, you can expect yours to go in roughly the following order:

Qualify – First, you need to make sure that you are actually qualified to receive a VA home loan. Look over the eligibility requirements as outlined in the previous section. If you are still unsure about whether or not you qualify, you should use the Veteran Affairs Eligibility Center to see what they have to say. Covering this base is important if you want to proceed with obtaining a VA home loan.

Apply For A COE – Next, you’re going to need to apply for a COE, or Certificate of Eligibility. You will need this certificate when you approach a VA-approved lender for a home loan.

Find A Lender – Not all lenders offer VA home loans. You should check around to see what your available options are. Lenders must be approved by the U.S. government, so double check that the one you’re interested in working with does participate. Otherwise, you will end up wasting a lot of time.

If You Have Full Entitlement You Dont Have A Home Loan Limit

Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you wont have to pay a down payment, and we guarantee to your lender that if you default on a loan thats over $144,000, well pay them up to 25% of the loan amount.;You have full entitlement if you meet either of the requirements listed below.

At least one of these must be true. Youve:;;;Never used your home loan benefit, or;;;Paid a previous VA loan in full and sold the property , or;;;Used your home loan benefit, but had a foreclosure or compromise claim and;repaid us in full

Note: You may have heard the terms additional entitlement, bonus entitlement, or tier 2 entitlement. We use these terms when we communicate with lenders about VA-backed loans over $144,000. You wont need to use these terms when applying for a loan.

It depends. If you apply and are eligible for a VA-backed home loan, youll receive a Certificate of Eligibility . This is the document that tells private lenders that you have VA home loan eligibility and entitlement.;

But your lender will still need to approve you for a loan. The lender will determine the size of loan you can afford based on your:;;;Credit history;;;Income;;;Assets

We dont require a minimum credit score, but some lenders may have different credit score requirements. Be sure to contact more than one lender to compare.

Don’t Miss: How To Make Personal Loan Agreement