How Does An Fha 203 Loan Work

A 203 loan can be a 15- or 30-year fixed-rate mortgage or an adjustable-rate mortgage .

The amount you can borrow depends on criteria such as credit rating and income. The down payment requirement is 3.5 percent of the purchase price plus repair costs, and the maximum loan amount is capped at 110 percent of the homes appraised value. Additionally, lenders require the borrower to pay mortgage insurance. Rates on 203 loans may be higher compared to conventional loans, as well.

There is another catch, too: The total amount borrowed must be within FHA loan limits for the area in which the home is located. Generally, the most you can borrow for the loan is the lowest of the following:

- The FHAs maximum mortgage limit for the area

- A calculation involving the homes before value plus improvement costs

- A calculation involving the homes after value, including the improvement

In most cases, the renovations are done by a licensed contractor, but occasionally, a 203 loan borrower can do some or all of the work themselves. This requires approval from the lender.

A 203 loan is a good fit for older homes, but not ones that are fairly new and dont need a minimum of $5,000 in renovations.

A 203 loan also offers solid refinance rates for cash-strapped homeowners who either cant or dont want to tap their home equity.

Benefits Of An Fha 203k Loan

The main benefit is having the ability to finance the purchase price and the renovation costs all with one loan and with a great interest rate. The 203k guidelines also allow for the funds to cover the costs of your temporary housing while the remodeling is being done.

The 203k rehabilitation loan can also be used for a refinance where you would be able to cash out the funds needed for the repairs on a home that you already own.

Definitions And Examples Of Fha 203 Loans

FHA 203 loans make it possible for people to rehabilitate properties that need some help and turn them into homes. Sometimes the location is good and the property has potential, but you need to make a few significant improvements. Without those repairs, the home might not be suitable for living, and lenders might be unwilling to fund loans on a property with problems. These loans give homebuyers an incentive to take such properties off the market and make them a valuable part of the community again.

Recommended Reading: How Long For Sba Loan Approval

Fha 203k Loan Calculator

Its a seller market. Homes are scarce, and prices are high. But sellers are likely to discount homes that need repairs since theyre harder to sell. With the FHA 203k Loan, you can buy a run-down house for dirt-cheap, modernize it, and gain instant equity. Here’s a scenario I hear all the time:

Rosa wants to buy a fixer-upper for $200,000 and spend about $75,000 to make improvements. She needs to borrow money to purchase and renovate the house.

Her bank offered her a $190,000 conventional loan so that she can buy the place, but they wont give her the money she needs to fix it up. The bank doesnt do renovation loans, and they wont extend a home equity loan either because the property has no equity.

Sure, I don’t have equity now, but the place will be worth so much more after I improve it, Rosa explained to the banks loan officer. Rosa is disappointed that the bank turned her down. The house is perfect for her. Its a sensible investment too because the listing price is well below the market value.

Using The 203k Loan Step By Step

Here are the steps youllcomplete when buying a fixer-upper with an FHA 203k loan.

Its a little differentfrom a regular loan, because youll be submitting your list of home improvements, and the loandoesnt completely fund until the improvements are complete.

When the loan closes and funds, the seller gets paid. The rest ofthe money from your lender goes into your escrow account.

Also Check: Need To Refinance My Car With Bad Credit

What Is The Interest Rate On 203k Fha Loan

An individual can make as low as 3.5% down payment, just like with FHA loans. Because the loan is FHA insured lenders can offer lower interest rates than what borrowers might be able to quote elsewhere for a 203k loan.

Credit history will determine the interest rate for each applicant. However FHA permits people with credit scores below 580 to apply 203k under the FHA Lenders may require a higher score, such as 620 to 644, to be able to issue a mortgage. It is still below the 720 score needed for a standard mortgage. The 203k FHA Loan is not free. A monthly mortgage insurance premium must be paid by the borrower. A grant fee may also be charged by the lending institution. Consider other factors before applying for this program. These include the financial costs, the detailed paperwork and the lengthy time it takes to get a reply from the lender. FHA Both the lender and the borrower. The 203k FHA is a great option for someone with low credit who wants to buy a home that needs repairs and modernization.

Downsides Of The 203k Loan Program

As you would expect, thereare some pluses and minuses with the 203k loan program.

The benefits areundeniable. You could:

- Deal with less competition to buy the home

- Gain valuable experience remodeling a home

But with every reward comes the preliminary work. The 203k loan isno exception.

As stated above, you will have to secure reputable contractors, and be uber-diligent about having them complete paperwork.

Dont be surprised if the lender requires you to send a bid back to the contractor two or three times for missing information.

You will also have todecide on the upgrades that are within your budget. That can be exciting, butalso stressful. Youll have to make decisions quickly to ensure the loanapproval stays on track.

In addition, the loanprocess will take more time than a standard loan.

You are increasing paperwork requirements by 2 to 3 times compared to a standard loan.

Go into the process expecting and embracing that fact. Dont think that youll be the exception that closes the loan in fifteen days. Set realistic expectations with the seller!

Are you ready to tacklethese relatively minor inconveniences to reap the benefits? Then a 203k loan isprobably the right loan for you.

Also Check: What Credit Score Is Needed For Usaa Auto Loan

What Is An Fha 203k And How Can I Qualify

The Federal Housing Administration agency plays a critical role in the U.S. by providing access to affordable credit for many underserved communities. FHA 203K loans are a lesser-known type of mortgage every homeowner should know about.

From hopeful first-time home buyers to those who just want to fix up a home they already have, the FHA makes it possible where many other lenders wont take the risk.

If you are in the or need repairs on your current one, you should know about the FHA 203k loan program.

What Is A 203 Loan

There are several FHA home loan programs available to you. Most single-family homes requiring minimal repairs are eligible for 203 loans the most common FHA loan.

But when a house needs extensive work for health, safety, and/or security reasons, you may need to apply for a 203 mortgage instead. Also known as a Section 203 loan, this rehab loan lets you buy the property as-is and use funds from the loan to complete the necessary repairs. You can also refinance your existing mortgage to perform structural and cosmetic repairs to your current home.

While Credible doesnt offer 203 loans, our streamlined process makes comparing rates for conventional loans easy. It only takes a few minutes to see prequalified rates and generate a streamlined pre-approval letter using our free online tools.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Don’t Miss: Creditloancompare.com Reviews

Limited : Minimal Repairs

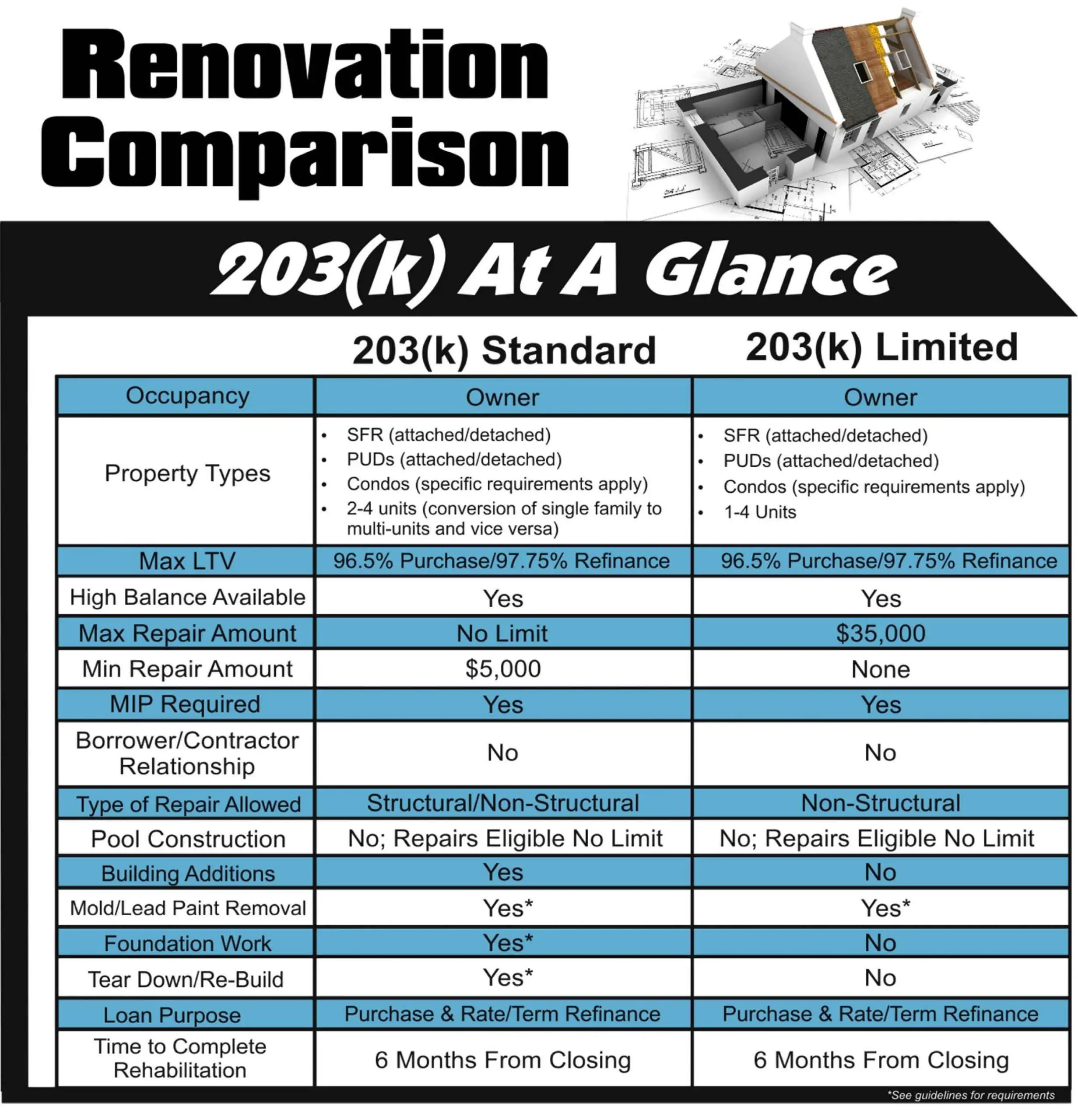

A home that does not require much work would usually be paid for using the limited 203. This option does not include structural work on the home, such as adding new rooms or landscaping, and the home must be habitable throughout the renovation period. Repairs under the limited 203 are capped at $35,000.

What Is A 203k Loan

203k loans are a type of renovation loan that includes funds to purchase the property plus additional funds to make home improvements and repairs. A minimum 640 credit score is required with a 3.5% down payment.

203k loans are government home loans guaranteed by the Federal Housing Administration and funded by private FHA-approved lenders.

You May Like: What Credit Score Is Needed For Usaa Auto Loan

Two Types Of Fha 203k Loans

Its important to note that there are two sub-types of 203k loan program: the full 203k, and the Streamline 203k.

In this article, we will focus mainly on the Streamline 203k loan, since it is the most popular type, and will suit most homeowners who are looking to buy a fixer-upper. Additionally, many more lenders offer the Streamline 203k program.

Here are some basic differences between the 203k sub-types:

Streamline 203k:

- Maximum $35,000 can be financed for repairs

Full 203k:

- Structural changes are allowed. In fact, the home can be leveled and rebuilt.

- No maximum repair limit as long as the entire loan is below FHAs maximum loan amount for the region.

How Much Can You Get From A 203k Loan

FHA 203k loan limits require a rehabilitation cost of at least $5,000. The total value of the finished house cannot be over the FHA mortgage limit for the area.

Property value is determined by the sum of the value of the house at the time of sale and the costs of the rehabilitation or 110% of the post-rehab value of the property .

Calculate your Maximum Mortgage amount using HUDs 203k loan calculator.

The Limited 203 Mortgage, also known as the FHA 203 streamlined loan, allows for the financing of up to $35,000 in repairs, upgrades, or improvements. This option is recommended for homeowners and buyers planning smaller projects with costs under the $35,000 limit.

Read Also: What Is The Maximum Fha Loan Amount In Texas

When Do You Need A Hud

A 203k consultant is essentially a project manager for 203k repairs. They help you file the proper paperwork and keep your project and loan on track while youre renovating.

You do not need a consultant to get approved for a limited 203k loan. But if your construction budget is over $35,000 or you plan to make structural repairs and therefore need a standard 203k loan, you will need to work with a HUD-approved 203k consultant. All standard 203k purchases require consultants.

To find a 203k consultant, you can ask your loan officer for a reference or search HUDs database for consultants in your area.

Buying A Home With A Limited 203 Mortgage

When purchasing a property with a Limited 203 home loan, details on the projects to be completed, including information on the general contractor, are evaluated with the other documentation during the underwriting phase. The contractor can be paid an advance at closing, prior to beginning the work, and then receive two draws following closing for the balance of the payment.

Also Check: How Do I Find Out My Auto Loan Account Number

Fha 203 Loans Explained

An FHA 203 loan allows you to use one loan for home improvement and a home purchase. You can also use these loans just for home improvements, but there might be better options available.

Learn how FHA 203 loans can help you finance a home purchase and renovation, the eligibility requirements and pros and cons of these loans, and alternatives to consider.

How To Qualify For An Fha 203k Loan

To qualify for a 203k loan, you must meet many of the same criteria as a regular FHA loan.

The credit score to qualify for 203k FHA loan is a minimum score of 500 if the borrower puts a 10% down payment. If the borrower has a credit score of at least 580, they can get away with as little as 3.5% of a down payment.

One thing to know about 203K loans is that sometimes the rate is slightly higher. They are a more complicated loan to get approved, so fewer lenders do them than traditional FHA loans.

Read Also: What Is An Rv Loan

What Kinds Of Properties Qualify

Qualifying homes for a FHA 203k loan include:

- A one- to four-family home that has been completed for a least a year

- A home that has been torn down, provided that some of the existing foundation is still in place

- A home that you want to move to a new location

- The home cannot be a co-op, but some condos are eligible

Your property will also have to qualify under the usual FHA requirements. For example, its value cannot exceed a certain maximum amount, which depends on where you live.

K Loan With Minimal Repairs

The 203k streamline is best for homes that dont have many parts. This does not include any structural work, such as new rooms or landscaping. The house must be habitable during the renovation. The maximum repair cost is $ 35,000 for repairs below the optimized 203k limit.

Dont Miss : What is USDA Home Loan Programs

You May Like: How Do You Find Your Student Loan Account Number

Is A 203 Loan Right For You

A 203 loan can be great for the right kind of buyer.

If you have extra time to spend finding a suitable home, lender, and contractors, and are detail-oriented enough to oversee the project approval and completion process, this could be a good way to finance a home purchase.

On the other hand, a 203 loan may not be good if you are in a hurry to move, lack the time or energy to cope with the added paperwork, or just want a home thats ready to move into without requiring any repairs.

If motivation is the issue, it may help to understand that a 203 loan can be a smart financial move. Theres a lot of friction in the process, but you can get a heck of an equity position if you do it right, Forney says.

How Do I Qualify For A 203k Rehab Loan

4.4/5To qualify for a 203k loan, you’ll need to meet the same requirements as any other FHA loan:

People also ask, how much do you have to put down on a 203k loan?

Down payment: The minimum down payment for a 203 loan is 3.5% if your credit score is 580 or higher. You‘ll have to put down 10% if your credit score is between 500 and 579. Down payment assistance may be available through state home buyer programs, and monetary gifts from friends and family are permitted as well.

Secondly, how does a 203k rehab loan work? The 203k loan helps the borrower open up one loanto pay for the purchase price of the home, plus the cost of repairs. Buyers end up with one fixed-rate FHA loan, and a home that’s in much better shape than when they found it. This allows the loan to close before construction has begun.

Consequently, is it hard to get a 203k loan?

FHA loans are not hard to get: most lenders work with FHA. However, most lenders do not do 203k Rehab loans. Most lenders do not want to do 203k loans because they take more time, are tougher to get approved, and require more work on the lender’s part.

How can I get a 203k loan with bad credit?

Also Check: What Credit Score Is Needed For Usaa Auto Loan

Use A 203k Loan To Cancel Fha Mortgage Insurance Premiums Sooner

All FHA loans require an upfront and ongoing mortgage insurance premium. Upfront MIP is 1.75% of the loan, and most FHA borrowers pay 0.85% in annual premiums. You can refinance to a conventional loan when you have 20% equity to avoid paying mortgage insurance for the life of the loan.

Imagine buying a home that no one else wants below market value. You fix it up with a 203k loan, and suddenly the home is worth a lot more. You might be very close to being able to refinance into a conventional loan soon after the contractors are gone.