Choose A Mortgage Broker License Types

Chapter 494 of the Florida Statutes sets the different license types and the requirements you need to meet to obtain them.

The license types for mortgage brokers include:

- Mortgage Broker License conducting loan originator activities through one or more licensed loan originators who act as independent contractors or are employed by you

- Mortgage Loan Originator License soliciting a mortgage loan, accepting an application for a mortgage loan, negotiating the terms or conditions of a new or existing mortgage loan, processing a mortgage loan application, or negotiating the sale of an existing mortgage loan to a non-institutional investor

You can find the full list of license types on the NMLS website.

Dont Let This Amazing Business Opportunity Pass You By

If youve ever dreamed about owning your own business, being your own boss, working on your own time and making a great living doing so, then dont pass up this loan broker business opportunity thats waiting for you. Becoming a commercial loan broker requires little more than the will and passion to succeed and the right commercial broker training to turn your dreams into a reality.

The Commercial Loan Broker Institute is a one-stop-shop for all your commercial loan broker business needs. We offer an unparalleled commercial loan broker training program, comprehensive branding, and web design, and ongoing mentoring and support to help you become a successful loan broker.

OPPORTUNITY for a brokerBIG RISKSAVOID

How Do I Become A Loan Processor In Illinois

Also Check: How Much Car Can I Afford Based On My Salary

Apply For The Mortgage Broker License

Onceyou have applied for the mortgage broker license, you need to determine yourstates requirement with the NMLS. Then, you have to clear the examination andlicensing fees, get the bond and submit the application to get your mortgagebroker license.

However,there might be a necessity to get your mortgage broker bond for a license. Amortgage broker bond helps protect the clients when you fail to follow thestates rules for operating as a broker.

Besides,it also helps prove that you are credible for the job and will provide the bestservice assistance. In addition to this, the amount of the brokerage bonddiffers greatly depending upon the state you are operating in.

Youmust know that you have to pay some amount here. Herein the payment will varydepending upon the factors like the financial history and the business details.

Onceyou have decided the bond amount, you need to apply online, after which youwill receive a bond certificate. Next, you need to sign the documents and sendthe license and the certificate to the state.

Oncethe state approves the application, you will get your approval. As of the day,you will be a licensed mortgage broker in the industry.

Licensing For Commercial Loan Brokers

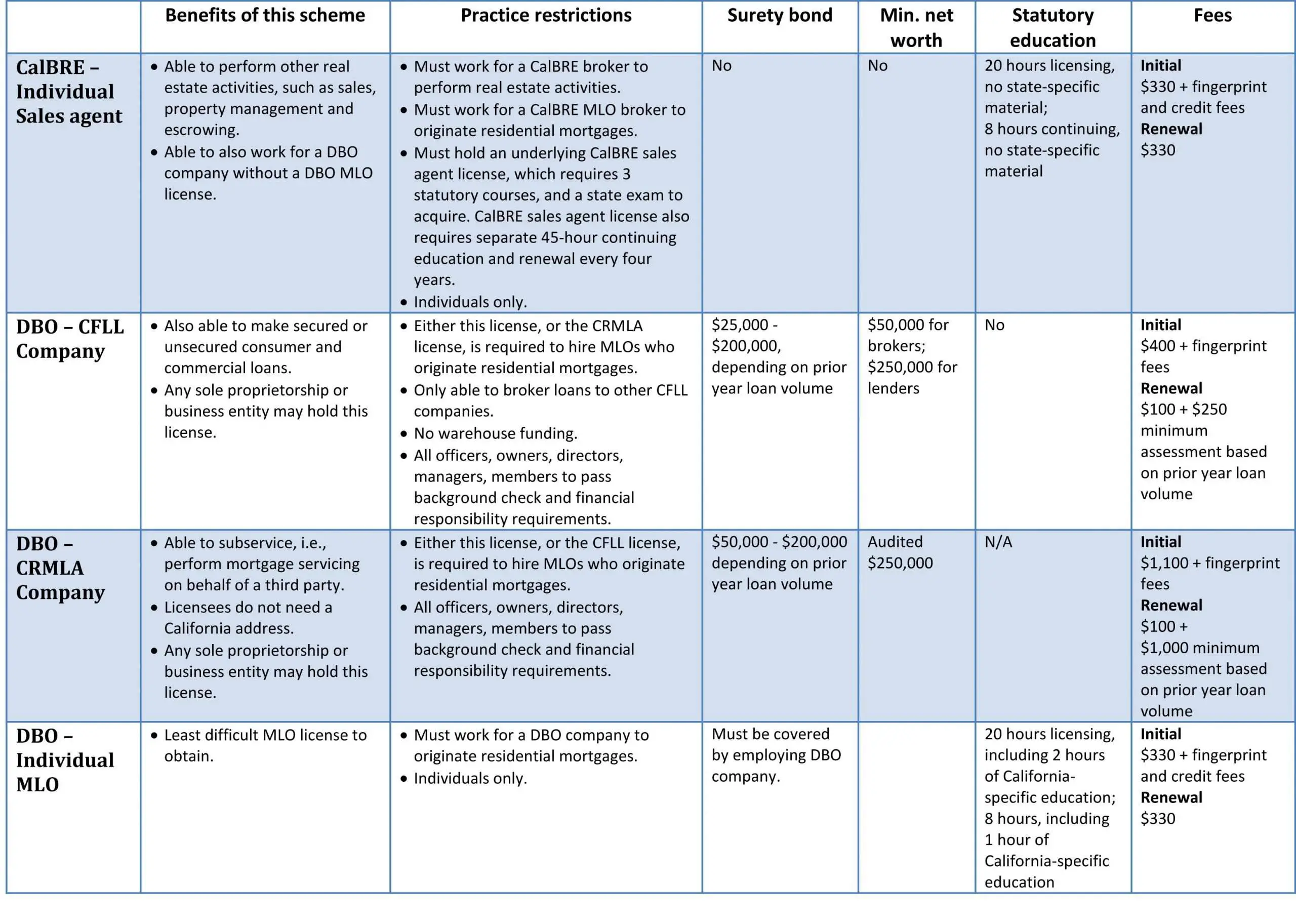

Most states in America do not require a commercial mortgage broker to obtain a mortgage broker’s license or a real estate broker’s license in order to negotiate commercial mortgage loans in their state. This fact, however, is often not obvious.

When you first look at the licensing scheme of most states, the law will say something like, “A broker must be licensed as a mortgage broker to negotiate a mortgage loan in this state.” Huh. Sounds like a mortgage broker’s license is clearly required, right?

However, when you look up the legal definition for a “mortgage loan” in that state, you will almost always find that a mortgage loan is defined as a loan on a one-to-four family dwelling! In other words, no mortgage broker’s license is required to negotiate a loan on 5+ residential units , commercial properties, or land.

Be careful about land. A loan on a single residential lot, purchased to be the future site of the borrower’s personal residence, is often considered to be a residential loan. This means that a mortgage broker’s license would be required to negotiate such a loan.

I am not licensed as an attorney, outside of California and Indiana, but my research suggests that a mortgage broker’s license may not be required in at least 40 states.

* A real estate broker’s license is required, rather than a mortgage broker’s license.

And of course you will need to know some commercial lenders.

You May Like: Fha Limits Texas

Be A Loan Broker Whose Name Is Protected

U.S. trademark protection is granted to the first entity to use a particular and unique mark or name in the city, town, or state where it operates, regardless of whether the mark is registered. But if your chosen mark is already registered by another company, even if you used it first, your registration will be rejected and youll probably need a lawyer to help you proceed.

Online trademark registration costs between $275 and $325 and requires information such as the kind of services your mark will be used for, the date of the marks first use, and whether theres a design element to the mark youre looking to trademark.

Once youve sent in your application, you should receive a response within six months of filing, according to the U.S. Patent and Trademark Office. There are some circumstances where registering through an intellectual-property attorney, or at least seeking legal advice beforehand, makes sense. If your mark is similar to another registered mark, or similar enough to confuse people, theres a decent chance your registration will be disputed.

If this happens, and you dont want to change the mark of your brokerage, a trademark lawyer may be able to help you find a way to get you some protection.

Do I Need To Be Licensed To Close Commercial Loans

Since all residential mortgage originators need to be licensed before they can do business in their state, many assume they will need to obtain a license to close commercial loans as well. But that isnt always the case.

The truth is it isnt always clear if a state requires a license in order to broker commercial loans, so we encourage brokers to either consult with their attorney or search the NMLS online database to determine whether or not a license is required to broker commercial loans in those states where they do business.

Don’t Miss: Usaa Car Loans Reviews

Get Your Pricing Structure In Place

Without having proper fee agreements in place, starting a commercial loan broker business means nothing. There are so many brokers that dont have the proper worded fee agreements in place when operating their business. Agreements are meant to protect the brokers business and, more importantly, insure the commissions that are to be paid. Without having this agreement in place, it exposes your commercial loan business to penalties.

To figure out what to charge for your services, youll want to know what the local demands for your services are going to be. This will give you an idea of how much of a percentage of the loan amount is that youll be able to charge as a fee. Most commercial loan brokers negotiate a percentage that is between 1%-2.5% of the loan. Its traditional that larger loans will have smaller commissions. Some brokers may also charge an application fee for services rendered at the time of the application. In the U.S., the average application fee is $2,000.

Distance Between Personal Residence And Nearest Branch Office Of The Mortgage Company

Some states have distance to branch office and/or corporate office distance requirements. What this means is if you want to get licensed in a particular state, the state can have a mandatory maximum distance requirement between the nearest branch office of the mortgage company and the residence of the loan officer. The nearest branch near the loan officers residence needs to be licensed in the state the loan officer is seeking to get licensed. If the nearest branch office of your mortgage company is out of state and/or further than the distance requirements, you cannot get licensed in that particular state.

Read Also: Usaa Preferred Dealerships

Applying For State Nmls License

Each state has different requirements for getting licensed. Many states require additional annual continuing education hours. Every year, loan officers need a minimum of 8 hours of continuing education hours to renew their NMLS licenses. However, many states require additional hours on top of the minimum 8 hours. To get licensed in a state that requires more hours than the minimum 8 hours of CE, the loan originator needs to meet the states additional hour requirement. You can take the additional hours of continuing education hours at any NMLS-approved course provider.

Bonus Who Will Fund My Deals

Our team at Silver Hill Funding has helped thousands of residential brokers find success in the commercial mortgage space. We have the tools and the experience needed to help jumpstart your commercial mortgage business. Whats more, we offer all of the education material and customizable collateral you need to get started with ease.

To learn more and to take the first step, be sure to . In just 30 days, youll have all the tools you need to start originating commercial loans.

Read Also: How Long It Takes For Sba To Approve Loan

Howto Become A Mortgage Broker

Becominga mortgage broker is not a child play. It would help if you got a certain levelof expertise and education to ensure you succeed. Besides, having the rightbackground will guarantee a greater success rate.

Ifyou are up for the challenge and want to be a mortgage broker, then here arethe details of how you can qualify and establish yourself successfully in theindustry.

How Will I Qualify Commercial Scenarios

The ability to analyze commercial scenarios and quickly determine the optimum lending solution is key for commercial originators. You wont develop this skill overnight, but its one you must work toward if you want to consistently close commercial deals.

For now, try to keep the following steps in mind when a commercial mortgage scenario reaches your desk. That way, youll begin to develop an internal checklist that allows you to save time and increase the chances of approval for your clients.

Read Also: 600 Fico Score Auto Loan

The Right Credit Card To Start A Loan Broker Business

A business credit card enables the online transactions and payments your new loan broker business will incur. With business credit cards, there are no corporate financial reviews every two years and your line of credit can never be turned into a term loan. Its always revolving and can be subject to credit limit increases as well.

The way the minimum payment is calculated with a business credit card is based on the principle plus interest depending on the card issuer.

To learn more about the application process and what you should consider when choosing the right credit card check out this article from .

Financial Responsibility Character And General Fitness

Pursuant to 32-9-120, MCA, the Division will review each MLO license application to see if the applicant demonstrated âfinancial responsibility, character, and general fitness to command the confidence of the community and to warrant a determination that the mortgage loan originator will operate honestly, fairly, and efficiently within the purposes of this section.â Additionally, the Division has adopted rules that define its standards and procedures for determining financial responsibility and also has a rule which addresses reviewing applicants adverse credit history. The Division often considers using a conditional license status if the applicant is cooperative in providing documentation and working towards improving their credit.

A conditional license is the status assigned when the regulator has reviewed the license and decided to issue a license through NMLS provided certain conditions imposed by the regulator are met. This status may also be used if a licensee is subject to conditions set by an administrative order that do not otherwise restrict their ability to conduct lawful activities under the license.

Read Also: Fha Land Loan

Your Guide To Getting A Mortgage Broker License In 2022

- What is a Mortgage Broker License?

- How do I Get a Mortgage Broker License?

- What Are the General Mortgage License Requirements?

- What Are the Mortgage Broker License Requirement in My State?

- What Are the Steps to Getting Mortgage Broker License?

- How Long Does It Take to Get a Mortgage Broker License?

- How Much Does It Cost to Get a Mortgage Broker License?

National Mortgage Licence System Test

Oncedone with your course, you will have to sit for the NMLS exam. It is commonlyknown as the SAFE Mortgage Loan Originator Test. The exam is meant to test theknowledge of the state guidelines, mortgage practices, and regulations of theperson sitting for the exam.

Toclear the examination successfully for both Federal and state parts of theexam, you will require at least a 75% score.

Besides,it would help if you also remembered that you have to renew your license eachyear. For restoring, you must clear the background and credit checks. Also,certain states have some specific requirements which you must be aware of.

Also Check: Bayview Loan Servicing Dallas Tx

Licensing Requirements To Start A Loan Broker Business

Although most states dont require a broker to be licensed to start a loan broker business, there are some that do. For those that do, the requirement is often limited only to real estate loans. The best way to determine whether or not you need a license in your state is to investigate and do your research. Each state has a licensing board that can provide this information. You can also check with member organizations in the banking industry or with your local branch of the Small Business Administration.

What Is A State Business License

If youre starting a business or nonprofit, you may be wondering what a state business license is. A state business license is a government-issued document that provides proof that your new business is legally allowed to operate in a specific state. This can include an operating license or it could be a sellers license that allows you to sell specific products in that state.

Some states require business licenses at the state level, but oftentimes entrepreneurs can obtain business licensing at the city or local level as well.

Also Check: What Is The Fha Loan Limit In Texas

Setting Up Your Brokerage

Setting up your company and how it will run and operate is an important part of starting your loan broker business. We will examine the various steps involved one by one, from creating your legal entity, to getting you tax ID, to financial accounts, and more.

If you have any questions as you are walking through these steps, dont hesitate to reach out to our team of coaches. We are always here to help you understand the critical steps and the best sequence.

OPPORTUNITY for a brokerBIG RISKSAVOID

Where Will I Source Leads

As a residential mortgage broker, you already have access to a wealth of clients who may have a need for commercial loans that previously would have had to look elsewhere for funding options. This is perhaps the greatest source of leads for brokers adding commercial lending to their offerings.

However, for both residential and commercial mortgage brokers, a strong network is the key to a successful business. Here are a few quick tips for growing your network:

- Partner with the right lender By working with the right lenders, youll be able to offer attractive funding choices to your current and potential clients, which can help grow your network. Youll know youve found the right team when theyre doing everything they can to support your clients needs.

- Participate in industry events As you likely do on the residential side, to expand your network for commercial loans, youll want to participate in industry events and business-related events in your community.

- Utilize social media In 2019, not having a social media presence can certainly hinder your ability to network effectively. You can expand your network online by sharing valuable information with your sphere. Your focus online should be to stand out as the lending expert that potential clients think of when they think of commercial loans.

Read Also: Fha Title 1 Loan Rates

Mortgage Broker License For Commercial And Residential Loans

BySonia Smith | Submitted On November 14, 2009

So you’re thinking about becoming a mortgage broker. Should you get a mortgage broker license? Most states require a license for all mortgage brokers. But you will also benefit from a broker license in your career. Read on to learn how you can get a broker’s license, and what the certification entails.

Depending on what state you live in, you will have different requirements for getting your mortgage broker license. Although not all states subject brokers to licensing and regulation, most do. Further, clients often feel more comfortable knowing you have a license and a disclosed history with the state government. The states that require broker licenses do so because licenses protect the consumers. Many clients will research their broker before signing a deal with the broker, and the Internet provides a large supply of information on brokers. On the Internet, you can find lists of brokers who have new licenses, inactivated licenses, and suspended licenses. In order to have your name on the good list, you need to have a state license.

All states have different specific requirements for getting a mortgage broker license. Most states require a minimum amount of experience and education, such as either a B.S. in finance or a related field, plus 18 months work experience or three years experiences in the mortgage lending field as a full-time loan officer with a mortgage broker. Some states require an examination, as well.