Revised Pay As You Earn

Revised Pay As You Earn has fewer eligibility requirements than PAYE or IBR. If you are struggling to make monthly payments but dont qualify for other income-driven repayment plans, then this may be the right option for you. In fact, you can sign up no matter how much you currently earn. But if you are married, this plan takes into account both spouses earnings, even if you file taxes separately.

Forgiveness takes place after 20 years, or 25 years if you have any loans from graduate school. For REPAYE, as for PAYE and IBR, discretionary income is defined as the difference between your annual income and 150% of the federal poverty guidelines for your family size and state of residence.

Growing Balances Overwhelmed And Discouraged Off

Among off-track borrowers, growing balances often presented a psychological barrier to successful repayment.45 Borrowers reported being overwhelmed and frustrated, and lost their motivation to make payments toward a balance that continued to grow. Many were resigned to being in debt indefinitely.

It feels like its never going to be paid off. … Its just a lot of interest. And Im not really paying hardly any of the principal off, because I cant afford to. … Which is also why you dont care about paying it off. Its never going to be paid off.

And even in forbearance, you still get tacked on all this interest. … And the interest accumulates more and more and more, and then you have to look at your bill and … your principal just even gets bigger.

If I saw that my payments made the principal go down, Id get excited … keep on paying. But it just keeps adding on to the point that you just lose the desire. You just want to focus on things you really need right now.

I have a resentment toward because it went up so high. Fifteen years ago, I remember borrowing $3,000. And it got so high. … So I dont want to pay them.

It feels insurmountable. … But just like even the car payment, like when you make the payments … and you see the balance went down, that does something. That makes me want to continue doing it. Student loans, you be like, Im just throwing money down the drain.

How A Direct Unsubsidized Loan Works

The key differences between an unsubsidized loan and a subsidized loan are the interest, loan limit and eligibility.

Unsubsidized student loans are more expensive than subsidized loans because interest starts accruing sooner on unsubsidized loans. The borrower is responsible for the interest that accrues on unsubsidized student loans during in-school and grace periods, as well as deferments and forbearances. Borrowers can choose to pay the interest as it accrues or to defer paying the interest until the student loans enter repayment. All federal student loans have a fixed interest rate.

If the borrower does not pay the interest as it accrues, the interest will capitalize and be added to the principal loan balance when the loan enters repayment. This can increase the size of the loan by as much as a tenth to a quarter. It also leads to interest compounding, since interest will be charged on the capitalized interest.

You May Like: How To Refinance An Avant Loan

What Is A Private Student Loan Final Word

A private student loan isnt always necessary to pay for college, but its often useful. Federal loans are limited by the Department of Education each year, so they dont always cover the full cost of education.

If youve accepted federal loans and Pell Grants, and youve applied for other sources of funding like scholarships, a private loan can help make up the difference.

When you choose a private student loan lender, make sure to follow the tips above and get the loan available.

Private Student Loan Relief

During the COVID-19 pandemic, most lenders chose to help borrowers with some form of private student loan relief. What this means is they offer a temporary forbearance to give you a break on your regular student loan payments. This does not mean lenders are waiving interest or automatically postponing payments as part of the CARES Act, the way the federal government has done on federal student loan loans owned by the U.S. Department of Education .

For those impacted by COVID-19, private student loan lenders began offering temporary reliefanywhere from 30 days to 12 monthsfrom regularly scheduled monthly payments. Because this is discretionary, policies and programs will vary by lender. If you are still having difficulty making your private student loan payments due to impacts from COVID, you should contact your lender.

Learn more tips strategies for paying off private student loans.

What to Read Next

Also Check: How Much To Loan Officers Make

Who Can Use A Private Student Loan

Both undergraduate and graduate students can apply for private student loans. However, most college students dont have the . If this is the case, you can take out a private student loan with a cosigner.

A cosigner is someone who meets the credit and income requirements . They agree to take responsibility for the loan if you start missing payments.

Many lenders also offer separate parent loans, which dont require a check on the students credit.

Private Loan Interest Rate And Repayment Term

When youre shopping for a private student loan, interest rate and repayment term are key points to consider.

Interest rate is the percentage youll repay in addition to the principal . Interest accrues annually, and private student loan interest rates range from about 3% to 13%. The lower an interest rate you can get, the better.

Repayment term is the amount of time you take to repay your loan principal plus interest. Because interest accrues annually, a longer term means youll pay more overall. However, a shorter term means youll pay more each month.

Also Check: Does Va Loan Work For Manufactured Homes

Providing Equity In Education

Not all groups of the population have access to the same level of education quality. Besides making education affordable, the government aims to create equity in education for different groups of people.

Hence, the budget plan involves investments in science and engineering programs, specifically in Historically Black Colleges and Minority-Serving Institutions. Moreover, the funds will be used to develop curriculum elements, increase access to research, mentorship, and fellowship, increase education capacity, etc.

Learning About Student Loan Repayment

Prior to graduation, you will attend an exit interview where your total loan balance will be shared with you, along with your rights and responsibilities as a federal student loan borrower. You will also most likely hear from your student loan servicer, the company that manages your student loan repayment, via mail or email. Pay attention to these communications there will be important information contained in them.

You May Like: Refinance Auto Loan With Same Lender

How Does A Private Student Loan Work

Once you have the answer to, What is a private student loan? you might also ask, How does a private student loan work? You can say what a private student loan is in theory, but what does it look like in practice?

After you apply for a private student loan and youre approved, heres what will happen next:

The private lender will contact your college directly to verify loan amounts.

The college and lender will make arrangements for disbursal.

The lender will send the full loan amount to your school.

Your college will apply the loan to your tuition and any other fees.

The college will give you the leftover funds to pay for other educational expenses like books and housing.

Standard Repayment Plan Eligibility

All borrowers with the following loans are eligible for the standard repayment plan:

- Direct subsidized loans

- FFEL PLUS loans

- FFEL consolidation loans

Note that private student loans arent eligible for federal repayment plans, such as standard repayment, but most do come with the option of a 10-year repayment plan option. Youll choose your repayment terms when you borrow your loan.

Don’t Miss: Can You Buy A Mobile Home With A Va Loan

Student Loan Repayment Options

We know college seniors have a lot on their plates: career searches, internships, and preparing for graduation. But amid everything, it is worth your time to take a moment to consider the upcoming repayment of your federal student loans that have been in deferment throughout your time in college. Here are some things to understand about your federal student loans.

Claim Federal Student Loans

First, youll want to check your federal aid award package. After you filed a Free Application for Federal Student Aid , the Federal Student Aid Office evaluated your Expected Family Contribution and approved certain kinds and amounts of financial aid including student loans.

If you log into your student account with your college, you can navigate to your financial account section that outlines your aid award. You can see if there are any unused student loans or other aid you can claim. A financial aid administrator can also help you find out if you have unused federal aid.

In most cases, youll be able to borrow student loans up to the federal student loan limits or your cost of attendance , whichever is lower. Here are limits for common types of federal loans:

- Undergraduate Direct loan limits are as high as $7,500 a year for dependent students or $12,500 for independent students.

- Graduate Direct loan limits are $20,500 a year for independent students.

- PLUS loans are available to parents and graduate students to borrow up to the cost of attendance, after all other aid is applied.

Because youve already been approved for these student loans, you can quickly claim this unused aid and get funds disbursed to your student account. You can also talk to your parents about applying for a Parent PLUS loan to help cover costs.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

What Is In The Budget Plan For Student Loan Borrowers

A few days ago, a new budget plan for 2022 was announced and submitted to Congress. The budget is worth almost $6 trillion, which is the highest amount of spending since World War II.

The White House noted that they are dealing with big challenges, and hence, they need more money. The President aims to invest in education, health, research, families, and other foundational elements of the country through the proposed budgets.

When To Use A Repayment Calculator For A Loan

The Repayment Calculator can be used for loans in which a fixed amount is paid back periodically, such as mortgages, auto loans, student loans, and small business loans. For other repayment options, please use the Loan Calculator instead. Include any upfront fees into the calculator to compute the real rate of interest.

Don’t Miss: Usaa Rv Loan Rates

How To Make Student Loan Payments With Icr

âYou can make payments in the following ways:

- Phone: ICR customer representatives can take payments using a debit card. You can set up the payments by calling the company at its phone number, 866-401-7190.

- Mail: You can mail payments for Department of Education Loans to National Payment Center, P.O. Box 790336, St Louis MO 63179-0336.

- Online: For Department of Education held loans, you can make payments at myeddebt.ed.gov.

To start making payments online, follow these three simple steps:

Do Private Student Loans Accrue Interest While In School

Even though the answer to, Do you have to pay student loans while in school? is usually no, that doesnt mean you should wait to make payments. Private student loans accrue interest while youre in school, meaning your loan balance will keep growing.

Unsubsidized federal student loans also accrue interest from the date of disbursement. The only loans that are immune from interest accrual are subsidized federal loans, which are awarded to students with financial need.

To understand how much interest will accrue on your student loans, use our student loan payment calculator.

You May Like: Can You Use A Va Loan To Buy Land And A Manufactured Home

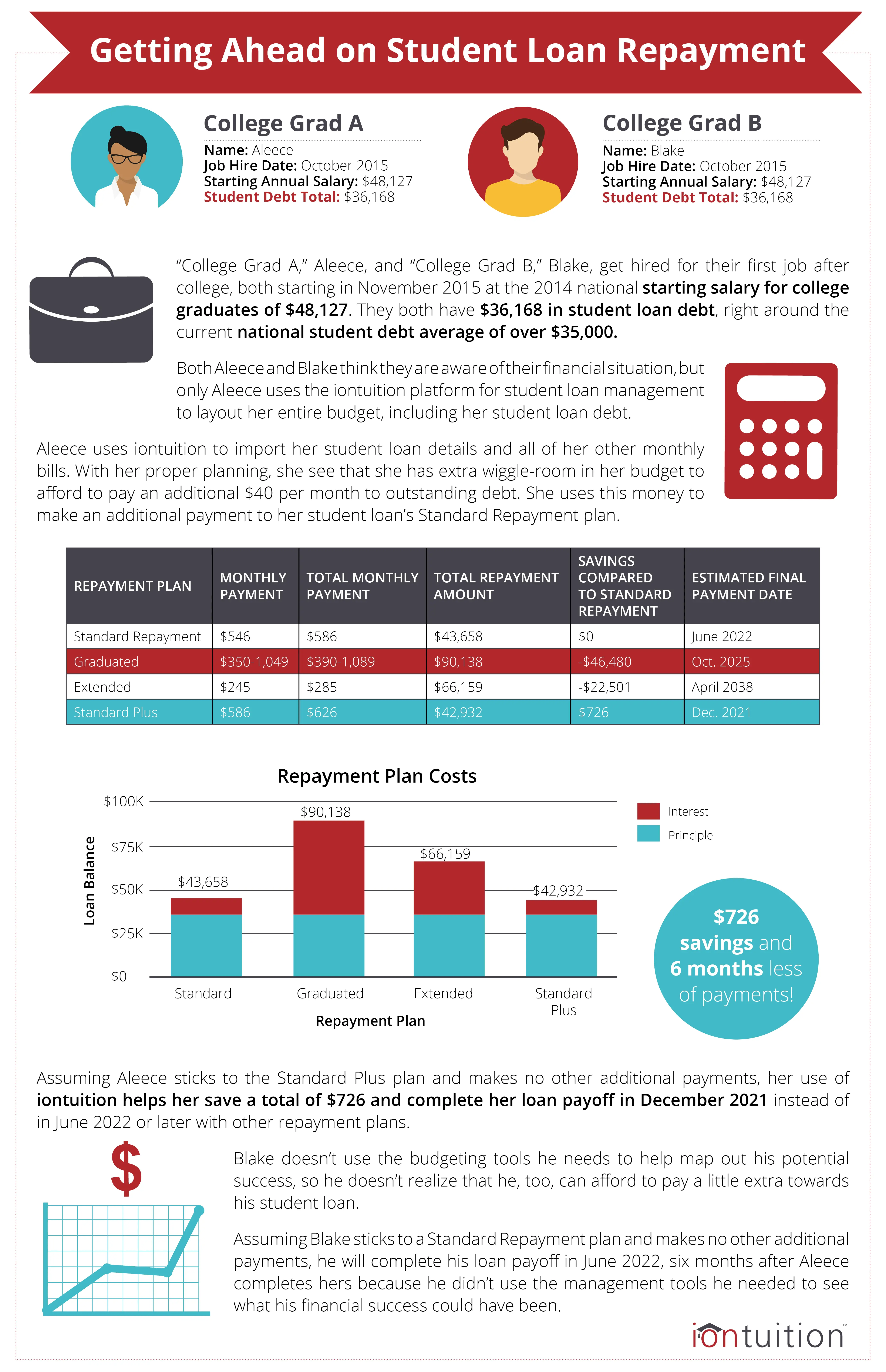

Federal Student Loan Repayment Plans

If you have federal Direct or FFEL loans, there are numerous options for you.

The Standard Repayment option is the default option. Youll make equal monthly payments over a period of 10 years.

The Graduated Repayment option allows you to start off with lower payments that steadily increase until you pay your loan in its entirety. The lower initial payments make it easier for you to meet your monthly financial commitments while you are still new on the job scene. As your salary increases, your monthly payments also increase.

With Income-Based Plans, your monthly payments are calculated as a percentage of your monthly income. When your earnings are low, you make smaller monthly payments. Your income is reviewed regularly and when it increases, you make larger monthly payments. Income-based repayment plans ensure that you make your monthly payments while still having money to meet your other expenses such as rent, utilities, and groceries.

Ial Interest Repayment Plan

With a partial repayment system, you will be paying a fraction of your loans interest on a fixed monthly amount.

However, you have to note that you will still owe more than you borrowed when you finish college.

Nevertheless, choosing this plan is a bit easier on your check and still helps keep your loan balance under control.

Also Check: Can I Refinance My Car Loan With The Same Lender

What Are My Private Loan Repayment Options

When dealing with private lenders, there are four basic options for repayment. .

Immediate Repayment begins as soon as you take out your loan. Some students prefer this option so that they can pay down their loans while still enrolled in school. This will save money on your interest rate in the long-run.

Interest-Only Repayment allows you to pay only the interest while you are in school, and the remainder of the loan becomes your responsibility upon graduation. Though you dont pay off the loan, paying the interest still helps you save money.

Partial Interest Repayment allows you to make lower monthly payments while you are enrolled, and the payment amounts increase over time.

With a full deferment, you do not any payments until after you graduate and become employed. However, what you must remember is that the interest starts accruing from the time you receive the money.

Payments On The Standard Plan

When youre set up on the standard repayment plan for student loans, your monthly payments are generally calculated based on what it will take to pay off your balance within 10 years time. That said, the plan requires you to pay a minimum of $50 a month.

However, consolidated loans are the exception. If you have Direct consolidation loans or FFEL consolidation loans, your payment term may range between 10 and 30 years. The $50 monthly minimum still applies however, the payment amount is determined not only by what you owe on the consolidated loans, but also any other student loan debt.

Also Check: Usaa Certified Auto Dealers

Types Of Student Loans

Higher education is something that not everyone can afford, and this is where student loans come in.

They come in many forms, and it is up to you to decide which one will work best with your needs and paying capabilities.

Lets start by discussing the three different types of student loans: federal, state, and private loans.

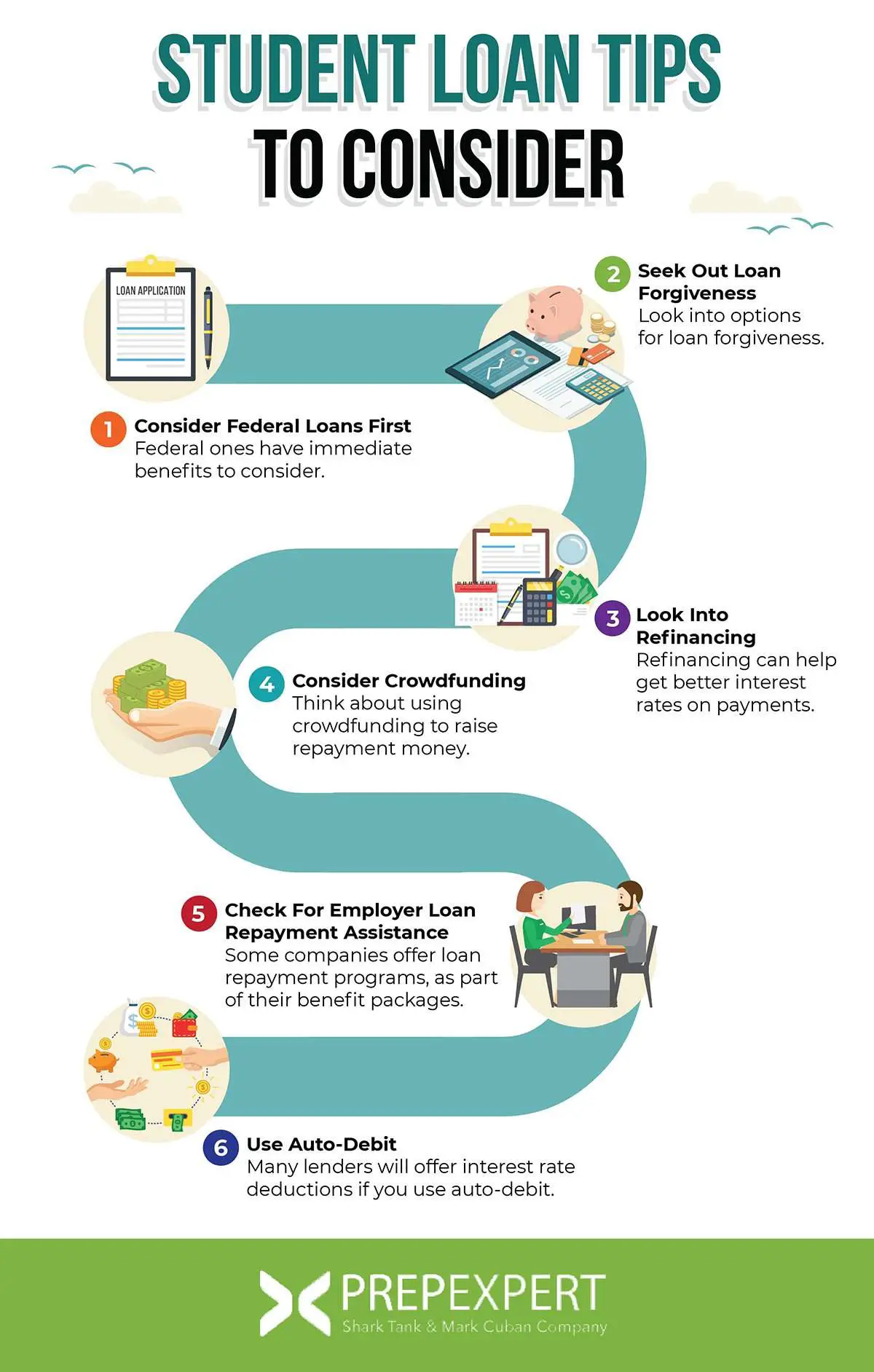

Refinance My Student Loans

Since repayment plans and loan terms vary by lender, and since interest rates change over time, you may want to consider refinancing your student loans. This can be a very effective way to manage your repayment by restructuring your loans. Refinancing allows you to combine multiple loans together , or you can refinance a single loan. Reasons you may want to consider refinancing as part of your repayment strategy include:

You May Like: Usaa Car Loan Reviews

Inquire About Repayment Assistance Through Your Employer

Some employers offer student loan repayment assistance or student loan forgiveness. As you begin applying for jobs after graduation, look specifically for employers that offer repayment assistance as a benefit. If youre in a field such as education/teaching, check out forgiveness opportunities that may apply to some or all of your loans.

Private Student Loan Options

Private student loan terms and conditions vary.

Different repayment options are available based on a loan’s promissory note and the loan owner’s policies.

Some repayment programs are described in a loan’s promissory note. Additional options may also be available at the lender’s discretion.

Don’t Miss: What Credit Score Is Needed For Usaa Auto Loan

What Can Icr Help You With

If Immediate Credit Recovery is assigned your defaulted student loans, you can contact the company about the following repayment options:

- Settlement: is the only option to save collection fees and reduce some of the accrued interest. Many federal student loan settlements save the borrower about 10-15% of the current loan balance.

- Loan Consolidation: allows you to get out of default fast. You do not need good credit to qualify. Your credit score won’t be checked in the application process. Instead, you’re eligible to get a Direct Consolidation Loan if you’re not under an active administrative wage garnishment and you have at least two loans to include in the application.

- Loan Rehabilitation: gets you out of default, qualifies you for new financial aid, and allows you to clear CAIVRS after making 9 payments in 10 months. This program also stops wage garnishment after you make your fifth payment.

- Voluntary Repayment: does not get you out of default. Choose this option only if you’re not eligible for consolidation or rehabilitation.