Do I Have To Pay Mortgage Insurance If I Put 20 Down Fha

When you buy a home with an FHA loan and you dont have at least 20 percent to put down, mortgage lenders require you to pay an FHA mortgage insurance premium, or MIP, which protects them from loss. if you cannot repay the loan.

How much do you have to put down to avoid PMI on a FHA loan?

One way to avoid paying PMI is to make a down payment equivalent to at least one-fifth of the homes purchase price in mortgage talk, the mortgage loan-to-value ratio is 80%. If your new home costs $ 180,000, for example, you would need to put in at least $ 36,000 to avoid paying PMI.

Can you avoid mortgage insurance on FHA?

FHA charges an advance premium that homebuyers pay when closing or financing their loan amount and increasing their debt. FHAs minimum down payment is 3.5%. And, unless they put down at least 10%, their monthly mortgage insurance payment cannot be canceled, unlike private mortgage insurance.

How Much Does An Fha Inspection Cost

An FHA appraisal costs an average of $300 to $425, according to HomeGuide.

Who pays for FHA required repairs? If the seller backs out for some reason or something else causes the loan to fall through, you wont get your money back. Now youve paid for repairs on a home that you dont own. Typically, the seller should cover the FHA repairs necessary for your loan to go through.

Using Gift Funds To Cover Your Down Payment

Many first-time home buyer programs let you cover the whole down payment with gift funds.

For example: If youre buying a $250,000 home with a3.5 percent down FHA loan, your entire $8,750 down payment couldbe a gift from your parents.

- The Conventional 97 loan and Freddie Mac Home Possible also allow 100 percent of the down payment to come from gift funds

- Fannie Maes HomeReady loan, by contrast, requires a 3 percent borrower contribution at minimum. That means youd have to pay at least $7,500 toward the $250,000 home out of pocket

Gift money can come from a parent, friend, employer,or anyone generous enough to help you out with your home purchase.

However, if youre going to use gift funds towardyour down payment, they have to be properly documented by the gift giver andthe home buyer. That means writing a gift letter to show your mortgage lender the money came from a verified source.

Thisextra step in your home buying process will be worthwhile. Be sure to let yourloan officer or real estate agent know early in the process that youll beusing gift funds for a down payment.

Dont Miss: What Car Loan Can I Afford Calculator

Also Check: Usaa 84 Month Auto Loan

Down Payment Assistance Programs And Gifts

Rules for FHA loans are easier than most when it comes to the source of your down payment. So you may be able to accept the whole amount from a down payment assistance program or as a gift.

Still, its important to remember lenders may impose stricter standards than the FHA minimums outlined here. So that last bit of advice stands: shop around for a more sympathetic lender if yours has strict rules over down payment assistance and gifts.

How To Apply For An Fha Loan

- Find an FHA lender. To find a HUD-approved lender that offers FHA loans, you can head to the agencys Lender List and search for qualified institutions in your area. Even though FHA loan requirements are the same everywhere, some lenders may have additional credit score requirements for approval. Our list of the best mortgage lenders is also a good place to start.

- Submit the application. Once youve selected a lender, fill out their application and provide all the information they need to process your request, which may include pay stubs, bank statements and old tax returns. The lender will also look into your credit history and your to calculate your debt-to-income ratio.

- Compare loan offers. You should always shop around and request quotes from more than one lender to make sure youre always getting the best loan terms and mortgage rates. Interest rates can vary between lenders even when it comes to federally-regulated programs like FHA-backed loans. Our mortgage calculator can help you figure out which loan is right for you.

- Research down payment assistance programs. Many states have programs in place to help low-income earners or first-time homebuyers purchase their homes. To qualify for an FHA loan, you need to make a down payment of at least 3.5% but this money can come from your savings, your relatives savings or down payment assistance programs.

Read Also: How To Get A Car Loan When Self Employed

Can You Put More Down On An Fha Loan

If youmoreput downitdownyou moreyouloanIt’sdownFHA

. Consequently, what happens if I put 20% down on an FHA loan?

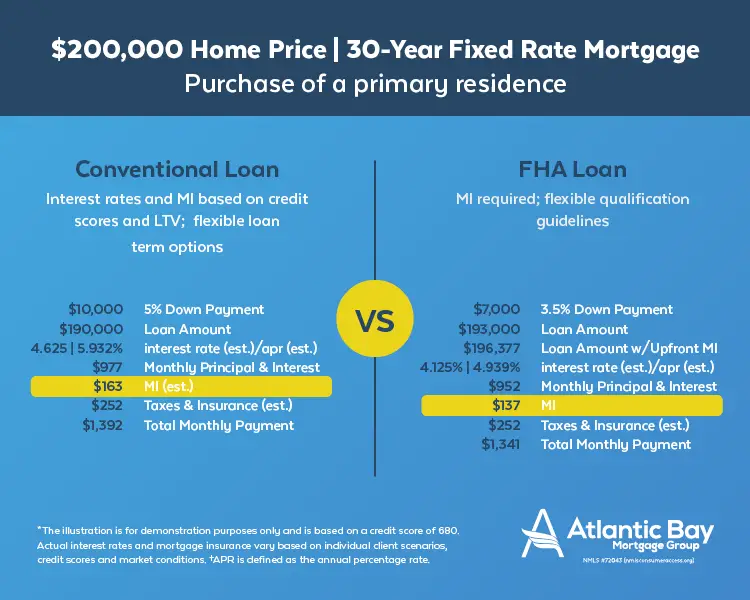

Conventional loans require private mortgage insurance if a buyer cannot put 20% down. FHA loans require mortgage insurance regardless of how much money is put down initially. Conventional wisdom says that buyers should only consider getting an FHA loan only if they cannot put 20% down.

Secondly, how much do you have to put down on an FHA loan? For an FHA loan, the minimum down payment you would need to buy a home is 3.5% down. Most lenders can lend up to $417,000 with the exception of Alaska, Hawaii, and Guam. An FHA loan comes with a monthly mortgage insurance premium, which can make it more expensive than a conventional mortgage.

Similarly, it is asked, can you put more money down on a FHA loan?

The reverse is also true–FHA mortgage loan applicants can put more money on their down payment in order to lower monthly mortgage bills-there is no requirement that the borrower must only pay the 3.5% minimum.

What is benefit of FHA loan?

The Federal Housing Administration loan program offers two primary benefits to home buyers a relatively small down payment, and more flexible guidelines: Borrowers who use this program can make a down payment as low as 3.5%. Borrowers with credit problems in the past may find it easier to qualify for FHA.

The Upfront Mortgage Insurance Premium:

FHA loans have a hefty upfront mortgage insurance premium equal to 1.75% of the loan amount. This is typically bundled into the loan amount and paid off throughout the life of the loan.

For example, if you were to purchase a $100,000 property and put down the minimum 3.5%, youd be subject to an upfront MIP of $1,688.75, which would be added to the $96,500 base loan amount, creating a total loan amount of $98,188.75.

And no, the upfront MIP is not rounded up to the nearest dollar. Use a mortgage calculator to figure out the premium and final loan amount.

However, your LTV would still be considered 96.5%, despite the addition of the upfront MIP.

Recommended Reading: Does Va Loan Work For Manufactured Homes

Also Check: Fha Loan Limits Texas

Other Loan Options To Consider

If you have high credit scores but are having a hard time raising a down payment of 20% of the purchase price, FHA loans are not your only option. Consider some of these alternatives:

- Freddie Mac Home Possible loan: Freddie Mac, as the Federal Home Loan Mortgage Corporation is popularly known, devised the Home Possible loan to lower the barriers to homeownership. Down payments start at 3% and can come from family, employer assistance, a secondary loan or “sweat equity.” The minimum credit score requirement is 660 , but if you or a co-applicant lack a credit score, you still could qualify through an alternative underwriting process.

- Fannie Mae 97 LTV loan: The Federal National Mortgage Association, better known as Fannie Mae, authorizes two categories of mortgage loans that require minimum down payments of 3% :

- The Fannie Mae Home Ready 97 LTV loan is designed for low-income borrowersspecifically those with incomes below 80% of their local area median income as designated by the U.S. Census Bureau.

- The Fannie Mae Standard 97 LTV loan is open to any borrower, provided at least one applicant is a first-time homebuyer and all applicants have credit scores. If all applicants for Fannie Mae LTV loans are first-time homebuyers, at least one must complete a homeowner education program.

Can You Do The Work Yourself With A 203k Loan

Yes! You can finance repairs needed to pass an FHA inspection or desired repairs done by a professional. If there are DIY home improvements you want to tackle, simply dont roll them into the bids for the work with the FHA 203k.

How do you know if you qualify for FHA loan? How to qualify for an FHA loan

Is 203k a conventional loan?

FHA 203 Loan

Offered by the U.S. Department of Housing and Urban Development , this loan is backed and insured by the FHA. While only approved lenders, such as Contour Mortgage, can offer these, they also have slightly more lenient terms than conventional mortgages.

How much income do you need for a construction loan? To qualify for a construction loan, your debt-to-income ratio should not exceed 45 percent. This is the percentage of your income that goes toward debt repayment each month. Calculate this ratio by dividing your total debt payments by your gross monthly income.

Recommended Reading: Can I Use A Va Loan To Buy Land

Down Payment On Your Secondary Residence

A second home is a residence that you intend to occupy in addition to your primary residence. A second home can be a vacation home or a property that you visit on a regular basis.

Conventional Loan: Conventional loan requirements are higher for people who want to buy a second home. To qualify for a loan on a second home, youll need a down payment of at least 10%. Keep in mind that restrictions on what is and isnt considered a second home may apply. For example, you can only rent the home for up to 180 days a year.

FHA Loan: You cannot use an FHA loan to buy a second property.

VA Loan: You cannot use a VA loan to buy a second property.

USDA Loan: You cannot use a USDA loan to buy a second property.

Understanding Federal Housing Administration Loans

In 2021, you can borrow up to 96.5% of the value of a home with an FHA loan. This means you’ll need to make a down payment of just 3.5%. You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan as long as you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member, or a grant for down-payment assistance.

It’s important to note that with an FHA loan, the FHA doesn’t actually lend you money for a mortgage. Instead, you get a loan from an FHA-approved lendera bank or another financial institution. However, the FHA guarantees the loan. Some people refer to it as an FHA-insured loan, for that reason.

In order to secure the guarantee of the FHA, borrowers who qualify for an FHA loan are also required to purchase mortgage insurance, and premium payments are made to FHA. Your lender bears less risk because the FHA will pay a claim to the lender if you default on the loan.

Though FHA loans require lower down payments and credit scores than conventional loans, they do carry other stringent requirements.

| For How Long You Pay the Annual Mortgage Insurance Premium |

|---|

| TERM |

Is an FHA Mortgage Still a Bargain?

Read Also: Bayview Loan Servicing Class Action Lawsuit

How To Qualify For An Fha Loan

To be eligible for an FHA loan, borrowers must meet the following lending guidelines:

- Have a FICO score of 500 to 579 with 10 percent down, or a FICO score of 580 or higher with 3.5 percent down

- Have verifiable employment history for the last two years

- Have verifiable income through pay stubs, federal tax returns and bank statements

- Use the loan to finance a primary residence

- Ensure the property is appraised by an FHA-approved appraiser and meets HUD guidelines

- Have a front-end debt ratio of no more than 31 percent of gross monthly income

- Have a back-end debt ratio of no more than 43 percent of gross monthly income

- Wait one to two years before applying for the loan after bankruptcy, or three years after foreclosure

Different Types Of Fha Loans

The FHA offers a variety of different loan programs besides purchase loans to meet the needs of homebuyers and homeowners throughout their financial lives.

| Type of FHA loan | |

| Borrowers can purchase or refinance a home and roll the costs of the renovations into one loan with the FHA 203 rehab loan program | |

| Energy-efficient mortgage | Homeowners can add the cost of energy-saving upgrades to the balance of a purchase or refinance loan with an FHA energy-efficient mortgage |

| Home equity conversion mortgage | More commonly known as a reverse mortgage, the HECM loan gives borrowers age 62 or older multiple options to access their equity and avoid a monthly payment |

| Section 245 loan | This program gives qualified borrowers the option to choose a loan with lower initial payments that increase as their income rises , or the choice to increase principal payments and pay off the loan faster |

Don’t Miss: How Long Does Sba Loan Take

Down Payments Help Avoid Pmi

PMI stands for Private Mortgage Insurance. Weve already talked a lot about PMI in this post, but the topic will come up again and again in discussions about down payments.

Since PMI does not protect your investment , most of us will want to avoid paying these premiums.

Paying at least 20 percent down prevents you from paying PMI premiums.

Read Also: How To Lower Car Loan Payments

Who Pays Fha Loan Closing Costs

Every FHA loan includes closing costs, but they can be reduced. While closing costs are generally considered to be the responsibility of the homebuyer, you may not have to pay for everything yourself. One of the biggest advantages of an FHA loan is the ability to avoid large upfront costs. To avoid high closing costs that could derail your home purchase, consider some of these options.

Don’t Miss: Becu Fha Loan

Discover Earnest Money Deposit Possibilities

When buying a house, you deposit earnest money into an escrow-holder account, which goes toward your down payment at closing. In the event the earnest money seems excessive, or it exceeds 2 percent of the sale price, the FHA requires proof of deposit to confirm the payment came from an acceptable source. You must submit either a copy of the canceled check deposited into escrow, certification from the escrow agent acknowledging receipt, or a separate paper trail for the lenders review.

References

Percent Down Payment Faq

Do I have to put 20% down on a house?

You do not have to put 20 percent down on a house. In fact, the average down payment for firsttime buyers is just 7 percent. And there are loan programs that let you put as little as zero down. However, a smaller down payment means a more expensive mortgage longterm. With less than 20 percent down on a house purchase, you will have a bigger loan and higher monthly payments. Youll likely also have to pay for mortgage insurance, which can be expensive.

What is the 20% down rule?

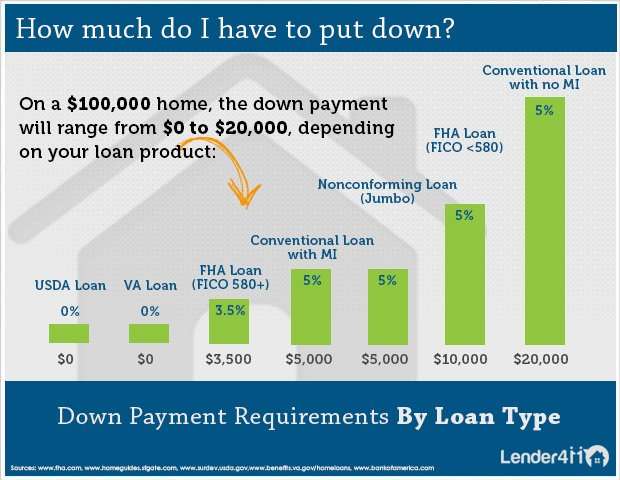

The 20 percent down rule is really a myth. Typically, mortgage lenders want you to put 20 percent down on a home purchase because it lowers their lending risk. Its also a rule that most programs charge mortgage insurance if you put less than 20 percent down . But its NOT a rule that you must put 20 percent down. Down payment options for major loan programs range from 0% to 3, 5, or 10% percent.

Is it better to make a large down payment on a house? How can I avoid PMI without 20% down?

Its possible to avoid PMI with less than 20% down. If you want to avoid PMI, look for lenderpaid mortgage insurance, a piggyback loan, or a bank with special noPMI loans. But remember, theres no free lunch. To avoid PMI, youll likely have to pay a higher interest rate. And many banks with noPMI loans have special qualifications, like being a firsttime or lowincome home buyer.

What are the benefits of putting 20% down on a house? Is it OK to put 10% down on a house?

Also Check: Capitalone Autoloans.com

Summary Zero Down Fha Loan

These are proven methods to get a zero down FHA loan, or purchase a home with an FHA loan without using any of your own funds. You will likely still need a few months reserves to cover your first mortgage payments. Even those can be covered by the gift funds that you receive from a relative.

If you would like to discuss your options or even get an FHA rate quote, then for a free consultation.

Should I Work With A Real Estate Agent

Home buyers never have to work with a real estate agent. After all, an agents commission comes out of your pocket, and you get to decide how to spend your money.

But a Realtor can usually earn his or her commission by helping you find the right house and guiding you through the process of closing on your home.

Realtors also have knowledge about local grants and incentives, which can help you lower your down payment needs.

Ultimately this has to be your decision, but I will point this out: If the seller has an agent and you dont, the sellers agent will claim all of the commission and will have no obligation to help you.

When you have an agent on your side, your agent will split the commission with the sellers agent. So either way, youre paying the same commission. You may as well get something for your money by bringing in your own agent.

Also Check: How Can I Get An Rv Loan With Bad Credit

Read Also: Fha Limits In Texas