Paying Off Your Car Loan Early: Things To Consider

Thinking of paying off your car loan? While theres the benefit of reducing your debt, take time to assess your personal financial position before making a decision. In this article, we highlight some of the important considerations to keep in mind.

3 min read

Timing can be an important factor in the car buying process. Learn when the best time to buy a car is and how timing can impact your decision making.

4 min read

There are many important factors to consider when deciding whether to buy a new or used car. Read more about the pros and cons of each car buying option.

4 min read

How To Calculate Car Loan Emi

The Equated Monthly Installments that you will pay will depend on a few key factors.

- The size of the loan

- The interest rate that is applicable to the loan

- The tenure of the loan

- The processing fees

The higher the loan amount, the higher your EMI will be. Similarly, the shorter the loan tenure the higher the EMI. To find the best compromise between an affordable EMI and duration you should check out our car loan EMI calculator.

How Do Interest Rates Work With Car Finance

Interest rates on car loans work similarly to personal loans and home loans, as opposed to say a credit card. With this loan youll need to make the minimum repayments towards the loan principal, plus interest on the total outstanding balance of the loan each billing period .

Additionally, there are two different types of car loan interest rates: fixed and variable. Heres how they work:

- Fixed interest: This means that your interest rate will remain fixed either for a set period or for the entirety of your car loan, allowing you to get a clear view of what your repayments could look like.

- Variable interest: This means that the interest rate for your car loan could either increase or decrease at your lenders discretion, and therefore increase or decrease your interest repayments accordingly.

Don’t Miss: How To Refinance Your Car Loan

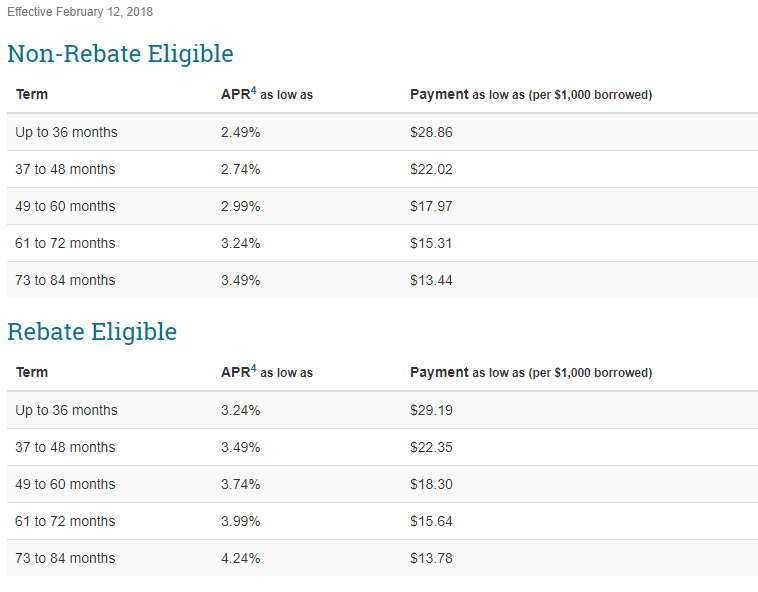

What Is A Good Auto Loan Interest Rate

A good auto loan interest rate is usually 4% or lower, but typically the best auto loan rates are for new cars. According to the 2022 report from the National Credit Union Administration , the average 60-month new car loan from a credit union has an interest rate of 2.78%. From a bank, the average rate is 4.69%. So, if you find these rates or lower, you know youre getting a fair rate on your car loan.

Average Interest Rate For Car Loan: Conclusion

Average interest rates for car loans are determined by a variety of factors, the most impactful thing being your credit score. Depending on your credit score and if you are buying a used or new car, auto loan rates can vary. Before financing a car, we recommend that you look at all of the providers available so you can get the best rates possible.

Recommended Reading: Should Both Spouses Be On Car Loan

How To Get The Best Auto Loan Rates

There are a few different ways to save money and find the best auto loan rates. Below, well outline some simple ways to reduce your interest rate for a new car, a used vehicle, or a lease buyout.

Remember that you may pay a higher APR if youre looking to purchase a used car or if youre hoping to buy a vehicle from a private party. And before you go searching for the best auto loans, make sure that repayment is possible based on your current financial situation.

Compare Current Car Loan Interest Rates In Canada

| Loan provider | ||

|---|---|---|

| From 4.99% | Autorama is one of the largest used car dealerships in Toronto. | Not specified online |

Note: the information below is just an example and does not take into account all of the factors lenders consider when evaluating a loan application. Actual lenders may charge different interest rates.

Read Also: Who Has The Lowest Rv Loan Rates

What Are Current Auto Loan Rates

An auto loan rate is the annual cost of borrowing money for a vehicle purchase or refinance. Its shown as a percentage, and its usually fixed for the duration of the loan term.

Auto loan rates are highly dependent on your credit report. Borrowers with higher credit scores tend to receive lower interest rates than those with poor credit. The age of the vehicle being financed also has an impact, as rates are higher for used cars than for new cars.

The table below shows the average rates for new and used cars based on buyers credit scores, according to Experians State of the Automotive Finance Market Q4 2021 report.

What To Know Before You Apply For An Auto Loan

Regardless of the type of auto loan you apply for, here is some basic information that can help you through the process.

Interest rate or APR: Your loan’s interest rate, also called annual percentage rate or APR, is the amount you agree to pay each year to borrow money, on top of the cost of the car. It includes any lender fees and is expressed as a percentage. APRs vary, but you can use the table below to estimate the interest rate you might expect for your credit score on a new or used auto loan.

Your credit score is only one factor that goes into determining your APR. Lenders also consider other criteria, such as income, the loan term and the type of vehicle youre buying.

> > MORE:How to get a car loan

Credit scores fall within a range of 300 to 850 on two basic scoring models, FICO and VantageScore. Some auto lenders use industry-specific scoring on top of the basic FICO model when making auto loan decisions, so the rate and whether youre approved can depend on which scoring model an auto lender uses. You can get your credit report with or from annualcreditreport.com.

Auto loan preapproval usually requires you to provide more personal information, such as a Social Security number. Its a conditional approval of credit, pending verification of your information, and typically carries more weight than pre-qualification. If youre buying from a dealership, presenting a preapproved loan offer from another lender gives the dealership a rate to beat.

You May Like: What Is Parent Plus Loan Interest Rate

Best Auto Loan Rates Providers

Based on our research, PenFed Credit Union currently offers the best annual percentage rate at 2.09%, and myAutoloan.com and Consumers Credit Union also generally offer some of the lowest rates and financing terms. In the table below are five top providers with some of the best auto loan rates in 2022.

Can My Credit Score Affect My Car Loan Application

As part of the application process for your car loan, the lender will perform a credit check to understand your credit history. This involves requesting a credit report from one of several licensed credit reporting agencies. Your credit report can contain information on any of your past and present credit products , as well as if youve ever missed repayments, defaulted on a loan, been bankrupt, or defaulted on utilities or phone bills .

If the credit report shows a history of missed or late payments on credit products, or if youve defaulted on a loan in the past, this could negatively impact your ability to obtain a car loan.

Read Also: How To Become Loan Agent

Where Can I Find The Best Car Loan In Canada

To find the best car loan provider, you first need to consider the four types of lenders who offer auto financing in Canada:

- Major banks. Biggest brand recognition. Can be a good choice for people with excellent credit scores or low debt ratios.

- Online car loan lenders. Convenient for online applicants or people who want fast funding or a quick answer. Can be a good choice for buyers with poor or fair credit scores.

- Like big banks, credit unions offer car loans and are often best for buyers with good credit scores.

- Dealerships. Good option if you can find a dealer selling a car you want and offering incentives, such as low-interest rate loans. Also a good option for those who hate comparison shopping.

For a quick comparison, use the Finder car loan comparison tool.

To help narrow down your options, consider what type of loan you need and then approach the following lenders:

| Type of Car Loan |

|---|

Digital Federal Credit Union

Est. APR

Best for applicants looking for more flexibility and fewer restrictions when financing a used car.

Pros

-

Maximum vehicle mileage higher than other lenders.

-

No maximum vehicle age.

-

Has a 24-hour access consumer loan call center.

-

Finances vehicles purchased from private parties.

-

Offers two opportunities for discounts on already low rates.

-

Allows co-signers.

-

Submitting an online purchase loan application results in a hard credit inquiry.

-

Social Security number required with initial application.

Qualifications

-

Minimum annual gross income: None.

-

Maximum debt-to-income ratio: 60%.

-

Bankruptcy restrictions: No bankruptcies in the previous 12 months.

-

Maximum mileage: 250,000.

Read Also: How Much Do You Need Down For Fha Loan

Choosing The Right Car Loan

The following table explains the dos and donts when choosing the right car loan:

| Dos | Donts |

|---|---|

| Compare – BankBazaar.com can help you compare the various car loan options available to you. | Eligibility – Do not apply for a loan amount that exceeds your eligibility, as this will result in the rejection of your loan application. |

| Whats the Interest? Choose a loan that offers you the best interest rate along with the loan amount you need. | Multiple Applications – Do not apply with multiple banks as this will have a negative impact on your credit score. |

| Keep it Simple Choose the car before applying for the loan and make sure the cost of the car fits your budget. | If your application is rejected, dont continue to keep apply at different banks. Chances of rejection will rise. |

| Hidden Fees and Charges – Sometimes what appears as obvious will have a hidden component. Be aware of the hidden fees and charges concerning the car loan. | Relying on the Dealership for loans – The loan that the dealer offers may not have the best interest rate. So, check the other options. |

| Special offers There could be special offers available when you are applying for your loan. Make sure you take advantage of them | Dont pick a car with a high service cost because you already have the EMI and the insurance premiums to pay. |

| Insurance Check the insurance premium for the car as this is a recurring cost. |

In case of bad credit, is a long-term car loan a better option?

Bank Of America: Best Bank Interest Rates

- New Car Loan Starting APR: 3.69%

- Used Car Loan Starting APR: 3.89%

Bank of America offers a new car loan APR of 3.69% to borrowers with excellent credit, while used car rates start at 3.89%. If your looking to refinance your auto loan, the lenders refinancing rates start at 4.79%. Bank of America Preferred Rewards members can also get an interest rate discount of up to 0.5%. As a national bank, Bank of America works with a huge variety of dealerships across the country, which means you dont have to limit your options.

Be aware that Bank of America wont finance vehicles older than 10 years or with more than 125,000 miles on the odometer. It also wont finance cars under $6,000 in value or alternative vehicles like motorcycles and RVs.

Bank of America Pros and Cons

The major perks and drawbacks of choosing a Bank of America auto loan can be found in the following table:

| Bank of America Pros | |

|---|---|

| Discounts for certain bank members | Doesnt offer prequalification |

The best auto loans from Bank of America come to those with a poor credit score, as the company is relatively generous with these drivers. You may end up paying a slightly higher APR, but your car loan will be backed by the financial strength of a large institution.

For more details on Bank of America, head to the companys website.

You May Like: How To Qualify For 500k Home Loan

Should You Get An Auto Loan From A Bank Or Dealership

It’s worth shopping at both banks and dealerships for an auto loan. New car dealers and manufacturers, just like banks, can have attractive loan products. Depending on the borrower’s credit score and market-driven circumstances, the interest rate offered by a car dealer can be as low as zero percent or under the going rates offered by banks.

It’s important to keep dealership financing as a possibility, but make sure to look for auto financing before deciding where to buy a car. Know your credit score and search online for bank and other lender rates. This should give you a range of what you can expect in the open market and help you determine if seller financing is a better deal for you.

Best Auto Loan Rate: Conclusion

You can find the best auto loan rates through various banks, credit unions, online lenders, and dealers. There are also many factors that affect your interest rates and different methods for you to get the lowest rates possible. We encourage you to shop around and compare your options to find the best auto loan for you.

Below are some frequently asked questions and answers about the best auto loan rates:

Don’t Miss: What Is Personal Loan Used For

What Are Other Important Car Ownership Costs To Consider

Beyond the cost of monthly car loan payments, vehicle ownership costs can add up.

Car insurance is one of the more significant costs that come with owning a vehicle. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.

Also, consider maintenance and repair costs, which can start at around $100 per visit but vary by the make and model of your vehicle. Use Edmunds car maintenance calculator to get an estimate of how much youll spend to maintain your vehicle.

Fuel expenses are another cost to keep in mind as you search for a new vehicle. If youre unsure of how much to budget, visit FuelEconomy.gov to view the fuel economy or gas mileage and projected annual fuel costs for the year for the make and model of the vehicle you select.

There are also registration fees, documentation fees and taxes that youll pay when you purchase the car. Youll also pay to renew your registration every one, two or three years. Renewal fees and cycles vary by state.

Estimate your monthly payments with Bankrates auto loan calculator.

What Is A Good Interest Rate For A Car Loan

Currently, under 6% is considered a good interest rate for borrowers with a credit score in the mid 600s.

Interest depends on your credit score, the amount borrowed, the loan term and your debt-to-income ratio. Borrowers with excellent credit may be eligible for lower interest rates as low as 2 or 3% for a new vehicle. Occasionally dealerships will even offer a 0% interest car loan as a special promotion . For a borrower with fair or poor credit, the rate can exceed 10% or even 15%.

Here is how lenders weigh your credit score:

| Category |

|---|

| $8,370.47 |

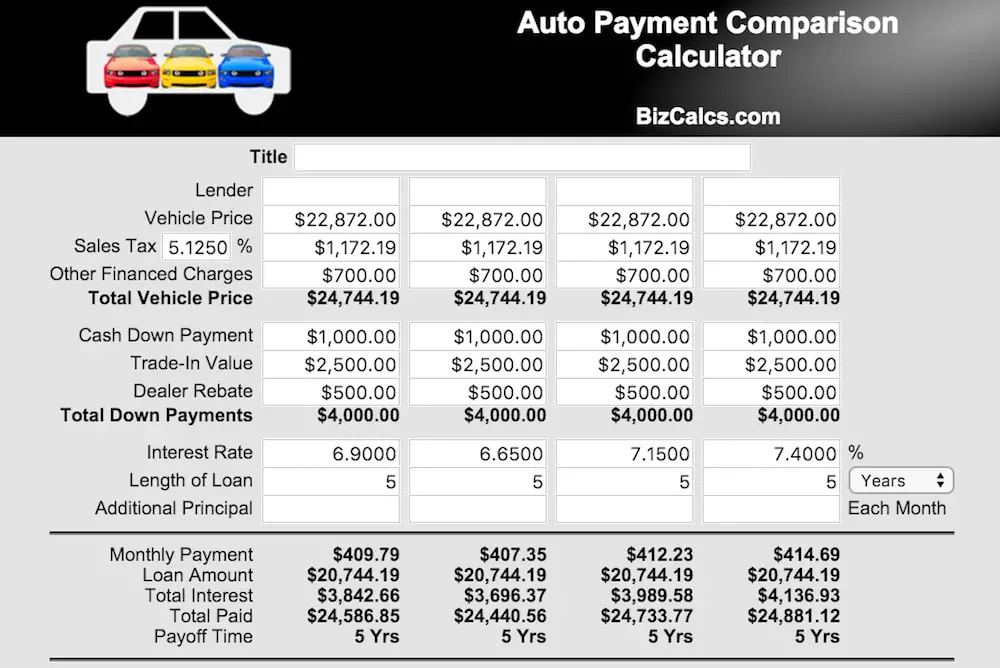

This example assumes that you borrow $40,000 for a car purchase . While the monthly payments of loan A are $154.47 more, loan B costs $5,770.58 more! Compare interest rates and limit the length to save serious money.

Recommended Reading: Can I Get Another Car Loan

Types Of Car Loans In Canada

All car loans are personal loans. Lenders loan money to a borrower for the express purpose of buying a vehicle. To get the best car loan not only do you need to compare auto finance features, but you need to determine the best type of car loan for your needs. First, consider the 10 types of car loans available in Canada:

To help you narrow down your options, here are the 10 best car loans in the Canadian marketplace, based on the type of loan, what each car loan is best for and where to find more details on these lenders and loans.

Secured car loanBEST: Get the lowest car loan rates

A secured car loan means the car or other assets you own is used as collateral to secure the loan. If you fail to repay the car loan, the lender has the legal right to claim ownership of the asset used as collateral and to sell that asset to repay the debt. The most common type of secured loan in Canada is a mortgage, but lenders also use secured car loans to help reduce the interest rate charged on the loan. Generally, the more secure and less risky a loan, the lower the interest rate. To learn more, read our guide on secured car loans.

Unsecured car loan BEST: For bad credit

Fixed-rate car loan BEST:Fixed budgets or large loans

A fixed-rate car loan means the lender used one interest rate throughout the entire loan term, even if interest rates fluctuate.

Variable-rate car loan

BEST: Smaller loans or short loan terms

Tips For Reducing Average Car Loan Rates

The best way to reduce the average auto loan rates you find is to improve your credit score. This can be done by paying your bills on time and keeping your credit card balances low. Paying your monthly payments in full can also help. Outstanding debts or collection notices can impact your credit score, so paying these off will improve your credit.

However, building your credit score can take time and the advice above may not be practical for everyone, especially those with a limited income struggling to pay minimum balances each month.

There are a few other things that can reduce your auto loan rates:

- Have someone cosign: Many lenders allow you to have another person cosign a loan. A cosigner with strong credit can reduce your interest rates.

- Buy a new car instead of a used one: While new cars are more expensive, lenders typically offer lower auto loan rates for new car purchases.

- Place a bigger down payment: A bigger down payment can reduce your interest rate as well as the amount of time it takes to pay off your loan.

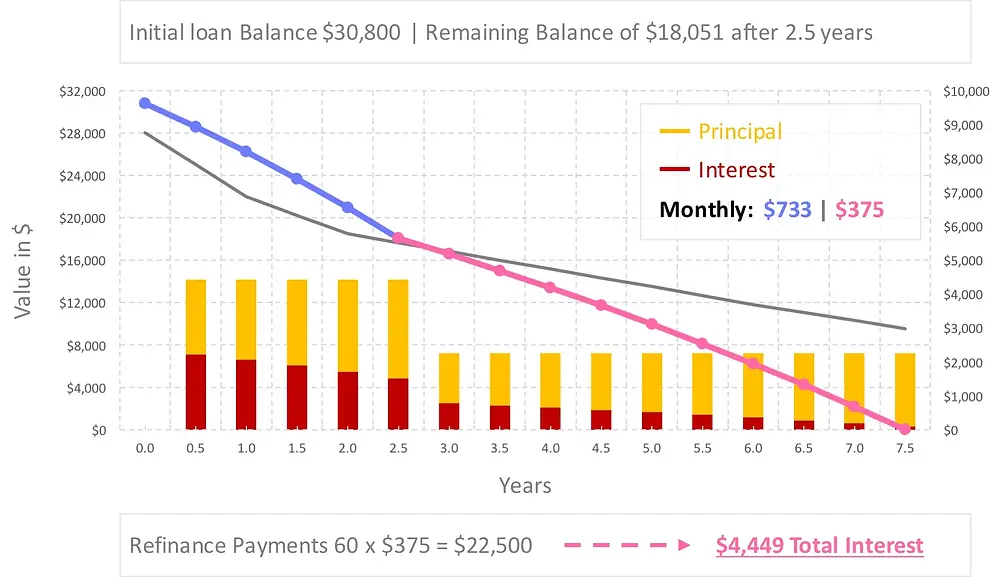

You might also consider trying to pay your loan in a shorter time frame. While this may not reduce your loan interest rate, it will mean that you pay off your loan sooner and will have to pay less interest. However, be sure to read your loan contract language carefully. Some lenders charge a prepayment penalty an extra fee for paying down your auto loan too early.

Also Check: What Do You Need To Get Personal Loan