Repayment Of Parent Plus Loans Starts Right Away

Theres another key difference between parent loans and students loans: Parents who use PLUS federal loans are expected to start paying once the loan is disbursed. However, parents can request a deferment while their child is in schooland repayment would start six months after graduation, for example.

Danger : You Can Easily Borrow More Than You Need

When you apply for a Direct PLUS Loan for your child, the government will check your , but not your income or debt-to-income ratio. In fact, it does not even consider what other debts you have. The only negative thing it looks for is an adverse . Once you’re approved for the loan, the school sets the loan amount based on its cost of attendance. However, a schools cost of attendance is usually more than most students actually pay. This can lead to parents borrowing more than their child needs for college.

If you have other outstanding debt, such as a mortgage, you may find yourself in over your head when it comes time to repay the PLUS loan.

Check Your Parent Plus Loan Eligibility

If you decide to use parent PLUS loans, youll need to meet these requirements:

- Be the biological parent or adoptive parent of a dependent undergraduate student who is enrolled at least half-time.

- Have a non-adverse credit history. If you do, you also must be able to satisfy additional requirements.

- Meet other basic federal student aid eligibility requirements, such as being a U.S. citizen or permanent resident.

Your credit is deemed adverse and disqualifies you from parent PLUS loan if your report lists:

- Accounts with total balances greater than $2,085 that were more than 90 days delinquent, placed in collections, or charged off within the past two years

- A default, repossession, foreclosure, bankruptcy, tax lien, wage garnishment, or federal student loan charge-off within the past five years

You May Like: Capital One Subprime Auto Loan

Are There Any Fees For A Direct Plus Loan

In addition to the interest, there is a loan fee on all Direct PLUS Loans. The loan fee is a percentage of the loan amount and is proportionately deducted from each loan disbursement. The percentage varies depending on when the loan is first disbursed. See detailed information from the office of Federal Student Aid.

You Have A Few Different Options For Repayment

Although Parent PLUS Loans have the disadvantage of an origination fee , they win points for flexible repayment plans.

Parent PLUS Loans are eligible for the following plans:

- Standard Repayment Plan: Pay your loans off with fixed monthly payments over 10 years.

- Graduated Repayment Plan: Start with small payments that gradually increase over a term of 10 years.

- Extended Repayment Plan: Pay fixed or graduated payments over 25 years.

- Income-Contingent Repayment: If you consolidate first, youll pay 20% of your discretionary income or what youd pay on a 12-year plan, whichever is lower. If you still have a balance left after 25 years, you could be eligible for student loan forgiveness.

As you can see, you have several options for repayment. They can make your monthly bills go higher or lower. You might make extra payments to pay the loan off as fast as possible or extend your term to 20 or 25 years for some financial relief.

These flexible repayment plans can be a lifesaver in the event you lose your job or run into financial hardship. Note that private student loan companies typically dont offer these same protections, but some will allow you to pause payments through forbearance under certain circumstances.

If youre concerned about your ability to pay back a parent loan, a federal Parent PLUS Loan might be the most accommodating option. But if you dont anticipate trouble with repayment, you might prefer a private lender.

Read Also: Should I Get A Fixed Or Variable Student Loan

Trouble With Your Plus Loan Reach Out

If you want to go over your options, schedule a free 10-minute phone call with me. Iâve got years of experience helping people like you with their student loans.

Reach out. I can help you rethink or repay your Parent Plus Loan in a way that works for you and your family.

Stop Stressing.

Hey, Iâm Tate.

I’m a student loan lawyer that helps people like you with their federal and private student loans wherever they live.

Are There Any Benefits To Parent Plus Loans

The one benefit that Parent PLUS loans do have in common with other student loans is that they are eligible for one of the governments income-based repayment programs. However, even that benefit is limited for parents. Qualified Parent PLUS loans are only eligible for the income-contingent repayment, which caps payments at 20% of income with forgiveness after 25 years.

While these PLUS loans might be bundled up into an award letter from a schools financial aid offer, parents should consider all their options first. As always, it pays to shop around and find the best fit for each family.

You May Like: How To Transfer Car Loan To Someone Else

Parent Plus Loan Denied

Parent PLUS loans are easy to get if you have had a good credit history, but if there are a few bumps in your financial road, your request can be denied.

Then what? Try using one of the detours.

The easiest way out of trouble is to find someone with good credit who will co-sign the loan. Its also the hardest thing to ask because that person has to assume responsibility for paying back the money if you stumble financially.

To include a co-signer, the applicant needs to complete the Electronic Endorsement Addendum section of the loan application. In addition, the parent must complete PLUS credit counseling and sign a PLUS master promissory note.

You also can appeal the rejection, a step that involves providing documentation of an extenuating circumstances that led to the denial. In addition to filing the appeal, the parent or parents need to complete PLUS credit counseling.

Its possible only one parent has a bad credit rating, in which case, the other parent could apply solo for the loan.

Finally, the student whose parents were rejected can apply for a Federal Direct Unsubsidized Stafford Loan. Under that plan, the student can borrow $4,000 to $5,000 annually, and up to $26,500 in pursuit of a degree. These are the same limits available to independent students.

7 Minute Read

Available May 1st For The Fall 2021 / Spring 2022 / Summer 2022 Semesters:

Once you have applied, if you would like to increase your requested amount, do not apply for a new loan. This request can be made from the parent by contacting the Office of Financial Aid.

PLUS Counseling is required for borrowers who have an endorser listed on the loan or appeal an original credit decision.

Also Check: Usaa Car Loan Requirements

Parent Plus Loan Rates And Fees

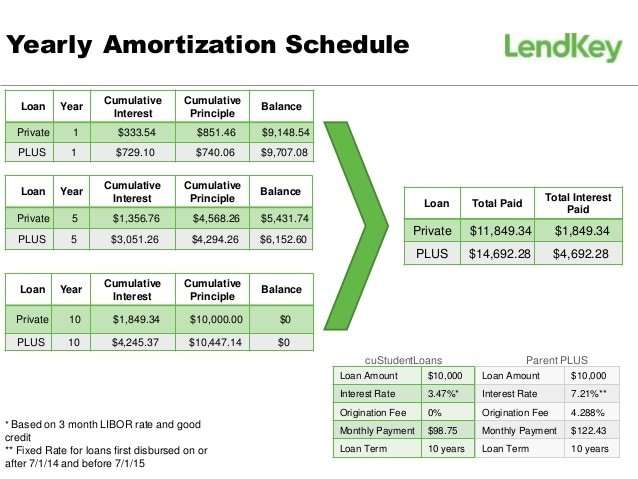

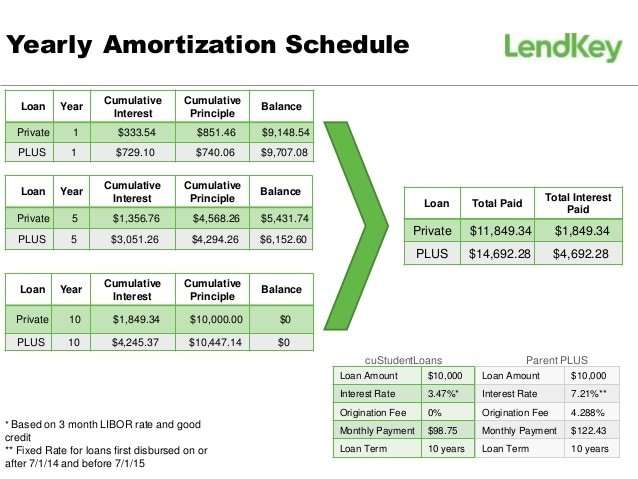

One key factor in identifying the best student loan is loan costs, such as student loan rates and fees. Parent PLUS loan interest rates and fees for the 2020-21 school year equal 5.30%. That is significantly higher than the 2.75% rate offered on Direct Loans extended to undergrads for the same period.

All federal student loans charge a one-time origination fee, which is withheld from disbursed funds . The parent PLUS loan origination fee is 4.228% of the principal for loans disbursed in the school year after October 1, 2020. Thats four times higher than the 1.059% fee that undergrads pay on federal student loans.

Parent Plus Loans Vs Private Student Loans: Which Has Better Rates

Parent PLUS Loans vs. private loans: Learn how to decide which is best to pay for your childs education.

If your childs financial aid doesnt cover the full cost of their higher education, and you dont want them to graduate with student loan debt, you may consider taking out loans yourself.

Parents willing to be primary borrowers on student loans have two main options: federal parent PLUS loans and private loans.

Parent PLUS loans generally offer more generous repayment plans, courtesy of the U.S. government. But if you have a solid credit score, private loans may help you save money in the long run.

To help you decide which option will work best for your family, heres a full breakdown of parent student loans.

Don’t Miss: Is Usaa Good For Auto Loans

Sign A Master Promissory Note And Receive Loan Funds

Finally, youll sign a Master Promissory Note through the schools financial aid officethe loan agreement that outlines the terms of your parent PLUS loan.

Loan funds are then disbursed to your childs school and applied to outstanding charges for room, board, tuition, and fees. The school pays out remaining funds to you or the student, per your selection on the loan application.

Should You Apply For A Parent Plus Loan Or Private Loan

While federal student loans, scholarships and grants can go a long way to cover the cost of a student’s college education, it’s not uncommon for parents to borrow money to chip in.

As a parent, you’ll have two main choices to explore: Parent PLUS loans and private student loans. The right one for you will depend on various personal financial factors, but it’s important to know how each works and how to pick the right one for you and your child.

Read Also: Student Loans Average

Danger : Plus Loans Aren’t Eligible For Most Income

The federal government offers four different income-driven repayment plans for student loans. They limit monthly payments to a percentage of the student’s discretionary income . If the student makes those payments for a certain number of years , any remaining loan balance will be forgiven.

Parent PLUS loans, however, are eligible for only one of these plans, Income-Contingent Repayment , and only after the parent has consolidated their parent loans into a federal direct consolidation loan. An ICR plan limits payments to no more than 20% of discretionary income, to be paid over a term of 25 yearswhich is a long time horizon for the average parent.

Getting Your Name Off A Cosigned Loan

Interest Rates For Direct Loans First Disbursed Between July 1 2021 And June 30 2022

Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans first disbursed on or after July 1, 2013 have fixed interest rates that are determined in accordance with formulas specified in sections 455 through of the Higher Education Act of 1965, as amended .

The interest rate is determined annually for all loans first disbursed during any 12-month period beginning on July 1 and ending on June 30, and is equal to the high yield of the 10-year Treasury notes auctioned at the final auction held before June 1 of that 12-month period, plus a statutory add-on percentage that varies depending on the loan type and, for Direct Unsubsidized Loans, whether the loan was made to an undergraduate or graduate student. Loans first disbursed during different 12-month periods may have different interest rates, but the rate determined for any loan is a fixed interest rate for the life of the loan.

For each loan type, the calculated interest rate may not exceed a maximum rate specified in the HEA. The maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students, 9.50% for Direct Unsubsidized Loans made to graduate and professional students, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

Don’t Miss: Can You Refinance With Fha Loan

What If I Can’t Pay My Parent Plus Loan

Parent PLUS loan borrowers have fewer options when it comes to flexible repayment plans. However, if your monthly payments are too high, you could opt for graduated or extended repayment. If youre willing to transfer your PLUS loan into a direct consolidation loan, you could also consider income-contingent repayment. All of these options can lower your monthly payments but will result in more interest being paid over time.

If you need to pause your payments, PLUS loans are eligible for the federal forbearance or deferment. However, interest will continue to accrue while your debt is on pause.

Denied A Parent Plus Loan

If you are found to have adverse credit history, you may still be able to borrow from the Parent PLUS Loan program. You have two options: submit a successful extenuating circumstances appeal for an exceptional circumstance, or reapply with a cosigner who does not have an adverse credit history.

If you want to appeal the decision, you must submit a request to appeal the decision and provide information regarding your denial decision. If successful, you may be required to completed loan counseling prior to receiving the Parent PLUS loan funds.

If you would like to apply with a cosigner who does not have adverse credit, the cosigner would need to complete an endorser application.

Now, if neither of these options works for you, your denial of a Parent PLUS Loan would actually make your dependent undergraduate student eligible for independent undergraduate student Stafford loan limits. Meaning, they will have access to additional loan funds they can borrow under their name to help pay their own college costs.

You May Like: What Degree Do You Need To Be A Loan Officer

Parent Plus Loans Vs Private Parent Loans: How To Choose

When comparing parent private student loans and Parent PLUS Loans, keep in mind that PLUS Loans offer federal benefits, but can have higher interest rates and fees than private loans.

Edited byAshley HarrisonUpdated October 8, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre like most parents, you want to help your child with the cost of college. But if you need to borrow money to cover the full cost, which is the better option for you: federal Parent PLUS Loans or parent private student loans?

Parent PLUS Loans have the highest interest rate and fees of any federal student loan, but you can borrow up to the total cost of attendance for your childs program .

With parent private student loans, you may be able to get a lower interest rate than you would with PLUS loans, but you cant take advantage of federal benefits like income-driven repayment plans or Public Service Loan Forgiveness .

If you cant decide between the two loan types, heres a breakdown of common scenarios:

Parent Plus Loan Eligibility

Parent PLUS Loans are available only to the parents of dependent undergraduate students. The parents of independent undergraduate students are not eligible for the Parent PLUS Loan.

If a dependent students parents are divorced, both parents can take out separate Parent PLUS Loans with separate Master Promissory Notes . But the combined Parent PLUS Loans cannot exceed your students cost of attendance minus other financial aid received.

You May Like: Usaa New Auto Loan Rates

Parent Plus Interest Rates Are Fixed

While the parent PLUS loan interest rate is the highest within the federal loan program, theres some good news: Parent PLUS loans have fixed interest rates. This means the interest rate will never change over the life of the loan.

Although many private lenders also offer fixed-rate loans for parents, they might also offer variable-rate loans. While the initial starting interest rate is often lower on a variable-rate loan than a fixed-rate loan, that rate can rise over time.

That means your monthly loan payment could increase, making it more difficult to budget or create a payoff plan.

You Have To Pass A Credit Check

Although you can borrow as much as you need with a Parent PLUS Loan, you first have to pass a credit check for approval. You dont necessarily need excellent credit, but you cant have an adverse credit history.

The Department of Education says you have adverse credit if any of the following applies:

- You have debt greater than $2,085 that has been delinquent for 90 or more days or has been placed in collections within the past two years.

- Your credit report shows one of the following in the past five years: default discharge of debt in bankruptcy foreclosure or repossession tax lien or wage garnishment write-off of a federal student debt.

Even with adverse credit, you could still qualify for a Parent PLUS Loan by applying with a creditworthy endorser. An endorser acts like a cosigner theyre equally responsible for the debt in case you miss payments.

Besides this credit check, Parent PLUS borrowers must also meet the general eligibility requirements for federal aid, including being a citizen or U.S. national.

As long as you meet these requirements, you should qualify for a Parent PLUS Loan.

Don’t Miss: Bayview Loan Servicing Reviews

How Much Can I Borrow

There are no set limits for Direct PLUS Loans. The parent may not borrow more than the cost of the students education less any other financial aid received. The parent requests an amount on the Green River Direct PLUS Loan for Parents Worksheet and the Financial Aid Office will determine the actual amount that may be borrowed.The Department of Education makes the PLUS loan credit decision after a review of the parents credit report.The parent and the student must both be U.S. citizens or eligible noncitizens, must not be in default on any federal education loans or owe an overpayment on a federal education grant, and must meet other general eligibility requirements.The student must be a dependent student who is enrolled at least half-time at a school that participates in the Direct Loan Program. Generally, the student is considered dependent if he or she is under 24 years of age, has no dependents, and is not married, a veteran or a ward of the court.