When To Consider A Personal Loan

Before you opt for a personal loan, you’ll want to consider whether there may be less expensive ways you could borrow. Some acceptable reasons for choosing a personal loan are:

- You don’t have and couldn’t qualify for a low-interest credit card.

- The credit limits on your credit cards don’t meet your current borrowing needs.

- A personal loan is your least expensive borrowing option.

- You don’t have any collateral to offer.

You might also consider a personal loan if you need to borrow for a fairly short and well-defined period of time. Personal loans typically run from 12 to 60 months. So, for example, if you have a lump sum of money due to you in two years but not enough cash flow in the meantime, a two-year personal loan could be a way to bridge that gap.

Here, for example, are five circumstances when a personal loan might make sense.

With A Fixed Rate Loan

- You know for the duration of your loan the exact payment amount you will be making each month.

- Your interest rate is locked in for the duration of your termup to 5 years.

- You could choose an amortiztion and payment schedule that meets your budget.

- You could switch to variable rate loan or pre-pay your loan at any time without penalty.

What People Love About Us

Ethan

Had the most pleasant and fantastic service at easyfinancial. Chloe went above and beyond to help us achieve our financial relief goal in the most friendly and professional manner.

Anonymous

easyfinancial provided me with an exceptional experience through a difficult time. I came in for a loan after being denied by the banks and they were not only able to help but they made everything so much easier.

Stephan

Quick and easy process. Got money within 48 hours of applying. Highly recommend!

Sean Crawford

They were willing to work with me to approve my personal loan when no other company or bank would help. That means a lot to me as I needed to get a credit rating.

Adriana Manta

Clayton and Melissa did a good job helping me create a plan to repay my old debt with a Personal Loan. Very informative customer service experience. Thanks again.

Natasha Chery

Great people, great service. Working with Melissa and Jerry was a pleasure! I had a surprise financial setback and they were happy to help me!

Ethan

Had the most pleasant and fantastic service at easyfinancial. Chloe went above and beyond to help us achieve our financial relief goal in the most friendly and professional manner.

Anonymous

easyfinancial provided me with an exceptional experience through a difficult time. I came in for a loan after being denied by the banks and they were not only able to help but they made everything so much easier.

Stephan

Sean Crawford

Adriana Manta

Natasha Chery

You May Like: Va Loans Mobile Homes

Compare Offers To Find The Best Loan

When searching for a personal loan, it can be helpful to compare several different offers to find the best interest rate and payment terms for your needs. With this comparison tool, you’ll just need to answer a handful of questions in order for Even Financial to determine the top offers for you. The service is free, secure and does not affect your .

Editorial note: The tool is provided and powered by Even Financial, a search and comparison engine that matches you with third-party lenders. Any information you provide is given directly to Even Financial. Select does not have access to any data you provide. Select may receive an affiliate commission from partner offers in the Even Financial tool. The commission does not influence the selection in order of offers.

Read more about Select’s picks for the best personal loans

Where To Find Personal Loans

The first place to look for personal loans may be your current bank or credit union. Your personal banker can advise you on what types of personal loans may be available and the borrowing options for which youre most likely to qualify.

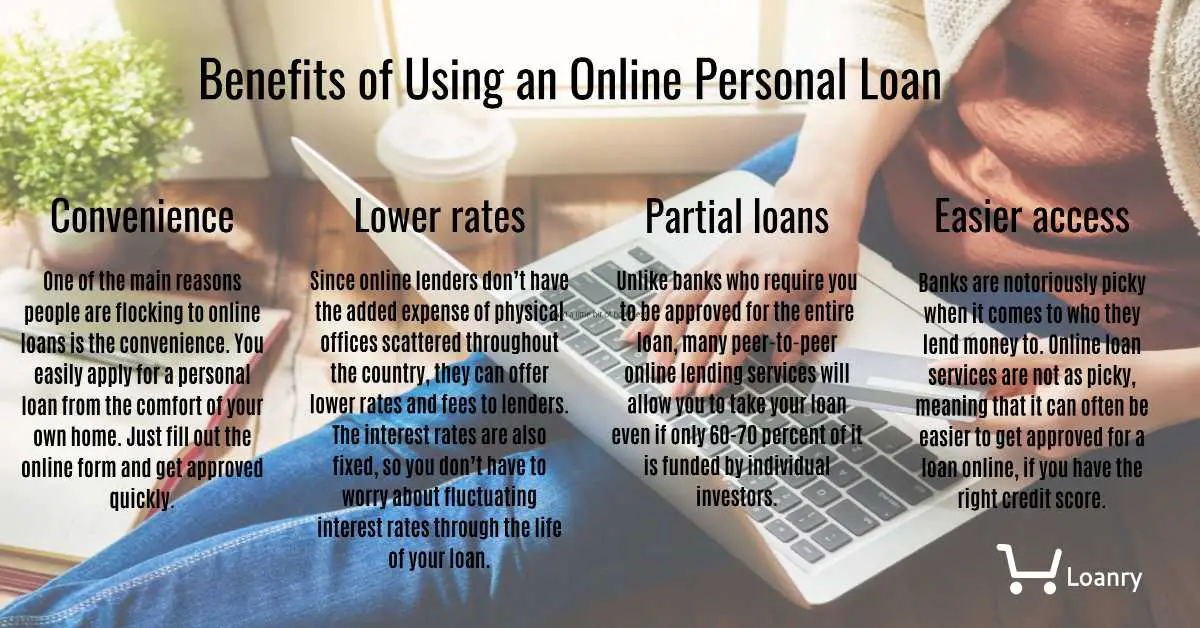

Personal loans can also be found online. Numerous lenders offer personal loans online. You can apply electronically, get a decision in minutes and, in some cases, get funding in as little as 24 to 48 hours after loan approval.

When comparing personal loans online or off, pay close attention to the details. Specifically, consider the following:

- Interest rate

- Borrowing limits

- Collateral requirements

You can check your credit report for free at AnnualCreditReport.com. When doing so, look for any errors that may be hurting your score and dont hesitate to dispute them.

Its also helpful to check the minimum requirements to qualify for a personal loan. Lenders can have different requirements when it comes to the , income, and debt-to-income ratio that are acceptable to be approved for a personal loan. This can help you narrow down the loans that may best fit your credit and financial profile.

Also Check: The Mlo Endorsement To A License Is A Requirement Of

How Do Personal Loans For Business Work

As previously mentioned, a personal loan for business is a way a borrower can acquire the financing they need for their business in the event they donât have enough revenue or time in business to qualify for a traditional business loan.

A personal loan can be money borrowed from a bank, credit union, or online lender with terms that dictate that the funds can be used for business purposes. These types of loans are usually term loans, meaning you pay them back in fixed, monthly installments with interest over the length of your repayment period .

Itâs important to note that not all personal loans are allowed to be used for business purposes. Therefore, if youâre looking to take out a personal loan for business, youâll want to be sure your lender will allow you to apply the funds toward your business.

If so, you can use your personal loan for a variety of business purposes, including purchasing inventory, meeting payroll, or buying ads.

Personal Loans Vs Other Borrowing Options

| Borrowing Option | ||

|---|---|---|

| Form an agreement with the individual | Could get low interest and lenient payback terms | Could ruin your relationship |

The first major alternative to a personal loan is a . With a personal loan, you receive a lump sum of money and pay it back over time. But a credit card allows you to borrow up to a certain amount of money any time you want. But unless you have a very high income and spotless credit, personal loans will usually offer the potential to borrow more.

Another borrowing option is a home equity loan. As the name suggests, it allows you to borrow against the equity of your home, which is the market value minus the balance on the mortgage. Depending on your houses value and how much youve paid off, you could borrow much bigger amounts than with a personal loan. But be careful, because if you default the lender could foreclose on your house. There are also home equity lines of credit, which let you borrow up to a certain amount whenever you want to for a given time period.

Those are the most reliable alternatives to a personal loan. There are other options, like payday loans, auto title loans and pawn shop loans, but they are too expensive to consider except as a last resort. You can also potentially borrow from friends and family, but that comes with its own issues, like causing relationship problems if you cant repay.

You May Like: Where Do I Find Student Loan Account Number

How Personal Loans Work

Personal loans are credit products, and many banks, credit unions and online lenders offer them. These loans are typically unsecured, which means you don’t have to provide any collateral. All come with terms, including:

- The number of months or years you have to repay the loan

- The interest rate, which is what the lender charges you to finance the loan

- The monthly payment

Some loans come with origination fees, which might be anywhere from 1% to 8% of the loan amount. The fee for a $5,000 loan, for example, could range from $50 to $400. The fees will be tacked on to the principal, and interest will be calculated on the total.

Once you apply for a personal loan, the lender will check your credit history and credit scores, and analyze your cash flow to determine whether you can handle the payments. If you’re approved, the money may be available to you within minutes or days, depending on the lender.

What Are My Personal Loan Options

Personal loans are available through financial institutions like banks and credit unions, as well as online lenders and peer-to-peer networks. You might even be able to find a lender who delivers funds as soon as the next business day.

A personal loan can be either secured or unsecured, depending on the lender. Secured loans require a form of collateral such as savings or investment accounts. An unsecured loan only requires your signature as a guarantee of repayment.

Recommended Reading: Rv Interest Rates Usaa

Cons Of Personal Loans

Hidden fees: When shopping and negotiating for a personal loan, its important to inquire about origination fees and prepayment penalties . Otherwise, the loan that looks good on paper may end up costing you more in the long run.

Requires good credit: If you have poor credit history, or no credit history, then it may be difficult for you to procure a personal loan, much less one with an agreeable interest rate. The better credit history you have, the better APR youll get.

The Best Personal Loan Companies

When it comes to getting a personal loan, the process can seem tedious and time-consuming. Choosing a loan that fits your needs requires a lot of research, and you might not know if you find one until after you take out a few options. However, there is an easier way! Instead of doing all the legwork yourself, AI powered software can do all of the work for you! Find out what loans are available near you, then compare them side by side all without having to

Don’t Miss: Usaa Auto Loan Bad Credit

How To Use Personal Loan Emi Calculator

Using a Personal Loan EMI Calculator is no more a complicated task, through the aid of technology anyone can easily able to get use it. You just have to enter required loan amount, interest rate applicable on loan amount & tenure period to repay the principal amount within a certain limit. Within a Seconds scheduled chart prepared upon your entered input values with a ratio bar clearly depicting the variation of interest rate & principal amount. This helps the borrowers to get a pre forecast on monthly payable EMIs & eventually enhance financial planning.

Compare Apr To Shop For Loans

When you start evaluating loan offers, youll want to compare the Annual Percentage Rate, or APR on each one. We tend to think of the interest rate as the cost of the loan, but some lenders artificially lower their interest rates by tacking on fees.

The APR takes all fees and charges into account so you can compare apples to apples when evaluating the loan offer. Lenders are required to disclose the APR on all consumer loans.

Don’t Miss: Bayview Loan Servicing Reviews

What Credit Score Do I Need For A Personal Loan

As with any credit product, personal loans with the lowest interest rates are available to people with the highest credit scores. Check your FICO® Score before applying. If it’s in the 670-to-850 range, the lender will consider your credit rating as good to excellent. In that case, the least expensive personal loan options will be open to you.

Many lenders do offer personal loans to people with lower credit scores, but the interest rates will rise as your scores dip. The difference in the loan’s ultimate cost can be dramatic. For example, if you take out a loan of $5,000 and it has a repayment term of three years:

- A rate of 5% will cost you $395 in interest

- A rate of 15% will cost you $1,240 in interest

- A rate of 25% will cost you $2,157 in interest

Keep in mind that individual lenders set their own interest rates, so you may get a better or worse rate with the same credit score. Review many lenders’ rates before deciding on one.

Pros Of Using A Personal Loan To Pay Off Your Car

- You may be able to get a lower interest rate. If youre locked into an auto loan with a high interest rate, a personal loan may allow you to reduce your APR while you finish paying off your car.

- You may be able to lower your monthly loan payments. By snagging a lower rate, adjusting your loan term, or both, you may be able to reduce your monthly car payments with a personal loan.

- You may be able to remove a cosigner. If you purchased your car with a cosigner, and you now want to remove that person from your loan, taking out a new loan can shift financial responsibility to you entirely.

Recommended Reading: Usaa Used Auto Loan

Is It Smart To Pay Off Credit Card Debt With A Personal Loan

Paying off a credit card with a personal loan may be better than continuing to repay the credit card debt directly in some cases. For example, if you have racked up a considerable amount of debt on a high-interest credit card, you may be able to qualify for a personal loan with a lower interest rate. In this scenario, you could potentially save money by paying off the high-interest debt with the personal loan.

When deciding whether to pay off credit card debt with a personal loan, it helps to find out the loan rates and terms youre eligible for, to see if it makes sense for you.

What Are The Costs Of A Personal Loan

A quick and simple way to get a clearer picture of the overall costs of taking out a personal loan is to use a personal loan calculator like the one offered by Experian.

In general, the costs of taking out a personal loan are determined by factors such as:

- Interest rate

- Origination fees

- Any added loan fees

If a personal loan has an origination fee, the fee amount may be deducted from the principal loan amount. This means that the amount of money the borrower can expect to receive will be lower than the actual loan amount. Interest is usually charged on each payment and represented in the loans annual percentage rate .

Recommended Reading: Sss Loan Requirements

What Are The Benefits Of Getting A Personal Loan

- A personal loan can help you consolidate higher interest rate loans and/or credit card balances into a loan with a convenient, predictable single payment that wont change.

- Theres no collateral requirement since this is an unsecured personal loan.

- Personal loans from Wells Fargo have no loan origination fee, unlike some of our competitors.

- You can choose from a number of payment terms from 12 to 84 months, depending on your loan amount.

Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you.

New credit accounts are subject to application, credit qualification, and income verification.

Representative example of repayment terms for an unsecured personal loan: For $13,000 borrowed over 36 months at 11.99% Annual Percentage Rate , the monthly payment is $432. This example is an estimate only and assumes all payments are made on time.

Deposit products offered by Wells Fargo Bank, N.A. Member FDIC.

What Is A Business Loan Used For

Since business loans tend to be larger amounts than personal loans and are riskier for lenders, they are granted by loan providers for specified purposes. In other words, before giving a sizeable amount of their money to help your business, a lender will want to feel confident that the risk of that investment is minimal.

Uses for business loans include:

- Purchasing new or used equipment

- Stocking up on inventory

- Repairs or renovations

These are just a few uses ultimately, a business loan is used to for financing a business. It should go without saying that financing a business can mean a lot of things.

Don’t Miss: Usaa Credit Score Range

To Cover Medical Expenses

Landing in the hospital or coping with an unexpected illness can be extremely expensive especially as deductibles on health insurance plans have risen dramatically in recent years. For those who have a hard time affording medical bills, a personal loan could be the solution. A personal loan could allow you to get the treatment you need without delay and pay off your medical expenses over time.

> > Read More: Can You Use a Personal Loan to Pay for Medical Expenses?

Paying Off Other High

Though a personal loan is more expensive than some other types of loans, it isn’t necessarily the most expensive. If you have a payday loan, for example, it is likely to carry a far higher interest rate than a personal loan from a bank. Similarly, if you have an older personal loan with a higher interest rate than you would qualify for today, replacing it with a new loan could save you some money. Before you do, however, be sure to find out whether there’s a prepayment penalty on the old loan or application or origination fees on the new one. Those fees can sometimes be substantial.

Don’t Miss: Is The Loan Forgiveness Program Legit