The Balance Of An Ibr Student Loan Could Grow

With that increased interest and longer repayment term, its possible that your loans remaining balance could grow instead of shrink. Large student loan balances can result in high monthly interest charges.

If you have an IBR plan, your monthly payments may not cover that accrued interest, which is referred to as negative amortization. With this specific income-driven plan, the government will pay all or some of the interest that isnt covered by your monthly payment. This will only last for up to three consecutive years from when you began repaying your student loan under the IBR plan.

Once those three years are up, if you dont continue qualifying for IBR or you leave the plan, any unpaid interest could be added to your balance and capitalized, ultimately build even more student loan debt.

Know The Tax Implications

Will you be able to pay off your student loans before the repayment term is complete? Or are you expecting to have some debt forgiven after the payment period is up?

If youre banking on student loan forgiveness, keep in mind that any forgiven debt under an income-driven plan has been taxable historically . Its unclear if tax-free forgiveness included in student loan stimulus relief will be around past Jan. 1, 2026.

If you wont be reaching forgiveness until well past that date, discuss your tax implications with a professional so you know what to expect before applying for Income-Based Repayment.

How To Apply For An Income

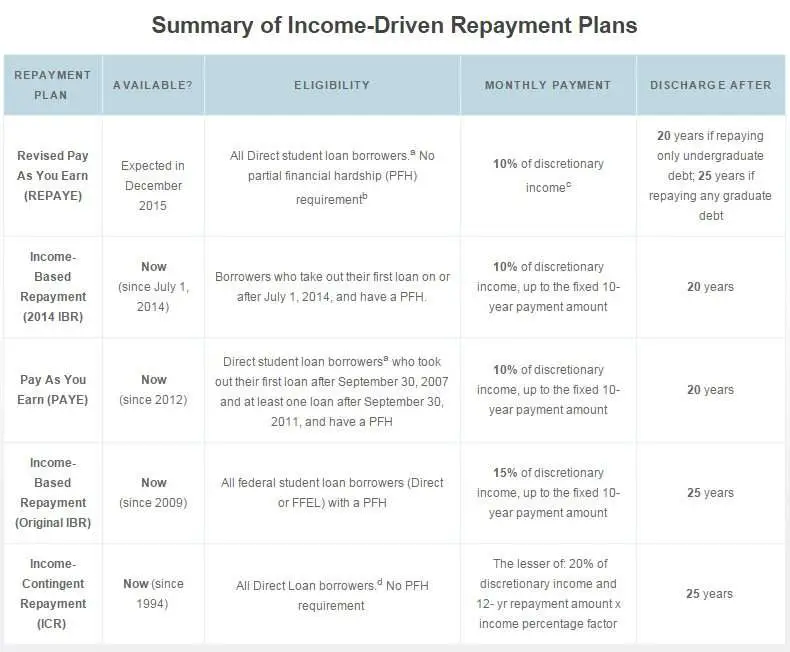

If you’ve decided that IDR is right for you, applying is both quick and easy. There are four different types of payment plans:

- Revised Pay As You Earn Repayment

- Pay As You Earn Repayment

- Income-Based Repayment

- Income-Contingent Repayment

All four are served by the same application, which you can find at the website for Federal Student Aid. The application has to be completed in a single session, so don’t start it when you have a bunch of other stuff going on. According to the website, it usually takes 10 minutes or less to apply, and the process is very similar for recertifying your income.

Also Check: Fannie Mae Home Loans For Bad Credit

Other Options To Consider

There are other ways to manage student loans when you can’t afford payments. With federal loans, you can take a deferment or put loans in forbearance temporarily.

With either one, you can take a break from making payments toward eligible loans for a set period of time set by your loan servicer. The difference lies in how the interest on subsidized loans is treated.

During a deferment period, you’re not responsible for paying the interest that accrues on subsidized loans and federal Perkins loans , because the government pays the interest for you. You will pay for interest on unsubsidized loans, direct PLUS loans, and loans from the federal family education loan program.

With a loan forbearance, however, interest will accrue on direct loans and FFEL loans during the time you arent making payments. You can make interest-only payments during your forbearance, which could be a smart choice because any interest you dont pay will be added to your principal. Consequently, you may end up with a higher loan balance at the end of your forbearance.

In March 2021, the Department of Education expanded the loan forbearance created by the CARES Act to apply to Federal Family Education Loans owned by private parties. Any payments made between March 13, 2020, and September 30, 2021, are eligible for reimbursement. Garnished wages or tax refunds will be returned to the borrower, and the loans will be restored to good status.

Why Must I Recertify Every Year And Submit New Documentation

Monthly payments under an income-driven repayment plan are based on your adjusted gross income , family size, and the state you live in. Since these items can change, your payments will change along with them. Each year you’re required to recertify so your monthly payment amount can be recalculated. If you don’t recertify, your payment may increase and any unpaid interest will be capitalized, or added to your principal balance.

You can also request to have your monthly payment amount recalculated if your financial circumstances drastically change before your annual recertification date. To get started, see What Do I Gather Before Applying?. If you still have additional questions, our Income-Driven Repayment section in FAQs can help.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

It Could Be A Confusing Process

There are too many income-driven repayment plans, making it harder for borrowers to choose which plan is best for them.

There are many details that differ among the income-driven repayment plans. PAYE provides the lowest monthly payment, but eligibility is limited to borrowers with loans disbursed since October 1, 2011.

For other borrowers, either IBR or REPAYE will offer the lowest cost, but which is best depends on borrower specifics, such as whether the borrower is married or will eventually get married, whether the borrowers income will increase, and whether the borrower has any federal loans from graduate school.

Student Loan Forgiveness: Which Loans Are Eligible

Only direct loans made by the federal government are eligible for forgiveness. Stafford loans, which were replaced by direct loans in 2010, are also eligible. If you have other federal loans, you may be able to consolidate them into one direct consolidation loan that would make you eligible. Non-federal loans do not qualify for forgiveness.

In addition, borrowers with federal student loans who attended for-profit colleges and seek loan forgiveness because their school defrauded them or broke specific laws were recently dealt with a setback. On May 29, 2020, former President Trump vetoed a bipartisan resolution that overturned new regulations that make it much more difficult to access loan forgiveness. The new, more onerous regulations went into effect on July 1, 2020.

Don’t Miss: What Do Mortgage Loan Officers Do

Pay Off Your Student Loans

Best if: You have the income to pay your student loans.

Millions of borrowers havent had to make a student loan payment in months, and for federal student loan borrowers, that will continue until September 30, 2021, following President Bidens executive order to extend the pause.

But just because you can stop paying your student loans doesnt mean you should stop your student loan repayment, especially if youve set a goal for yourself to get out of debt by a certain date. If youre still bringing in income right now then dont lose sight of your overall debt repayment strategy. And if youre looking to get on a payment plan that would let you pay off your student debt even faster, weve got five ways to do that at HerMoney.com.

And, yes, during his campaign, President Biden proposed cancelling at least $10,000 in student debt per borrower, but theres no way of knowing if or when that would ever pass. In other words, if you have the money, its always best to move forward with your loan repayment strategy.

Setting goals and creating a debt pay-off plan will help. Here are the basics:

You might need to cut back in some areas to really tackle your student loans.

A lot of self-reflection is involved with finding that extra cash in your budget, Rodriguez says. Look through your expenses and get real with yourself about the things that you actually need versus you just wanted or you were doing mindlessly.

Student Loan Income Based Repayment Plans: How They Work Now

Income-Driven Repayment plans a broad term that describes a collection of similar plans that base a student loan borrowers monthly payment on their income and family size can be a crucial option for borrowers, and sometimes these plans are the only way a borrower can have a manageable monthly student loan payment. IDR plans include Income Contingent Repayment , Income Based Repayment , Pay As You Earn , and Revised Pay As You Earn .

IDR plans rely on a formula applied to the borrowers income and family size to calculate their monthly payment. Payments are based on whats known as a borrowers discretionary income which, for purposes of these plans, is defined as the amount of the borrowers AGI above a 100-150% of the federal poverty exemption, depending on the specific plan, adjusted for family size. Monthly payments are typically 10% to 20% of a borrowers monthly discretionary income .

Don’t Miss: Do Loan Companies Verify Bank Statements

Different Terms And Conditions

The IBR and PAYE Plans require that borrowers demonstrate a “need” to make income-driven payments. This debt-to-income test checks to see whether the borrower would see a payment amount reduction under the IBR or PAYE Plan relative to the 10-year standard repayment plan.

The IBR Plan has different terms and conditions depending on when the student borrowed. If the borrower is a “new borrower” on or after July 1, 2014, then the borrower will have payments that are generally 10% of discretionary income, and forgiveness is provided for after 20 years of qualifying payment. If a borrower is not a new borrower on or after July 1, 2014, then payments will generally be 15% of discretionary income, and forgiveness is provided for after 25 years of qualifying repayment.

Similar to the definition of “new borrower” for Pay As You Earn, a new borrower for the IBR Plan is one who, when receiving a federal student loan on or after July 1, 2014, the borrower did not have an outstanding balance on another federal student loan.

Seniors And Income Based Repayment Of Student Loans

By Eric Olsen Executive Director HELPS Nonprofit law firm, www.helpsishere.org

You may have received a notice about a defaulted student loan and do not know what to do. There are many articles on the internet with incomplete information that scare seniors into thinking that they are going to lose their social security. This article will explain options about past due student loans, specifically how to apply for a federal income based repayment plan. In many cases lower income seniors and other persons have to pay nothing or very little.

This program only applies to federal public student loans. Private student loans do not qualify for federal income contingent repayment plans. However social security or other retirement income is protected from garnishment for private student loans debt under federal law. Seniors can choose to not pay private student loans.

It is not a current practice for lenders to file lawsuits for repayment of student loans. Although it is not common, it is possible for federal student lenders to garnish 15% of a persons social security. You will be notified in writing of the lenders intent to garnish social security. In almost all cases garnishment of social security for student loans can be prevented when certain steps are taken. They cannot garnish other retirement income like pensions.

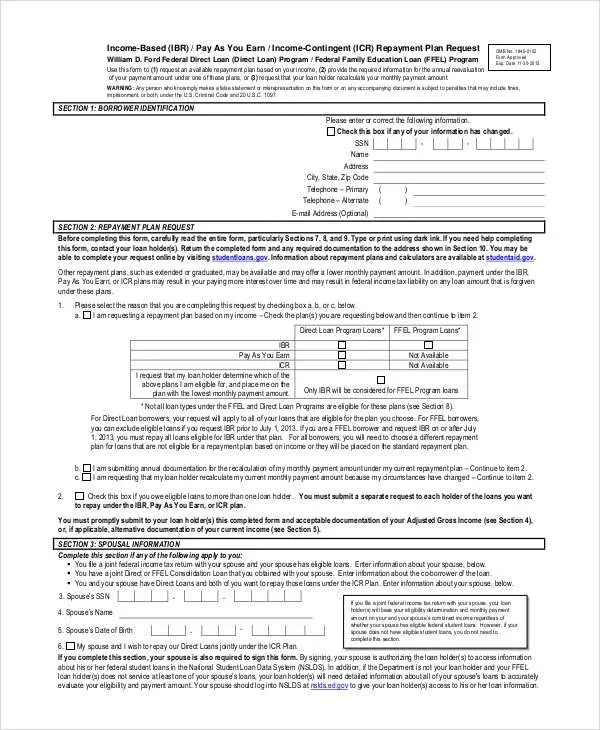

Here are the steps to apply for IBR.

Do You Have a Question You’d Like Steve to Answer? .

Read Also: Loan Officer License California

Why You Should Report A Change In Income

Reporting a change of income, even if it’s the loss of a part-time job or side gig that you work in addition to your full-time career, could make a difference in reducing your loan payments. If your budget is stretched thin and you’re worried about missing payments, lowering payments through income recertification could help you avoid default.

You enter default status when you’re at least 270 days late on making payments. Once you enter default, you arent eligible for income-driven repayment plans.

Defaulting can be harmful to your credit score, and it can also result in other negative consequences, such as wage garnishment and an offset of your tax refund.

Whether it makes sense to change your income-driven repayment plan depends on how long you expect your income to be lower than it was, how much of a financial strain your current payment presents, and what your new student loan payment may end up being.

Leaving Income Driven Repayment

You may remain in these plans regardless of whether you maintain a partial financial hardship. The rules are different depending on the type of plan. For REPAYE, for example, it never matters whether you have a partial financial hardship. You can leave the PAYE or REPAYE plans at any time if you want to switch. If you leave IBR, you must repay under a standard plan. However, you do not have to stay in the standard plan for the life of the life. You can change after making one monthly payment under the standard plan. Be advised that switching repayment plans usually means that the government will add accrued interest to the balance. You should check the rules of your particular plan and check with your servicer to make the decision that is best for you.

Don’t Miss: Va Manufactured Home Guidelines

Why Don’t More People Know About This

In a simple Google search I found misleading financial articles touting loan forgiveness as a secret strategy for getting off scot-free, with the potential tax bill given a quiet mention at the end. I’ve also had clients tell me about debt counsellors offering up the ‘pay-nothing’ solution, going so far as to advise loan-holders to file taxes separately from their spouses to keep their income as low as possible. This means that along with accruing interest, they’re likely paying higher annual income taxes, as the Married Filing Separately option generally disqualifies tax payers from common deductions and results in a higher tax bill.

IBR plans assume a 5% increase in salary per year, so for most people, even if they start off on the low end of the income spectrum, in all likelihood they’ll be debt-free before the clock strikes 25 years. The people I am worried about are the ones whose educations are inordinately expensive and who graduate without a clear income path which I see frequently for people in creative fields. Many of these folks have honed ninja-level frugality skills, which allows them to keep the ‘pay-nothing’ plan going without realizing where they’re headed.

How Many People Get Forgiveness Through Income

A recent report by the National Consumer Law Center revealed that only 32 student loan borrowers have seen their loans forgiven through income-driven repayment plans in the programs 25-year history. However, this shouldnt discourage you from seeking out these programs. The report states that the plans themselves arent the issue but rather a failure on the part of loan servicers to adequately inform borrowers about their options.

If you think you qualify for income-driven repayment, reach out to your servicer directly to request access.

You May Like: What Is An Rv Loan

Can Your Budget Handle A Non

Under income-based repayment, youre required to recertify your income and family size every year so your servicer can recalculate your monthly payment based on program guidelines.

Certain life changes including a new marriage and filing taxes jointly can cause your monthly payment to increase substantially or even make you ineligible to make payments tied to your salary.

If that happens, its important to know your monthly payments will never exceed what you would pay with the standard 10-year plan however, non-fixed student loan payments meaning payments that could change every year based on your annual income can make it difficult to manage your budget, especially if youve taken on other debt, such as a mortgage or car loan.

What If I Do Not Recertify Family Size

Besides income, family size is an element that determines your monthly payment amount. Sure, if you have a large family, your monthly payment amount will be lower. However, if you do not recertify family size, your loan servicer will assume that you have only one person in the family.

Therefore, even if you are two or more people, your monthly payment rate can increase as you do not recertify the information. Yet, you will not be placed to another plan as it was in the case of not recertifying income.

Recommended Reading: What Credit Score Is Needed For Usaa Auto Loan

Youll Pay Taxes On Your Forgiven Balance

Unlike forgiveness with Public Service Loan Forgiveness, the loan forgiveness after 20 or 25 years in an income-driven repayment plan is taxable under current law. The IRS treats the cancellation of debt as income to the borrower.

In effect, the taxable student loan forgiveness substitutes a smaller tax debt for the student loan debt. There are several options for dealing with the tax debt.

- If the borrower is insolvent, with total debt exceeding total assets, the borrower can ask the IRS to forgive the tax debt by filing IRS Form 982.

- The taxpayer might propose an offer in compromise by filing IRS Form 656.

- The final option, other than paying off the tax bill in full, is to seek a payment plan of up to six years by filing IRS Form 9465 or using the Online Payment Agreement Tool. The IRS charges interest on the payment plans. The borrower may be required to sign up for auto-debit if the tax debt is $25,000 or more.

See also:Common Mistakes Involving Income-Driven Repayment Plans

If Youre Seeking Forgiveness Its A Long Time To Carry Debt

The repayment term of 20 or 25 years is more than half of the average work-life for college graduates. Some borrowers have compared the repayment plans with indentured servitude, saying that it feels like they are in debt forever. Certainly, borrowers who choose an income-driven repayment plan will be in debt longer than in the standard repayment plan and may pay more interest due to the longer repayment term.

Borrowers in a 20 or 25-year repayment term will still be repaying their own student loans when their children enroll in college. They are less likely to have saved for their childrens college education and will be less willing to borrow to help them pay for school.

Once you choose an income-driven repayment plan, you are locked into that repayment plan. Repayment plan lock happens because the loan payments will jump if you switch from an income-driven repayment plan to another repayment plan. The loan payments will be based on the loan balance when you change repayment plans, not the original loan balance. This can make the new monthly loan payments unaffordable.

As you are deciding what repayment plan is right for you, use our repayment calculators. We have a repayment calculator for each income-driven plan:

Also Check: How Long For Sba Loan Approval