How Your Loan Term And Apr Affect Personal Loan Payments

When you take out a personal loan, two notable factors that will impact your loan payment include the loan term and APR. When you begin to compare loans from different lenders, a personal loan calculator will show different amounts for your monthly loan payment should the APR and loan terms differ.

Using a personal loan APR of 7.63% as an example, heres a simple breakdown of what the personal loan payment calculator can show you for a $5,000 loan and $10,000 loan.

| Your payments on a $5,000 personal loan | |

|---|---|

| Loan balance | |

| $5,610 | $6,030 |

In another scenario, the $10,000 loan balance and five-year loan term stay the same, but the APR is adjusted, resulting in a change in the monthly loan payment amount.

| Your payments on a $10,000 personal loan |

|---|

| Loan balance |

| $22,712 |

S To Calculate Interest On Loan

Please follow the below steps.

Interest = P * r * t

Example #1

Let us take an example, Trevor, who has deposited his money at ABC Bank Ltd. As per the bank policy, Trevor has been offered an interest rate of 6% on a sum of $1,000 that has been deposited for a period of 3 years. Calculate the interest to be earned by Trevor at the end of 3 years.

Solution:

- Outstanding principal sum, P = $1,000

- Rate of interest, r = 6%

- Tenure of deposit, t = 3 years

Use the above data for the calculation of interest.

The interest earned by Trevor can be calculated as,

Interest = $1,000 * 6% * 3

Therefore, Trevor will earn an interest of $180 at the end of 3 years.

Example #2

Solution:

- Outstanding principal sum, P = $5,000

- Rate of interest, r = 8%

- Number of payments per year, N = 2

Use the above data for calculation of interest charged for 1st six months.

How To Use Credit Karmas Simple Loan Calculator

Whether youre thinking of taking out a personal loan for debt consolidation or a student loan for college costs, you probably want a sense of how much your loan will cost over time.

Our loan calculator can help you understand the costs of borrowing money and how loan payments may fit into your budget. It takes into account your desired loan amount, repayment term and potential interest rate. Youll be able to view an estimated monthly payment, as well as the amortization schedule, which provides a breakdown of the principal and interest you may pay each month.

Keep in mind that this loan payment calculator only gives you an estimate, based on the information you provide. Loan fees like prepayment penalty or origination fee could increase your costs or reduce the loan funds you receive. This loan payment calculator also doesnt account for additional mortgage-related costs, like homeowners insurance or property taxes, that could affect your monthly mortgage payment.

Here are more details on the information youll need to estimate your monthly loan payment.

Read Also: Can You Pay Personal Loan With Credit Card

Why Use Personal Loans

About half of all personal loans are used for debt consolidation. The interest rates of personal loans are normally lower than credit cards, making personal loans a great vehicle through which a person could consolidate credit card debt or other debts sitting at higher interest rates. When deciding to take a personal loan for debt consolidation, the fees should be fully considered. The fee included APR is a better reference than the interest rate for comparison purposes. Other common uses of personal loans include the payment of medical bills, home renovations, small business expansions, vacations, weddings, and other larger purchases. The following are a number of more specific examples of uses of personal loans:

Try to Avoid Fraudulent or Predatory Loans

Unfortunately, fraudulent or predatory lenders do exist. Firstly, it is unusual for a lender to extend an offer without first asking for credit history, and a lender doing so may be a telltale sign to avoid them. Loans advertised through physical mail or by phone have a high chance of being predatory. The same is often said for auto title loans, cash advances, no-credit-check loans, and payday loans. Generally, these loans come with very high interest rates, exorbitant fees, and very short payback terms.

How To Calculate Personal Loan Payments

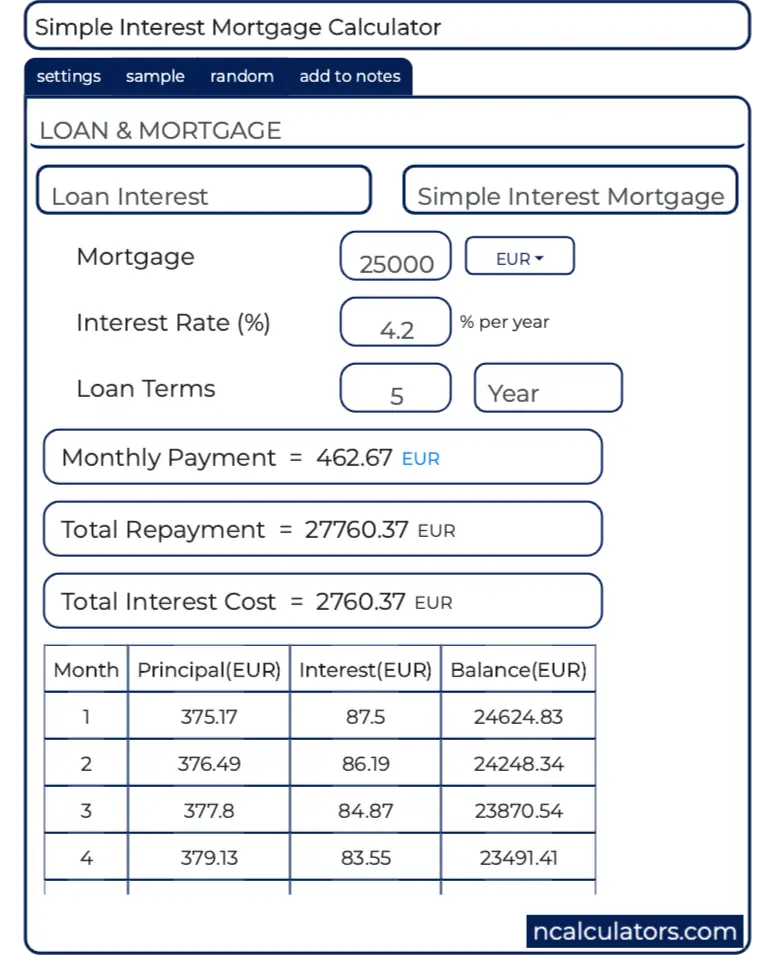

To begin your calculation, enter the amount you are hoping to borrow along with the yearly interest rate and the number of months that you are intending to borrow the money for. If you wish, you can alter the start loan date and include any additional deposits you are making at the beginning, along with any extra fees or balloon payments. Once you click the ‘calculate’ button, the personal loan calculator will show you:

- Your regular monthly payment figure

- The total interest you will pay

- Your total loan repayment figure

- Your estimated payoff date

You will also be shown graphs and a monthly repayment schedule of your principal and personal loan interest payments. Should you wish to calculate loan figures without compounding, give the simple interest calculator a try.

You May Like: Is It Hard To Get Small Business Loan

How Amortizing Payments Work

If you have a fixed-rate loan the amount paid each month is determined by the interest rate and the lenght of the loan. Lenders can look at the term of the loan and charge an interest rate which they feels compensates them for the risk of loss, the cost of inflation, their business overhead & their profit margin. With a fixed rate loan the amount of each payment stays the same across the duration of the loan, but the percent of each payment that goes toward principal or interest changes over time. Early on in the loan’s term a relatively large share of the payment is applied toward interest, then as the borrower pays down the loan an increasing share of the payment goes toward interest.

Rather than using the above calculator repeatedly you can use an amortization schedule to print out the entire schedule for a loan. We host an amortization calculator which enables you to create printable amortization tables. It shows the monthly payments and amortization schedule for the principal and interest portion of loans, while other costs of borrowing like licensing or taxes are excluded.

More Ways to Calculate Your Loan Payments

If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or future balance will be.

Prefer to calculate offline? See our free Simple Excel loan calculator.

Always Enter A 0 For The Unknown Value

Note – You must enter a zero if you want a value calculated.

Why not design the calculator to recalculate the last unknown?

Because we want the calculator to be able to create a payment schedule using the loan terms you need. This behavior is a feature! After all, there is no such thing as a “correct” loan payment. The payment amount is correct as long as both the lender and debtor agree to it!

Read Also: How Much Can I Afford Fha Loan

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

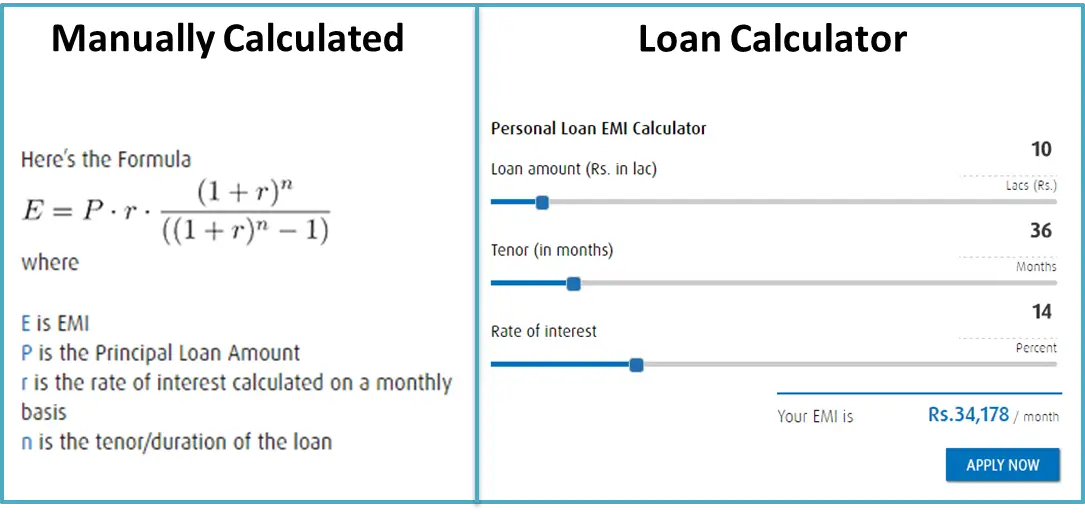

Diy Tips Formulas And Tools

The Balance / Theresa Chiechi

The easiest way to compute loan interest is with a calculator or spreadsheet, but you can also do it by hand if you prefer. For quick answers, use technologyonline calculators or spreadsheets. To understand the details, do a portion of the math yourself. You’ll make more informed decisions when you understand the numbers.

Recommended Reading: How To Get An Rv Loan With Bad Credit

Start With The Interest Rate

The higher your credit score, the lower the interest rate you will likely qualify for on a personal loan. If you think you might be in the market for a personal loan in the future, its a good idea to get to work building up your credit score. Contest any errors in your credit report, pay your bills on time and keep your credit utilization ratio below 30%.

Once you’re ready to shop for a personal loan, don’t just look at one source. Compare the rates you can get from credit unions, traditional banks, online-only lenders and peer-to-peer lending sites.

When you’ve found the best interest rates, take a look at the other terms of the loans on offer. For example, its generally a good idea to steer clear of installment loans that come with pricey credit life and credit disability insurance policies. These policies should be voluntary but employees of lending companies often pitch them as mandatory for anyone who wants a loan. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can’t pay off.

The Consumer’s Guide To Personal Loans

Applying for a personal loan is probably one of the easiest ways to secure additional cash on-hand, making it ideal for paying off credit card debt & consolidating other high-interest debt.

Application can be a bit time-consuming, which is why it is important to prepare all of the necessary documents beforehand to speed up the approval process.

Read Also: How To Calculate Student Loan Debt

See The Real Cost Of Debt

The above calculator also has a second tab which shows the current interest rates on savings accounts. This further shows how expensive debt is because most forms of consumer debt charge a far higher rate of interest than banks pay savers AND savers get taxed on interest income they earn at their ordinary tax rates. The table below shows the full cost of $10,000 of debt at various rates of interest. While different consumer debt types typically have different amounts, we kept the amount column constant to show the absolute difference in cost per Dollar earned or borrowed. We also presumed interest-only payments on the debt & a 25% tax rate on income.

| Account Type |

|---|

What Does This Personal Loan Calculator Show

Affordability is a prime concern when taking out a personal loan. A personal loan calculator helps give you a better idea of the total cost of borrowing so you can determine if it suits your budget.

Note that some types of loans, such as federal student loans for example, tend to be much less expensive than a personal loan, so youll want to compare all your options.

Student Loan Heros free personal loan calculator shows the total cost of the loan, the total amount paid in interest and the monthly payment amount.

To use this personal loan payment calculator, fill in the following information:

- Personal loan balance: The amount you wish to borrow from your selected lender.

- Interest rate: Its better to enter the annual percentage rate here. Your APR includes the interest rate and additional loan fees and is a more accurate measure of your cost of borrowing.

- Term in years: The loan term expressed in years rather than months .

You May Like: What Is The Maximum Va Loan Amount

What Are The Requirements I Need To Secure For My Application

The following are the common requirements that lenders look for:

- Income and employment-related documents

- Bank statements

- Collateral

Lenders will want to make sure that applicants are capable of fulfilling their obligations, and one way to reduce the risk of non-payment & fraud is to ensure of this is by securing documents that show proof of income/employment.

Some kinds of loans such as mortgages and auto loans are secured by the title on the property. Lenders can also use other assets to secure financing, lowering their risk & giving consumers lower rates.

Mortgage Interest Compounding In Canada

Mortgage interest in Canada is compounded semi-annually. This means that while you might be making monthly mortgage payments, your mortgage interest will only be compounded twice a year. Semi-annual compounding saves you money compared to monthly compounding. Thats because interest will be charged on top of your interest less often, giving interest less room to grow.

To see how this works, lets first look at credit cards. Not all credit cards in Canada chargecompound interest, but for those that do, they usually are compounded monthly. The unpaid interest is added to the credit card balance, which will then be charged interest if it continues to be unpaid. For example, you purchased an item for $1,000 and charged it to your credit card which has an interest rate of 20%. You decide not to pay it off and make no payments. To simplify, assume that there is no minimum required payment.

The same applies to mortgages, but instead of monthly compounding, the compounding period for mortgages in Canada is semi-annually. Instead of adding unpaid interest to your balance every month like a credit card, a mortgage lender is limited to adding unpaid interest to your mortgage balance twice a year. In other words, this affects your actual interest rate based on the interest being charged.

Read Also: What Is The Formula For Calculating Loan Payments

What Are Personal Loans

Personal loans are loans with fixed amounts, interest rates, and monthly payback amounts over defined periods of time. Typical personal loans range from $5,000 to $35,000 with terms of 3 or 5 years in the U.S. They are not backed by collateral as is typical for secured loans. Instead, lenders use the credit score, income, debt level, and many other factors to determine whether to grant the personal loan and at what interest rate. Due to their unsecured nature, personal loans are usually packaged at relatively higher interest rates to reflect the higher risk the lender takes on.

Secured Personal Loans

Although uncommon, secured personal loans do exist. They are usually offered at banks and credit unions backed by a car, personal savings, or certificates of deposits as collateral. Like all other secured loans such as mortgages and auto loans, borrowers risk losing the collateral if timely repayments are not made. Generally, the maximum loan limit is based on the collateral the borrower is willing to put up. Most online lenders only offer unsecured personal loans. While the Personal Loan Calculator is mainly intended for unsecured personal loans, it can be used for secured personal loans as long as the inputs correctly reflect the loan conditions.

Traditional Personal Loans

Personal Loans from P2P Lenders

Three Loan Options You Most Likely Don’t Need To Touch

- Payment Frequency – set how often payments are scheduled. The calculator supports 11 options, including biweekly , monthly, and annually. The schedule calculates payment due dates from the first payment due date.

- Compounding – usually, you should set the compounding frequency to be the same as the payment frequency. Doing so results in simple, periodic interest. Setting this option to “Exact/Simple” results in simple, exact day interest.

- Amortization Method – leave this setting set to “normal” unless you have a specific reason for setting it otherwise. For a complete explanation of these options, see Nine Loan Amortization Methods.

Recommended Reading: What Will My Student Loan Payment Be Calculator

Interest Rates And Apy

Be sure to use the interest rate in your calculationsnot the annual percentage yield.

The APY accounts for compounding, which is the interest you earn as your account grows due to interest payments. APY will be higher than your actual rate unless the interest is compounded annually, so APY can provide an inaccurate result. That said, APY makes it easy to quickly find out how much youll earn annually on a savings account with no additions or withdrawals.

Monthly Interest Rate Calculation Example

To calculate a monthly interest rate, divide the annual rate by 12 to reflect the 12 months in the year. You’ll need to convert from percentage to decimal format to complete these steps.

Example: Assume you have an APY or APR of 10%. What is your monthly interest rate, and how much would you pay or earn on $2,000?

Want a spreadsheet with this example filled in for you? See the free Monthly Interest Example spreadsheet, and make a copy of the sheet to use with your own numbers. The example above is the simplest way to calculate monthly interest rates and costs for a single month.

You can calculate interest for months, days, years, or any other period. Whatever period you choose, the rate you use in calculations is called the periodic interest rate. Youll most often see rates quoted in terms of an annual rate, so you typically need to convert to whatever periodic rate matches your question or your financial product.

You can use the same interest rate calculation concept with other time periods:

Also Check: What Is An Upside Down Car Loan