Is A Secured Loan A Bad Idea

Secured loans may not be a bad idea. If you can qualify for a secured loan you should consider the option but it may not be your first choice. Just know that if you default on the loan you will most likely lose the collateral you provide. However, the risk may be justifiable with lower interest rates and longer terms.

Getting Additional Help With Debt

If you are feeling overwhelmed by debt and you need more answers, consider contacting American Consumer Credit Counseling. They are a nonprofit organization that provides access to credit counselors. They provide free advice to help consumers find ways to more effectively manage their money and get out of debt. If you do need financial help with your debt problems, keep in mind that they offer a no-obligation consultation.

Which Business Lending Option Works Best For You

As with many decisions, the right one depends on your individual circumstances. A good starting point is to decide what your business goals are and the time frame in which you want to achieve them.

The faster process of unsecured lending may make it more suitable to businesses growing rapidly or requiring quick access to funds. A secured loan may suit a business after a larger amount of cash that they can pay back over a longer period, and generally at a lower interest rate.

Recommended Reading: What Do I Need To Get Loan From Bank

What To Know About Secured Loans

Qualifying: Secured personal loans can be easier to qualify for than unsecured loans. A lender considers your credit score, history, income and debts, but adding collateral to the application can lower the lenders risk and give it more confidence to lend to you.

Rates: Secured loans typically have lower annual percentage rates than unsecured loans. Rates are decided using the same factors lenders review to qualify you, so the value of your collateral can affect your rate.

If you secure financing with a vehicle, for example, the value of the vehicle is a factor in deciding whether you qualify and what rate youll get.

» MORE: Compare secured loans from banks, credit unions, online lenders

Repayments: Secured personal loans are usually repaid in fixed, monthly installments over a few years. Secured loans may have variable rates, which means monthly payment amounts can also vary.

Risk: The penalty for not repaying a secured loan is twofold: Your credit will suffer, and the lender can seize the collateral, sometimes after only a few missed payments.

Even one missed payment can drop your credit score by as many as 100 points, and the impact on your credit wont be softened because its a secured loan.

Online lenders that offer secured loans tend to require a vehicle as collateral: Oportun, Upgrade and OneMain all offer vehicle-secured loans. The lender may want the vehicle appraised before it lends to you.

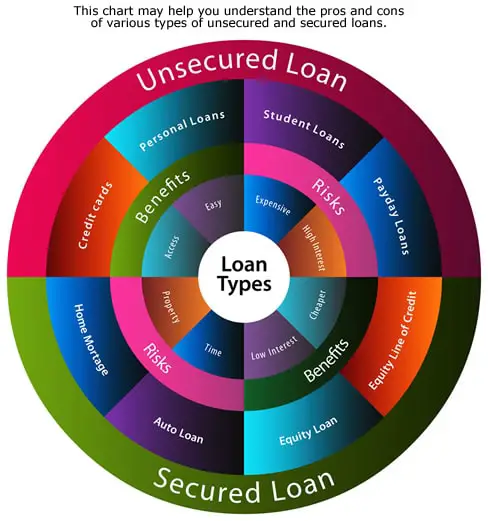

Which Loan Type Is Right For You

Which type of loan is better for you is determined in large part by lenders and the reason you need the loan. And that leads us to the main advantages and disadvantages of secured and unsecured loans. A benefit of secured loans can be that if you have a weak or unproven credit history, secured loans can be easier to qualify for since they mitigate the risk for your lender. The arrangement also provides another benefit: secured loans can have lower interest rates than unsecured loans. If youre in a position to repay your loan so you dont lose your collateral, a secured loan can be a money saver.

Learn more about the potential benefits of personal loans.

Read Also: Who Qualifies For Parent Plus Loan

What Do I Need For An Unsecured Loan

If you are considering an unsecured loan you should have some kind of credit history and stable income at the minimum. While some lenders may not require any supporting documents, other lenders may request proof of income, identification, residency, or other documents. In most cases, you wont need much to qualify for an unsecured loan.

Pros And Cons Of Unsecured Business Loans

- Fast funding: Typically, the applicant doesnt have to go through the same vetting process that a secured business loan requires since theres no collateral to assess. Therefore, you may be approved for financing more quickly.

- Fewer limits on use: Unsecured business loans may come with more lenient rules about how youre able to use the funds.

- Safeguards assets: Even if you default, as long as the lender doesnt have a court order, it cant seize your business or personal property.

- Higher interest rates: The risk in issuing an unsecured loan is higher for your lender, so the loan will usually come with a higher interest rate than a secured loan does.

- May require personal assurance: Again, depending on the lender, you may have to provide a personal guarantee in case your business goes into bankruptcy. That can endanger your personal assets, even if they werent agreed on as collateral, since youre personally responsible for paying back the loan.

- A smaller amount: Due to the risk, lenders may not offer as much money as they might for secured loans.

- Stricter approval requirements: These loans typically have more stringent eligibility requirements than secured loans since lenders want to minimize risk. Potential lenders may look at things like your businesss financial history and revenue.

You May Like: Is The Loan Forgiveness Program Legit

Secured Vs Unsecured Loans: Which Is Right For You

Which type of loan is right for you depends largely on the circumstances youre in and what your goals are. Keep in mind that a secured loan is normally easier to get, as its a safer venture for the lender. This is especially true if you have a poor credit history or no credit history. If thats the case, lenders justifiably want some kind of reassurance that theyre not just gambling with their money .

A secured loan will tend to include better terms, such as lower interest rates, higher borrowing limits, and, as discussed above, longer repayment schedules. A secured loan is often the only option in some situations, such as applying for a mortgage or making a purchase far beyond your normal borrowing limit.

Then again, maybe you dont have or want to provide collateral. Perhaps youre more concerned with just weathering a storm, and youre not worried about paying a higher interest rate. Or maybe you plan to pay back the money immediately, in which case, youre not concerned about interest or a lengthy payment plan. And assuming you dont need a small fortune, the higher borrowing limit might not be a feature that you care about. In these cases, you might prefer an unsecured loan.

How Do I Get a Secured Loan? How do I Get an Unsecured Loan?

For borrowers with a lower credit rating who do manage to get a loan, they can expect to pay higher-than-normal interest rates and premiums and get stricter payment terms than those borrowers with high credit scores.

Whats The Difference Between Secured And Unsecured Loans

The main difference between a secured loan and an unsecured loan is whether the lender requires security.

A secured loan for your business requires security. This may be property, inventory, accounts receivables or other assets. If the loan canât be met, the lender may rely upon these assets to clear the outstanding balance, interest or fees.

An unsecured loan for your business doesnât require physical assets as security. Instead, your lender will often look at the strength and cash flow of your business as security.

You May Like: How Much Car Loan Can I Be Approved For

What To Know About Unsecured Loans

Qualifying: Borrowers with good and excellent credit usually have the best chance of qualifying for an unsecured loan. Lenders review your credit score, history and debt-to-income ratio to decide whether you qualify. Some lenders review alternative data like your college education and where you live, too.

Rates: Unsecured loans have fixed rates that typically range from 6% to 36%. The lowest APRs usually go to the most qualified borrowers, while borrowers with fair or bad credit scores will get higher rates.

» MORE: Compare unsecured loans with no collateral

Repayments: Unsecured loans are repaid in fixed, monthly installments, and repayment terms are usually two to seven years.

Risk:Unsecured loans may be a safer choice for some borrowers. If you fail to repay, only your credit will be affected. Some lenders allow you to go on a hardship plan if you cant make your monthly payments. These plans can involve lowering or deferring your monthly payments.

If the loan is in default, which happens between 30 and 90 days after you miss a payment, it could be sent to collections and ultimately the collections agency can take you to court.

Where to get them:Online lenders can have low rates and features like fast funding and a fully online process.

Not all banks offer unsecured loans U.S. Bank, PNC and Wells Fargo are among the national banks that do. Banks may offer a lower rate if youre already a customer.

What Is An Unsecured Personal Loan

The truth is that most personal loans are unsecured, meaning that there is no collateral involved. If you dont pay up, the lender stands to lose all of the money they lend to you. For this reason theyre riskier for the lender, which affects other characteristics of the loan.

Unsecured loans also are common in other areas of your life. These types of lending products also are considered unsecured loans because theyre not backed by any collateral:

Before you can qualify for an unsecured personal loan, lenders will assess things like your credit score, your payment history listed on your credit report and your income. Most lenders require a credit score of 670 to qualify for an unsecured personal loan.

An unsecured personal loan may:

Recommended Reading: Who Is Still Funding Ppp Loans

What Happens If You Default On A Secured Loan

If you make your payments on time, your collateral remains yours. But if you stop making payments and default on your secured loan, the lender has the rightper your agreementto take possession of your collateral.

Whenever you take out a secured loan or line of credit, review your agreement carefully. Being a few weeksor even a few dayslate on a mortgage payment may result in a late fee, but it generally won’t trigger a foreclosure. What you want to know is how soon a foreclosure could happen. Learn the same for any auto loan or any other secured loan you may have.

Defaulting on a secured loan carries the same credit consequences as defaulting on an unsecured loan: It can negatively affect your credit history and credit score for up to seven years. However, with a secured loan, the bad news doesn’t end there. You may also lose your home or car. You may forfeit any cash deposit you’ve put up as collateral. And if the proceeds from the sale of your home, car or other collateral don’t cover your entire debt, you may be on the hook for the remaining balance.

How Do Secured And Unsecured Loans Affect Your Credit

Secured and unsecured loans impact your credit in much the same way. When you apply for the loan, the lender will check your credit score and report. Once you have the credit card or loan, they’ll report your payment history, credit card limit and balance , to one or more of the consumer credit companies: Experian, TransUnion and Equifax.

Paying your loan or credit card on time can help you build credit. And using secured or unsecured personal loans to consolidate credit card debt can improve your credit score by reducing your credit utilization. Curious about your results? You can use free credit monitoring to track your credit score and report and see precisely how you’re doinga good idea well before you complete your loan application as well.

Both secured and unsecured loans can play positive roles in your financial life. Together, they’re the keys to homeownership, car purchases, responsible credit card use, financing your education and sometimes simply managing your money effectively. Borrow judiciously and pay your loans back in a timely manner your credit will fare just fine.

You May Like: Can I Transfer My Car Loan To My Business

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most the different types of lending options, the best rates, the best lenders, how to pay off debt and more so you can feel confident when investing your money.

Qualifying For A Personal Loan

Theres no one specific, step-by-step way to qualify for a personal loan. Thats because every lender has somewhat different requirements for credit scores and other factors, and every borrowers personal situation is somewhat different.

That said, there are some basics you can expect. Most lenders will check your credit history and credit scores, review your income, and consider how much debt you already have before they approve your loan. One key question the lender is likely to investigate is whether you earn enough income to afford the payments you have to make each month. If you apply for an unsecured loan, your credit, income and current debt will likely receive more scrutiny, because theres no collateral to back your loan.

If you apply for a secured loan, the lender will want to feel confident about your collateral, its value and the fact that you own it outright.

Recommended Reading: What Is The Max Va Home Loan

What Should You Know Before You Borrow A Loan

Besides understanding the difference between secured and unsecured loans, there are a few other steps you should take before borrowing money.

First, make sure you can afford to pay back the loan. Take a look at your budget, and use a loan calculator to calculate your monthly payments and interest charges. Make sure you have a clear plan for repayment, so you dont get stuck with debt you cant afford whats more, make sure not to borrow more than you need.

It can also be a good idea to shop around and compare offers from multiple lenders to ensure you find the loan with the lowest cost of borrowing.

As mentioned, some online lenders let you prequalify, meaning you can check your rates with no impact on your credit score. Take your time to do your due diligence and shop around before signing on the dotted line.

Examples Of Secured Loans

- Mortgage A mortgage is a loan to pay for a home. Your monthly mortgage payments will consist of the principal and interest, plus taxes and insurance.

- Home Equity Line of Credit A home equity loan or line of credit allows you to borrow money using your homes equity as collateral.

- Auto Loan An auto loan is an auto financing option you can obtain through the dealer, a bank, or credit union.

- Boat Loan A boat loan is a loan to pay for a boat. Similar to an auto loan, a boat loan involves a monthly payment and interest rate that is determined by a variety of factors.

- Recreational Vehicle Loan A recreational vehicle loan is a loan to pay for a motor-home. It may also cover a travel trailer.

You May Like: How Va Home Loan Works

Can You Pay Off Student Loans With Personal Loans

Due to federal standards imposed by the Higher Education Act, most lenders do not allow borrowers to repay student loans with personal loan funds. Some lenders extend personal loans for educational use, though these offerings may only be available in some states. Alternatively, personal loan funds can cover various living expenses, leaving cash to pay down student loan debt.

Note: On August 24, 2022, President Biden announced the cancellation of $10,000 of federal student loan debt for eligible borrowers. Federal Pell Grant recipients may benefit from the cancellation of $20,000 in those debts. Biden also extended the pause on federal student loan payments to December 31, 2022.

What Are The Disadvantages Of An Unsecured Loan

A secured loan may sound good, especially if you need a larger amount, but it can have some serious downside.

Some of the disadvantages include:

- You could lose your collateral if you default on your loan.

- Secured loans may have some restrictions, like a minimum balance on the bank account you use as collateral, or lack of flexibility on what you can use the money for.

- The loan decision time may be longer since the value of your collateral needs to be considered.

Read Also: How To Get 500k Business Loan

Difference Between Secured And Unsecured Loan

- The most important difference between a secured and unsecured loan is the collateral required to attain the loan. A secured loan requires you to provide the lender with an asset that will be used as a collateral for the loan. Whereas and unsecured loan doesnt require you to provide an asset as collateral in order to attain a loan.

- Another key difference between a secured and unsecured loan is the rate of interest. Secured loans usually have a lower rate of interest when compared to an unsecured loan. This is because unsecured loans are considered to be risker loans by lenders than secured loans.

- Secured loans are easier to obtain while unsecured loans are harder to obtain, as it is less risker for a banker to dispense a secured loan.

- Secured loans usually have longer repayment periods when compared to unsecured loans. In general, secured loans offer a borrower a more desirable contract that an unsecured loan would.

- Secured loans are easier to obtain for the mere fact that they are less risky for a lender to give out, while unsecured loans are comparatively harder to obtain.