Great Service Great Rates

Get in the drivers seat today and enjoy our auto loan benefits, including:

- Terms up to 84 months1

- Easy, convenient auto pay

- Access to our auto-buying partners

- Apply online, on the phone or the branch nearest you

- No payments for up to 90 days2

Terms and Conditions

1 APR = Annual Percentage Rate. Payment Example for qualified buyers based at 3.99% APR for 36 months per $1,000 borrowed with 90 days to first payment: 35 monthly payments of $29.71 and a final payment of $29.69. Rates, terms, and conditions are subject to change and are not available to refinance an existing California or North Island Credit Union auto loan. Your overall credit worthiness will determine the rate, term, and amount available to you. Fees and charges may apply.

2 Interest will accrue from contract date. Your overall creditworthiness will determine the days to first payment, rate, term, and amount available to you. All loans subject to approval and acceptable collateral. Rates, terms, and conditions are subject to change and are not available to refinance an existing California Credit Union auto loan. Fees and charges may apply.

What Credit Score Do Credit Unions Require For Auto Loans

There isnt a minimum credit score that all require for auto loans. It depends on the credit union, the type and age of the car, and the borrowers other qualifications such as employment history and income. The higher your credit score, the lower your rate will generally be. Typically, a credit score over 720 will give borrowers the very best rates.

Best Auto Loan Rates: Compare Top Lenders

As mentioned, one of the simplest ways to find the best auto loan rates is to shop around. Do this before you get in the room with a loan officer at a car dealership. You can get as many offers as you want, as long as you make sure they only require a soft credit check.

When youre ready to move forward with an offer, you can go through the full loan application process with the financial institution that gives you the best auto loan rates overall. Below you can start comparing the best auto loan rates available.

Recommended Reading: Negative Equity Car Loan Calculator

Auto Loans As Low As 399% Apr2

It pays to be a credit union memberespecially when youre in the market for an auto loan. Take advantage of our competitive auto rates as low as 3.99% APR2. Purchase a new or used vehicle, or refinance your existing auto loan from another lender to lower your payments.

- No payments for up to 90 days1

- Competitive fixed rates and terms of 36 to 84 months3

- Search for your perfect vehicle with our auto-buying partners

General Credit Union Auto Loan Faqs

How do I make a payment on my auto loan?

We offer several options to make it as convenient as possible for you.

Why would I get pre-approved for an auto loan?Should my loan term be 24, 36, 48, 60, or 72 months?How long does it take to get an auto loan?Where do I send proof of insurance?

You can and provide the declaration page provided by your insurance company that shows Credit Union of Texas listed as lienholder. Keep in mind, a copy of your insurance card is not acceptable for this documentation.

If you’d rather send us your proof of insurance by mail or fax, please use this address or number:

CUTXSan Antonio, TX 78269Fax: 866-830-7922

If you have other questions, call us at 866-382-0069.

Recommended Reading: Credit Union Home Equity Loan

Orange County’s Credit Union

| Less than $25,000 |

Maximum term not available on all loan amounts. Lowest APR not available for the max term listed. Contact Orange County’s Credit Union for details.

Personal Loan Rate Assumptions

¹APR is Annual Percentage Rate. All loans are subject to application, credit qualification, income verification, and approval. Not all applicants will qualify for the lowest rate. APR may vary and is determined by your credit qualifications. APR includes 0.25% discount for automatic payments via an Orange Countys Credit Union checking/savings account or payroll deduction. Loans without automatic payments from a checking/savings account will be 0.25% higher. Example monthly payment: For a $1,000 loan for a term of 12 months with a 9.00% APR, the monthly payment will be $87.45.

Vehicle Loans

| up to 100% LTV |

Maximum term not available on all loan amounts. Lowest APR not available for the max term listed. Contact Orange County’s Credit Union for details.

Auto Loan Rate Assumptions

Vehicles with more than 5,000 miles will be classified as used auto. Minimum vehicle year is 2016.

The First Time Auto Buyer program requires automatic payments, proof of insurance and proof of income before funding.

| 80% LTV |

Maximum term not available on all loan amounts. Lowest APR not available for the max term listed. Contact Orange County’s Credit Union for details.

New as indicated on purchase order from dealer. All other purchases are classified as Used.

Motorcycle Loan Rate Assumptions

How Is My Rate Determined

Rates are determined by your personal credit history, loan term, account relationship, and payment method. Members may be eligible for a 0.50% discount by maintaining electronic payments on the loan and Plus or Relationship benefits on your DCU checking account. Rates and terms on loans for other types of vehicles, including mobility vehicles, will differ.

Recommended Reading: How Do I Pay My Santander Auto Loan

How Is Interest Calculated On A Car Loan

A few different factors help lenders determine the car loan interest rates youll be offered. The more well-rounded your application, the better your chances of scoring a low rate. Although there are many factors that may play a role in your interest rate, these are the five main points lenders consider when reviewing your application:

- Those with higher scores generally have access to lower car loan rates, so improving your credit history is an important part of getting a low interest rate on your car loan.

- Income. Lenders consider your income because it reflects your ability to pay back the loan. They also want to see a low debt-to-income ratio to make sure you can afford your loan.

- Loan term. The loan term impacts the interest rate that youre offered as well as how much interest youll pay over the life of the loan. A lender could offer you a lower interest rate on a longer loan term, but this doesnt mean youll save money: youll pay more interest on a longer loan term.

- Vehicle. Your vehicles make and model can also play a role car loan rates, especially if youre buying a used car. Since its possible that your car will be used as collateral to secure the loan, lenders often charge higher interest for cars that are of poorer quality and are more likely to break down.

- Type of interest rate. Banks and credit unions can offer fixed and variable interest rates on a car loan. Generally, variable-rate car loans have lower starting rates than fixed-rate car loans.

How Does Lendingtree Get Paid

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Written by Jenn Jones | Edited by Katie Lowery | Updated November 30, 2022

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Also Check: How To Pay Sba Loan

Easiest To Join: Nasa Federal Credit Union

NASA Federal Credit Union

-

Only offers branches in the D.C. area

-

Lower fees only available for shorter term loans

NASA Federal Credit Union is open to NASA employees, NASA retirees, and their family members. However, you dont have to be a world-class scientist to enjoy membership. It also offers membership to non-employees who join the National Space Society, and the first year is complimentary. After that, your membership will cost $47 a year with automatic renewal. Membership includes their magazine, the latest information on space news, and invitations to conferences and events.

NASA Federal Credit Union offers new and used auto loans and recreational vehicle loans. Auto loan rates start at 3.64%, and although there is no payment due for the first 60 days, interest does accrue. The lowest rates have terms up to 36 months. Longer terms up to 84 months are available, but the rates do increase. You can apply online in a few minutes. You can also reach customer service through email, online chat, and over the phone.

NASA Federal Credit Union has multiple branches in Maryland and Virginia, near the D.C. areas and shared branches at affiliated credit unions. However, the majority of its services are offered online, including digital baking, student loans, credit cars, personal loans, financial planning services, and car loans.

What Are The Pros And Cons Of Car Loans

There are both pros and cons to car loans. While a car loan might enable you to purchase a more expensive vehicle, and to balance repaying costs over a longer timeframe, youll usually need to pay interest, and there can be associated fees to consider. There are also the risks of repossession. Your credit score may also be impacted by you taking out a car loan.

You May Like: How To Get Help With Student Loan Forgiveness

Read Also: How To Refinance Sba Loan

Navy Federal Credit Union

Navy Federal Credit Union offers excellent car loans for financing new cars with terms up to eight years. You can join if you are affiliated with the military, Department of Defense, Coast Guard or National Guard.

Why it stands out: Borrowers can expect convenience while applying for a loan online and if they receive a preapproved loan, Navy Federal will issue a check for the loan amount. Other benefits available to members include access to GAP guaranteed auto protection insurance.

Pros:

- New vehicle terms up to eight years

- Starting APRs under 3% for both new and used vehicles

Cons:

- You or one of your family or household members must have military ties to join.

What to look for: Navy Federal offers starting APRs as low as 2.79% for new vehicles and 2.89% for late-model used vehicles with terms up to 96 months for new vehicles and 72 months for used. Auto loan preapproval checks and interest rates are good for 90 days from the approval date.

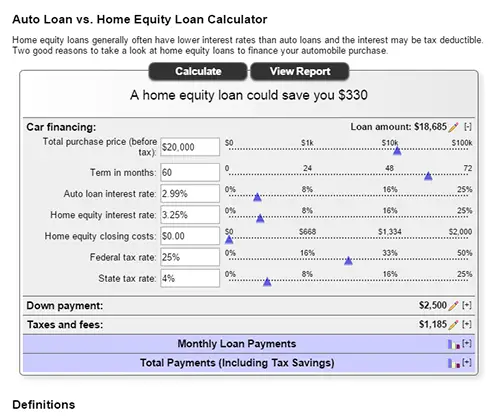

What Will My Monthly Payment Be

Many factors go into determining the final loan amount for the purchase of a new or used vehicle. These factors include any manufacturer’s rebate, the trade-in value of your old vehicle less any outstanding balance, your down payment, etc.

Once the loan amount is determined the interest rate and the term of the loan will be used to estimate your vehicle payment. To estimate your monthly payment, try our Monthly Payment Calculator.

Read Also: $50 Loan Instant No Credit Check

How To Apply For An Auto Loan

Follow these general steps to apply for an auto loan:

Best Credit Unions For Car Loans

Overall, credit unions offer better auto loan rates than banks or dealerships, which can save you money now and over time. This is because credit unions are not driven by profit like banks are and do not count on making the most off the loans they approve.

Much like banks, decide to issue loans depending on your credit, your employment history and your income. However, credit unions are often more willing to work with people who have fair or poor credit scores less than 669 when it comes to auto financing.

Don’t Miss: How Much Home Loan Can I Get On 70000 Salary

Boat Atv & Watercraft Loan Rates

| 80% LTV |

Maximum term not available on all loan amounts. Lowest APR not available for the max term listed. Contact Orange County’s Credit Union for details.

Other Auxiliary Loan Rate Assumptions

New as indicated on purchase order from dealer. All other purchases are classified as Used.

¹APR is Annual Percentage Rate. The approximate payment per $1,000 on a new auxillary loan with a 60-month term at 6.99% APR is $19.86. All rates include a 0.25% discount for automatic payments. APRs for loans without automatic payments or if automatic payment is discontinued will be 0.25% higher.²Maximum term not available on all New Boat and Yacht loan amounts. Contact Orange County’s Credit Union for details.³We may finance up to 100% of purchase price including tax, license and warranty. If Amount Financed exceeds vehicle value it may cause an increase in interest rate . We use M.S.R.P. value for new vehicles and Retail Kelley Blue Book value for used vehicles. The Credit Union reserves the right to limit loan to value on all vehicles based on individual credit worthiness.There’s a $50 fee for an Orange County’s Credit Union vehicle refinance. There’s a $25 fee for all Private Party Transactions. These fees are included in the APR calculation. Cash out is not available for these loan programs.

Home Loans

Member savings may vary based on individual circumstances, including terms of the loan.

Best Online Auto Loan: Lightstream

LightStream

- 5.99% to 11.99%* with Auto Pay & Excellent Credit

- Minimum loan amount: $5,000

LightStream offers a fully online process for its extensive list of vehicle loan options. It’s very transparent about its rates and terms, and it has few restrictions on what kind of car it will finance. However, it scored below average marks in the J.D. Power 2022 U.S. Consumer Lending Satisfaction Study for personal loans.

-

No restrictions on make, model, or mileage

-

Offers unsecured loans to borrowers with excellent credit

-

Prefers borrowers with good credit

LightStream is a division of Truist Bank. It stands out for its online lending process. Borrowers can apply online, e-sign the loan agreement, and receive funds via direct deposit as soon as the same day.

LightStream also offers a remarkably wide range of auto loan options, including new and used dealer purchases, refinancing, lease buyouts, and classic cars. It even offers unsecured loans for those with excellent credit.

Rates from the lender start as low as 5.99%, which includes a 0.5%-point discount for autopay. The maximum APR on a LightStream loan is 22.99%.

Recommended Reading: How Do I Apply For Loan

Best For Green Vehicles: Suncoast Credit Union

Suncoast Credit Union

-

Only serves part of Florida

Suncoast Credit Union is Floridas largest credit union and has branches throughout Floridas west coast. In addition to car loans, it offers personal loans, mortgages, full banking services, and financial tools. It has an easy-to-use website with a lot of consumer educational material and financial calculators, as well as webinars and how-to blogs.

Suncoast Credit Unions auto loan rates start at 3% for green vehicles and 3.25% for other cars. You can also get financing for watercraft, recreational vehicles, and motorcycles as well as cars. Max terms are usually 72 months for cars.

It also offers a helpful chart that lists the starting rates for different types of vehicles and rewards its members with low rates for purchasing a green car, defined as an electric vehicle or a car with a combined EPA rating of 28 mph or better.

To join Suncoast Credit Union, you must meet its membership requirements: You must live, work, attend school, or worship in one of the counties in Southwest and the West Coast of Florida that it serves. It does require proof, such as a utility bill or a signed lease.

Top Car Loans To Help You Finance Your 2023 Car Purchase

New year, new car? If youre considering purchasing a new or used vehicle this year, its crucial that you compare your loan options carefully to ensure you choose the best option for your needs and budget.

The start of the new year is considered one of the more popular times to purchase a new or used vehicle. This is because dealerships will often offer clearance sales for the previous years models, as these older models become less attractive to buyers by February/March.

Whether youre considering purchasing a Ute for your business, or a hatchback to get you around your city, its worthwhile comparing a range of vehicle and financing options before you sign on the dotted line for your next car.

Recommended Reading: How To Apply For Va Loan