Why Is It Important To Know The Interest Rate And Terms On My Student Loans

Its important to know your interest rate and terms on the student loans you borrow, so you can understand how much youll owe. If you take out $15,000 in student loans, youre not just going to owe $15,000. Youre going to owe $15,000 plus interest over the life of your loan .

Like the example above, if you borrowed $15,000 at a rate of 5% over the standard 10-year repayment plan, you would end up paying back $19,091 total.

Check Out: Todays Student Loan Interest Rates

Can You Claim Student Loans On Taxes

If you made payments toward interest on your student loans, you might be able to claim the student loan interest tax deduction. You can deduct $2,500 or the amount of interest you paid during the tax year, whichever is less.

Tip:

If you decide to refinance, remember to research and compare as many lenders as possible. This way, you can find a loan that best suits your needs. Credible makes this easy you can compare your prequalified rates from multiple lenders in two minutes.

Kat Tretina is a freelance writer who covers everything from student loans to personal loans to mortgages. Her work has appeared in publications like the Huffington Post, Money Magazine, MarketWatch, Business Insider, and more.

When Does Interest Accrue

Interest starts accumulating like this from the moment your loan is disbursed unless you have a subsidized federal loan. In that case, youre not charged interest until after the end of your grace period, which lasts for six months after you leave school.

With unsubsidized loans, you can choose to pay off any accrued interest while youre still in school. Otherwise, the accumulated interest is capitalized, or added to the principal amount, after graduation.

If you request and are granted a forbearancebasically, a pause on repaying your loan, usually for about 12 monthskeep in mind that even though your payments may stop while youre in forbearance, the interest will continue to accrue during that period and ultimately will be tacked onto your principal amount. If you suffer economic hardship and enter into deferment, interest continues to accrue only if you have an unsubsidized or PLUS loan from the government.

Those with federal student loans may encounter a gap in their requirement to pay interest: Interest on student loans from federal agencies and within the Federal Family Education Loan Program has been suspended until Sept 30, 2021, through an executive order signed by President Biden on his first day in office and an announcement by the Department of Education.

Read Also: Usaa Proof Of Residency Request Form

Enter Your Email Below And Your Free Private And Downloadable Loan Calculator Will Be On The Way

If you find this spreadsheet useful, please share it so can others can benefit.

I cant wait to help you save money on your student debt, whether you use my calculator or hire me for a one on one consult. Ive worked with dozens of dentists, doctors, veterinarians, lawyers, businesspersons, chiropractors, pharmacists, physicians assistants, psychologists, family counselors, and more! Id love to hear feedback on the spreadsheet as well, so dont be shy. Thanks for trusting me to help with your student debt!

Additional Factors To Consider When Calculating Student Loan Interest

When calculating your student loan interest, keep in mind that there are a few other key factors at play:

- Fixed vs. variable rates. Unlike federal student loans, which offer only fixed interest rates, some private lenders offer fixed or variable student loan interest rates. A fixed rate wont change during your loan term, but variable rates can decrease or increase based on market conditions.

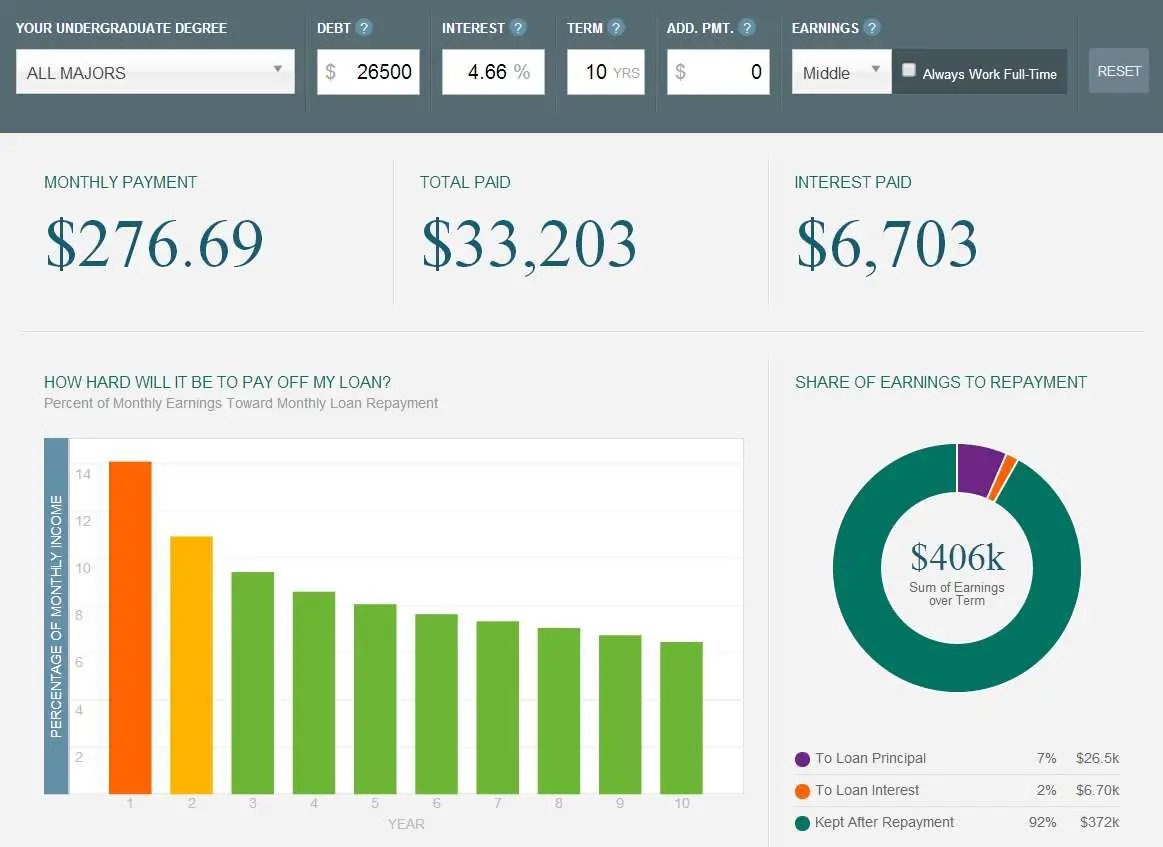

- Term length. How short or long your student loan term is dramatically changes how much total interest youll pay. In addition to calculating your total interest paid, the student loan calculator above shows you how much of your monthly payment goes toward interest to see this view, click on show amortization schedule.

- Private student loans require a credit check. The stronger your credit, the more likely youll be offered competitive, low interest rates. Borrowers with bad credit might be approved at a higher interest rate, which means more money spent on interest charges overall.

Read Also: Usaa Auto Refinance Phone Number

Capitalization Increases Interest Costs

In most cases, youll pay off all of the accrued interest each month. But there are a few scenarios in which unpaid interest builds up and is capitalized, or added to your principal loan balance. Capitalization causes you to pay interest on top of interest, increasing the total cost of the loan.

For federal student loans, capitalization of unpaid interest occurs:

-

When the grace period ends on an unsubsidized loan.

-

After a period of forbearance.

-

After a period of deferment, for unsubsidized loans.

-

If you leave the Revised Pay as You Earn , Pay as You Earn or Income-Based-Repayment plan.

-

If you dont recertify your income annually for the REPAYE, PAYE and IBR plans.

-

If you no longer qualify to make payments based on your income under PAYE or IBR.

-

Annually, if youre on the Income-Contingent Repayment plan.

For private student loans, interest capitalization typically happens in the following situations, but check with your lender to confirm.

-

At the end of the grace period.

-

After a period of deferment.

-

After a period of forbearance.

To avoid interest capitalization, make interest-only student loan payments while youre in school before you enter repayment and avoid entering deferment or forbearance. If youre on an income-driven repayment plan for federal student loans, remember to certify your income annually.

How Can I Limit The Amount Of Money I Need To Borrow For College

Before taking out student loans, its a good idea to finance your education through other means. Here are some of your best options to limit the amount of money you need to borrow in student loans:

- Use a 529 plan: If your parents or other relatives have set up a 529 plan for you, you can use that money to help cover the costs of college.

- Apply for scholarships and grants:One of your best bets is to research and apply for gift aid, like scholarships and grants. Gift aid is a great resource because its money you dont have to pay back.

- Fill out the Free Application for Federal Student Aid : Always fill out the FAFSA even if you dont think youll qualify for financial aid. To be eligible for federal student loans and work-study, for example, you must have completed the FAFSA.

Don’t Miss: Sss Housing Loan

Student Loan Forgiveness Calculation

In all of the income-driven repayment plans, the balance on your student loans is forgiven after either 20 or 25 years. If making income-driven repayments for 20-25 years, any balance on the loan is then forgiven at that time. To get your student loan forgiveness amount, we calculate how much you would normally pay on your student loan in total, and subtract it by what you would pay in any of the income-driven plans after 25 years.

What Is The Pay As You Earn Calculator

Our Pay As You Earn student loan calculator will show you how much youll pay each month for your student loans under the federal PAYE repayment program. Our PAYE calculator will also show you how much student loan forgiveness you can receive after 20 years of payments under the plan. Pay As You Earn is one of four options available under the IDR program.

Don’t Miss: Does Va Loan Work For Manufactured Homes

Already Borrowed Here Is How You Can Decrease Your Student Loan Rates

If youre one of the millions of borrowers who already has student loan debt, you are not out of luck in terms of managing your repayment effectively.

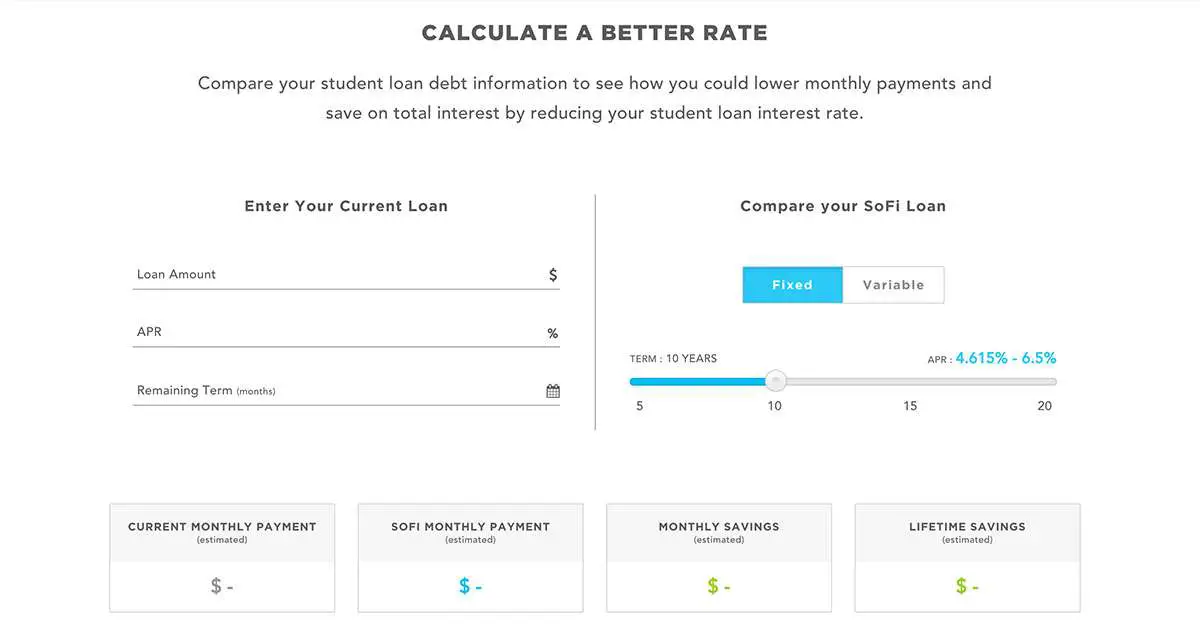

You may consider refinancing your federal or private student loans to obtain a lower interest rate on your debt through a private lender. Doing so creates a much rosier picture for your total student loan payments and it may help reduce your monthly obligation immediately.

However, refinancing federal student loans to a private loan removes all federal protections such as income-driven repayment plans, forgiveness opportunities, and more.

To help better manage your student loan payments for federal loans, consolidation may also be beneficial. The Direct Consolidation Loan from the federal government allows you to combine multiple loans under a single, new loan.

This will not lower your total interest, but it will allow you to take advantage of income-driven repayment plans or an extended repayment plan that can ease the cash flow burden each month.

Talk to your loan servicer to learn more about federal consolidation. To see what your payments would be under the most popular income-driven plan, the Income-Based Repayment Plan , check out our IBR Calculator.

If you are looking to refinance your student loans with a private lender to lower your interest rate, check out some of the following highly-rated partners of ours.

Compare Student Loan Refinance Companies

What Types Of Student Loans Are There

The two types of student loans available are federal loans, provided by the federal government, and private student loans, made by financial institutions like banks and credit unions. Federal student loans typically come with lower interest rates and more consumer protections than private loans. So its best to borrow those up to the maximum allowed, if necessary, before considering private loans.

Also Check: How Much To Loan Officers Make

How Do I Apply For Student Loans

To get federal student loans, submit the Free Application for Federal Student Aid, known as the FAFSA. Its available Oct. 1 each year for the following school year. Depending on your financial need, the FAFSA could qualify you not only for student loans, but for federal grants and work-study, plus some types of state and college financial aid. To get private loans, submit an application directly to the lender. Private loans require a credit check, while most federal loans dont.

What Will My Repayment Schedule Be

Your repayment term, or the amount of time it takes to pay off student loans, depends on the type of loan you took out and the payoff plan you choose. Federal student loans come with a standard repayment term of 10 years, but you can opt for a 20- or 25-year term if you choose an income-driven repayment plan, which ties monthly payments to your income. Private loans often come with terms of five, 10 or 15 years.

Also Check: Rv Loan With 670 Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How Can I Pay Off $200k In Student Loans

If youre looking to pay off $200,000 in student loans, the optimal way to repay the debt mainly depends on the type of loans you have.

- If you have federal student loans, be sure to consider all of your repayment options. For example, you could be eligible for an IDR plan to help you manage your payments. Or you might qualify to have some or all of your student loans forgiven through programs like Public Service Loan Forgiveness. Your loan servicer can help you explore what options are available to you.

- If you have private student loans, you could consider refinancing, especially if you can reduce the interest rate on any of your loans. You can use our student loan refinancing calculator below to see how much you can save by refinancing your student loans.

Step 1. Enter your loan balance

Recommended Reading: What Happens If You Default On Sba Loan

If You Have A Postgraduate Loan And A Plan 1 Plan 2 Or Plan 4 Loan

You pay back 6% of your income over the Postgraduate Loan threshold . In addition, youll pay back 9% of your income over the Plan 1, Plan 2 or Plan 4 threshold.

Example

You have a Postgraduate Loan and a Plan 2 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 2 threshold of £2,274.

Your income is £650 over the Postgraduate Loan threshold and £126 over the Plan 2 threshold .

You will pay back £39 to your Postgraduate Loan and £11 to your Plan 2 loan. So your total monthly repayment will be £50.

Example

You have a Postgraduate Loan and a Plan 1 loan.

Your annual income is £28,800 and you are paid a regular monthly wage. This means that each month your income is £2,400 . This is over the Postgraduate Loan monthly threshold of £1,750 and the Plan 1 threshold of £1,657.

Your income is £650 over the Postgraduate Loan threshold and £743 over the Plan 1 threshold .

You will pay back £39 to your Postgraduate Loan and £66 to your Plan 1 loan. So your total monthly repayment will be £105.

Can I Get My Loans Forgiven

In some circumstances, your student loans may be discharged before your repayment term ends. For example, for federal loan borrowers, if you make 120 on-time loan payments while working full-time for the government or a qualifying nonprofit, you could get your loans forgiven through the Public Service Loan ForgivenessProgram.

You May Like: Credit Score Needed For Usaa Personal Loan

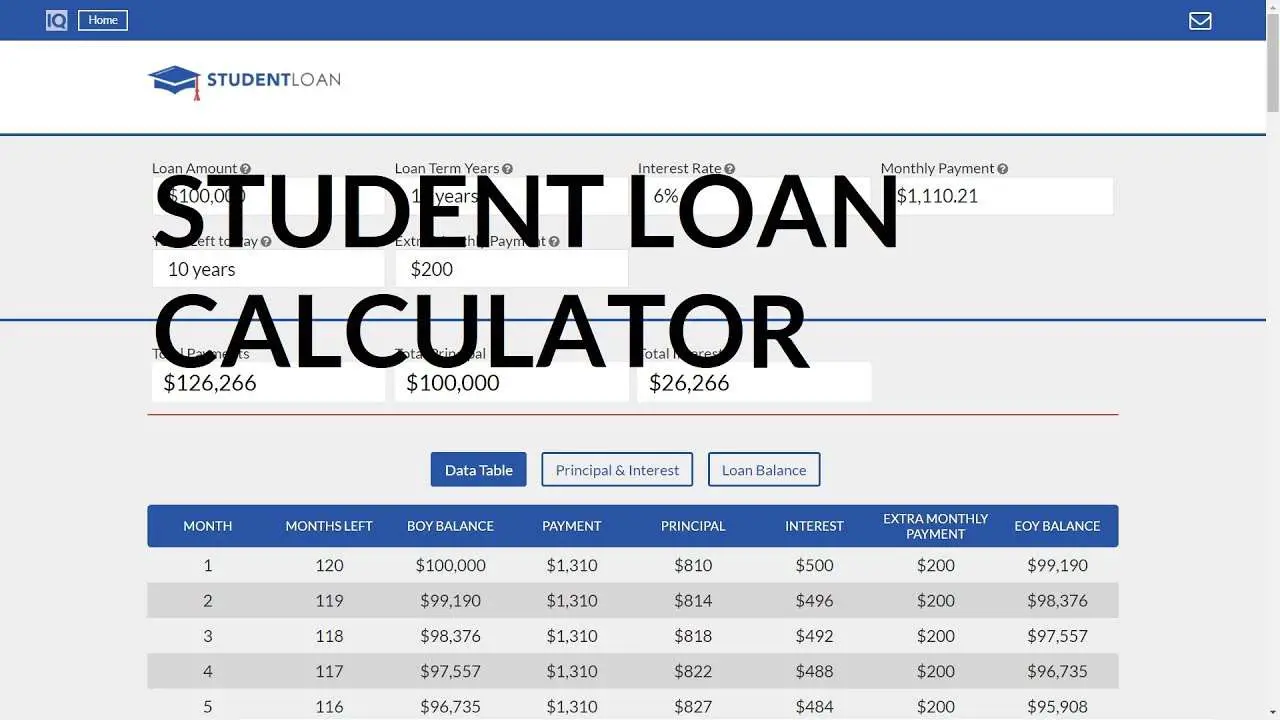

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

Home Equity Line Of Credit

A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan. The interest rate is usually variable and tied to an index such as the prime rate. Our home equity calculators can answer a variety of questions, such as: Should you borrow from home equity? If so, how much could you borrow? Are you better off taking out a lump-sum equity loan or a HELOC? How long will it take to repay the loan?

Recommended Reading: Can I Refinance My Car Loan With The Same Lender

Quick Tips For Calculating Student Loan Payments Each Semester

Start with federal loans issued directly to students using the Repayment Estimator calculator.

- Understand student loans can be accepted, rejected, or canceled on a semester-by-semester basis.

- Gather basic information about your students private student loans and then call the servicer or use the Road2College calculator to calculate monthly payments for each loan separately. Then add them up for a total monthly payment your student will be responsilble for. If you co-signed for the loan, be ready to repay these loans if your student cant.

- Calculate Parent PLUS loan payments each semester.

- No matter which loans end up being too high, look for ways for the student to painlessly rebudget. Changing meal plans or changing the way they buy or sell textbooks alone could save the student hundreds per year.

Calculating your student and your monthly student loan payments, while your student is in college, will keep you abreast of what your monthly financial commitments will be.

You will have a good idea of what the future holds in terms of financial obligations, and you will be able to reassess if necessary along the way.

CONNECT WITH OTHER PARENTS TRYING TO FIGURE OUT

HOW TO PAY FOR COLLEGE

Predict Your Ibr Paye And Repaye Payment

You know what youre paying now, but youd probably like to know what you could be paying in five years too. Youd also like a calculation to know if you should refinance your student loans.

Pretend youre a resident physician making $60,000 for the next four years. Youll finish residency in July 2024. For half the year, youd make a resident income of $60,000 but the other half the year youd make an attending income of $200,000. Hence youd make $130,000 for this in-between year.

Once you become an attending, youll earn $200,000 adjusted up for inflation. What would your monthly student loan payments be under PAYE, REPAYE, and IBR?

To find out, manually enter your income growth over time and instantly see how your payments change.

Read Also: Usaa Auto Loan Rates And Terms

Start With Federal Student Loans Issued Directly To Students When Calculating Payments

Most undergraduate students can borrow up to $31,000 in total for undergraduate studies.

The exception is for independent students or dependent students whose parents dont qualify for PLUS loans and need to make up for cost of attendance differences.

These undergraduates can borrow up to $57,500 for an undergraduate degree.

On an annual basis, the amount a student can borrow is between $5,500 and $12,500, depending on their year in school and whether parents qualify for PLUS loans.

Families can decide annually and on a semester-by-semester basis how much of the limit theyd like to accept or cancel.

Use the our student loan calculatorto calculate payments.

Your minimum monthly payment is based on the type of loan, the amount you owe, the length of your repayment plan and your interest rate. Youll typically have 10 to 25 years to repay federal loans entirely. Shorter lengths of repayment time or larger loans will result in higher monthly payments.

To get the most accurate results in our calculator, enter your loan amounts separately with their individual interest rates and terms.

You may have a mix of federal and private loans. If you dont know how much you have in federal student loans, search for your federal loans in the National Student Loan Data System or contact your private student loan lender.